Tax Lien Auctions California

Tax Lien Auctions California - Properties become subject to the county tax collector’s power to sell because of a default in the payment of property taxes for five or more. The auction is conducted by the county tax collector, and the. A reoffer sale will be held on september.

Properties become subject to the county tax collector’s power to sell because of a default in the payment of property taxes for five or more. The auction is conducted by the county tax collector, and the. A reoffer sale will be held on september.

The auction is conducted by the county tax collector, and the. A reoffer sale will be held on september. Properties become subject to the county tax collector’s power to sell because of a default in the payment of property taxes for five or more.

Pursuant to the Tax Lien, Tax May be Collected from Estate Property in

Properties become subject to the county tax collector’s power to sell because of a default in the payment of property taxes for five or more. The auction is conducted by the county tax collector, and the. A reoffer sale will be held on september.

Tax Review PDF Taxes Tax Lien

The auction is conducted by the county tax collector, and the. A reoffer sale will be held on september. Properties become subject to the county tax collector’s power to sell because of a default in the payment of property taxes for five or more.

Federal tax lien on foreclosed property laderdriver

Properties become subject to the county tax collector’s power to sell because of a default in the payment of property taxes for five or more. The auction is conducted by the county tax collector, and the. A reoffer sale will be held on september.

Tax Lien Focus Group Real Estate And Profit Acceleration Enjoy Your

The auction is conducted by the county tax collector, and the. A reoffer sale will be held on september. Properties become subject to the county tax collector’s power to sell because of a default in the payment of property taxes for five or more.

EasytoUnderstand Tax Lien Code Certificates Posteezy

A reoffer sale will be held on september. The auction is conducted by the county tax collector, and the. Properties become subject to the county tax collector’s power to sell because of a default in the payment of property taxes for five or more.

Tax Lien Sale PDF Tax Lien Taxes

Properties become subject to the county tax collector’s power to sell because of a default in the payment of property taxes for five or more. A reoffer sale will be held on september. The auction is conducted by the county tax collector, and the.

My Open path

A reoffer sale will be held on september. Properties become subject to the county tax collector’s power to sell because of a default in the payment of property taxes for five or more. The auction is conducted by the county tax collector, and the.

Tax Lien Investing Tips Tax Lien Investing Tips brought to you by

A reoffer sale will be held on september. The auction is conducted by the county tax collector, and the. Properties become subject to the county tax collector’s power to sell because of a default in the payment of property taxes for five or more.

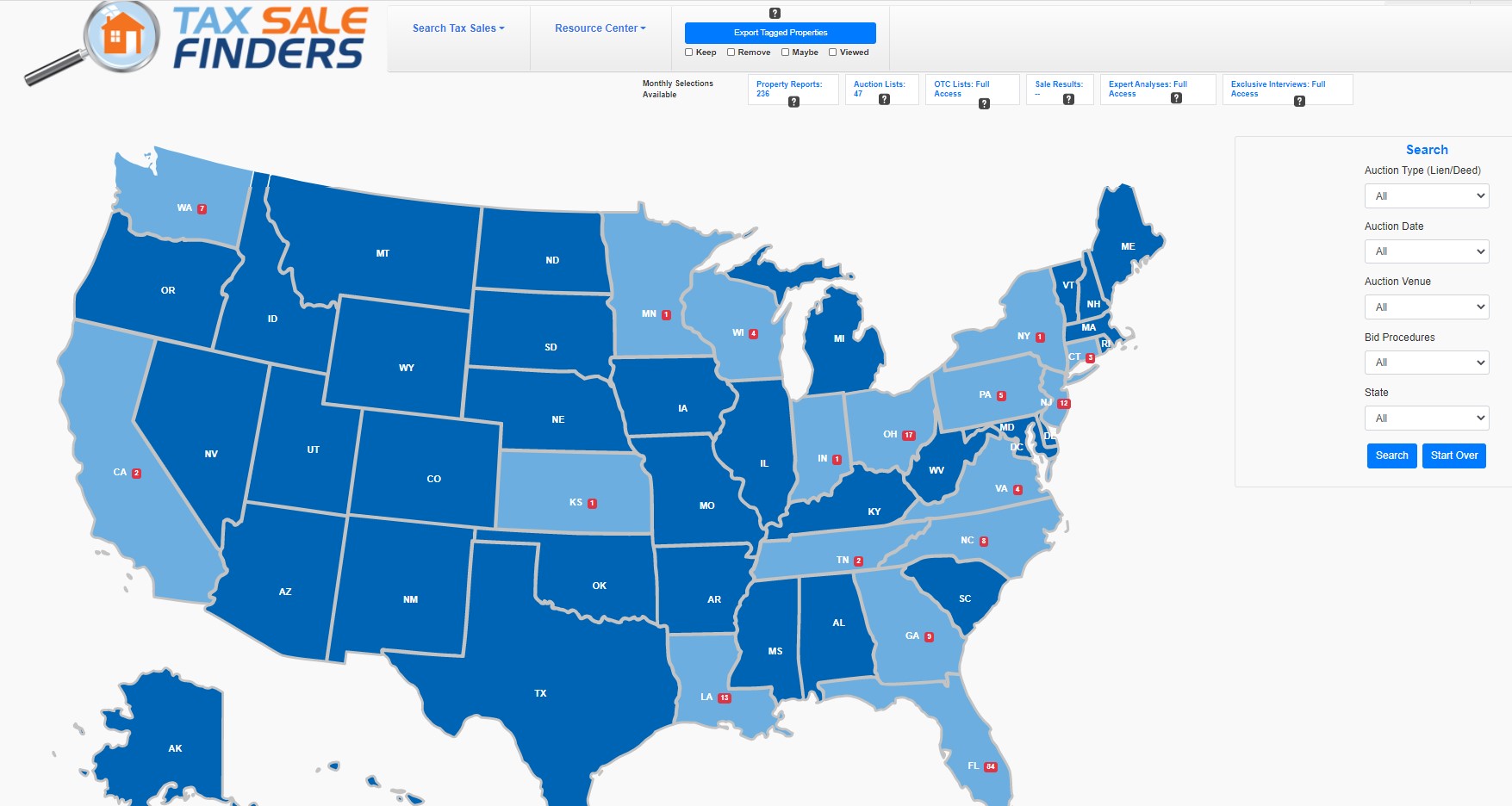

How to Buy Tax Lien and Auction Properties (Live Webinar + Replay)

The auction is conducted by the county tax collector, and the. Properties become subject to the county tax collector’s power to sell because of a default in the payment of property taxes for five or more. A reoffer sale will be held on september.

About Apartment Foreclosures, Auctions, and Tax Lien Deeds

Properties become subject to the county tax collector’s power to sell because of a default in the payment of property taxes for five or more. The auction is conducted by the county tax collector, and the. A reoffer sale will be held on september.

A Reoffer Sale Will Be Held On September.

Properties become subject to the county tax collector’s power to sell because of a default in the payment of property taxes for five or more. The auction is conducted by the county tax collector, and the.