Tax Definition Math

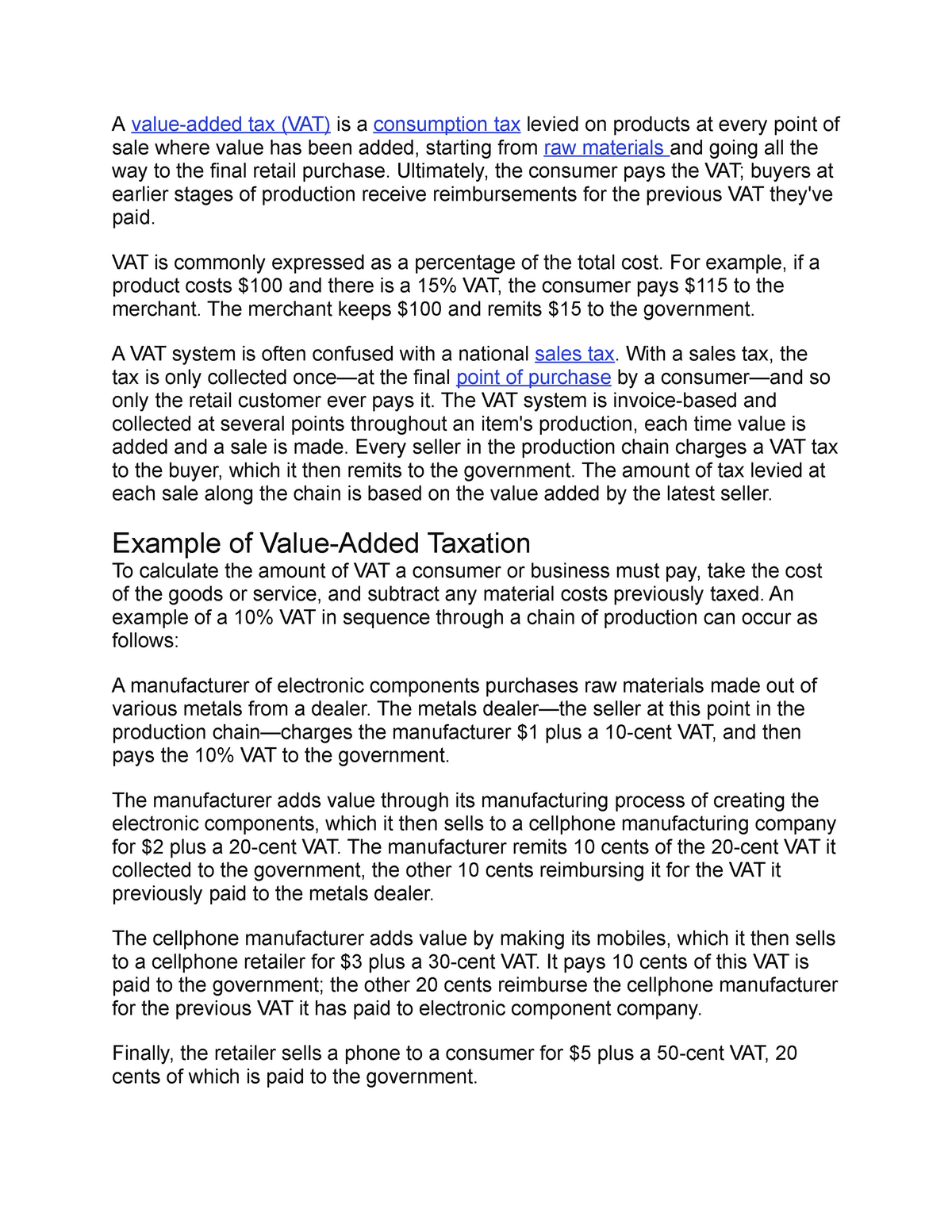

Tax Definition Math - Money that the government collects based on income, sales, and other activities. Taxes are often referred to as progressive, regressive, or flat. Income tax is based on your salary or wage. A tax is a compulsory financial charge or other levy imposed upon a taxpayer by a governmental organization in order to fund various public. A flat tax, or proportional tax, charges a constant percentage. In mathematics, we will learn about all these taxes levied by the government such as sales tax, value added tax, goods and services tax. There are many different types of tax. Tax is money you pay to the government.

In mathematics, we will learn about all these taxes levied by the government such as sales tax, value added tax, goods and services tax. Tax is money you pay to the government. There are many different types of tax. A flat tax, or proportional tax, charges a constant percentage. Money that the government collects based on income, sales, and other activities. A tax is a compulsory financial charge or other levy imposed upon a taxpayer by a governmental organization in order to fund various public. Taxes are often referred to as progressive, regressive, or flat. Income tax is based on your salary or wage.

Money that the government collects based on income, sales, and other activities. Income tax is based on your salary or wage. In mathematics, we will learn about all these taxes levied by the government such as sales tax, value added tax, goods and services tax. There are many different types of tax. A tax is a compulsory financial charge or other levy imposed upon a taxpayer by a governmental organization in order to fund various public. Tax is money you pay to the government. Taxes are often referred to as progressive, regressive, or flat. A flat tax, or proportional tax, charges a constant percentage.

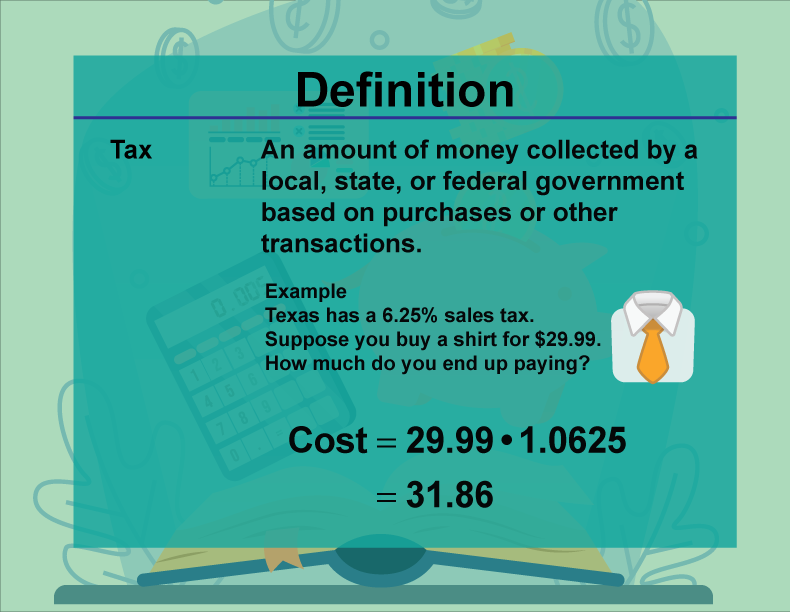

DefinitionRatios, Proportions, and Percents ConceptsCalculating Tax

Tax is money you pay to the government. A flat tax, or proportional tax, charges a constant percentage. Taxes are often referred to as progressive, regressive, or flat. A tax is a compulsory financial charge or other levy imposed upon a taxpayer by a governmental organization in order to fund various public. There are many different types of tax.

Excise Tax vs. Sale Tax How the Two Taxes Work (2023) Shopify

A flat tax, or proportional tax, charges a constant percentage. Taxes are often referred to as progressive, regressive, or flat. In mathematics, we will learn about all these taxes levied by the government such as sales tax, value added tax, goods and services tax. There are many different types of tax. Tax is money you pay to the government.

DefinitionFinancial LiteracyTax Deduction Media4Math

Income tax is based on your salary or wage. A flat tax, or proportional tax, charges a constant percentage. Tax is money you pay to the government. There are many different types of tax. Taxes are often referred to as progressive, regressive, or flat.

sales tax A Maths Dictionary for Kids Quick Reference by Jenny Eather

Income tax is based on your salary or wage. Tax is money you pay to the government. There are many different types of tax. A flat tax, or proportional tax, charges a constant percentage. In mathematics, we will learn about all these taxes levied by the government such as sales tax, value added tax, goods and services tax.

Taxes Definition Types, Who Pays, and Why (2024)

Income tax is based on your salary or wage. Taxes are often referred to as progressive, regressive, or flat. A tax is a compulsory financial charge or other levy imposed upon a taxpayer by a governmental organization in order to fund various public. Money that the government collects based on income, sales, and other activities. There are many different types.

Calculation of Sales Tax Definition, Formula, Examples How to find

There are many different types of tax. Tax is money you pay to the government. In mathematics, we will learn about all these taxes levied by the government such as sales tax, value added tax, goods and services tax. Taxes are often referred to as progressive, regressive, or flat. Money that the government collects based on income, sales, and other.

Math Formula To Calculate Property Tax Math Info

Money that the government collects based on income, sales, and other activities. In mathematics, we will learn about all these taxes levied by the government such as sales tax, value added tax, goods and services tax. There are many different types of tax. A tax is a compulsory financial charge or other levy imposed upon a taxpayer by a governmental.

Value Added Tax Definition Examples Investopedia Studocu

There are many different types of tax. A flat tax, or proportional tax, charges a constant percentage. In mathematics, we will learn about all these taxes levied by the government such as sales tax, value added tax, goods and services tax. Money that the government collects based on income, sales, and other activities. Tax is money you pay to the.

How to calculate taxes and discounts Basic Concept, Formulas and

Income tax is based on your salary or wage. Tax is money you pay to the government. Taxes are often referred to as progressive, regressive, or flat. There are many different types of tax. A tax is a compulsory financial charge or other levy imposed upon a taxpayer by a governmental organization in order to fund various public.

DefinitionFinancial LiteracyTax Media4Math

Taxes are often referred to as progressive, regressive, or flat. Income tax is based on your salary or wage. Money that the government collects based on income, sales, and other activities. There are many different types of tax. A tax is a compulsory financial charge or other levy imposed upon a taxpayer by a governmental organization in order to fund.

Income Tax Is Based On Your Salary Or Wage.

In mathematics, we will learn about all these taxes levied by the government such as sales tax, value added tax, goods and services tax. Tax is money you pay to the government. Money that the government collects based on income, sales, and other activities. A tax is a compulsory financial charge or other levy imposed upon a taxpayer by a governmental organization in order to fund various public.

Taxes Are Often Referred To As Progressive, Regressive, Or Flat.

A flat tax, or proportional tax, charges a constant percentage. There are many different types of tax.

:max_bytes(150000):strip_icc()/taxes-4188113-1-fb27402db4ac4638875e56eefb0ba00d.jpg)