Certificate Of Tax Lien

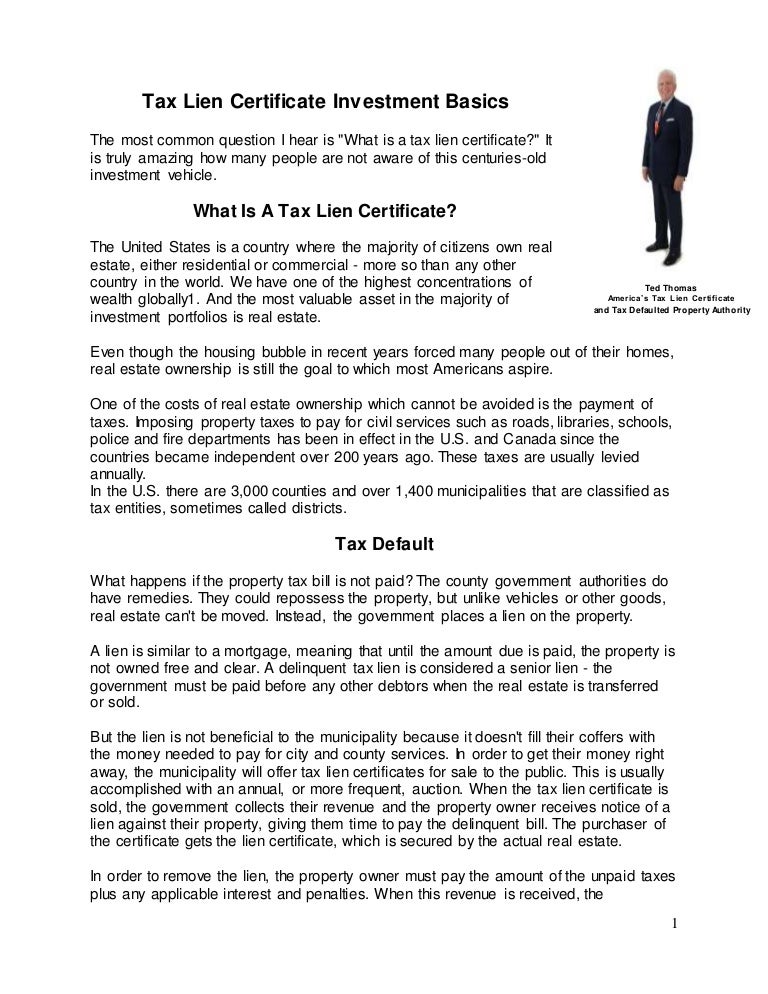

Certificate Of Tax Lien - If the federal tax lien has not been released within 30 days of satisfying your tax liability, you can request a certificate of release of federal tax lien. Certificates are typically sold at auction. Governments sell tax lien certificates to investors in order to recover money from delinquent property taxes due to them. Tax lien investing involves an investor purchasing a property at auction that currently has a tax lien against it. Homeowners then have an opportunity to. A tax lien certificate is a claim against property that has had a lien placed upon it as a result of unpaid property taxes. The request must be in writing and. They pay off the lien, and then the property is theirs, typically purchased as an investment. If an investor wins a tax lien.

Governments sell tax lien certificates to investors in order to recover money from delinquent property taxes due to them. A tax lien certificate is a claim against property that has had a lien placed upon it as a result of unpaid property taxes. The request must be in writing and. They pay off the lien, and then the property is theirs, typically purchased as an investment. Homeowners then have an opportunity to. If an investor wins a tax lien. If the federal tax lien has not been released within 30 days of satisfying your tax liability, you can request a certificate of release of federal tax lien. Certificates are typically sold at auction. Tax lien investing involves an investor purchasing a property at auction that currently has a tax lien against it.

The request must be in writing and. If the federal tax lien has not been released within 30 days of satisfying your tax liability, you can request a certificate of release of federal tax lien. Certificates are typically sold at auction. If an investor wins a tax lien. A tax lien certificate is a claim against property that has had a lien placed upon it as a result of unpaid property taxes. Governments sell tax lien certificates to investors in order to recover money from delinquent property taxes due to them. They pay off the lien, and then the property is theirs, typically purchased as an investment. Homeowners then have an opportunity to. Tax lien investing involves an investor purchasing a property at auction that currently has a tax lien against it.

ABCs of Tax Lien and Deed Investing Special 90 Off Tax Lien

If an investor wins a tax lien. Tax lien investing involves an investor purchasing a property at auction that currently has a tax lien against it. A tax lien certificate is a claim against property that has had a lien placed upon it as a result of unpaid property taxes. If the federal tax lien has not been released within.

Tax Lien Certificate Investment Basics

Tax lien investing involves an investor purchasing a property at auction that currently has a tax lien against it. They pay off the lien, and then the property is theirs, typically purchased as an investment. If the federal tax lien has not been released within 30 days of satisfying your tax liability, you can request a certificate of release of.

How to Buy a Tax Lien Certificate 15 Steps (with Pictures)

They pay off the lien, and then the property is theirs, typically purchased as an investment. Homeowners then have an opportunity to. Governments sell tax lien certificates to investors in order to recover money from delinquent property taxes due to them. If an investor wins a tax lien. A tax lien certificate is a claim against property that has had.

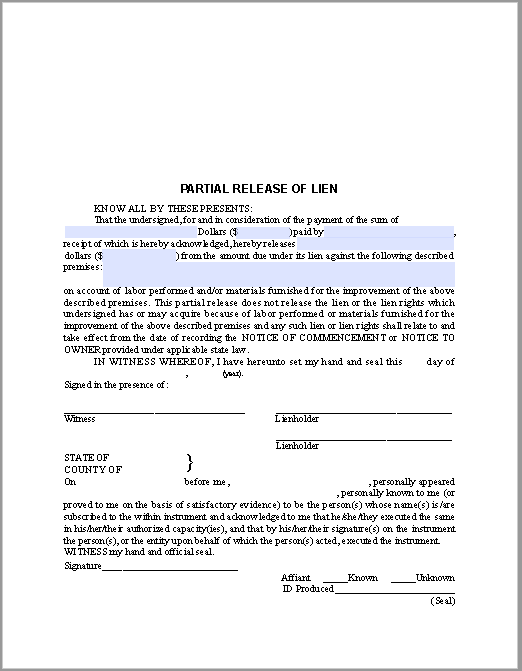

Lien Certificate Samples Archives Free Fillable PDF Forms

Homeowners then have an opportunity to. Governments sell tax lien certificates to investors in order to recover money from delinquent property taxes due to them. If an investor wins a tax lien. A tax lien certificate is a claim against property that has had a lien placed upon it as a result of unpaid property taxes. Tax lien investing involves.

Tax Lien Certificate Definition

Homeowners then have an opportunity to. If the federal tax lien has not been released within 30 days of satisfying your tax liability, you can request a certificate of release of federal tax lien. The request must be in writing and. Tax lien investing involves an investor purchasing a property at auction that currently has a tax lien against it..

tax lien certificate

A tax lien certificate is a claim against property that has had a lien placed upon it as a result of unpaid property taxes. The request must be in writing and. Homeowners then have an opportunity to. Governments sell tax lien certificates to investors in order to recover money from delinquent property taxes due to them. If an investor wins.

Tax Lien & Deeds For Beginners Copy Tax Lien Certificate School

A tax lien certificate is a claim against property that has had a lien placed upon it as a result of unpaid property taxes. They pay off the lien, and then the property is theirs, typically purchased as an investment. Governments sell tax lien certificates to investors in order to recover money from delinquent property taxes due to them. Tax.

Everything to know about tax lien certificate Latest Infographics

If an investor wins a tax lien. The request must be in writing and. Homeowners then have an opportunity to. They pay off the lien, and then the property is theirs, typically purchased as an investment. Tax lien investing involves an investor purchasing a property at auction that currently has a tax lien against it.

What is a Tax Lien Certificate United Tax Liens

If an investor wins a tax lien. Certificates are typically sold at auction. They pay off the lien, and then the property is theirs, typically purchased as an investment. A tax lien certificate is a claim against property that has had a lien placed upon it as a result of unpaid property taxes. The request must be in writing and.

Tax Lien Certificate Investor's wiki

They pay off the lien, and then the property is theirs, typically purchased as an investment. Tax lien investing involves an investor purchasing a property at auction that currently has a tax lien against it. Governments sell tax lien certificates to investors in order to recover money from delinquent property taxes due to them. Homeowners then have an opportunity to..

If An Investor Wins A Tax Lien.

The request must be in writing and. They pay off the lien, and then the property is theirs, typically purchased as an investment. A tax lien certificate is a claim against property that has had a lien placed upon it as a result of unpaid property taxes. Certificates are typically sold at auction.

Homeowners Then Have An Opportunity To.

Tax lien investing involves an investor purchasing a property at auction that currently has a tax lien against it. Governments sell tax lien certificates to investors in order to recover money from delinquent property taxes due to them. If the federal tax lien has not been released within 30 days of satisfying your tax liability, you can request a certificate of release of federal tax lien.

/GettyImages-CA21828-a19376e37c97499799e45f8aa4940dd3.jpg)