Tax Lien Sale Texas

Tax Lien Sale Texas - Further guidelines discussing other aspects of. Texas, currently has 2,419 tax liens and 28,853 other distressed listings available as of january 6. These are the basic fundamentals of the sales process of all texas tax lien sales. Smart homebuyers and savvy investors looking. Sales results by month are posted on the delinquent tax sales link at the bottom of this page. Cause numbers are noted as withdrawn,. In texas, properties with tax liens are offered for sale to the public by the county commissioner. The homeowner retains the right. A person conducting a sale for the foreclosure of a tax lien under rule 736 of the texas rules of civil procedure shall, within 10 days of the sale, pay.

Cause numbers are noted as withdrawn,. A person conducting a sale for the foreclosure of a tax lien under rule 736 of the texas rules of civil procedure shall, within 10 days of the sale, pay. In texas, properties with tax liens are offered for sale to the public by the county commissioner. Smart homebuyers and savvy investors looking. These are the basic fundamentals of the sales process of all texas tax lien sales. Sales results by month are posted on the delinquent tax sales link at the bottom of this page. Further guidelines discussing other aspects of. Texas, currently has 2,419 tax liens and 28,853 other distressed listings available as of january 6. The homeowner retains the right.

Further guidelines discussing other aspects of. A person conducting a sale for the foreclosure of a tax lien under rule 736 of the texas rules of civil procedure shall, within 10 days of the sale, pay. Smart homebuyers and savvy investors looking. These are the basic fundamentals of the sales process of all texas tax lien sales. Sales results by month are posted on the delinquent tax sales link at the bottom of this page. In texas, properties with tax liens are offered for sale to the public by the county commissioner. Texas, currently has 2,419 tax liens and 28,853 other distressed listings available as of january 6. Cause numbers are noted as withdrawn,. The homeowner retains the right.

Tax Review PDF Taxes Tax Lien

Smart homebuyers and savvy investors looking. Further guidelines discussing other aspects of. Sales results by month are posted on the delinquent tax sales link at the bottom of this page. Cause numbers are noted as withdrawn,. These are the basic fundamentals of the sales process of all texas tax lien sales.

Analysis of Bulk Tax Lien Sale Center for Community Progress

These are the basic fundamentals of the sales process of all texas tax lien sales. In texas, properties with tax liens are offered for sale to the public by the county commissioner. A person conducting a sale for the foreclosure of a tax lien under rule 736 of the texas rules of civil procedure shall, within 10 days of the.

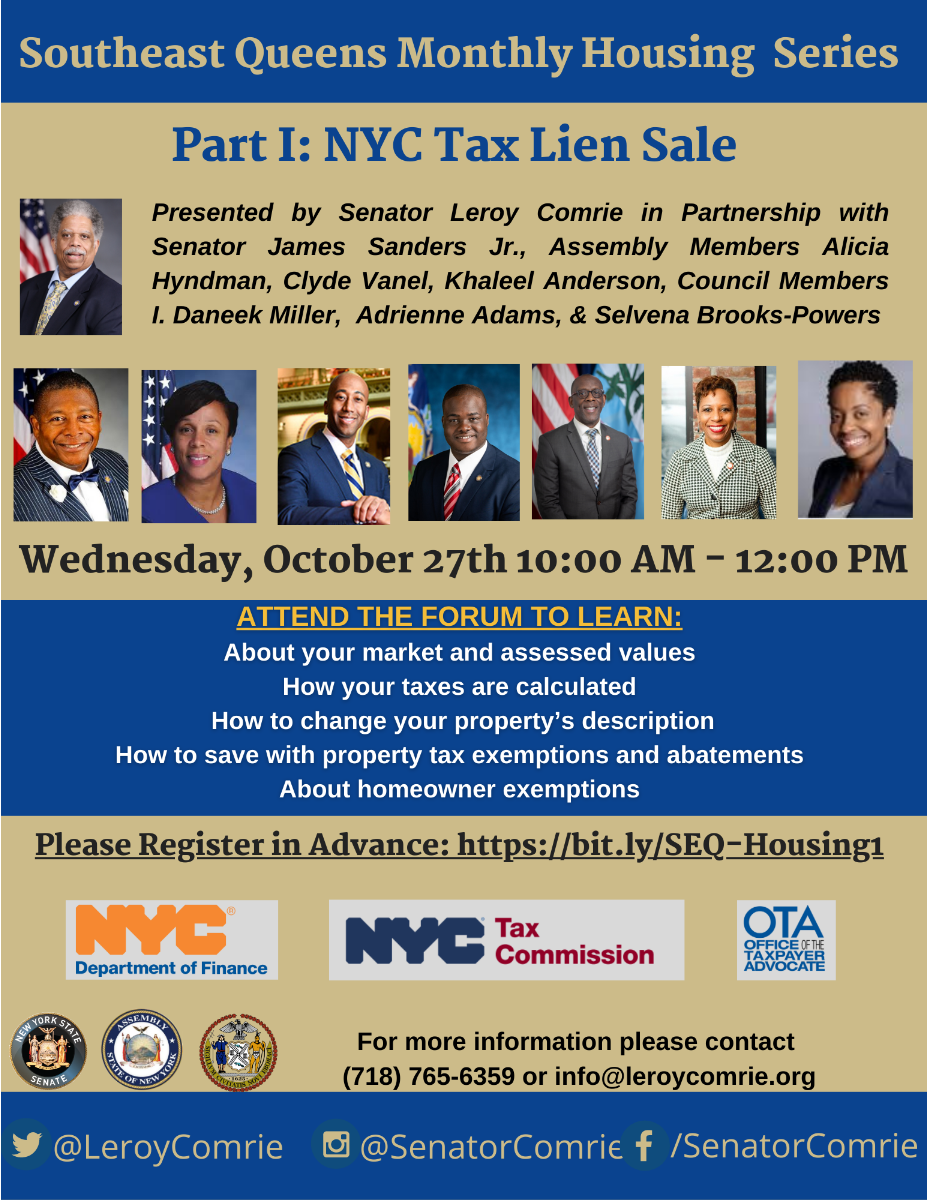

NYC Tax Lien Sale Information Session Jamaica311

In texas, properties with tax liens are offered for sale to the public by the county commissioner. The homeowner retains the right. A person conducting a sale for the foreclosure of a tax lien under rule 736 of the texas rules of civil procedure shall, within 10 days of the sale, pay. Sales results by month are posted on the.

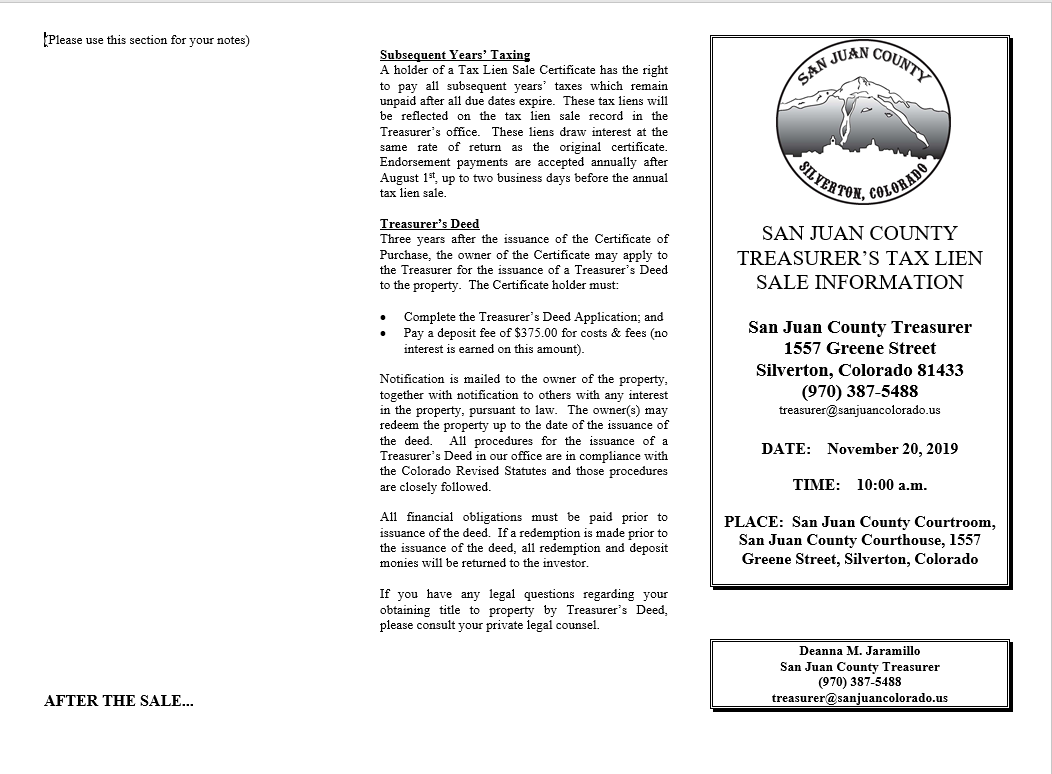

Tax Lien Sale San Juan County

A person conducting a sale for the foreclosure of a tax lien under rule 736 of the texas rules of civil procedure shall, within 10 days of the sale, pay. These are the basic fundamentals of the sales process of all texas tax lien sales. Smart homebuyers and savvy investors looking. In texas, properties with tax liens are offered for.

Tax Lien Properties Texas Real Estate Tax Lien Investing for Beginners

Cause numbers are noted as withdrawn,. Further guidelines discussing other aspects of. The homeowner retains the right. A person conducting a sale for the foreclosure of a tax lien under rule 736 of the texas rules of civil procedure shall, within 10 days of the sale, pay. These are the basic fundamentals of the sales process of all texas tax.

NYC Tax Lien Sale Reform Conference EastNewYorkCLT

Cause numbers are noted as withdrawn,. A person conducting a sale for the foreclosure of a tax lien under rule 736 of the texas rules of civil procedure shall, within 10 days of the sale, pay. In texas, properties with tax liens are offered for sale to the public by the county commissioner. Texas, currently has 2,419 tax liens and.

Informational Brochure About the Tax Lien Sale EastNewYorkCLT

In texas, properties with tax liens are offered for sale to the public by the county commissioner. Sales results by month are posted on the delinquent tax sales link at the bottom of this page. A person conducting a sale for the foreclosure of a tax lien under rule 736 of the texas rules of civil procedure shall, within 10.

Tax Lien Focus Group Real Estate And Profit Acceleration Enjoy Your

Sales results by month are posted on the delinquent tax sales link at the bottom of this page. These are the basic fundamentals of the sales process of all texas tax lien sales. Further guidelines discussing other aspects of. Texas, currently has 2,419 tax liens and 28,853 other distressed listings available as of january 6. The homeowner retains the right.

Tax Lien Sale PDF Tax Lien Taxes

Smart homebuyers and savvy investors looking. These are the basic fundamentals of the sales process of all texas tax lien sales. A person conducting a sale for the foreclosure of a tax lien under rule 736 of the texas rules of civil procedure shall, within 10 days of the sale, pay. In texas, properties with tax liens are offered for.

TEXAS TAX LIEN SALES GUIDE

These are the basic fundamentals of the sales process of all texas tax lien sales. Further guidelines discussing other aspects of. The homeowner retains the right. In texas, properties with tax liens are offered for sale to the public by the county commissioner. A person conducting a sale for the foreclosure of a tax lien under rule 736 of the.

These Are The Basic Fundamentals Of The Sales Process Of All Texas Tax Lien Sales.

Texas, currently has 2,419 tax liens and 28,853 other distressed listings available as of january 6. Further guidelines discussing other aspects of. In texas, properties with tax liens are offered for sale to the public by the county commissioner. A person conducting a sale for the foreclosure of a tax lien under rule 736 of the texas rules of civil procedure shall, within 10 days of the sale, pay.

Sales Results By Month Are Posted On The Delinquent Tax Sales Link At The Bottom Of This Page.

Cause numbers are noted as withdrawn,. Smart homebuyers and savvy investors looking. The homeowner retains the right.