S Corp Balance Sheet Requirement

S Corp Balance Sheet Requirement - If your s corp has more than $250,000 in net receipts and assets in a given tax year, then you must include a balance sheet when you file your s corp return (“schedule l”). Yes , per page 21 of the irs instructions linked to below, corporations with total receipts (page 1, line 1a plus lines 4 through 10) and total assets at the end of the tax year less than. You must maintain a balance sheet for your s corporation. Income tax return for an s corporation where the corporation reports to the irs their balance sheet as found in the corporation’s books and records. When it comes time to file taxes, you’ll be able to refer to this sheet in order to remain. Throughout the tax year, you must maintain a detailed balance sheet for your s corporation. Do you need to maintain a balance sheet for an s corporation tax return? In some instances you have to transcribe all of the information from a balance sheet onto the s corporation tax form. Does an s corp have to file a balance sheet?

If your s corp has more than $250,000 in net receipts and assets in a given tax year, then you must include a balance sheet when you file your s corp return (“schedule l”). You must maintain a balance sheet for your s corporation. Do you need to maintain a balance sheet for an s corporation tax return? Yes , per page 21 of the irs instructions linked to below, corporations with total receipts (page 1, line 1a plus lines 4 through 10) and total assets at the end of the tax year less than. Income tax return for an s corporation where the corporation reports to the irs their balance sheet as found in the corporation’s books and records. Throughout the tax year, you must maintain a detailed balance sheet for your s corporation. In some instances you have to transcribe all of the information from a balance sheet onto the s corporation tax form. When it comes time to file taxes, you’ll be able to refer to this sheet in order to remain. Does an s corp have to file a balance sheet?

Does an s corp have to file a balance sheet? Do you need to maintain a balance sheet for an s corporation tax return? Income tax return for an s corporation where the corporation reports to the irs their balance sheet as found in the corporation’s books and records. Yes , per page 21 of the irs instructions linked to below, corporations with total receipts (page 1, line 1a plus lines 4 through 10) and total assets at the end of the tax year less than. When it comes time to file taxes, you’ll be able to refer to this sheet in order to remain. In some instances you have to transcribe all of the information from a balance sheet onto the s corporation tax form. Throughout the tax year, you must maintain a detailed balance sheet for your s corporation. If your s corp has more than $250,000 in net receipts and assets in a given tax year, then you must include a balance sheet when you file your s corp return (“schedule l”). You must maintain a balance sheet for your s corporation.

How To Complete Form 1120S & Schedule K1 (+Free Checklist) 雷竞技app,雷电

When it comes time to file taxes, you’ll be able to refer to this sheet in order to remain. You must maintain a balance sheet for your s corporation. Do you need to maintain a balance sheet for an s corporation tax return? In some instances you have to transcribe all of the information from a balance sheet onto the.

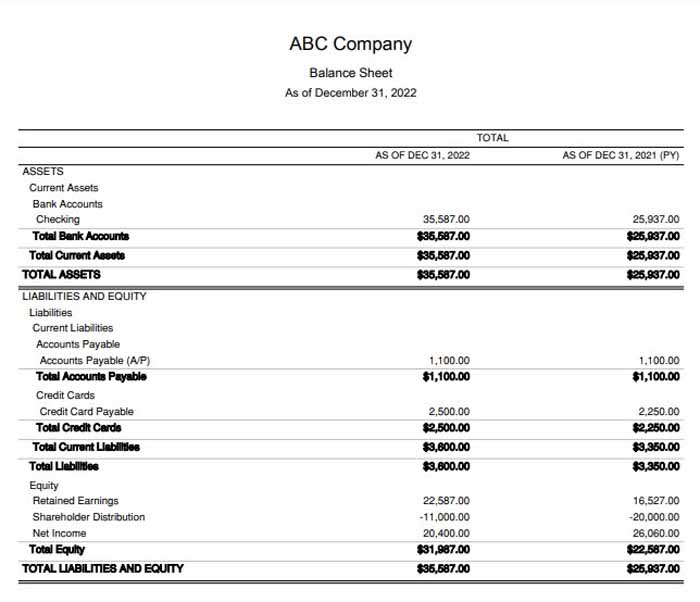

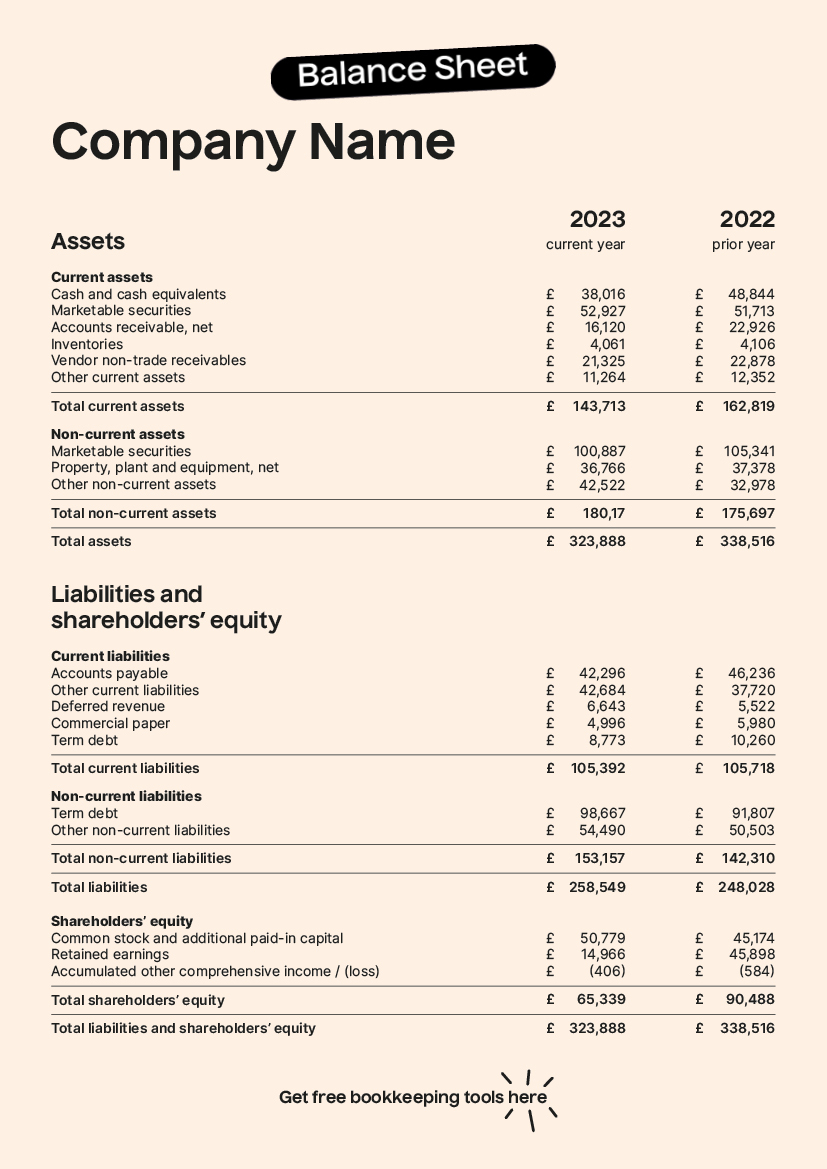

50 S Corp Balance Sheet Template Template

Do you need to maintain a balance sheet for an s corporation tax return? If your s corp has more than $250,000 in net receipts and assets in a given tax year, then you must include a balance sheet when you file your s corp return (“schedule l”). Does an s corp have to file a balance sheet? In some.

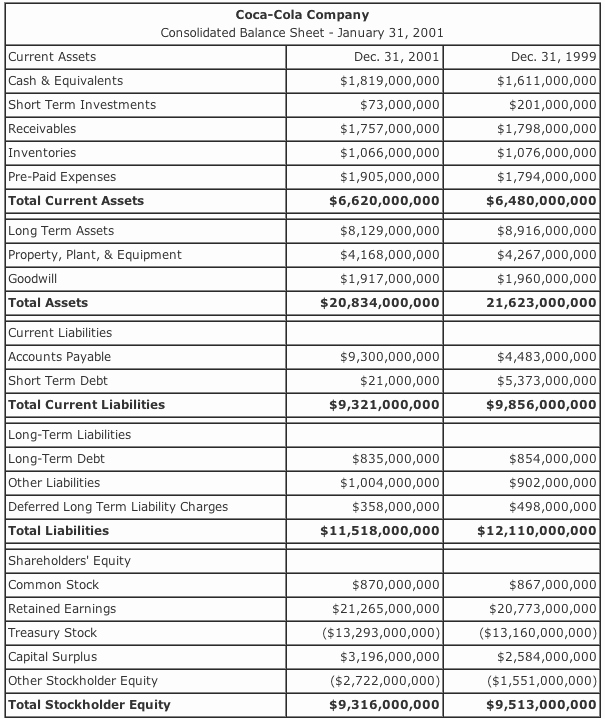

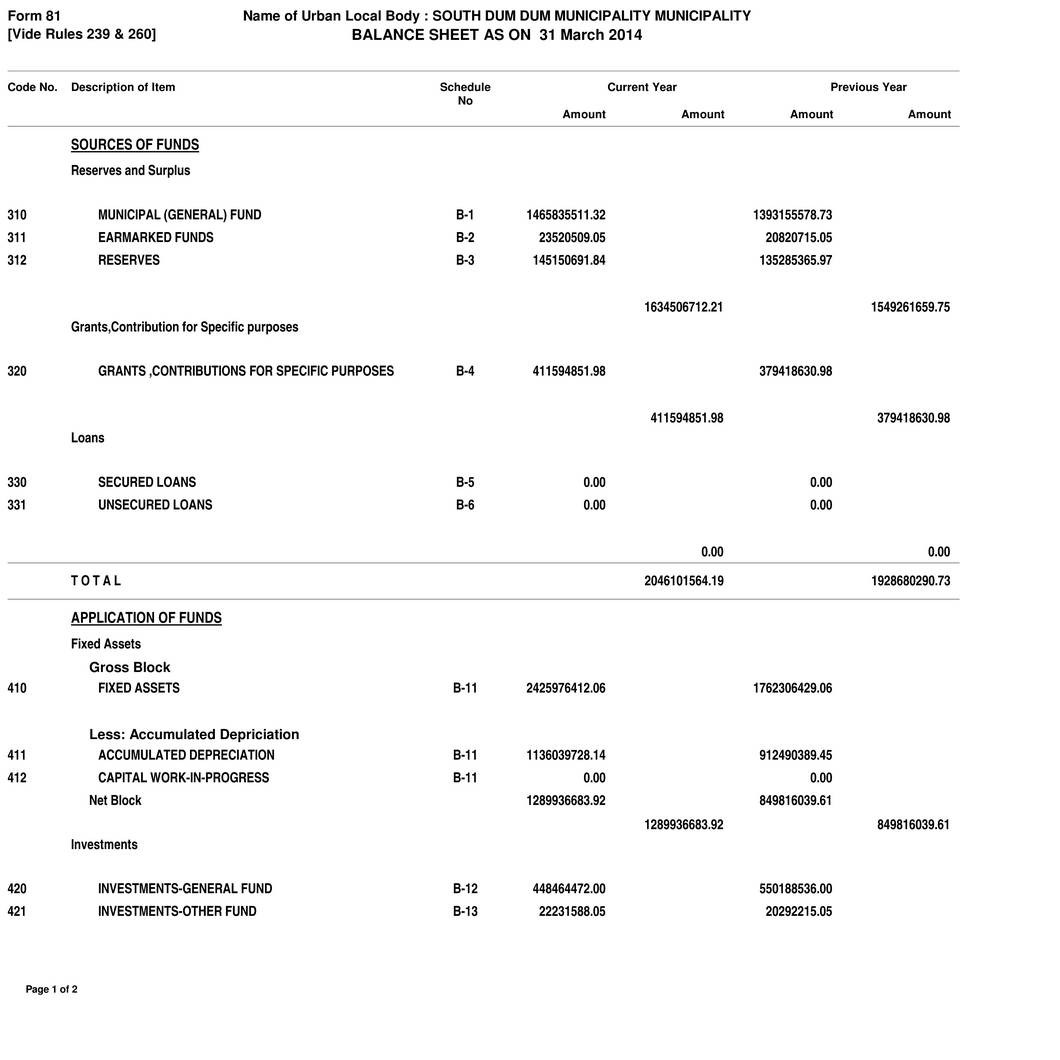

Financial Statements Balance Sheet SCORE

Does an s corp have to file a balance sheet? Yes , per page 21 of the irs instructions linked to below, corporations with total receipts (page 1, line 1a plus lines 4 through 10) and total assets at the end of the tax year less than. In some instances you have to transcribe all of the information from a.

S Corp Balance Sheet Template

When it comes time to file taxes, you’ll be able to refer to this sheet in order to remain. You must maintain a balance sheet for your s corporation. Do you need to maintain a balance sheet for an s corporation tax return? Yes , per page 21 of the irs instructions linked to below, corporations with total receipts (page.

50 S Corp Balance Sheet Template

You must maintain a balance sheet for your s corporation. Income tax return for an s corporation where the corporation reports to the irs their balance sheet as found in the corporation’s books and records. In some instances you have to transcribe all of the information from a balance sheet onto the s corporation tax form. Yes , per page.

How to read a balance sheet TaxScouts

When it comes time to file taxes, you’ll be able to refer to this sheet in order to remain. In some instances you have to transcribe all of the information from a balance sheet onto the s corporation tax form. Does an s corp have to file a balance sheet? If your s corp has more than $250,000 in net.

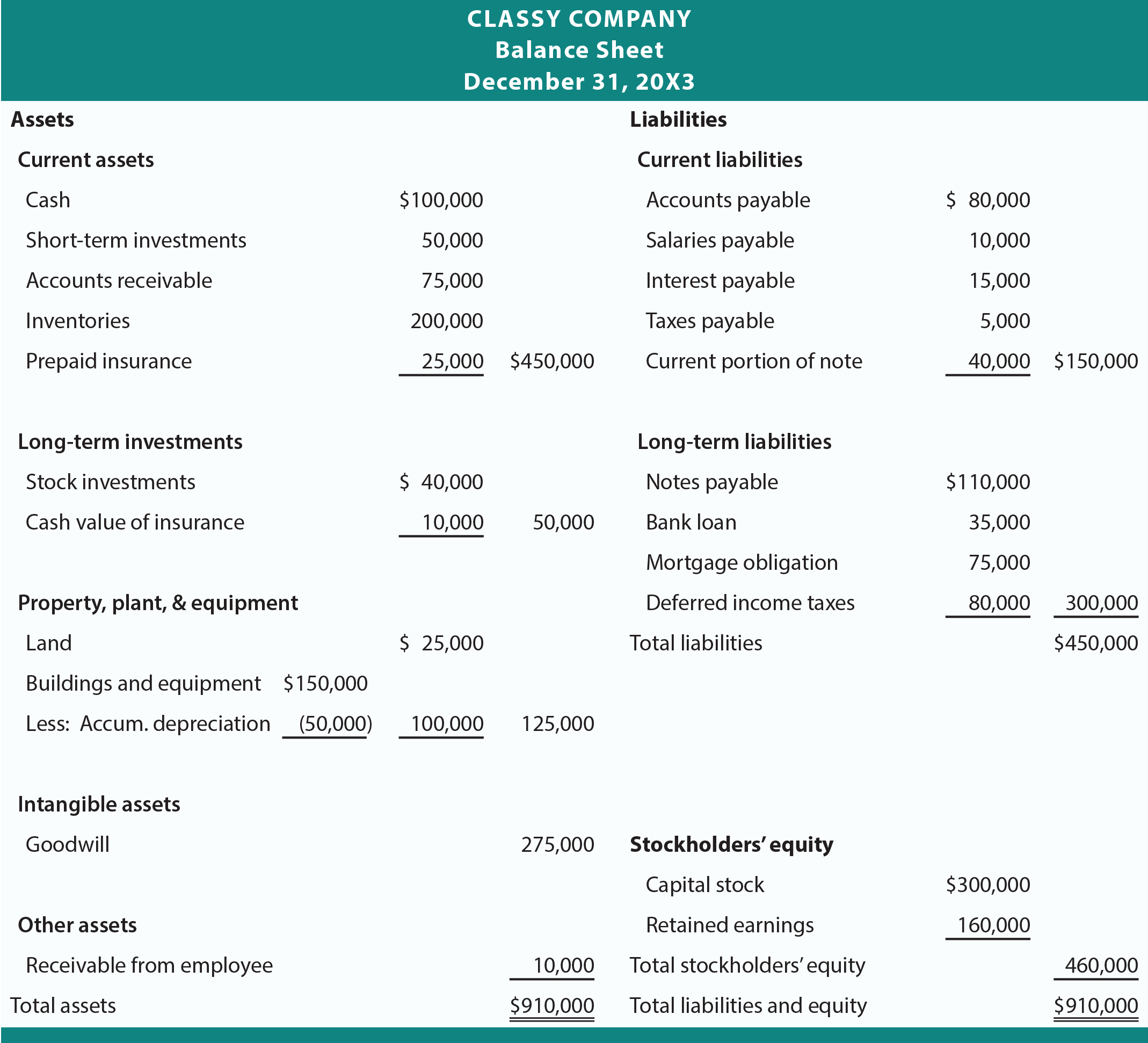

Balance Sheet Definition, Purpose, Format, Example, and More

Yes , per page 21 of the irs instructions linked to below, corporations with total receipts (page 1, line 1a plus lines 4 through 10) and total assets at the end of the tax year less than. If your s corp has more than $250,000 in net receipts and assets in a given tax year, then you must include a.

S Corp Balance Sheet Template

If your s corp has more than $250,000 in net receipts and assets in a given tax year, then you must include a balance sheet when you file your s corp return (“schedule l”). When it comes time to file taxes, you’ll be able to refer to this sheet in order to remain. Yes , per page 21 of the.

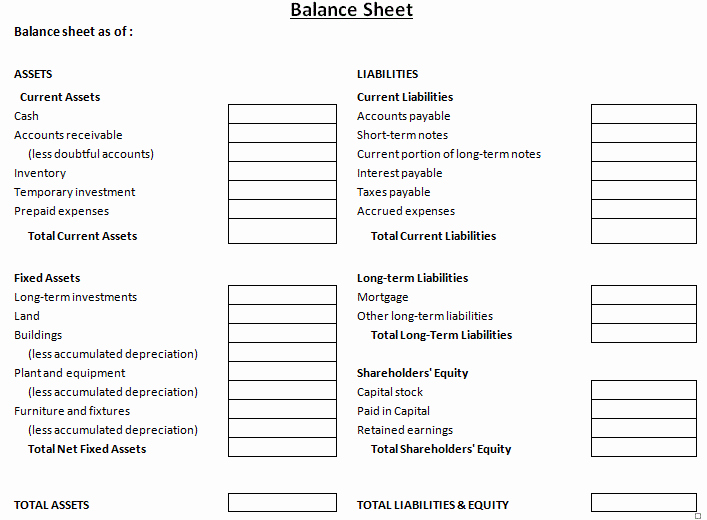

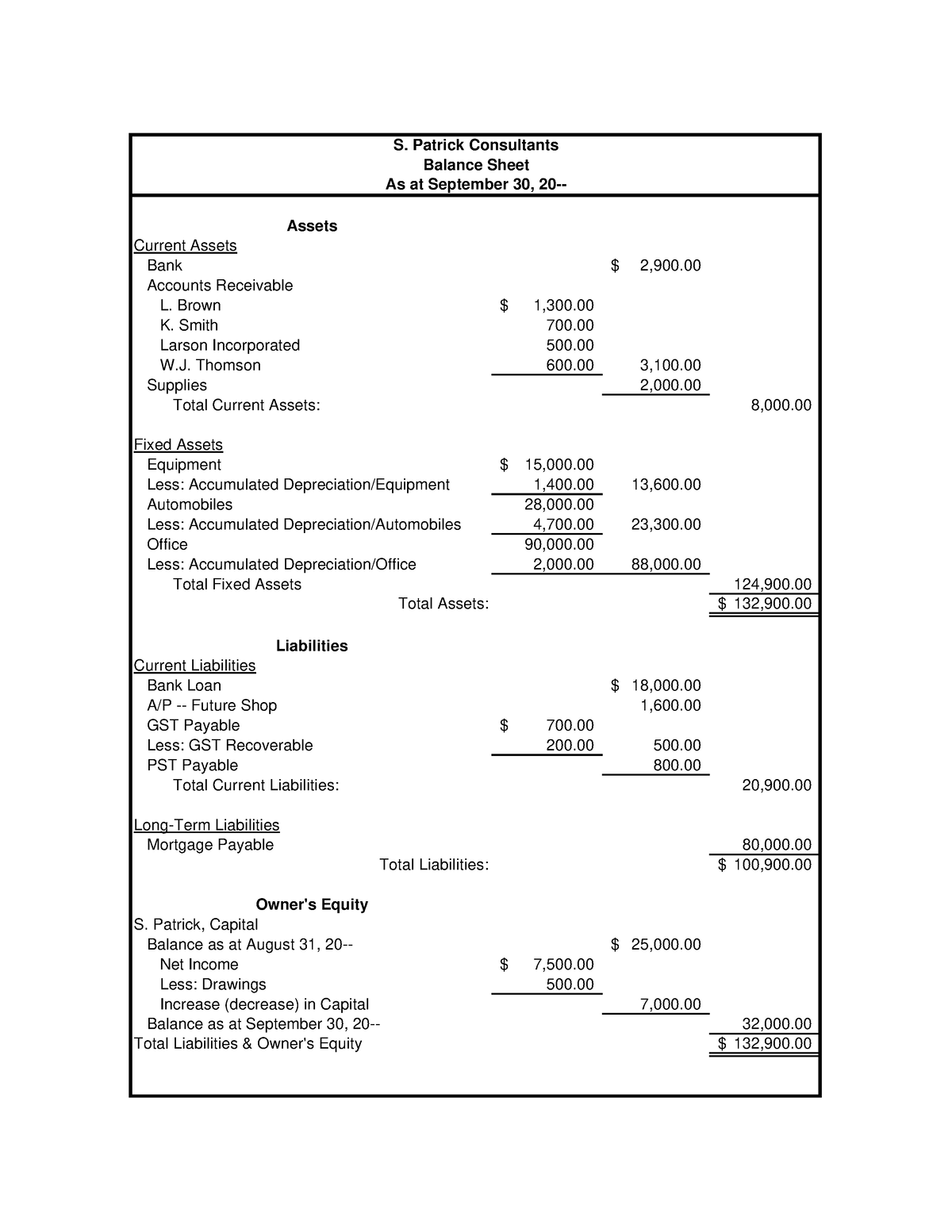

Classified Balance Sheet PDF Template Free Download Assets Current

Income tax return for an s corporation where the corporation reports to the irs their balance sheet as found in the corporation’s books and records. If your s corp has more than $250,000 in net receipts and assets in a given tax year, then you must include a balance sheet when you file your s corp return (“schedule l”). When.

50 S Corp Balance Sheet Template Template

When it comes time to file taxes, you’ll be able to refer to this sheet in order to remain. You must maintain a balance sheet for your s corporation. Throughout the tax year, you must maintain a detailed balance sheet for your s corporation. Income tax return for an s corporation where the corporation reports to the irs their balance.

Throughout The Tax Year, You Must Maintain A Detailed Balance Sheet For Your S Corporation.

Do you need to maintain a balance sheet for an s corporation tax return? In some instances you have to transcribe all of the information from a balance sheet onto the s corporation tax form. When it comes time to file taxes, you’ll be able to refer to this sheet in order to remain. Income tax return for an s corporation where the corporation reports to the irs their balance sheet as found in the corporation’s books and records.

If Your S Corp Has More Than $250,000 In Net Receipts And Assets In A Given Tax Year, Then You Must Include A Balance Sheet When You File Your S Corp Return (“Schedule L”).

Yes , per page 21 of the irs instructions linked to below, corporations with total receipts (page 1, line 1a plus lines 4 through 10) and total assets at the end of the tax year less than. Does an s corp have to file a balance sheet? You must maintain a balance sheet for your s corporation.