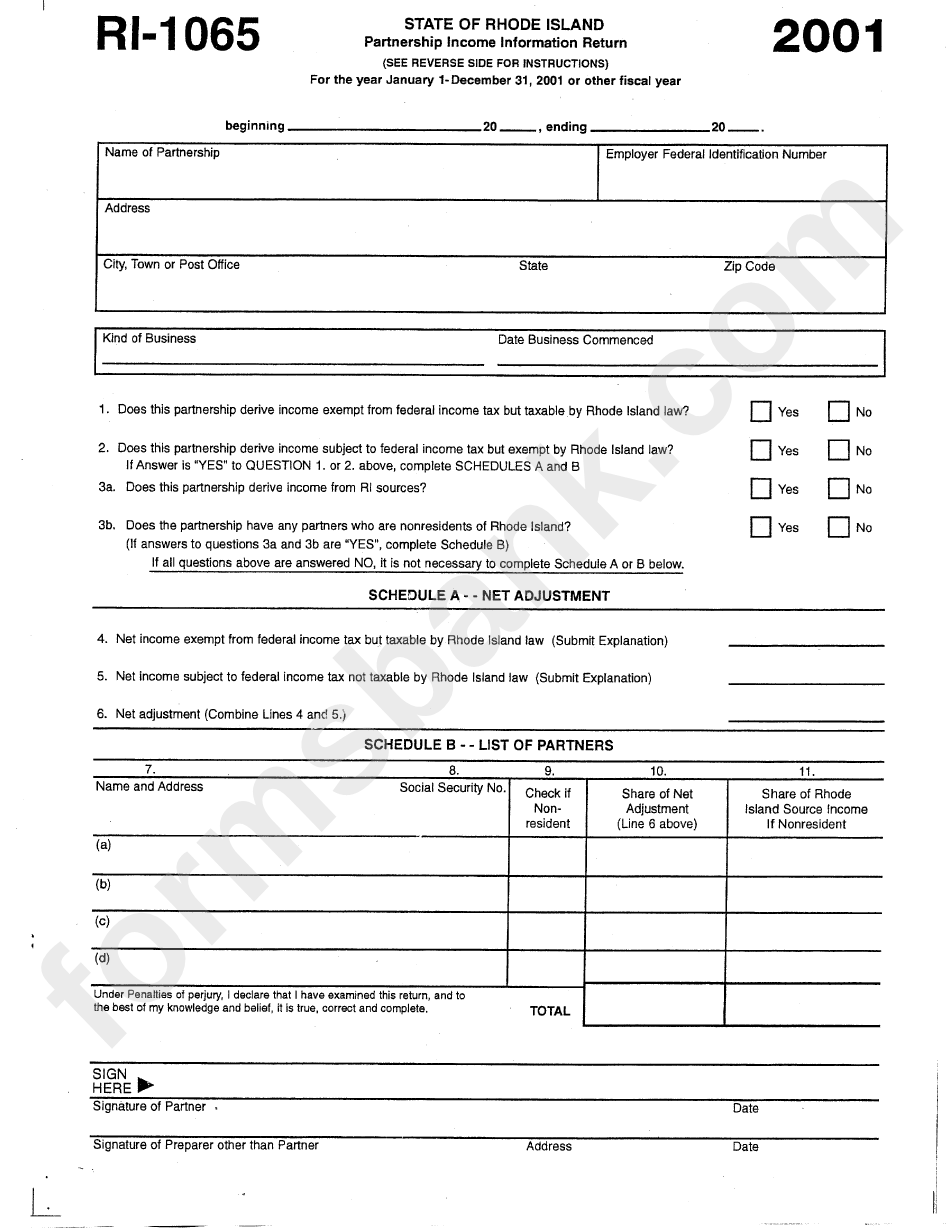

Ri Form 1065

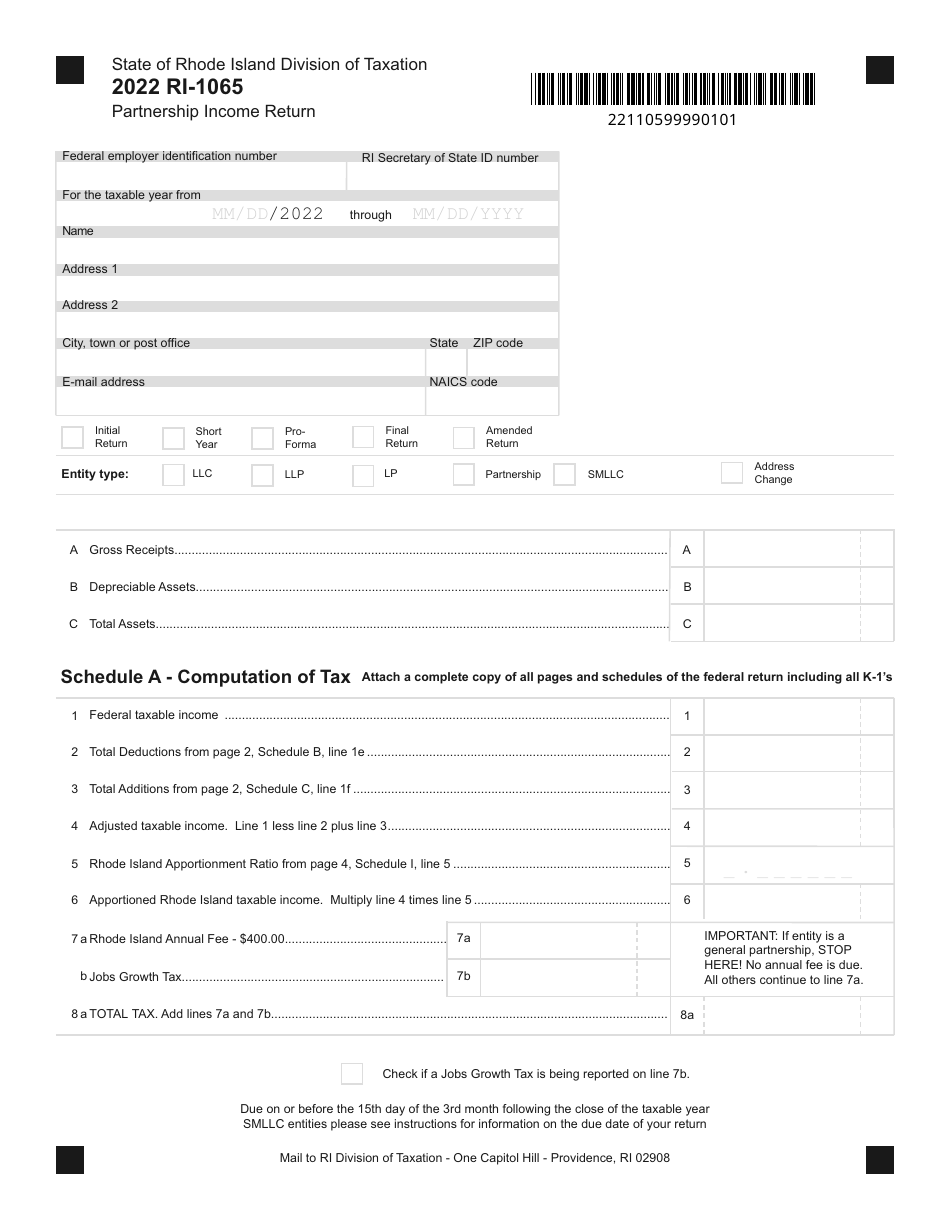

Ri Form 1065 - Apportioned rhode island taxable income. Rhode island does not follow the irs return perfection period. In accordance with changes signed into law in june of 2022, a larger business registrant will be required to use electronic means to file returns and remit. If the electronic return cannot be corrected and retransmitted, the taxpayer must. Download or print the 2023 rhode island (partnership income tax return to be filed by llcs, llps, lps and partnerships) (2023) and other income tax forms. 40 rows learn about the minimum annual tax requirements and filing deadlines for different business structures in rhode island. The new sole proprietor check box is.

The new sole proprietor check box is. In accordance with changes signed into law in june of 2022, a larger business registrant will be required to use electronic means to file returns and remit. If the electronic return cannot be corrected and retransmitted, the taxpayer must. Download or print the 2023 rhode island (partnership income tax return to be filed by llcs, llps, lps and partnerships) (2023) and other income tax forms. Rhode island does not follow the irs return perfection period. Apportioned rhode island taxable income. 40 rows learn about the minimum annual tax requirements and filing deadlines for different business structures in rhode island.

In accordance with changes signed into law in june of 2022, a larger business registrant will be required to use electronic means to file returns and remit. Download or print the 2023 rhode island (partnership income tax return to be filed by llcs, llps, lps and partnerships) (2023) and other income tax forms. The new sole proprietor check box is. 40 rows learn about the minimum annual tax requirements and filing deadlines for different business structures in rhode island. Apportioned rhode island taxable income. If the electronic return cannot be corrected and retransmitted, the taxpayer must. Rhode island does not follow the irs return perfection period.

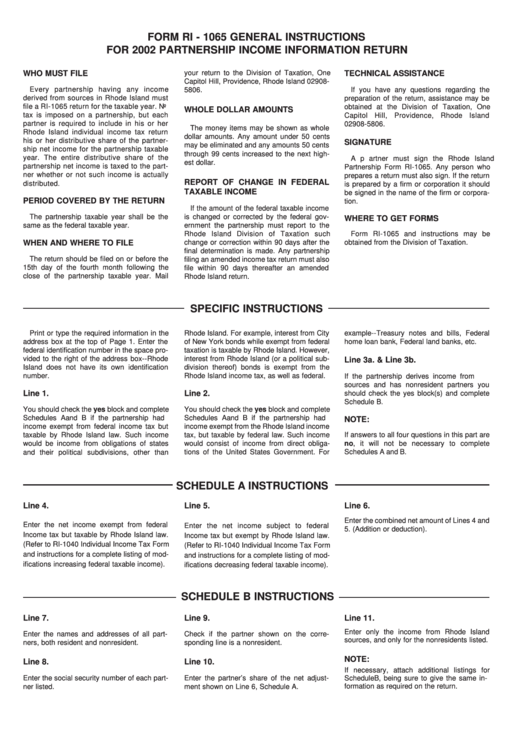

Form Ri 1065 General Instructions For 2002 Partnership

Download or print the 2023 rhode island (partnership income tax return to be filed by llcs, llps, lps and partnerships) (2023) and other income tax forms. 40 rows learn about the minimum annual tax requirements and filing deadlines for different business structures in rhode island. Apportioned rhode island taxable income. The new sole proprietor check box is. Rhode island does.

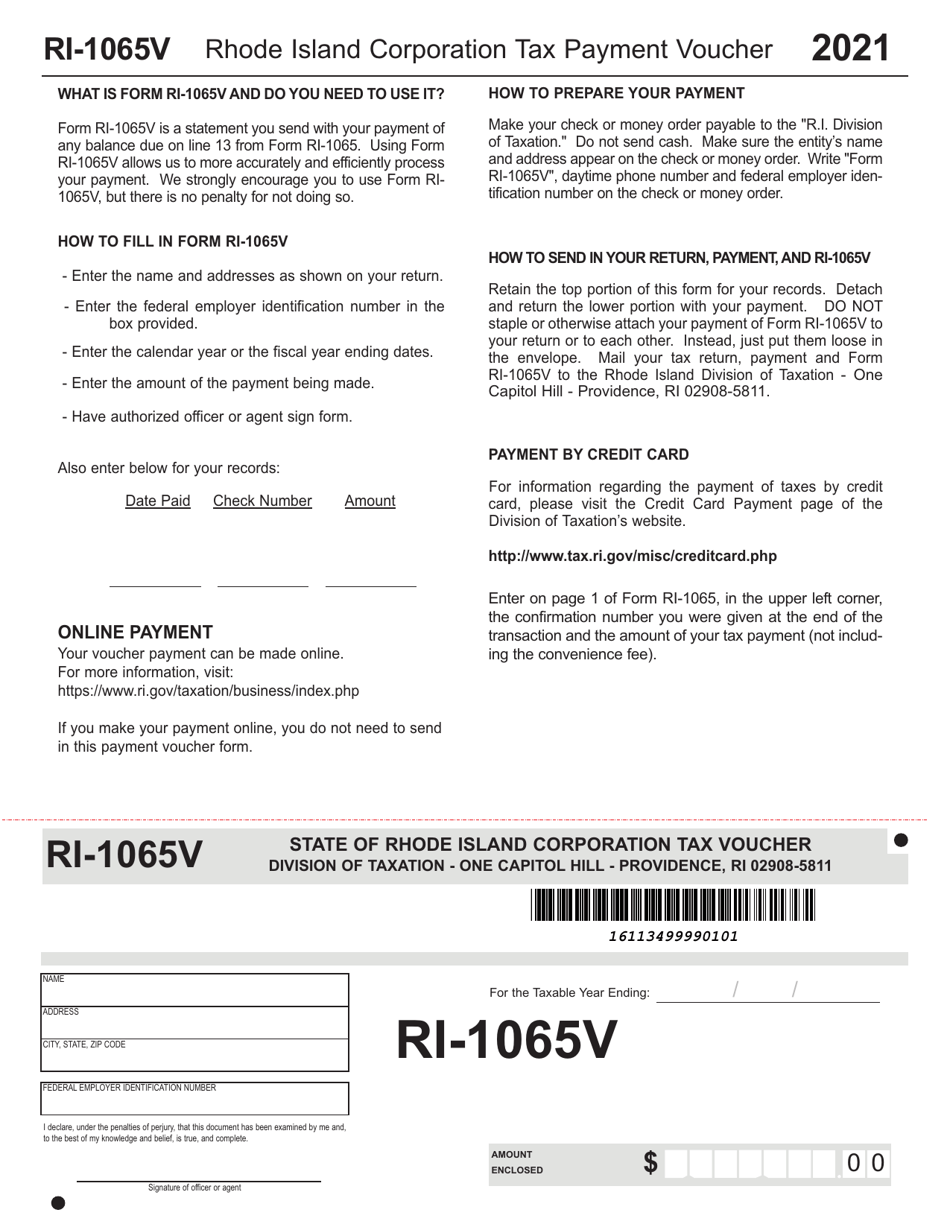

Form RI1065V 2021 Fill Out, Sign Online and Download Fillable PDF

In accordance with changes signed into law in june of 2022, a larger business registrant will be required to use electronic means to file returns and remit. If the electronic return cannot be corrected and retransmitted, the taxpayer must. Download or print the 2023 rhode island (partnership income tax return to be filed by llcs, llps, lps and partnerships) (2023).

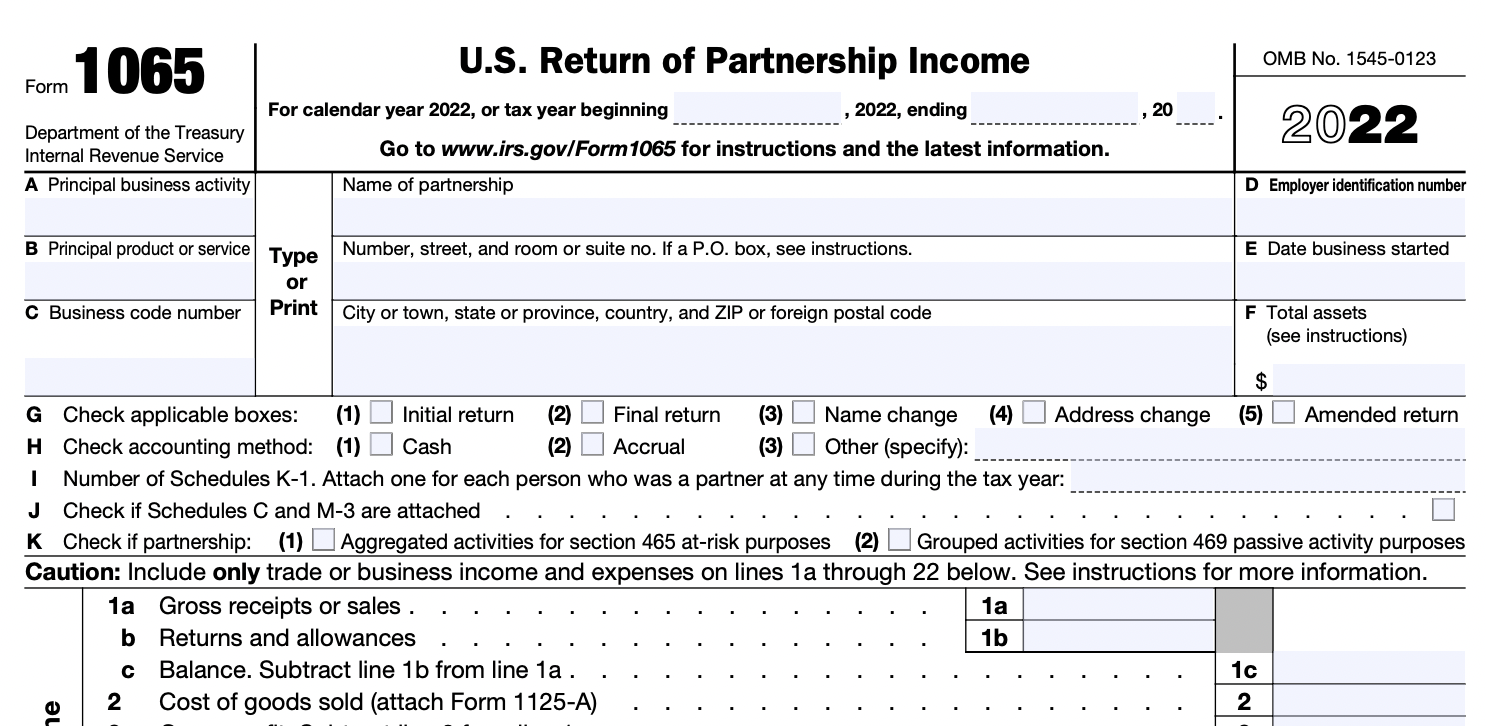

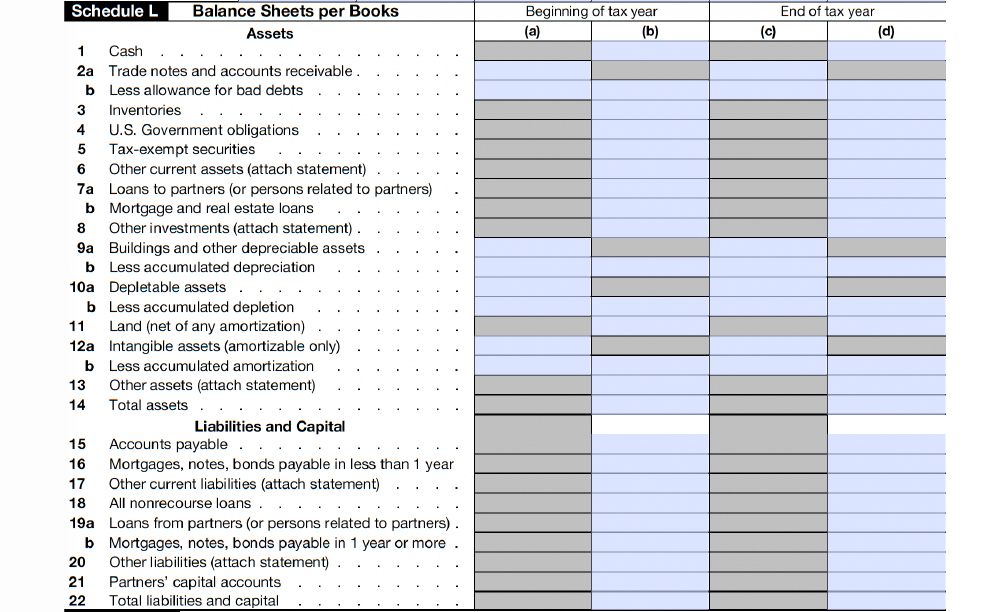

2023 Form 1065 Printable Forms Free Online

Apportioned rhode island taxable income. Download or print the 2023 rhode island (partnership income tax return to be filed by llcs, llps, lps and partnerships) (2023) and other income tax forms. 40 rows learn about the minimum annual tax requirements and filing deadlines for different business structures in rhode island. In accordance with changes signed into law in june of.

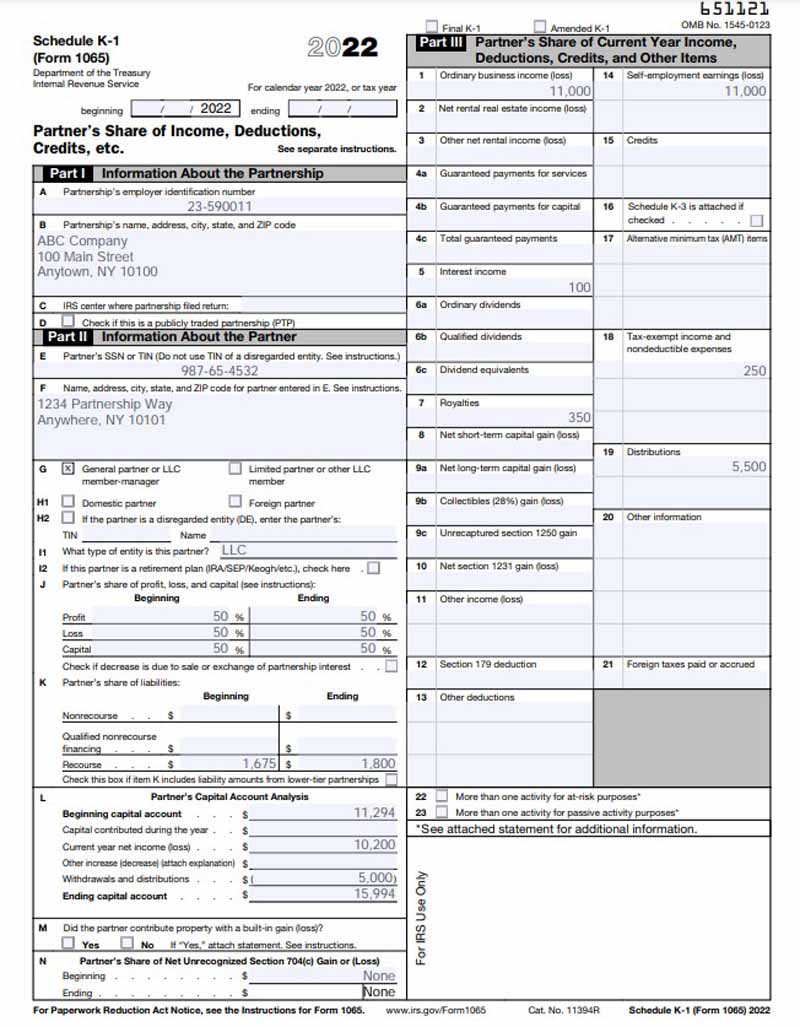

1065 Form Generator ThePayStubs

In accordance with changes signed into law in june of 2022, a larger business registrant will be required to use electronic means to file returns and remit. 40 rows learn about the minimum annual tax requirements and filing deadlines for different business structures in rhode island. Rhode island does not follow the irs return perfection period. If the electronic return.

How to Fill Out Form 1065 for 2023. StepbyStep Instructions for

In accordance with changes signed into law in june of 2022, a larger business registrant will be required to use electronic means to file returns and remit. Download or print the 2023 rhode island (partnership income tax return to be filed by llcs, llps, lps and partnerships) (2023) and other income tax forms. Rhode island does not follow the irs.

Form Ri1065 Partnership Information Return printable pdf download

If the electronic return cannot be corrected and retransmitted, the taxpayer must. The new sole proprietor check box is. 40 rows learn about the minimum annual tax requirements and filing deadlines for different business structures in rhode island. Apportioned rhode island taxable income. In accordance with changes signed into law in june of 2022, a larger business registrant will be.

How to Fill Out Form 1065 for 2021. StepbyStep Instructions YouTube

Apportioned rhode island taxable income. Rhode island does not follow the irs return perfection period. In accordance with changes signed into law in june of 2022, a larger business registrant will be required to use electronic means to file returns and remit. Download or print the 2023 rhode island (partnership income tax return to be filed by llcs, llps, lps.

Form 1065 Instructions U.S. Return of Partnership

The new sole proprietor check box is. Apportioned rhode island taxable income. In accordance with changes signed into law in june of 2022, a larger business registrant will be required to use electronic means to file returns and remit. Rhode island does not follow the irs return perfection period. 40 rows learn about the minimum annual tax requirements and filing.

Form RI1065 Download Fillable PDF or Fill Online Partnership

Rhode island does not follow the irs return perfection period. 40 rows learn about the minimum annual tax requirements and filing deadlines for different business structures in rhode island. If the electronic return cannot be corrected and retransmitted, the taxpayer must. In accordance with changes signed into law in june of 2022, a larger business registrant will be required to.

IRS Form 1065 Overview & StepbyStep Guide by Richard Nickson Issuu

Download or print the 2023 rhode island (partnership income tax return to be filed by llcs, llps, lps and partnerships) (2023) and other income tax forms. The new sole proprietor check box is. If the electronic return cannot be corrected and retransmitted, the taxpayer must. In accordance with changes signed into law in june of 2022, a larger business registrant.

If The Electronic Return Cannot Be Corrected And Retransmitted, The Taxpayer Must.

Rhode island does not follow the irs return perfection period. Download or print the 2023 rhode island (partnership income tax return to be filed by llcs, llps, lps and partnerships) (2023) and other income tax forms. The new sole proprietor check box is. In accordance with changes signed into law in june of 2022, a larger business registrant will be required to use electronic means to file returns and remit.

40 Rows Learn About The Minimum Annual Tax Requirements And Filing Deadlines For Different Business Structures In Rhode Island.

Apportioned rhode island taxable income.