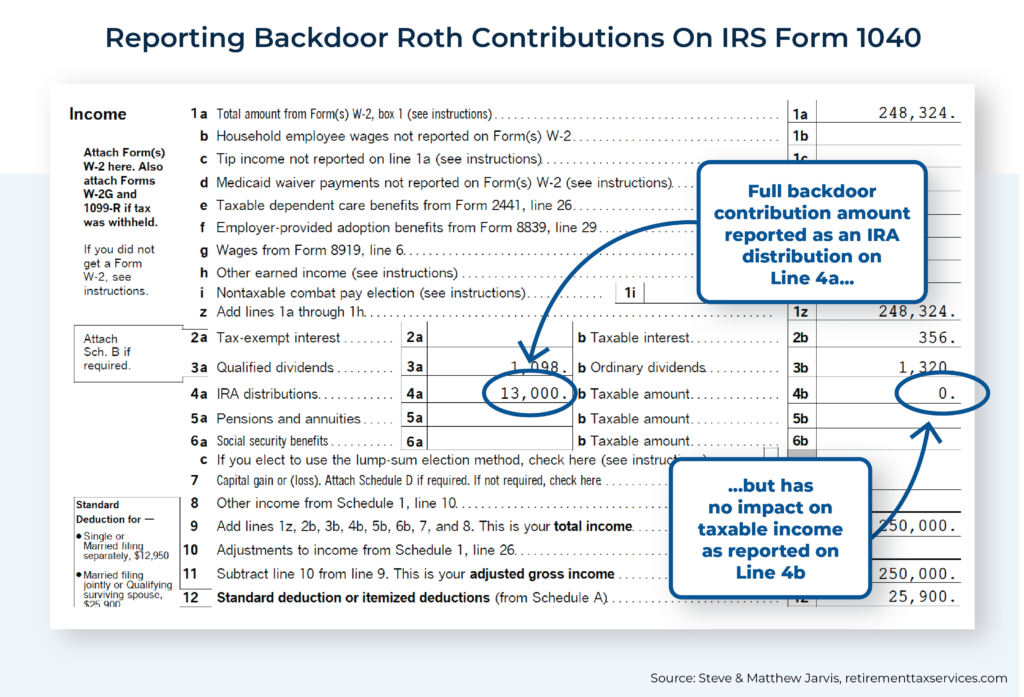

Tax Form For Backdoor Roth

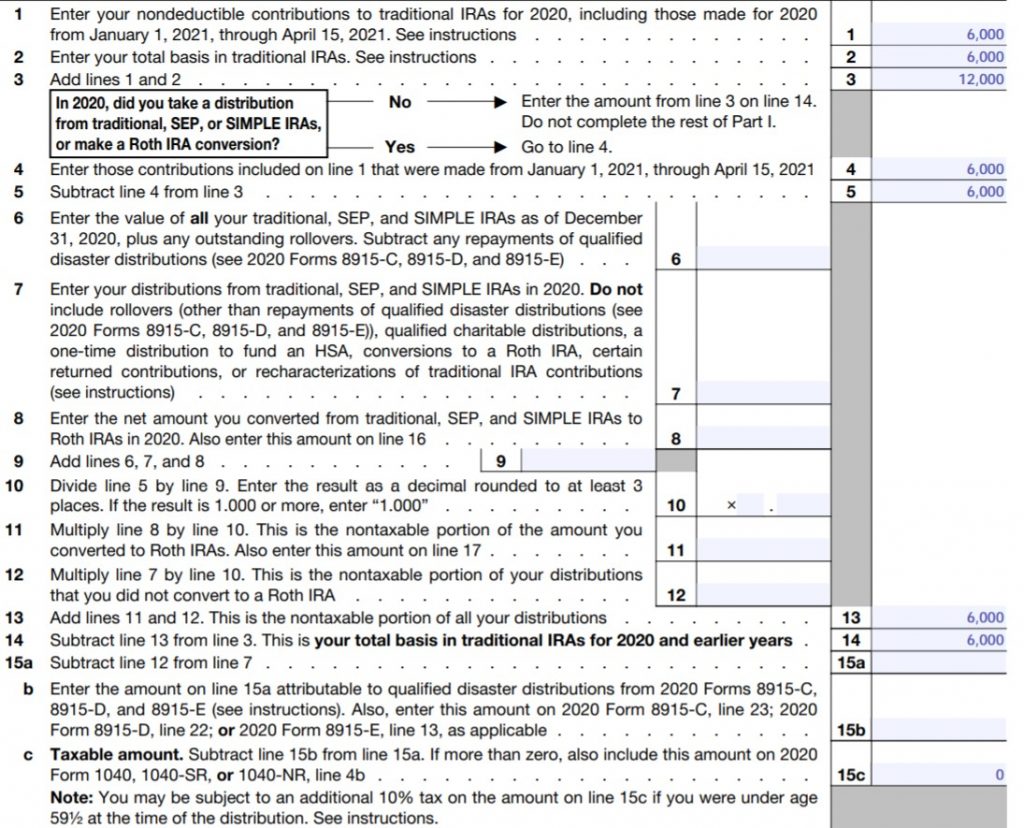

Tax Form For Backdoor Roth - The full distribution does not need to be converted to a roth ira. The tax form, which is filed as part of your overall return, reports to the irs. Form 8606 is the key to reporting backdoor roth iras successfully. Here's how to do it. Form 8606 is a key component to reporting a backdoor roth ira. A backdoor roth ira allows you to get around income limits by converting a traditional ira into a roth ira. Conversions must be reported on form 8606, part ii.

A backdoor roth ira allows you to get around income limits by converting a traditional ira into a roth ira. The full distribution does not need to be converted to a roth ira. Here's how to do it. Form 8606 is the key to reporting backdoor roth iras successfully. The tax form, which is filed as part of your overall return, reports to the irs. Form 8606 is a key component to reporting a backdoor roth ira. Conversions must be reported on form 8606, part ii.

The tax form, which is filed as part of your overall return, reports to the irs. Form 8606 is the key to reporting backdoor roth iras successfully. Here's how to do it. Form 8606 is a key component to reporting a backdoor roth ira. A backdoor roth ira allows you to get around income limits by converting a traditional ira into a roth ira. Conversions must be reported on form 8606, part ii. The full distribution does not need to be converted to a roth ira.

Effective Backdoor Roth Strategy Rules, IRS Form 8606

Here's how to do it. Form 8606 is the key to reporting backdoor roth iras successfully. The tax form, which is filed as part of your overall return, reports to the irs. A backdoor roth ira allows you to get around income limits by converting a traditional ira into a roth ira. Conversions must be reported on form 8606, part.

Can I Withdraw My Contributions From a Roth IRA Without a Penalty?

Form 8606 is the key to reporting backdoor roth iras successfully. The full distribution does not need to be converted to a roth ira. The tax form, which is filed as part of your overall return, reports to the irs. A backdoor roth ira allows you to get around income limits by converting a traditional ira into a roth ira..

How to Report a Backdoor Roth Conversion Gilbert Wealth

A backdoor roth ira allows you to get around income limits by converting a traditional ira into a roth ira. Here's how to do it. Form 8606 is the key to reporting backdoor roth iras successfully. Form 8606 is a key component to reporting a backdoor roth ira. The tax form, which is filed as part of your overall return,.

Backdoor IRA Gillingham CPA

The full distribution does not need to be converted to a roth ira. Here's how to do it. Form 8606 is the key to reporting backdoor roth iras successfully. The tax form, which is filed as part of your overall return, reports to the irs. Form 8606 is a key component to reporting a backdoor roth ira.

Make Backdoor Roth Easy On Your Tax Return

Form 8606 is a key component to reporting a backdoor roth ira. Form 8606 is the key to reporting backdoor roth iras successfully. Conversions must be reported on form 8606, part ii. The full distribution does not need to be converted to a roth ira. The tax form, which is filed as part of your overall return, reports to the.

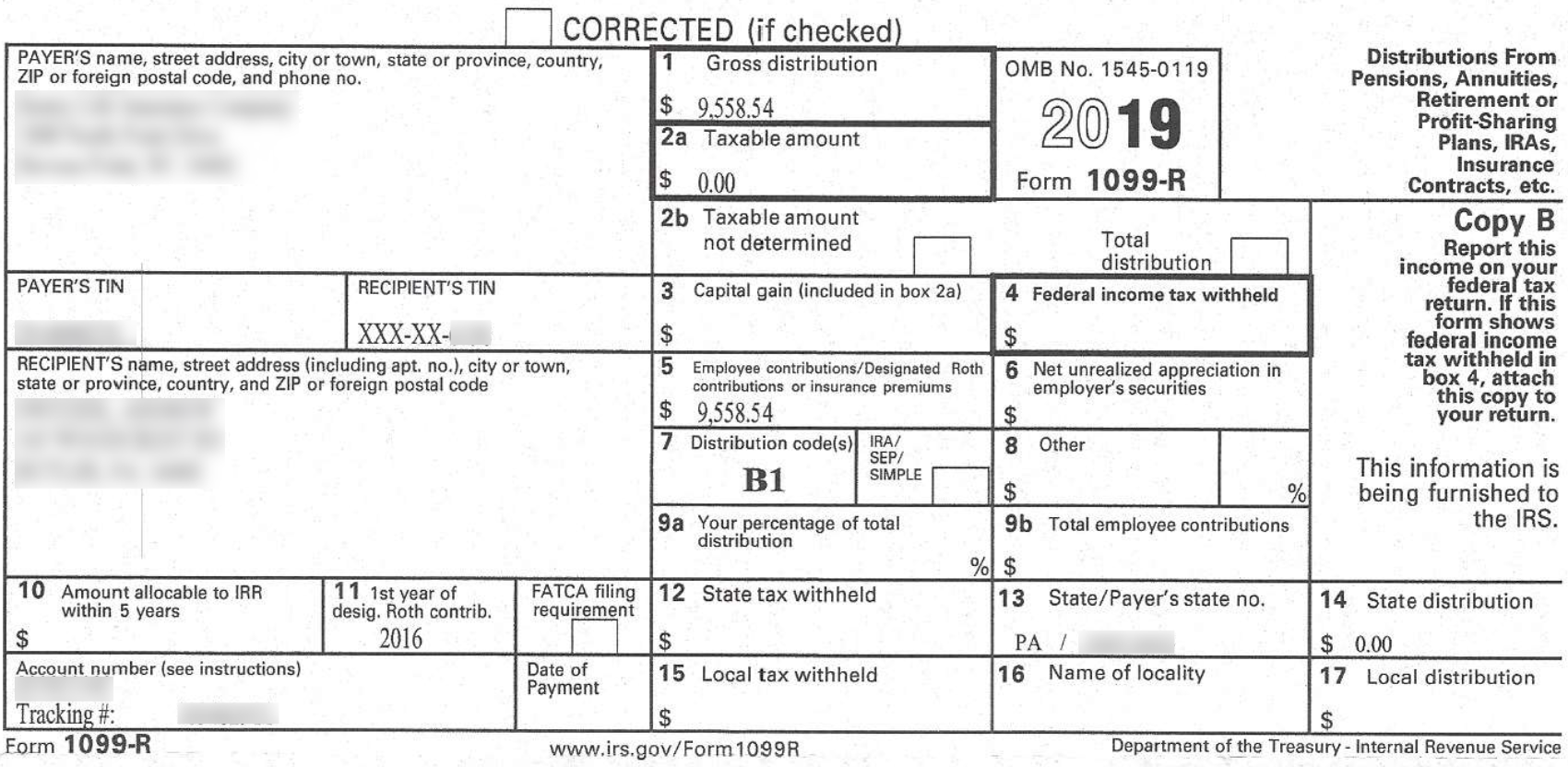

Tax form for backdoor Roth Conversion r/tax

Form 8606 is the key to reporting backdoor roth iras successfully. Form 8606 is a key component to reporting a backdoor roth ira. The tax form, which is filed as part of your overall return, reports to the irs. The full distribution does not need to be converted to a roth ira. Conversions must be reported on form 8606, part.

Make Backdoor Roth Easy On Your Tax Return

The tax form, which is filed as part of your overall return, reports to the irs. Conversions must be reported on form 8606, part ii. A backdoor roth ira allows you to get around income limits by converting a traditional ira into a roth ira. Form 8606 is a key component to reporting a backdoor roth ira. The full distribution.

LATE Backdoor ROTH IRA Tax Tutorial TurboTax & Form 8606 walkthrough

Here's how to do it. The full distribution does not need to be converted to a roth ira. A backdoor roth ira allows you to get around income limits by converting a traditional ira into a roth ira. The tax form, which is filed as part of your overall return, reports to the irs. Form 8606 is a key component.

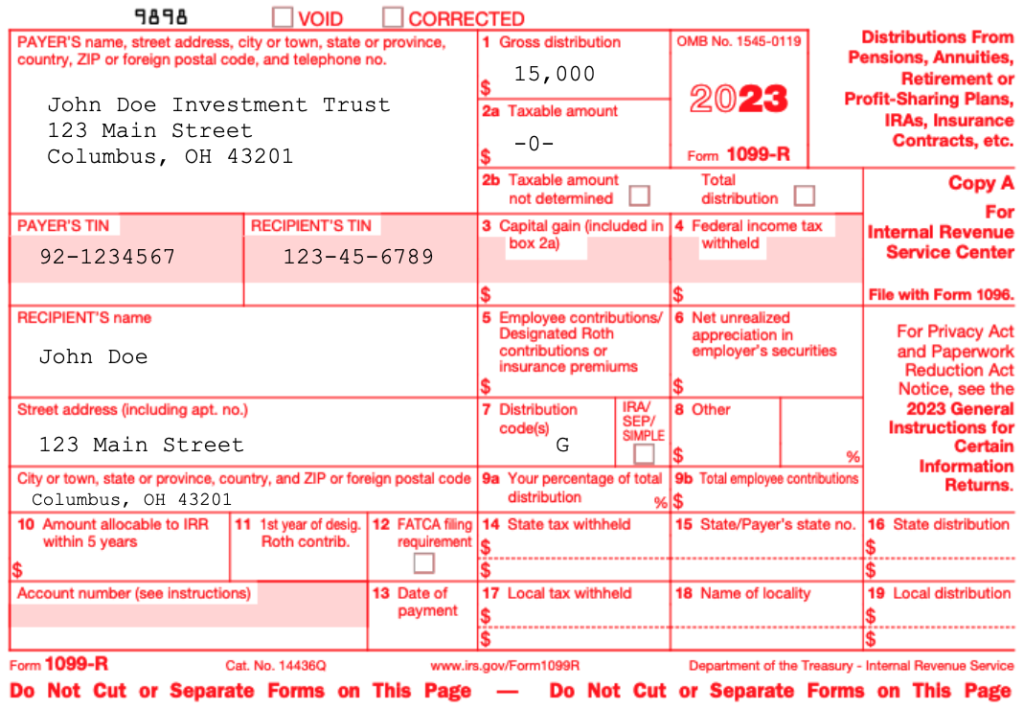

How to File IRS Form 1099R Solo 401k

Conversions must be reported on form 8606, part ii. Form 8606 is a key component to reporting a backdoor roth ira. A backdoor roth ira allows you to get around income limits by converting a traditional ira into a roth ira. The full distribution does not need to be converted to a roth ira. Here's how to do it.

Make Backdoor Roth Easy On Your Tax Return

Conversions must be reported on form 8606, part ii. Form 8606 is the key to reporting backdoor roth iras successfully. The tax form, which is filed as part of your overall return, reports to the irs. Form 8606 is a key component to reporting a backdoor roth ira. A backdoor roth ira allows you to get around income limits by.

Form 8606 Is The Key To Reporting Backdoor Roth Iras Successfully.

A backdoor roth ira allows you to get around income limits by converting a traditional ira into a roth ira. Form 8606 is a key component to reporting a backdoor roth ira. The tax form, which is filed as part of your overall return, reports to the irs. Here's how to do it.

Conversions Must Be Reported On Form 8606, Part Ii.

The full distribution does not need to be converted to a roth ira.