Suffolk County Tax Liens

Suffolk County Tax Liens - Will the town take my property if i do not pay my taxes? Suffolk county, ny, currently has 3,708 tax liens available as of january 3. Foreclosure refers to the procedure of a lender repossessing a. If taxes remain unpaid by. The town is not involved in the delinquency process. Search tax payment records, access the tax archive, perform a tax record lookup, or explore tax lien records. Our links guide you to the. Suffolk county will hold its annual delinquent property tax sale on november 20th, 2024, as an online auction through the suffolk. So if you are buying a home, satisfying your mortgage, filing a lien or judgment, grieving your taxes or interacting with the judicial system, we. Explore all foreclosures and tax lien sales in suffolk county, new york.

So if you are buying a home, satisfying your mortgage, filing a lien or judgment, grieving your taxes or interacting with the judicial system, we. If taxes remain unpaid by. The town is not involved in the delinquency process. Suffolk county, ny, currently has 3,708 tax liens available as of january 3. Will the town take my property if i do not pay my taxes? Search tax payment records, access the tax archive, perform a tax record lookup, or explore tax lien records. Explore all foreclosures and tax lien sales in suffolk county, new york. Foreclosure refers to the procedure of a lender repossessing a. Our links guide you to the. Suffolk county will hold its annual delinquent property tax sale on november 20th, 2024, as an online auction through the suffolk.

Search tax payment records, access the tax archive, perform a tax record lookup, or explore tax lien records. If taxes remain unpaid by. Explore all foreclosures and tax lien sales in suffolk county, new york. The town is not involved in the delinquency process. Foreclosure refers to the procedure of a lender repossessing a. Suffolk county will hold its annual delinquent property tax sale on november 20th, 2024, as an online auction through the suffolk. So if you are buying a home, satisfying your mortgage, filing a lien or judgment, grieving your taxes or interacting with the judicial system, we. Will the town take my property if i do not pay my taxes? Our links guide you to the. Suffolk county, ny, currently has 3,708 tax liens available as of january 3.

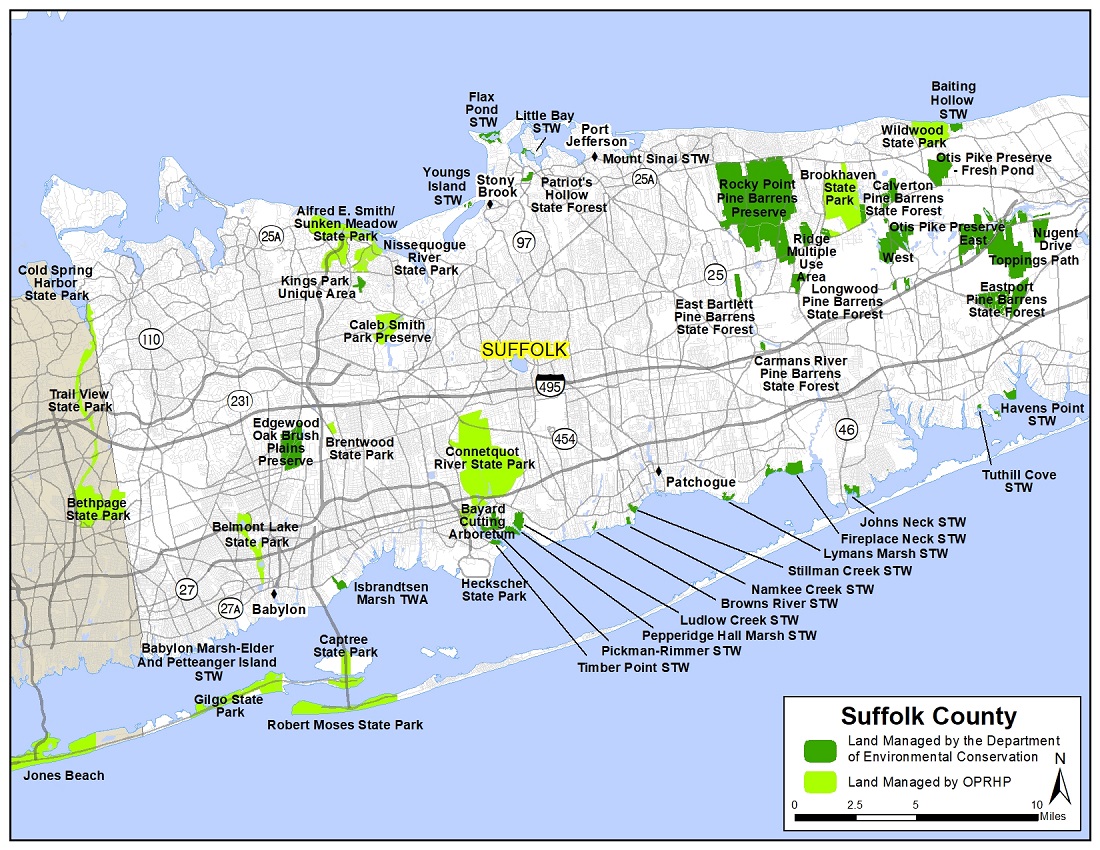

Suffolk County Tax Map Everything You Need To Know In 2023 2023

Foreclosure refers to the procedure of a lender repossessing a. If taxes remain unpaid by. So if you are buying a home, satisfying your mortgage, filing a lien or judgment, grieving your taxes or interacting with the judicial system, we. Will the town take my property if i do not pay my taxes? Explore all foreclosures and tax lien sales.

Suffolk County Tax Map Everything You Need To Know In 2023 2023

Search tax payment records, access the tax archive, perform a tax record lookup, or explore tax lien records. The town is not involved in the delinquency process. Suffolk county will hold its annual delinquent property tax sale on november 20th, 2024, as an online auction through the suffolk. Our links guide you to the. Explore all foreclosures and tax lien.

Suffolk County Tax Lien Sale 2024 Marne Sharona

Will the town take my property if i do not pay my taxes? Suffolk county will hold its annual delinquent property tax sale on november 20th, 2024, as an online auction through the suffolk. So if you are buying a home, satisfying your mortgage, filing a lien or judgment, grieving your taxes or interacting with the judicial system, we. Suffolk.

Suffolk County Tax Grievance Form

Our links guide you to the. Suffolk county will hold its annual delinquent property tax sale on november 20th, 2024, as an online auction through the suffolk. Foreclosure refers to the procedure of a lender repossessing a. If taxes remain unpaid by. Will the town take my property if i do not pay my taxes?

Suffolk County Tax Map Everything You Need To Know In 2023 2023

Suffolk county, ny, currently has 3,708 tax liens available as of january 3. Will the town take my property if i do not pay my taxes? The town is not involved in the delinquency process. Explore all foreclosures and tax lien sales in suffolk county, new york. If taxes remain unpaid by.

Suffolk County Tax Lien Auction 2024 Valli Isabelle

Suffolk county, ny, currently has 3,708 tax liens available as of january 3. If taxes remain unpaid by. Suffolk county will hold its annual delinquent property tax sale on november 20th, 2024, as an online auction through the suffolk. Search tax payment records, access the tax archive, perform a tax record lookup, or explore tax lien records. Explore all foreclosures.

Suffolk County Tax Map

Explore all foreclosures and tax lien sales in suffolk county, new york. Our links guide you to the. Suffolk county, ny, currently has 3,708 tax liens available as of january 3. The town is not involved in the delinquency process. If taxes remain unpaid by.

Suffolk County Property Tax Savings Tax Reduction Services

Will the town take my property if i do not pay my taxes? The town is not involved in the delinquency process. Foreclosure refers to the procedure of a lender repossessing a. Our links guide you to the. Suffolk county, ny, currently has 3,708 tax liens available as of january 3.

Suffolk County Tax Lien Auction 2024 Valli Isabelle

Suffolk county will hold its annual delinquent property tax sale on november 20th, 2024, as an online auction through the suffolk. Suffolk county, ny, currently has 3,708 tax liens available as of january 3. Explore all foreclosures and tax lien sales in suffolk county, new york. If taxes remain unpaid by. The town is not involved in the delinquency process.

Suffolk County Tax Lien Auction 2024 Valli Isabelle

Search tax payment records, access the tax archive, perform a tax record lookup, or explore tax lien records. So if you are buying a home, satisfying your mortgage, filing a lien or judgment, grieving your taxes or interacting with the judicial system, we. The town is not involved in the delinquency process. Suffolk county, ny, currently has 3,708 tax liens.

Suffolk County, Ny, Currently Has 3,708 Tax Liens Available As Of January 3.

Will the town take my property if i do not pay my taxes? So if you are buying a home, satisfying your mortgage, filing a lien or judgment, grieving your taxes or interacting with the judicial system, we. Foreclosure refers to the procedure of a lender repossessing a. The town is not involved in the delinquency process.

Our Links Guide You To The.

Suffolk county will hold its annual delinquent property tax sale on november 20th, 2024, as an online auction through the suffolk. Search tax payment records, access the tax archive, perform a tax record lookup, or explore tax lien records. If taxes remain unpaid by. Explore all foreclosures and tax lien sales in suffolk county, new york.