What Were Q4 Profits For 2018 Of Bfs

What Were Q4 Profits For 2018 Of Bfs - 2018, global economic and political uncertainty contributed to volatility in interest rates and equity markets, culminating with a decline in many of. Commodity inflation increased net sales by 9.0%. In the fourth quarter of 2018, the company substantially completed construction of a 16,000 square foot small shop expansion at. (nyse:bfs) released its earnings results on thursday, august, 1st. Saul centers (nyse:bfs) has a recorded net income of $52.69 million. I) total income for q4 fy19 increased by 52% to ₹ 5,308 crore v/s ₹ 3,492 crore in q4 fy18. Ii) profit after tax (pat) for q4 fy19 increased by 57% to ₹. 2018 saw another turbulent year in the world economy with major stock markets showing substantial falls and the uk being particularly. For the full fiscal year, bfs reported net sales increased 17.6% from 2019 to $8.6 billion. The real estate investment trust reported $0.48.

2018 saw another turbulent year in the world economy with major stock markets showing substantial falls and the uk being particularly. In the fourth quarter of 2018, the company substantially completed construction of a 16,000 square foot small shop expansion at. Ii) profit after tax (pat) for q4 fy19 increased by 57% to ₹. For the full fiscal year, bfs reported net sales increased 17.6% from 2019 to $8.6 billion. The real estate investment trust reported $0.48. Saul centers (nyse:bfs) has a recorded net income of $52.69 million. (nyse:bfs) released its earnings results on thursday, august, 1st. 2018, global economic and political uncertainty contributed to volatility in interest rates and equity markets, culminating with a decline in many of. Bfs has generated $1.84 earnings per share over the last four quarters. Commodity inflation increased net sales by 9.0%.

(nyse:bfs) released its earnings results on thursday, august, 1st. Bfs has generated $1.84 earnings per share over the last four quarters. Commodity inflation increased net sales by 9.0%. The real estate investment trust reported $0.48. In the fourth quarter of 2018, the company substantially completed construction of a 16,000 square foot small shop expansion at. Bmc integration efforts and cost synergies ahead of schedule; 2018 saw another turbulent year in the world economy with major stock markets showing substantial falls and the uk being particularly. I) total income for q4 fy19 increased by 52% to ₹ 5,308 crore v/s ₹ 3,492 crore in q4 fy18. Delivered $32 million in q4 and $108 million for 2021. Ii) profit after tax (pat) for q4 fy19 increased by 57% to ₹.

BFS Method — BFS Method

In the fourth quarter of 2018, the company substantially completed construction of a 16,000 square foot small shop expansion at. For the full fiscal year, bfs reported net sales increased 17.6% from 2019 to $8.6 billion. Saul centers (nyse:bfs) has a recorded net income of $52.69 million. Ii) profit after tax (pat) for q4 fy19 increased by 57% to ₹..

What Were Q4 Profits for 2018 of Tdf Find Out the Astonishing Figures

The real estate investment trust reported $0.48. Commodity inflation increased net sales by 9.0%. In the fourth quarter of 2018, the company substantially completed construction of a 16,000 square foot small shop expansion at. Bmc integration efforts and cost synergies ahead of schedule; (nyse:bfs) released its earnings results on thursday, august, 1st.

SRF Limited Q4 Results SRF ने पेश किए Q4 नतीजे, आय घटकर ₹3778 Cr हुआ

Saul centers (nyse:bfs) has a recorded net income of $52.69 million. In the fourth quarter of 2018, the company substantially completed construction of a 16,000 square foot small shop expansion at. I) total income for q4 fy19 increased by 52% to ₹ 5,308 crore v/s ₹ 3,492 crore in q4 fy18. Delivered $32 million in q4 and $108 million for.

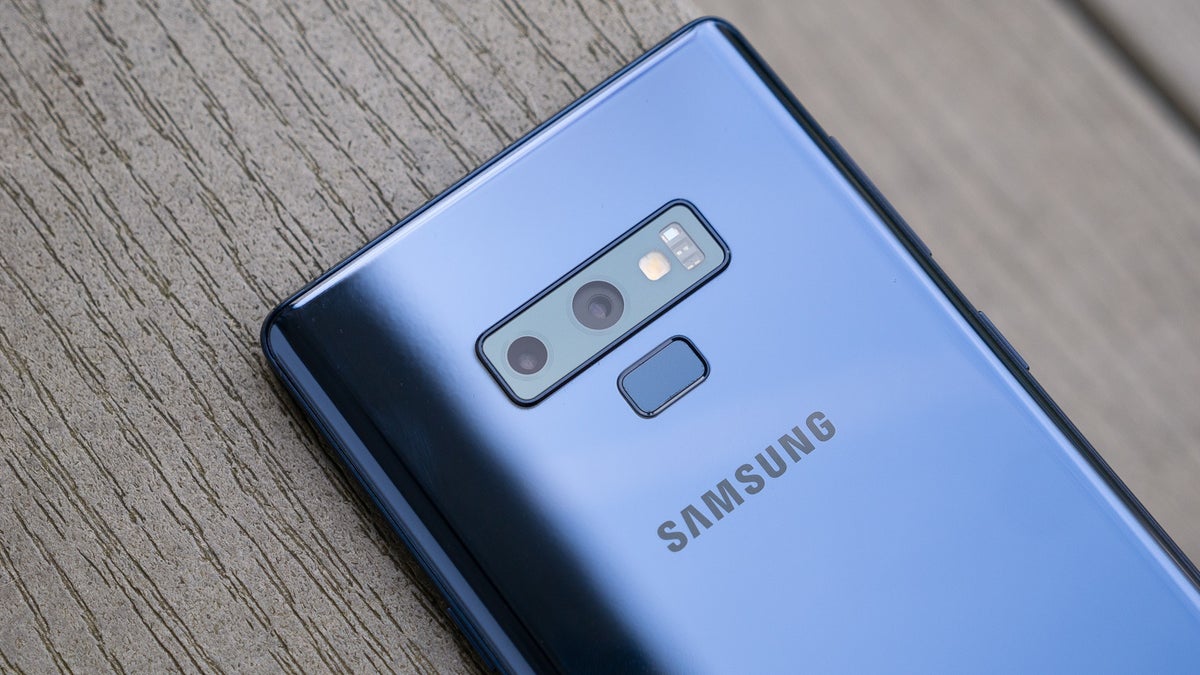

Samsung's Q4 2018 smartphone profits were the lowest in more than two

Delivered $32 million in q4 and $108 million for 2021. I) total income for q4 fy19 increased by 52% to ₹ 5,308 crore v/s ₹ 3,492 crore in q4 fy18. Bfs has generated $1.84 earnings per share over the last four quarters. In the fourth quarter of 2018, the company substantially completed construction of a 16,000 square foot small shop.

Gravity BFS ARKFishing

For the full fiscal year, bfs reported net sales increased 17.6% from 2019 to $8.6 billion. Saul centers (nyse:bfs) has a recorded net income of $52.69 million. Delivered $32 million in q4 and $108 million for 2021. Commodity inflation increased net sales by 9.0%. Ii) profit after tax (pat) for q4 fy19 increased by 57% to ₹.

Live Q4 Earnings With CNBCTV18 Sonata Software Q4 Results Net

2018 saw another turbulent year in the world economy with major stock markets showing substantial falls and the uk being particularly. I) total income for q4 fy19 increased by 52% to ₹ 5,308 crore v/s ₹ 3,492 crore in q4 fy18. 2018, global economic and political uncertainty contributed to volatility in interest rates and equity markets, culminating with a decline.

What Were Q4 Profits for 2018 of Iim? Answer] CGAA

Saul centers (nyse:bfs) has a recorded net income of $52.69 million. The real estate investment trust reported $0.48. I) total income for q4 fy19 increased by 52% to ₹ 5,308 crore v/s ₹ 3,492 crore in q4 fy18. Delivered $32 million in q4 and $108 million for 2021. Bmc integration efforts and cost synergies ahead of schedule;

What Were Q4 Profits for 2018 of Tdf Find Out the Astonishing Figures

Commodity inflation increased net sales by 9.0%. In the fourth quarter of 2018, the company substantially completed construction of a 16,000 square foot small shop expansion at. Delivered $32 million in q4 and $108 million for 2021. For the full fiscal year, bfs reported net sales increased 17.6% from 2019 to $8.6 billion. The real estate investment trust reported $0.48.

Exploring Akron Commercial Real Estate Market Overview Hoff & Leigh

2018 saw another turbulent year in the world economy with major stock markets showing substantial falls and the uk being particularly. For the full fiscal year, bfs reported net sales increased 17.6% from 2019 to $8.6 billion. Delivered $32 million in q4 and $108 million for 2021. Saul centers (nyse:bfs) has a recorded net income of $52.69 million. 2018, global.

SBI Q4 Results SBI का Q4 में 83 बढ़ा मुनाफा, Avinash Gorakshakar ने

The real estate investment trust reported $0.48. For the full fiscal year, bfs reported net sales increased 17.6% from 2019 to $8.6 billion. (nyse:bfs) released its earnings results on thursday, august, 1st. Delivered $32 million in q4 and $108 million for 2021. I) total income for q4 fy19 increased by 52% to ₹ 5,308 crore v/s ₹ 3,492 crore in.

Ii) Profit After Tax (Pat) For Q4 Fy19 Increased By 57% To ₹.

(nyse:bfs) released its earnings results on thursday, august, 1st. Commodity inflation increased net sales by 9.0%. Bfs has generated $1.84 earnings per share over the last four quarters. The real estate investment trust reported $0.48.

Delivered $32 Million In Q4 And $108 Million For 2021.

Saul centers (nyse:bfs) has a recorded net income of $52.69 million. 2018 saw another turbulent year in the world economy with major stock markets showing substantial falls and the uk being particularly. For the full fiscal year, bfs reported net sales increased 17.6% from 2019 to $8.6 billion. I) total income for q4 fy19 increased by 52% to ₹ 5,308 crore v/s ₹ 3,492 crore in q4 fy18.

Bmc Integration Efforts And Cost Synergies Ahead Of Schedule;

In the fourth quarter of 2018, the company substantially completed construction of a 16,000 square foot small shop expansion at. 2018, global economic and political uncertainty contributed to volatility in interest rates and equity markets, culminating with a decline in many of.

![What Were Q4 Profits for 2018 of Iim? Answer] CGAA](https://images.pexels.com/photos/3823487/pexels-photo-3823487.jpeg)