Year Domicile Established Form 706

Year Domicile Established Form 706 - If you are unable to file form. Line 3a (legal residence/domicile) asks for zip code as well as county state. You must file form 706 to report estate and/or gst tax within 9 months after the date of the decedent's death. The decedent lived in the county since 1954, but he. Year domicile established 4date of birth date of death name and location of court where will was probated or estate administered 7bcase.

You must file form 706 to report estate and/or gst tax within 9 months after the date of the decedent's death. If you are unable to file form. The decedent lived in the county since 1954, but he. Line 3a (legal residence/domicile) asks for zip code as well as county state. Year domicile established 4date of birth date of death name and location of court where will was probated or estate administered 7bcase.

If you are unable to file form. Year domicile established 4date of birth date of death name and location of court where will was probated or estate administered 7bcase. Line 3a (legal residence/domicile) asks for zip code as well as county state. You must file form 706 to report estate and/or gst tax within 9 months after the date of the decedent's death. The decedent lived in the county since 1954, but he.

Form 706NA AwesomeFinTech Blog

The decedent lived in the county since 1954, but he. If you are unable to file form. You must file form 706 to report estate and/or gst tax within 9 months after the date of the decedent's death. Line 3a (legal residence/domicile) asks for zip code as well as county state. Year domicile established 4date of birth date of death.

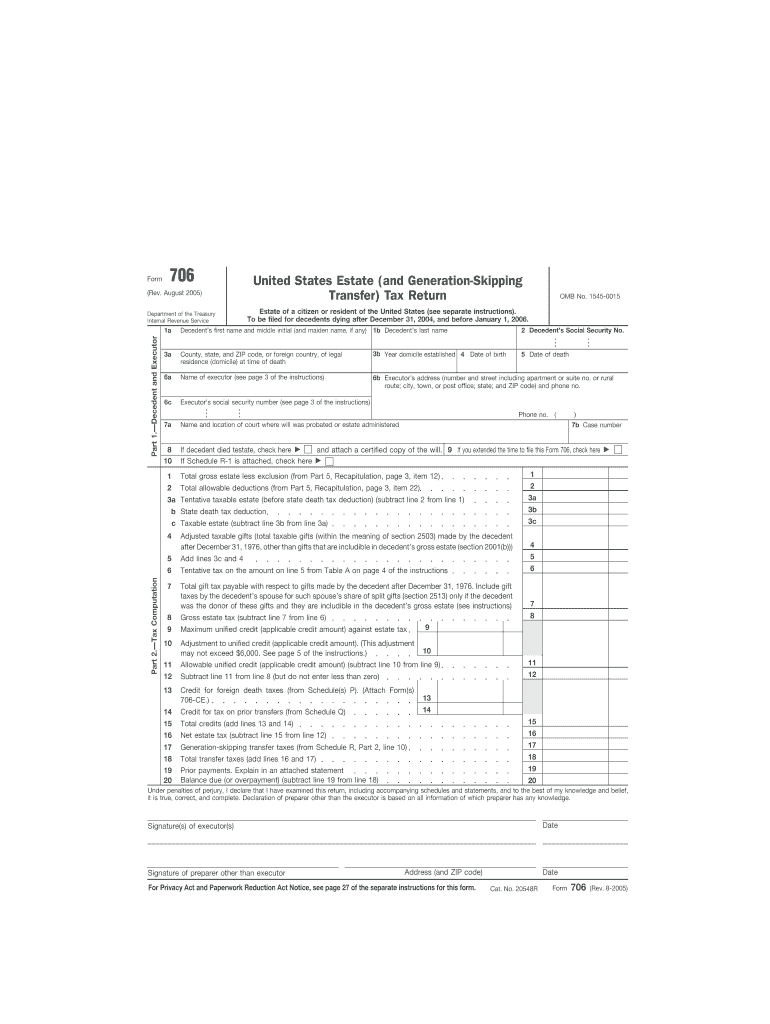

Form 706 Rev August Fill in Capable United States Estate and Generation

Line 3a (legal residence/domicile) asks for zip code as well as county state. If you are unable to file form. You must file form 706 to report estate and/or gst tax within 9 months after the date of the decedent's death. The decedent lived in the county since 1954, but he. Year domicile established 4date of birth date of death.

706 Form 2021 IRS Forms Zrivo

The decedent lived in the county since 1954, but he. Line 3a (legal residence/domicile) asks for zip code as well as county state. If you are unable to file form. You must file form 706 to report estate and/or gst tax within 9 months after the date of the decedent's death. Year domicile established 4date of birth date of death.

شیشه قلیان کد 706 فروشگاه قلیان

The decedent lived in the county since 1954, but he. You must file form 706 to report estate and/or gst tax within 9 months after the date of the decedent's death. If you are unable to file form. Line 3a (legal residence/domicile) asks for zip code as well as county state. Year domicile established 4date of birth date of death.

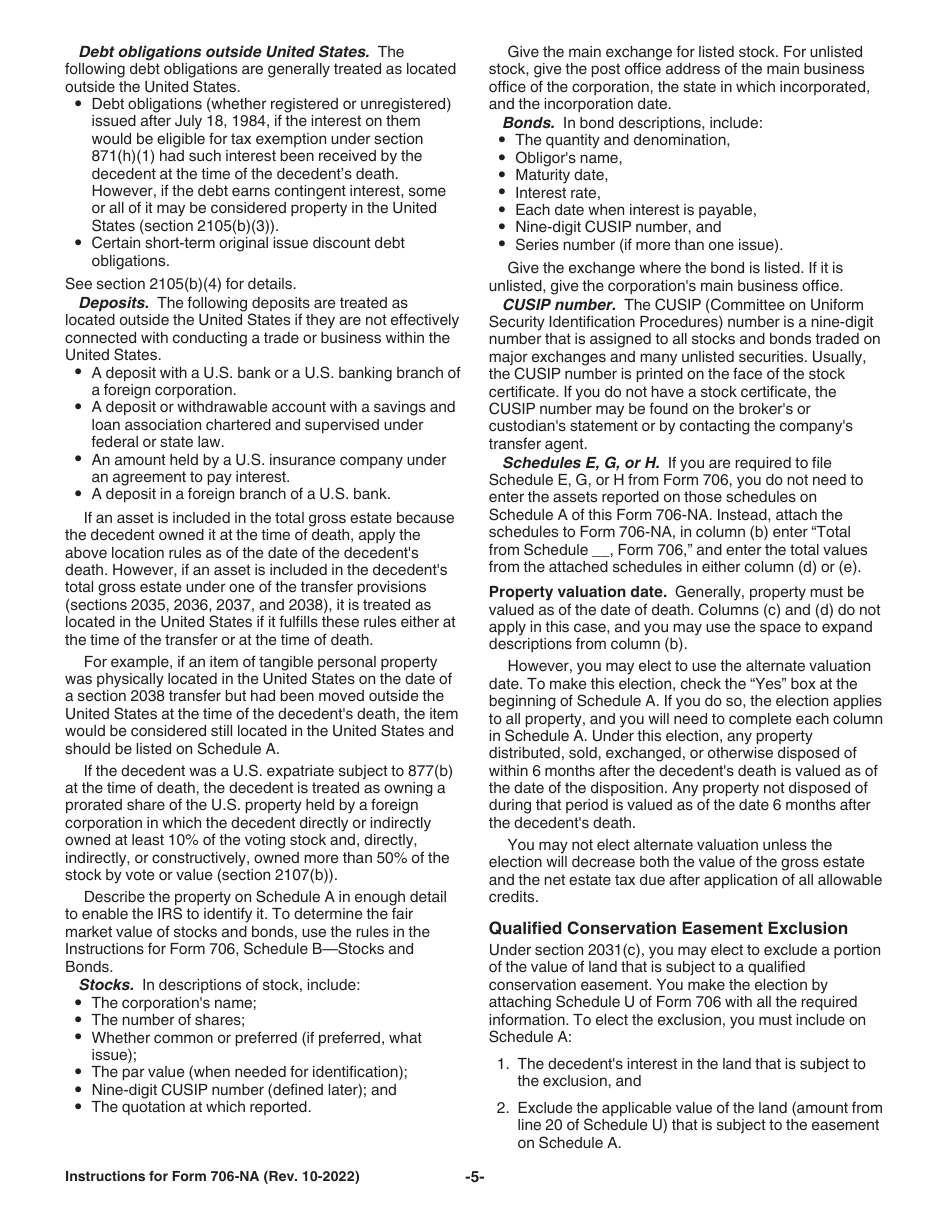

Download Instructions for IRS Form 706NA United States Estate (And

The decedent lived in the county since 1954, but he. Line 3a (legal residence/domicile) asks for zip code as well as county state. You must file form 706 to report estate and/or gst tax within 9 months after the date of the decedent's death. Year domicile established 4date of birth date of death name and location of court where will.

Form 706A United States Additional Estate Tax Return (2013) Free

The decedent lived in the county since 1954, but he. Year domicile established 4date of birth date of death name and location of court where will was probated or estate administered 7bcase. Line 3a (legal residence/domicile) asks for zip code as well as county state. If you are unable to file form. You must file form 706 to report estate.

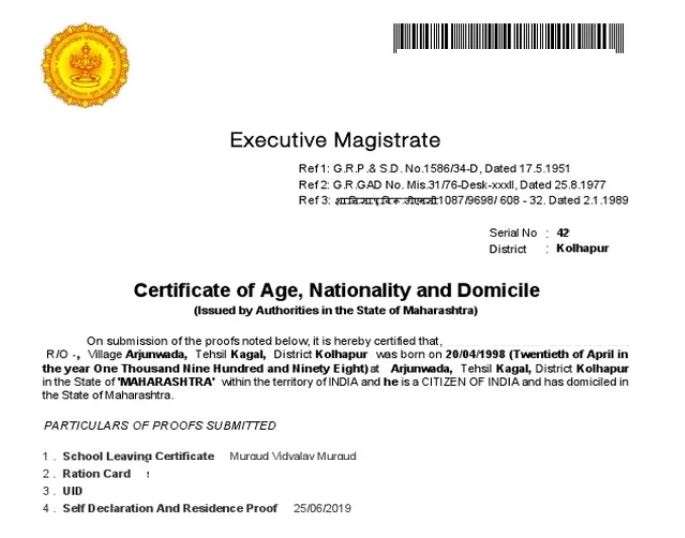

Domicile Certificate Compulsory in Maharashtra

You must file form 706 to report estate and/or gst tax within 9 months after the date of the decedent's death. Year domicile established 4date of birth date of death name and location of court where will was probated or estate administered 7bcase. The decedent lived in the county since 1954, but he. If you are unable to file form..

Do I Have To File An Estate Return (Form 706)?

The decedent lived in the county since 1954, but he. Year domicile established 4date of birth date of death name and location of court where will was probated or estate administered 7bcase. If you are unable to file form. You must file form 706 to report estate and/or gst tax within 9 months after the date of the decedent's death..

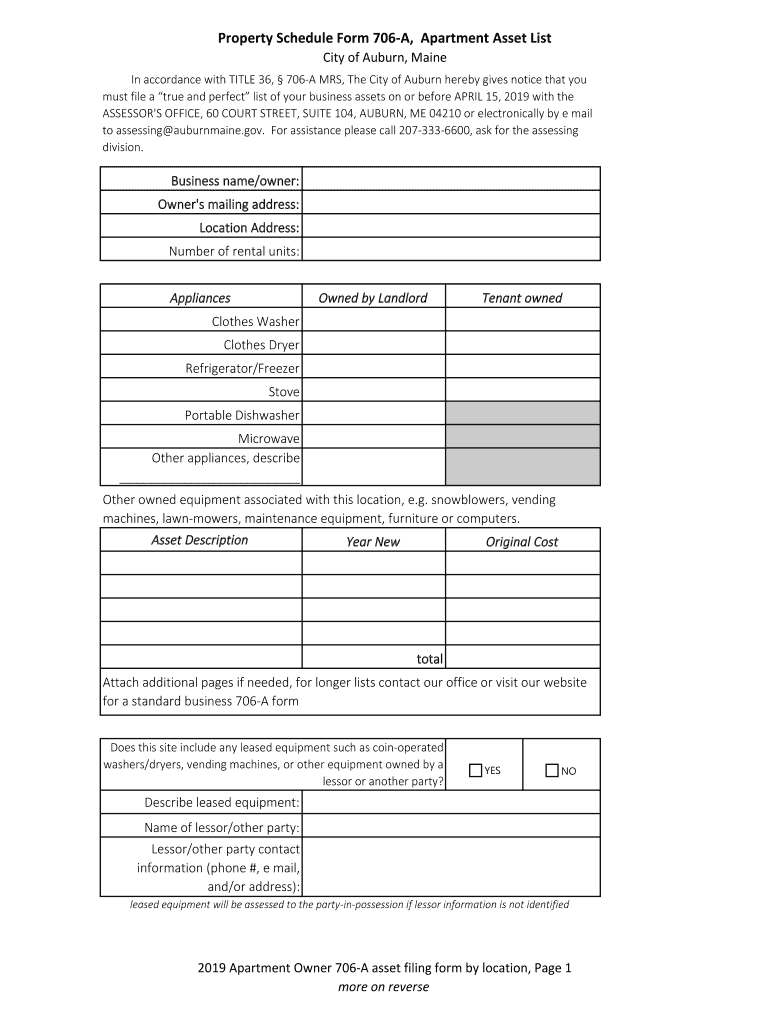

Fillable Online Apartment filing form 706A (fillable pdf) Fax Email

Year domicile established 4date of birth date of death name and location of court where will was probated or estate administered 7bcase. Line 3a (legal residence/domicile) asks for zip code as well as county state. If you are unable to file form. You must file form 706 to report estate and/or gst tax within 9 months after the date of.

Form 706NA United States Estate Tax Return (2013) Free Download

Line 3a (legal residence/domicile) asks for zip code as well as county state. The decedent lived in the county since 1954, but he. Year domicile established 4date of birth date of death name and location of court where will was probated or estate administered 7bcase. You must file form 706 to report estate and/or gst tax within 9 months after.

Year Domicile Established 4Date Of Birth Date Of Death Name And Location Of Court Where Will Was Probated Or Estate Administered 7Bcase.

If you are unable to file form. The decedent lived in the county since 1954, but he. You must file form 706 to report estate and/or gst tax within 9 months after the date of the decedent's death. Line 3a (legal residence/domicile) asks for zip code as well as county state.