Tax Liens North Carolina

Tax Liens North Carolina - Department of revenue does not send property. In north carolina, tax lien investing differs from states solely dealing in tax liens. Search logic mandated by the ucc statute and locates exact matches excluding noise words and abbreviations as provided below. In north carolina, understanding tax liens is crucial, as they can have significant implications for property owners and investors alike. Once a real property tax bill becomes delinquent in north carolina, the tax collector may foreclose its tax lien. The property tax in north carolina is a locally assessed tax, collected by the counties.

The property tax in north carolina is a locally assessed tax, collected by the counties. Search logic mandated by the ucc statute and locates exact matches excluding noise words and abbreviations as provided below. In north carolina, tax lien investing differs from states solely dealing in tax liens. Once a real property tax bill becomes delinquent in north carolina, the tax collector may foreclose its tax lien. In north carolina, understanding tax liens is crucial, as they can have significant implications for property owners and investors alike. Department of revenue does not send property.

Search logic mandated by the ucc statute and locates exact matches excluding noise words and abbreviations as provided below. In north carolina, understanding tax liens is crucial, as they can have significant implications for property owners and investors alike. Department of revenue does not send property. The property tax in north carolina is a locally assessed tax, collected by the counties. In north carolina, tax lien investing differs from states solely dealing in tax liens. Once a real property tax bill becomes delinquent in north carolina, the tax collector may foreclose its tax lien.

North Carolina Tax Deed Basics State Overview! YouTube

The property tax in north carolina is a locally assessed tax, collected by the counties. Once a real property tax bill becomes delinquent in north carolina, the tax collector may foreclose its tax lien. In north carolina, understanding tax liens is crucial, as they can have significant implications for property owners and investors alike. Department of revenue does not send.

How To Buy State Tax Lien Properties In North Carolina Real

Once a real property tax bill becomes delinquent in north carolina, the tax collector may foreclose its tax lien. In north carolina, tax lien investing differs from states solely dealing in tax liens. Search logic mandated by the ucc statute and locates exact matches excluding noise words and abbreviations as provided below. In north carolina, understanding tax liens is crucial,.

Tax Lien Tax Lien North Carolina

In north carolina, tax lien investing differs from states solely dealing in tax liens. Search logic mandated by the ucc statute and locates exact matches excluding noise words and abbreviations as provided below. Department of revenue does not send property. In north carolina, understanding tax liens is crucial, as they can have significant implications for property owners and investors alike..

Tax Lien Certificates vs. Tax Deeds What's the Difference? PropLogix

Once a real property tax bill becomes delinquent in north carolina, the tax collector may foreclose its tax lien. Department of revenue does not send property. Search logic mandated by the ucc statute and locates exact matches excluding noise words and abbreviations as provided below. In north carolina, understanding tax liens is crucial, as they can have significant implications for.

How To Buy Tax Lien Properties In North Carolina YouTube

Search logic mandated by the ucc statute and locates exact matches excluding noise words and abbreviations as provided below. In north carolina, tax lien investing differs from states solely dealing in tax liens. Once a real property tax bill becomes delinquent in north carolina, the tax collector may foreclose its tax lien. The property tax in north carolina is a.

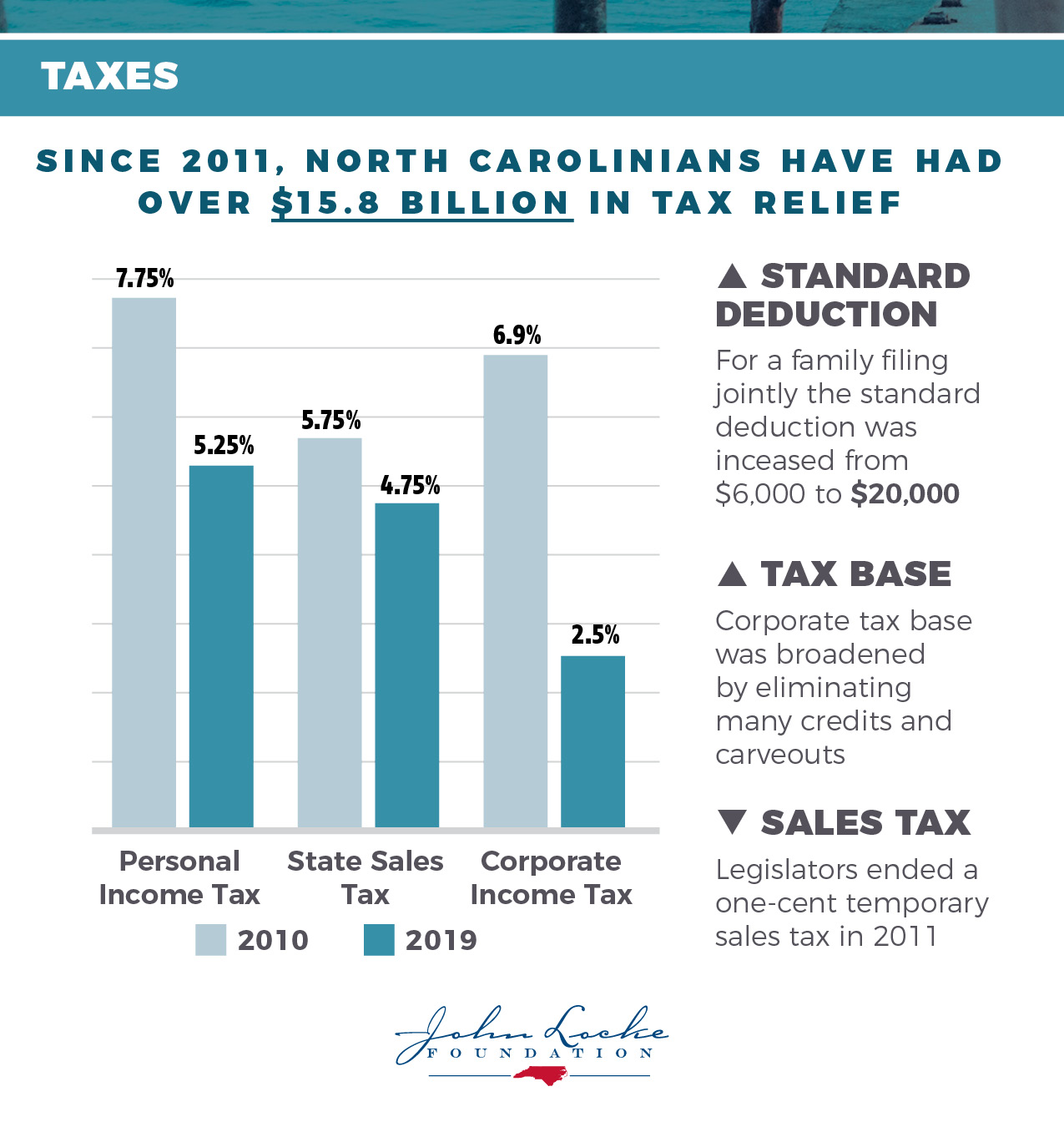

North Carolina At A Glance Taxes John Locke Foundation John Locke

In north carolina, understanding tax liens is crucial, as they can have significant implications for property owners and investors alike. Once a real property tax bill becomes delinquent in north carolina, the tax collector may foreclose its tax lien. In north carolina, tax lien investing differs from states solely dealing in tax liens. Department of revenue does not send property..

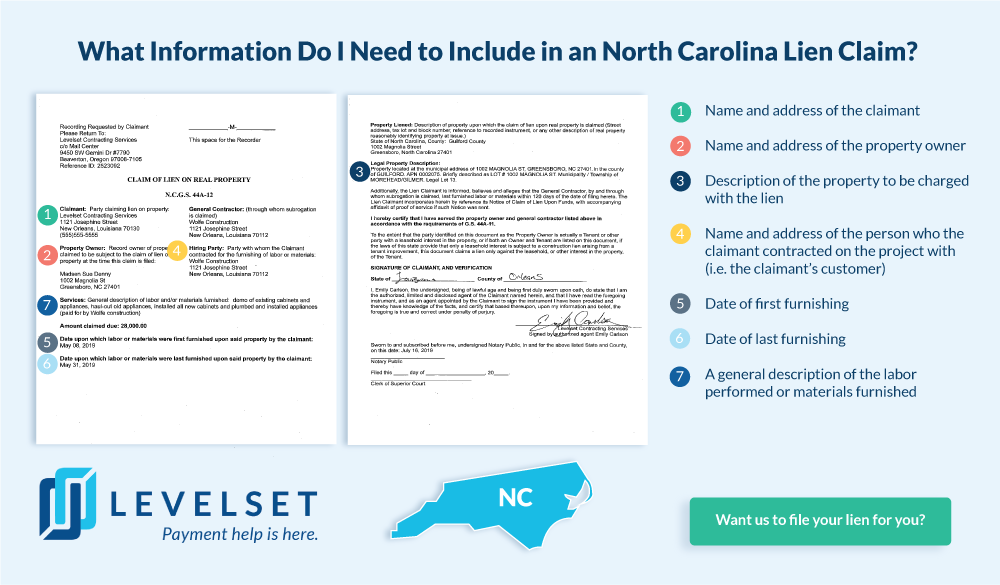

How to File a North Carolina Mechanics Lien Guide + Form Download

In north carolina, understanding tax liens is crucial, as they can have significant implications for property owners and investors alike. Once a real property tax bill becomes delinquent in north carolina, the tax collector may foreclose its tax lien. The property tax in north carolina is a locally assessed tax, collected by the counties. Department of revenue does not send.

North Carolina Tax Lien and Deed Investing Book by Brian Mahoney

The property tax in north carolina is a locally assessed tax, collected by the counties. Once a real property tax bill becomes delinquent in north carolina, the tax collector may foreclose its tax lien. Department of revenue does not send property. In north carolina, understanding tax liens is crucial, as they can have significant implications for property owners and investors.

How To Buy Tax Liens In North Carolina YouTube

Search logic mandated by the ucc statute and locates exact matches excluding noise words and abbreviations as provided below. In north carolina, understanding tax liens is crucial, as they can have significant implications for property owners and investors alike. Department of revenue does not send property. In north carolina, tax lien investing differs from states solely dealing in tax liens..

North Carolina Tax Lien and Deed Investing Book Buying

Search logic mandated by the ucc statute and locates exact matches excluding noise words and abbreviations as provided below. Once a real property tax bill becomes delinquent in north carolina, the tax collector may foreclose its tax lien. In north carolina, tax lien investing differs from states solely dealing in tax liens. Department of revenue does not send property. In.

Search Logic Mandated By The Ucc Statute And Locates Exact Matches Excluding Noise Words And Abbreviations As Provided Below.

In north carolina, understanding tax liens is crucial, as they can have significant implications for property owners and investors alike. Department of revenue does not send property. The property tax in north carolina is a locally assessed tax, collected by the counties. Once a real property tax bill becomes delinquent in north carolina, the tax collector may foreclose its tax lien.