What Is A Local Tax

What Is A Local Tax - Local tax refers to taxes imposed by local government entities such as counties, cities, and municipalities. Local taxes are assessments imposed by state, county, or municipal governments to fund a wide range of public. Municipal taxes, also known as local taxes or local levies, are a type of tax imposed by municipalities or local governments on citizens.

Municipal taxes, also known as local taxes or local levies, are a type of tax imposed by municipalities or local governments on citizens. Local tax refers to taxes imposed by local government entities such as counties, cities, and municipalities. Local taxes are assessments imposed by state, county, or municipal governments to fund a wide range of public.

Municipal taxes, also known as local taxes or local levies, are a type of tax imposed by municipalities or local governments on citizens. Local tax refers to taxes imposed by local government entities such as counties, cities, and municipalities. Local taxes are assessments imposed by state, county, or municipal governments to fund a wide range of public.

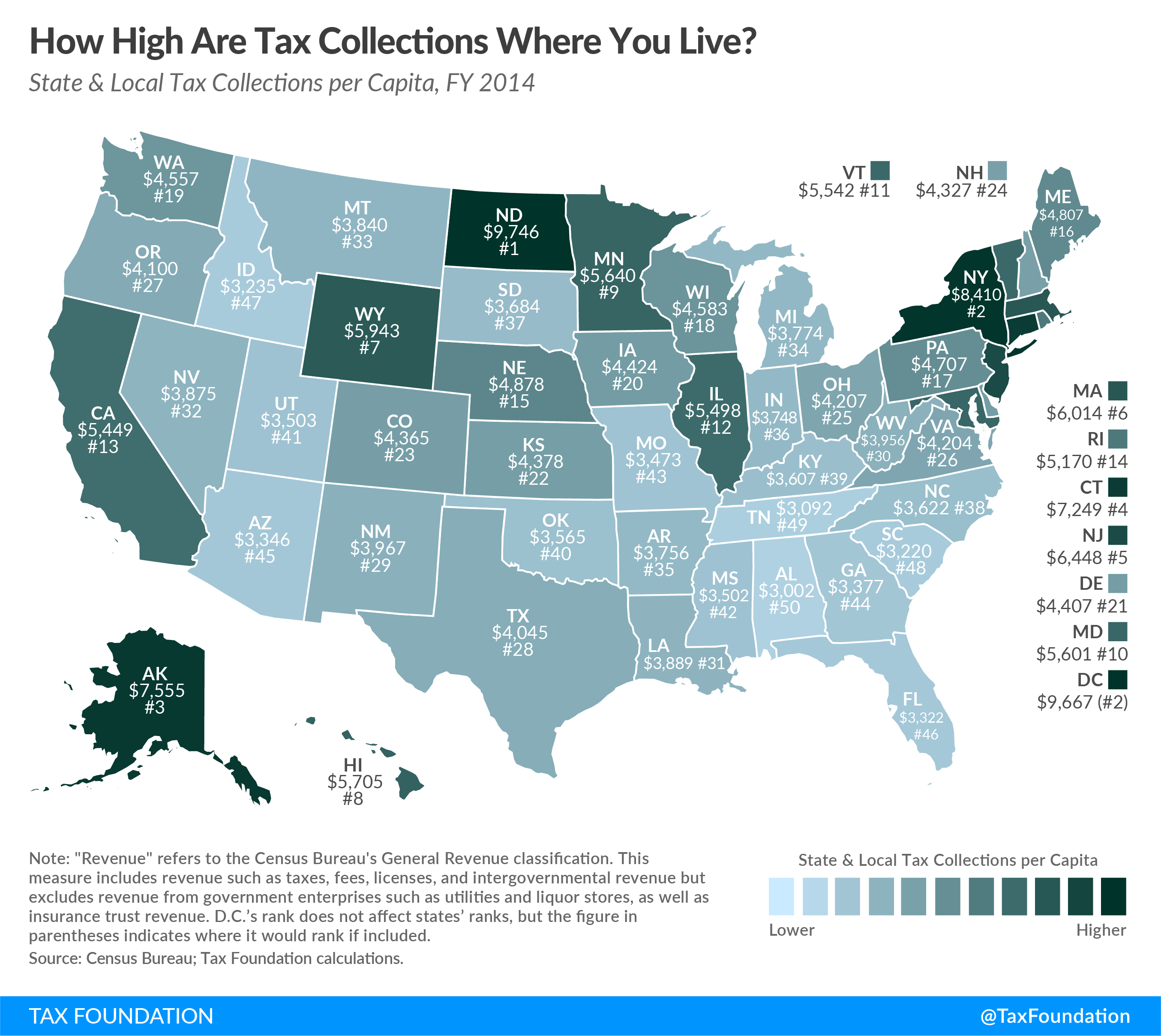

StateLocal Tax Burden Rankings Tax Foundation

Local tax refers to taxes imposed by local government entities such as counties, cities, and municipalities. Municipal taxes, also known as local taxes or local levies, are a type of tax imposed by municipalities or local governments on citizens. Local taxes are assessments imposed by state, county, or municipal governments to fund a wide range of public.

The State and Local Tax Deduction A Primer Tax Foundation

Municipal taxes, also known as local taxes or local levies, are a type of tax imposed by municipalities or local governments on citizens. Local tax refers to taxes imposed by local government entities such as counties, cities, and municipalities. Local taxes are assessments imposed by state, county, or municipal governments to fund a wide range of public.

Local Tax AwesomeFinTech Blog

Municipal taxes, also known as local taxes or local levies, are a type of tax imposed by municipalities or local governments on citizens. Local taxes are assessments imposed by state, county, or municipal governments to fund a wide range of public. Local tax refers to taxes imposed by local government entities such as counties, cities, and municipalities.

Understanding State And Local Taxes Phoenix Tax Consultants

Municipal taxes, also known as local taxes or local levies, are a type of tax imposed by municipalities or local governments on citizens. Local tax refers to taxes imposed by local government entities such as counties, cities, and municipalities. Local taxes are assessments imposed by state, county, or municipal governments to fund a wide range of public.

State and Local Tax Collections Per Capita in Your State, 2021

Municipal taxes, also known as local taxes or local levies, are a type of tax imposed by municipalities or local governments on citizens. Local taxes are assessments imposed by state, county, or municipal governments to fund a wide range of public. Local tax refers to taxes imposed by local government entities such as counties, cities, and municipalities.

State and Local Tax

Local tax refers to taxes imposed by local government entities such as counties, cities, and municipalities. Local taxes are assessments imposed by state, county, or municipal governments to fund a wide range of public. Municipal taxes, also known as local taxes or local levies, are a type of tax imposed by municipalities or local governments on citizens.

How High Are Tax Collections Where You Live? Tax Foundation

Local tax refers to taxes imposed by local government entities such as counties, cities, and municipalities. Local taxes are assessments imposed by state, county, or municipal governments to fund a wide range of public. Municipal taxes, also known as local taxes or local levies, are a type of tax imposed by municipalities or local governments on citizens.

Know More About Local Tax Mission and Goals for Our Clients

Local taxes are assessments imposed by state, county, or municipal governments to fund a wide range of public. Local tax refers to taxes imposed by local government entities such as counties, cities, and municipalities. Municipal taxes, also known as local taxes or local levies, are a type of tax imposed by municipalities or local governments on citizens.

State and Local Tax Deduction by State Tax Policy Center

Local taxes are assessments imposed by state, county, or municipal governments to fund a wide range of public. Municipal taxes, also known as local taxes or local levies, are a type of tax imposed by municipalities or local governments on citizens. Local tax refers to taxes imposed by local government entities such as counties, cities, and municipalities.

State and Local Tax XB4 Tax, Assurance and Advisory Services

Local taxes are assessments imposed by state, county, or municipal governments to fund a wide range of public. Local tax refers to taxes imposed by local government entities such as counties, cities, and municipalities. Municipal taxes, also known as local taxes or local levies, are a type of tax imposed by municipalities or local governments on citizens.

Municipal Taxes, Also Known As Local Taxes Or Local Levies, Are A Type Of Tax Imposed By Municipalities Or Local Governments On Citizens.

Local tax refers to taxes imposed by local government entities such as counties, cities, and municipalities. Local taxes are assessments imposed by state, county, or municipal governments to fund a wide range of public.