Voluntary Foreclosure

Voluntary Foreclosure - A homeowner, not a lender, starts the voluntary foreclosure process. Voluntary foreclosure is a legal process in which a homeowner willingly surrenders their property. A traditional foreclosure begins when a bank or mortgage company decides to foreclose on a property. They do this because they’re unable or unwilling to make. Voluntary foreclosure is a proactive measure taken by borrowers who find themselves unable to meet mortgage obligations. This decision is known as a strategic default, which is also sometimes called voluntary foreclosure or walking.

A traditional foreclosure begins when a bank or mortgage company decides to foreclose on a property. A homeowner, not a lender, starts the voluntary foreclosure process. Voluntary foreclosure is a proactive measure taken by borrowers who find themselves unable to meet mortgage obligations. They do this because they’re unable or unwilling to make. This decision is known as a strategic default, which is also sometimes called voluntary foreclosure or walking. Voluntary foreclosure is a legal process in which a homeowner willingly surrenders their property.

This decision is known as a strategic default, which is also sometimes called voluntary foreclosure or walking. Voluntary foreclosure is a proactive measure taken by borrowers who find themselves unable to meet mortgage obligations. Voluntary foreclosure is a legal process in which a homeowner willingly surrenders their property. A traditional foreclosure begins when a bank or mortgage company decides to foreclose on a property. A homeowner, not a lender, starts the voluntary foreclosure process. They do this because they’re unable or unwilling to make.

FORECLOSURE OR SALE BareLaw

Voluntary foreclosure is a proactive measure taken by borrowers who find themselves unable to meet mortgage obligations. This decision is known as a strategic default, which is also sometimes called voluntary foreclosure or walking. A traditional foreclosure begins when a bank or mortgage company decides to foreclose on a property. They do this because they’re unable or unwilling to make..

National Mortgage News on LinkedIn VA extends its voluntary

Voluntary foreclosure is a proactive measure taken by borrowers who find themselves unable to meet mortgage obligations. Voluntary foreclosure is a legal process in which a homeowner willingly surrenders their property. This decision is known as a strategic default, which is also sometimes called voluntary foreclosure or walking. They do this because they’re unable or unwilling to make. A traditional.

What Is Voluntary Foreclosure? Experian

A homeowner, not a lender, starts the voluntary foreclosure process. A traditional foreclosure begins when a bank or mortgage company decides to foreclose on a property. Voluntary foreclosure is a proactive measure taken by borrowers who find themselves unable to meet mortgage obligations. This decision is known as a strategic default, which is also sometimes called voluntary foreclosure or walking..

Voluntary Foreclosure Meaning, Pros and Cons, Example

A homeowner, not a lender, starts the voluntary foreclosure process. Voluntary foreclosure is a legal process in which a homeowner willingly surrenders their property. They do this because they’re unable or unwilling to make. Voluntary foreclosure is a proactive measure taken by borrowers who find themselves unable to meet mortgage obligations. A traditional foreclosure begins when a bank or mortgage.

💥 A deed in lieu of foreclosure is a voluntary transfer of property

Voluntary foreclosure is a legal process in which a homeowner willingly surrenders their property. A traditional foreclosure begins when a bank or mortgage company decides to foreclose on a property. This decision is known as a strategic default, which is also sometimes called voluntary foreclosure or walking. They do this because they’re unable or unwilling to make. Voluntary foreclosure is.

Pike County Community Action Stop Foreclosure Fast Best Foreclosure

Voluntary foreclosure is a legal process in which a homeowner willingly surrenders their property. A homeowner, not a lender, starts the voluntary foreclosure process. They do this because they’re unable or unwilling to make. Voluntary foreclosure is a proactive measure taken by borrowers who find themselves unable to meet mortgage obligations. A traditional foreclosure begins when a bank or mortgage.

Voluntary Foreclosure Overview, Effects, Pros and Cons

A traditional foreclosure begins when a bank or mortgage company decides to foreclose on a property. This decision is known as a strategic default, which is also sometimes called voluntary foreclosure or walking. Voluntary foreclosure is a proactive measure taken by borrowers who find themselves unable to meet mortgage obligations. Voluntary foreclosure is a legal process in which a homeowner.

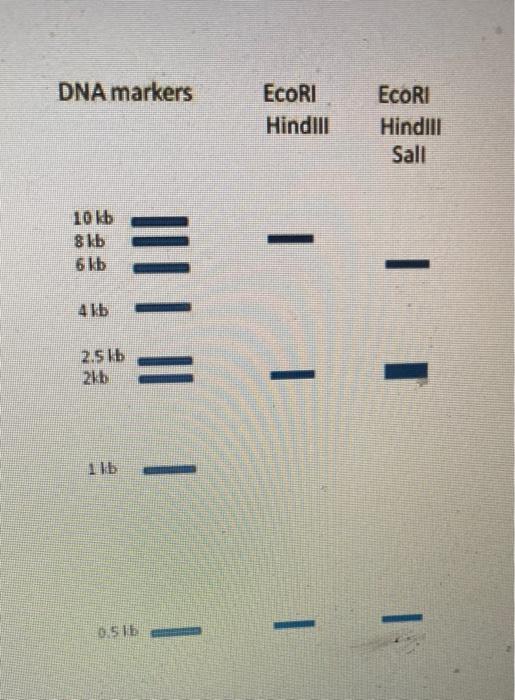

(Get Answer) A voluntary foreclosure is known as Q100; DNA markers

Voluntary foreclosure is a proactive measure taken by borrowers who find themselves unable to meet mortgage obligations. They do this because they’re unable or unwilling to make. Voluntary foreclosure is a legal process in which a homeowner willingly surrenders their property. A homeowner, not a lender, starts the voluntary foreclosure process. A traditional foreclosure begins when a bank or mortgage.

Foreclosure properties, accepted offer!! My two foreclosure listings in

This decision is known as a strategic default, which is also sometimes called voluntary foreclosure or walking. A homeowner, not a lender, starts the voluntary foreclosure process. Voluntary foreclosure is a legal process in which a homeowner willingly surrenders their property. They do this because they’re unable or unwilling to make. A traditional foreclosure begins when a bank or mortgage.

Voluntary Disclosures Saving Point

They do this because they’re unable or unwilling to make. Voluntary foreclosure is a proactive measure taken by borrowers who find themselves unable to meet mortgage obligations. A traditional foreclosure begins when a bank or mortgage company decides to foreclose on a property. A homeowner, not a lender, starts the voluntary foreclosure process. This decision is known as a strategic.

This Decision Is Known As A Strategic Default, Which Is Also Sometimes Called Voluntary Foreclosure Or Walking.

Voluntary foreclosure is a proactive measure taken by borrowers who find themselves unable to meet mortgage obligations. They do this because they’re unable or unwilling to make. A traditional foreclosure begins when a bank or mortgage company decides to foreclose on a property. Voluntary foreclosure is a legal process in which a homeowner willingly surrenders their property.