What Is A State Tax Lien

What Is A State Tax Lien - A tax lien is a tactic state tax authorities use to collect outstanding debt. It gives the agency an interest in your property if. What is a tax lien?

What is a tax lien? It gives the agency an interest in your property if. A tax lien is a tactic state tax authorities use to collect outstanding debt.

What is a tax lien? It gives the agency an interest in your property if. A tax lien is a tactic state tax authorities use to collect outstanding debt.

Tax Lien What Is A State Tax Lien Ohio

A tax lien is a tactic state tax authorities use to collect outstanding debt. It gives the agency an interest in your property if. What is a tax lien?

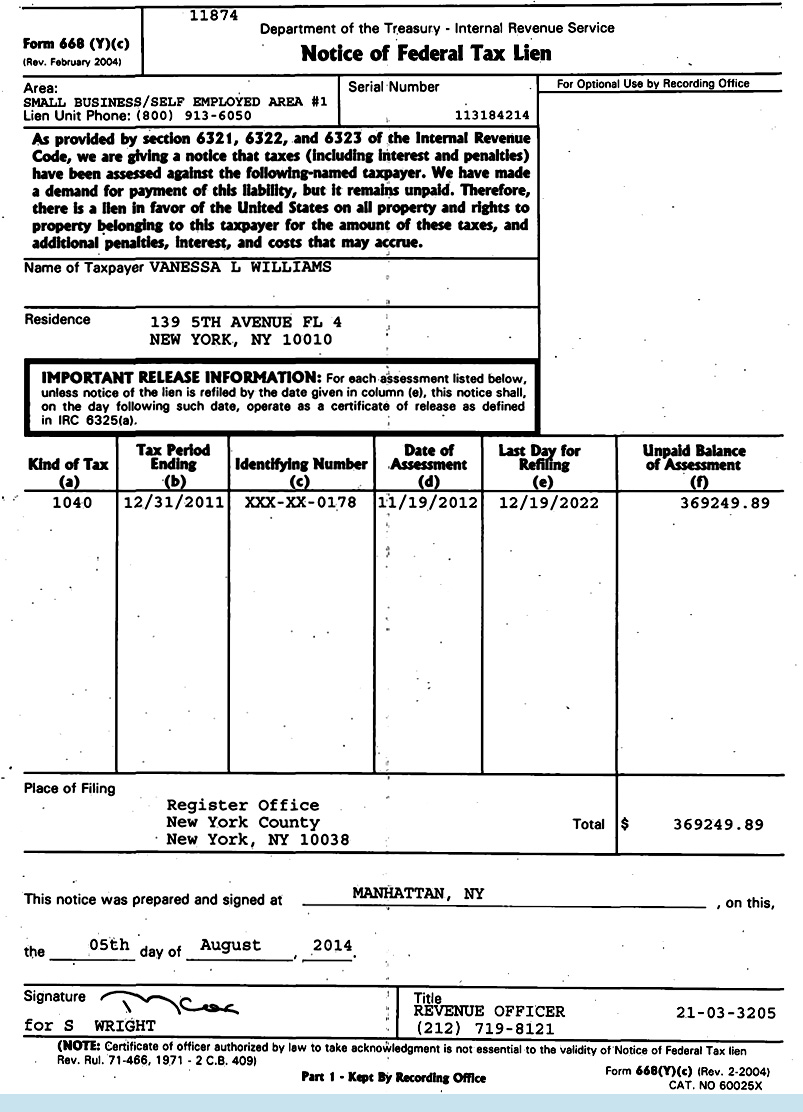

How to Tackle IRS Tax Lien or Levy Notice? Internal Revenue Code

It gives the agency an interest in your property if. What is a tax lien? A tax lien is a tactic state tax authorities use to collect outstanding debt.

Tax Lien California State Tax Lien

It gives the agency an interest in your property if. A tax lien is a tactic state tax authorities use to collect outstanding debt. What is a tax lien?

Federal tax lien on foreclosed property laderdriver

What is a tax lien? It gives the agency an interest in your property if. A tax lien is a tactic state tax authorities use to collect outstanding debt.

Federal & State Tax Lien Removal Help Instant Tax Solutions

A tax lien is a tactic state tax authorities use to collect outstanding debt. It gives the agency an interest in your property if. What is a tax lien?

Tax Lien Indiana State Tax Lien

It gives the agency an interest in your property if. A tax lien is a tactic state tax authorities use to collect outstanding debt. What is a tax lien?

Pursuant to the Tax Lien, Tax May be Collected from Estate Property in

A tax lien is a tactic state tax authorities use to collect outstanding debt. It gives the agency an interest in your property if. What is a tax lien?

Tax Lien Sale PDF Tax Lien Taxes

A tax lien is a tactic state tax authorities use to collect outstanding debt. What is a tax lien? It gives the agency an interest in your property if.

Tax Lien Texas State Tax Lien

What is a tax lien? A tax lien is a tactic state tax authorities use to collect outstanding debt. It gives the agency an interest in your property if.

It Gives The Agency An Interest In Your Property If.

A tax lien is a tactic state tax authorities use to collect outstanding debt. What is a tax lien?