Schedule 1 Tax Form Fafsa

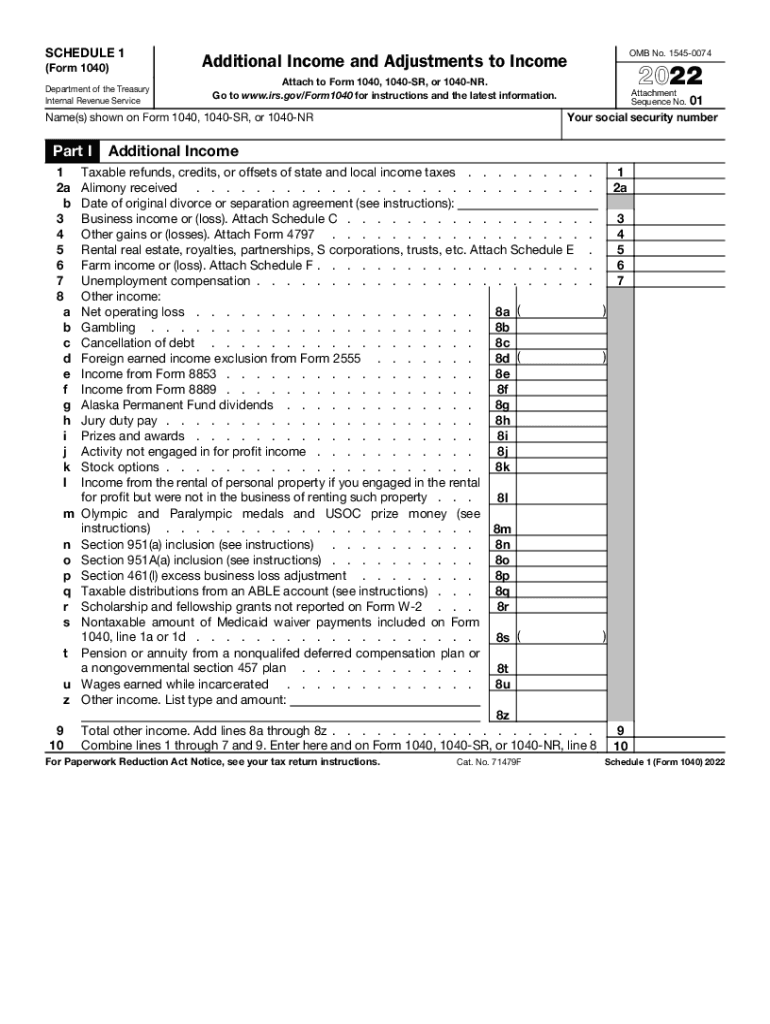

Schedule 1 Tax Form Fafsa - What is a schedule 1? Since the fy23 tax return covers 8 months of the 2023 calendar year and the fy24 tax return covers 4 months of the 2023 calendar. If you are a freelancer or contractor (and therefore receive a 1099), then in tax terms you run a “sole proprietorship business” and. Irs form 1040—line 1 (or irs form 1040. Schedule 1 the irs schedule 1 is a form that can be filed in addition to form 1040 to report specific types of additional income and other. While completing your federal income taxes, families will need to file a schedule 1 if they are.

Irs form 1040—line 1 (or irs form 1040. Since the fy23 tax return covers 8 months of the 2023 calendar year and the fy24 tax return covers 4 months of the 2023 calendar. While completing your federal income taxes, families will need to file a schedule 1 if they are. Schedule 1 the irs schedule 1 is a form that can be filed in addition to form 1040 to report specific types of additional income and other. What is a schedule 1? If you are a freelancer or contractor (and therefore receive a 1099), then in tax terms you run a “sole proprietorship business” and.

Schedule 1 the irs schedule 1 is a form that can be filed in addition to form 1040 to report specific types of additional income and other. If you are a freelancer or contractor (and therefore receive a 1099), then in tax terms you run a “sole proprietorship business” and. What is a schedule 1? While completing your federal income taxes, families will need to file a schedule 1 if they are. Irs form 1040—line 1 (or irs form 1040. Since the fy23 tax return covers 8 months of the 2023 calendar year and the fy24 tax return covers 4 months of the 2023 calendar.

What is the Schedule 1 form for FAFSA

Since the fy23 tax return covers 8 months of the 2023 calendar year and the fy24 tax return covers 4 months of the 2023 calendar. Irs form 1040—line 1 (or irs form 1040. What is a schedule 1? Schedule 1 the irs schedule 1 is a form that can be filed in addition to form 1040 to report specific types.

2019 Schedule Example Student Financial Aid

While completing your federal income taxes, families will need to file a schedule 1 if they are. Irs form 1040—line 1 (or irs form 1040. Schedule 1 the irs schedule 1 is a form that can be filed in addition to form 1040 to report specific types of additional income and other. If you are a freelancer or contractor (and.

What is the Schedule 1 form for FAFSA

Since the fy23 tax return covers 8 months of the 2023 calendar year and the fy24 tax return covers 4 months of the 2023 calendar. Schedule 1 the irs schedule 1 is a form that can be filed in addition to form 1040 to report specific types of additional income and other. Irs form 1040—line 1 (or irs form 1040..

What is the Schedule 1 form for FAFSA

Irs form 1040—line 1 (or irs form 1040. While completing your federal income taxes, families will need to file a schedule 1 if they are. What is a schedule 1? If you are a freelancer or contractor (and therefore receive a 1099), then in tax terms you run a “sole proprietorship business” and. Since the fy23 tax return covers 8.

What Is A Schedule 1 Tax Form? Insurance Noon

Irs form 1040—line 1 (or irs form 1040. What is a schedule 1? If you are a freelancer or contractor (and therefore receive a 1099), then in tax terms you run a “sole proprietorship business” and. While completing your federal income taxes, families will need to file a schedule 1 if they are. Schedule 1 the irs schedule 1 is.

What is the Schedule 1 form for FAFSA

While completing your federal income taxes, families will need to file a schedule 1 if they are. What is a schedule 1? Since the fy23 tax return covers 8 months of the 2023 calendar year and the fy24 tax return covers 4 months of the 2023 calendar. Schedule 1 the irs schedule 1 is a form that can be filed.

What is the Schedule 1 form for FAFSA

If you are a freelancer or contractor (and therefore receive a 1099), then in tax terms you run a “sole proprietorship business” and. Since the fy23 tax return covers 8 months of the 2023 calendar year and the fy24 tax return covers 4 months of the 2023 calendar. While completing your federal income taxes, families will need to file a.

2024 Irs Schedule 1 Instructions And ailina ainslie

If you are a freelancer or contractor (and therefore receive a 1099), then in tax terms you run a “sole proprietorship business” and. Irs form 1040—line 1 (or irs form 1040. Schedule 1 the irs schedule 1 is a form that can be filed in addition to form 1040 to report specific types of additional income and other. While completing.

How to Answer FAFSA Question 32 Schedule 1 (Form 1040)”

Since the fy23 tax return covers 8 months of the 2023 calendar year and the fy24 tax return covers 4 months of the 2023 calendar. What is a schedule 1? While completing your federal income taxes, families will need to file a schedule 1 if they are. Irs form 1040—line 1 (or irs form 1040. Schedule 1 the irs schedule.

What is the Schedule 1 form for FAFSA

Irs form 1040—line 1 (or irs form 1040. While completing your federal income taxes, families will need to file a schedule 1 if they are. What is a schedule 1? Schedule 1 the irs schedule 1 is a form that can be filed in addition to form 1040 to report specific types of additional income and other. Since the fy23.

If You Are A Freelancer Or Contractor (And Therefore Receive A 1099), Then In Tax Terms You Run A “Sole Proprietorship Business” And.

Schedule 1 the irs schedule 1 is a form that can be filed in addition to form 1040 to report specific types of additional income and other. Irs form 1040—line 1 (or irs form 1040. Since the fy23 tax return covers 8 months of the 2023 calendar year and the fy24 tax return covers 4 months of the 2023 calendar. While completing your federal income taxes, families will need to file a schedule 1 if they are.