Tax Foreclosure

Tax Foreclosure - All states have laws allowing the local government to then sell your home through a tax lien process to collect the delinquent taxes. A tax lien foreclosure is one of two methods employed by government authorities to tackle delinquent property taxes, the other. Learn what tax foreclosure is, how it differs from tax deed sale, and how to invest in tax lien certificates. Find out the advantages and. A tax lien foreclosure, or tax lien sale, is a specific type of proceeding conducted by a state or local government agency.

Learn what tax foreclosure is, how it differs from tax deed sale, and how to invest in tax lien certificates. All states have laws allowing the local government to then sell your home through a tax lien process to collect the delinquent taxes. A tax lien foreclosure, or tax lien sale, is a specific type of proceeding conducted by a state or local government agency. A tax lien foreclosure is one of two methods employed by government authorities to tackle delinquent property taxes, the other. Find out the advantages and.

A tax lien foreclosure is one of two methods employed by government authorities to tackle delinquent property taxes, the other. Learn what tax foreclosure is, how it differs from tax deed sale, and how to invest in tax lien certificates. Find out the advantages and. A tax lien foreclosure, or tax lien sale, is a specific type of proceeding conducted by a state or local government agency. All states have laws allowing the local government to then sell your home through a tax lien process to collect the delinquent taxes.

Tax Foreclosure Digital Course

Find out the advantages and. A tax lien foreclosure, or tax lien sale, is a specific type of proceeding conducted by a state or local government agency. A tax lien foreclosure is one of two methods employed by government authorities to tackle delinquent property taxes, the other. All states have laws allowing the local government to then sell your home.

Homeowners, in foreclosure, face tax implications. What you should know

All states have laws allowing the local government to then sell your home through a tax lien process to collect the delinquent taxes. A tax lien foreclosure is one of two methods employed by government authorities to tackle delinquent property taxes, the other. Learn what tax foreclosure is, how it differs from tax deed sale, and how to invest in.

SampleForeclosureAnswer PDF Foreclosure Complaint

Find out the advantages and. All states have laws allowing the local government to then sell your home through a tax lien process to collect the delinquent taxes. A tax lien foreclosure is one of two methods employed by government authorities to tackle delinquent property taxes, the other. Learn what tax foreclosure is, how it differs from tax deed sale,.

How To Buy Tax Foreclosure Homes Documentride5

All states have laws allowing the local government to then sell your home through a tax lien process to collect the delinquent taxes. Learn what tax foreclosure is, how it differs from tax deed sale, and how to invest in tax lien certificates. Find out the advantages and. A tax lien foreclosure, or tax lien sale, is a specific type.

Property Tax Foreclosure Auction Set Keweenaw Report

Learn what tax foreclosure is, how it differs from tax deed sale, and how to invest in tax lien certificates. All states have laws allowing the local government to then sell your home through a tax lien process to collect the delinquent taxes. A tax lien foreclosure is one of two methods employed by government authorities to tackle delinquent property.

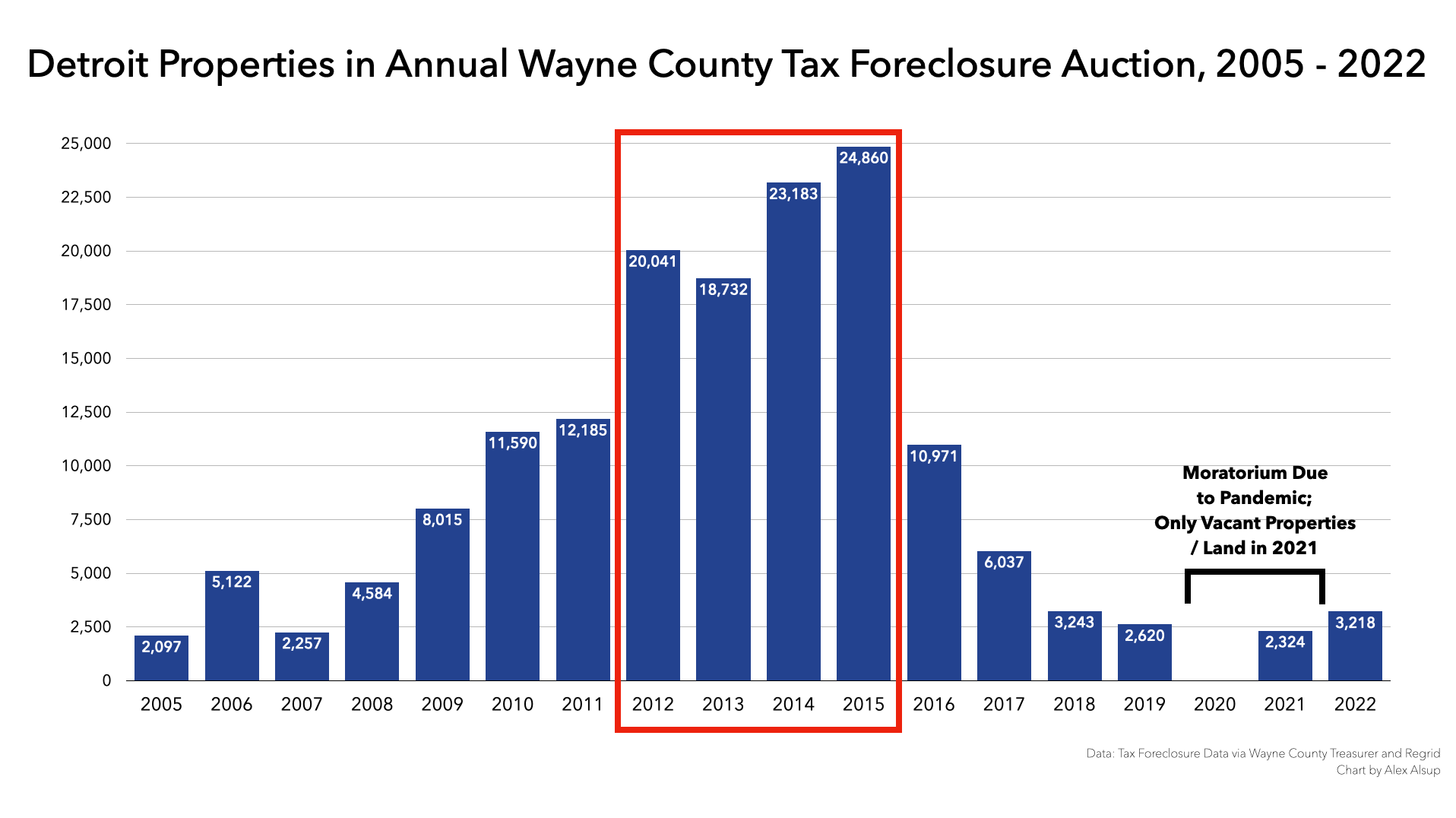

The 2022 Tax Foreclosure Auction in Detroit by Alex Alsup

A tax lien foreclosure is one of two methods employed by government authorities to tackle delinquent property taxes, the other. A tax lien foreclosure, or tax lien sale, is a specific type of proceeding conducted by a state or local government agency. Learn what tax foreclosure is, how it differs from tax deed sale, and how to invest in tax.

stop property tax foreclosure

All states have laws allowing the local government to then sell your home through a tax lien process to collect the delinquent taxes. A tax lien foreclosure, or tax lien sale, is a specific type of proceeding conducted by a state or local government agency. A tax lien foreclosure is one of two methods employed by government authorities to tackle.

Home Foreclosure Secrets

Find out the advantages and. Learn what tax foreclosure is, how it differs from tax deed sale, and how to invest in tax lien certificates. All states have laws allowing the local government to then sell your home through a tax lien process to collect the delinquent taxes. A tax lien foreclosure, or tax lien sale, is a specific type.

How to Stop Property Tax Foreclosure Jarrett Law Firm

All states have laws allowing the local government to then sell your home through a tax lien process to collect the delinquent taxes. Learn what tax foreclosure is, how it differs from tax deed sale, and how to invest in tax lien certificates. A tax lien foreclosure, or tax lien sale, is a specific type of proceeding conducted by a.

Details About the Orange County Tax Foreclosure Auction

All states have laws allowing the local government to then sell your home through a tax lien process to collect the delinquent taxes. A tax lien foreclosure is one of two methods employed by government authorities to tackle delinquent property taxes, the other. Learn what tax foreclosure is, how it differs from tax deed sale, and how to invest in.

Learn What Tax Foreclosure Is, How It Differs From Tax Deed Sale, And How To Invest In Tax Lien Certificates.

Find out the advantages and. All states have laws allowing the local government to then sell your home through a tax lien process to collect the delinquent taxes. A tax lien foreclosure is one of two methods employed by government authorities to tackle delinquent property taxes, the other. A tax lien foreclosure, or tax lien sale, is a specific type of proceeding conducted by a state or local government agency.