Rhode Island Tax Lien

Rhode Island Tax Lien - In rhode island, municipal real estate tax sales are a crucial mechanism used by local governments to collect delinquent. Tax sale information for bidders. (a) taxes assessed against any person in any city or town for either personal property or real estate shall. When an owner of real estate becomes delinquent in the payment of their real estate taxes, the municipal government at. View monthly rhode island tax lien list recorded with appropriate city or town. Using the best available information, the rhode island division of taxation has sent formal notice, by regular and certified. View information and requirements about the town of bristol. Legally, a tax is a lien in favor of the city that arises by operation of law upon the date of assessment. Tax titles on real estate.

Tax titles on real estate. When an owner of real estate becomes delinquent in the payment of their real estate taxes, the municipal government at. (a) taxes assessed against any person in any city or town for either personal property or real estate shall. View monthly rhode island tax lien list recorded with appropriate city or town. Using the best available information, the rhode island division of taxation has sent formal notice, by regular and certified. Tax sale information for bidders. Legally, a tax is a lien in favor of the city that arises by operation of law upon the date of assessment. View information and requirements about the town of bristol. In rhode island, municipal real estate tax sales are a crucial mechanism used by local governments to collect delinquent.

Tax sale information for bidders. When an owner of real estate becomes delinquent in the payment of their real estate taxes, the municipal government at. View monthly rhode island tax lien list recorded with appropriate city or town. (a) taxes assessed against any person in any city or town for either personal property or real estate shall. In rhode island, municipal real estate tax sales are a crucial mechanism used by local governments to collect delinquent. Legally, a tax is a lien in favor of the city that arises by operation of law upon the date of assessment. Using the best available information, the rhode island division of taxation has sent formal notice, by regular and certified. View information and requirements about the town of bristol. Tax titles on real estate.

Rhode Island State Taxes Taxed Right

Legally, a tax is a lien in favor of the city that arises by operation of law upon the date of assessment. View monthly rhode island tax lien list recorded with appropriate city or town. In rhode island, municipal real estate tax sales are a crucial mechanism used by local governments to collect delinquent. (a) taxes assessed against any person.

rhode island tax rates 2020 Russ

Legally, a tax is a lien in favor of the city that arises by operation of law upon the date of assessment. View monthly rhode island tax lien list recorded with appropriate city or town. View information and requirements about the town of bristol. When an owner of real estate becomes delinquent in the payment of their real estate taxes,.

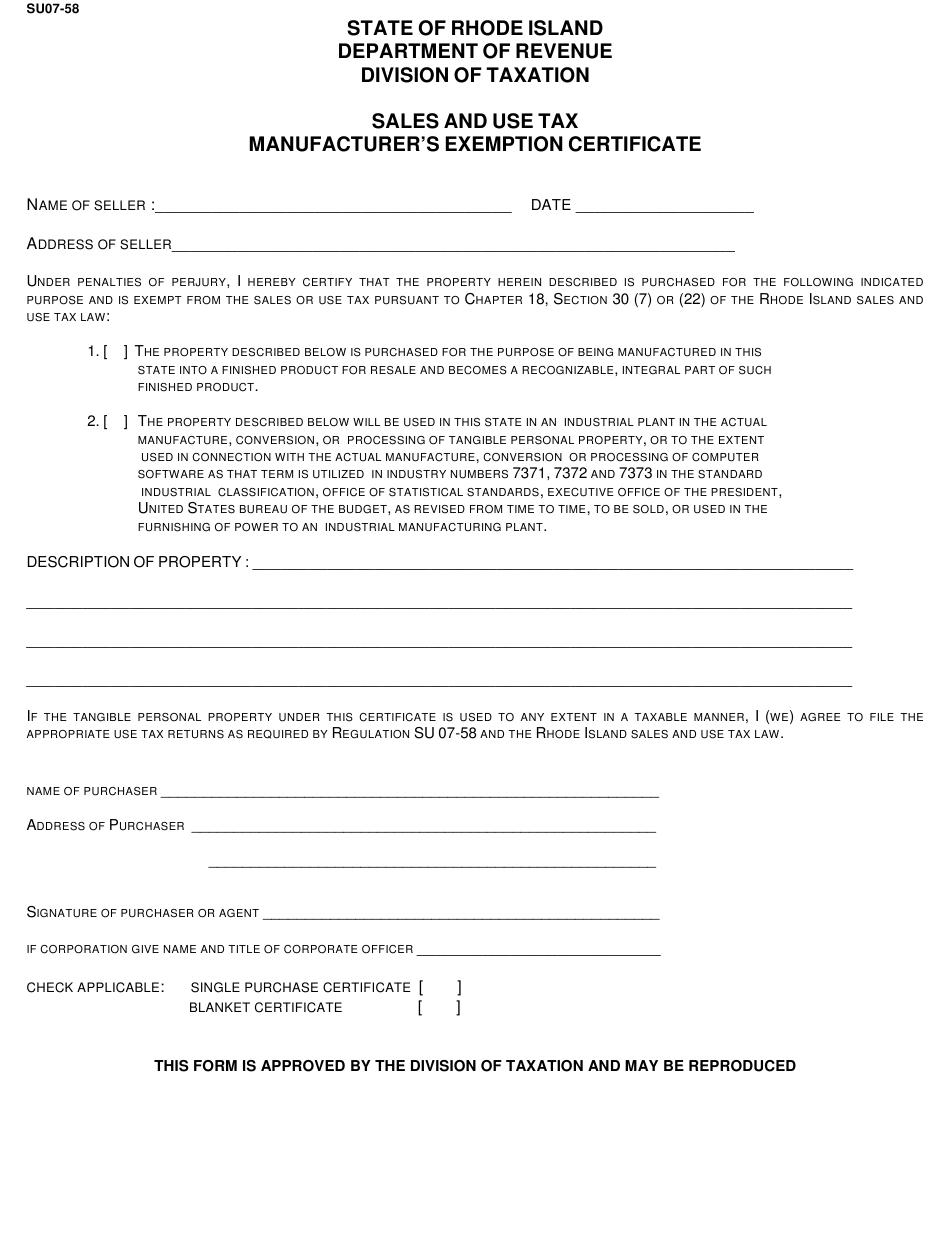

Rhode Island Tax Exempt Form

In rhode island, municipal real estate tax sales are a crucial mechanism used by local governments to collect delinquent. View monthly rhode island tax lien list recorded with appropriate city or town. (a) taxes assessed against any person in any city or town for either personal property or real estate shall. View information and requirements about the town of bristol..

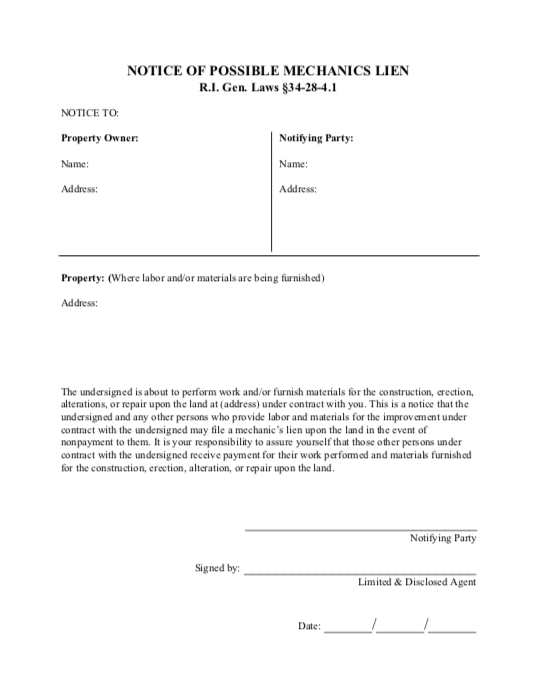

Rhode Island Notice of Possible Mechanics Lien Form Levelset

(a) taxes assessed against any person in any city or town for either personal property or real estate shall. Using the best available information, the rhode island division of taxation has sent formal notice, by regular and certified. View monthly rhode island tax lien list recorded with appropriate city or town. In rhode island, municipal real estate tax sales are.

The Complete Guide to Rhode Island Lien & Notice Deadlines National

Tax titles on real estate. View information and requirements about the town of bristol. (a) taxes assessed against any person in any city or town for either personal property or real estate shall. Using the best available information, the rhode island division of taxation has sent formal notice, by regular and certified. When an owner of real estate becomes delinquent.

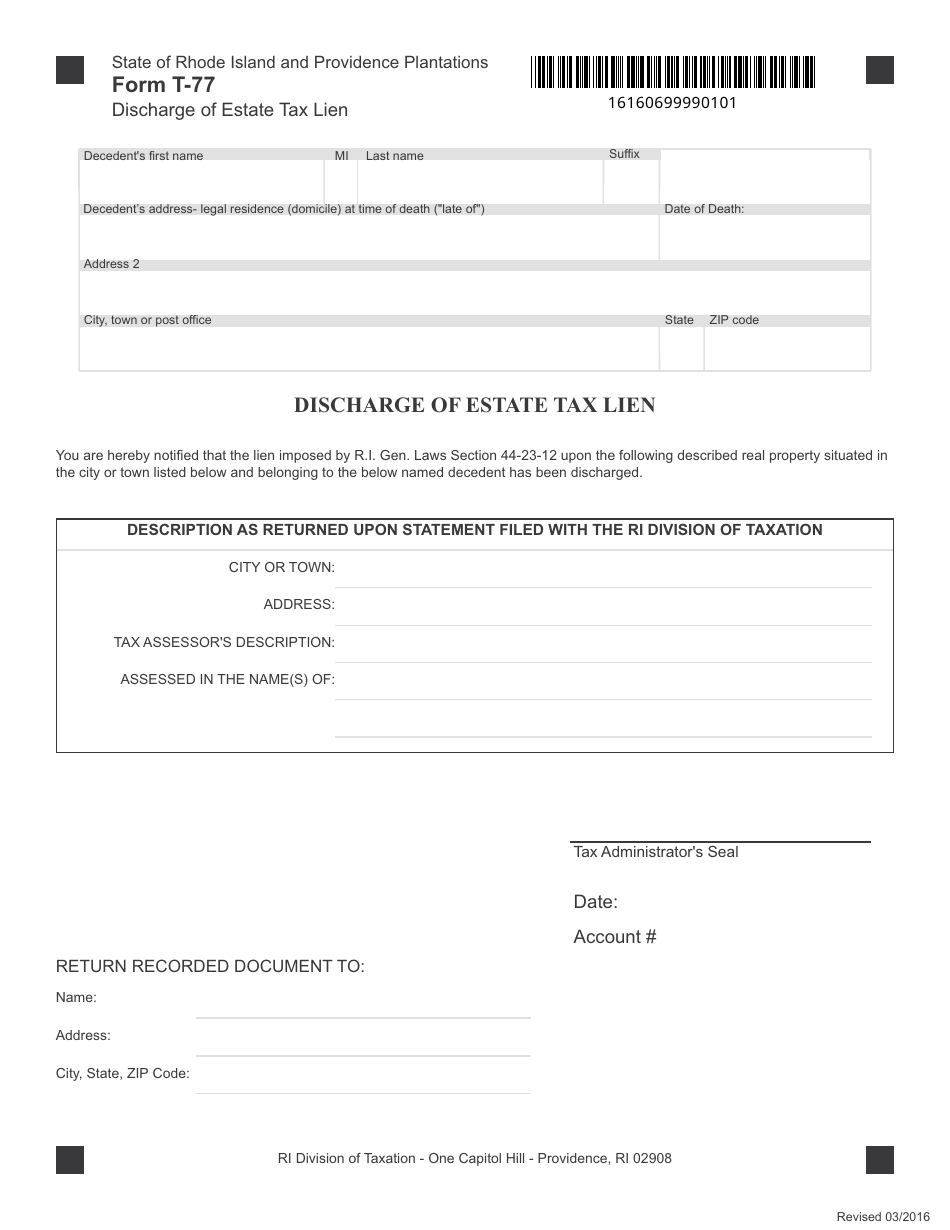

Form T77 Fill Out, Sign Online and Download Fillable PDF, Rhode

View information and requirements about the town of bristol. Using the best available information, the rhode island division of taxation has sent formal notice, by regular and certified. View monthly rhode island tax lien list recorded with appropriate city or town. When an owner of real estate becomes delinquent in the payment of their real estate taxes, the municipal government.

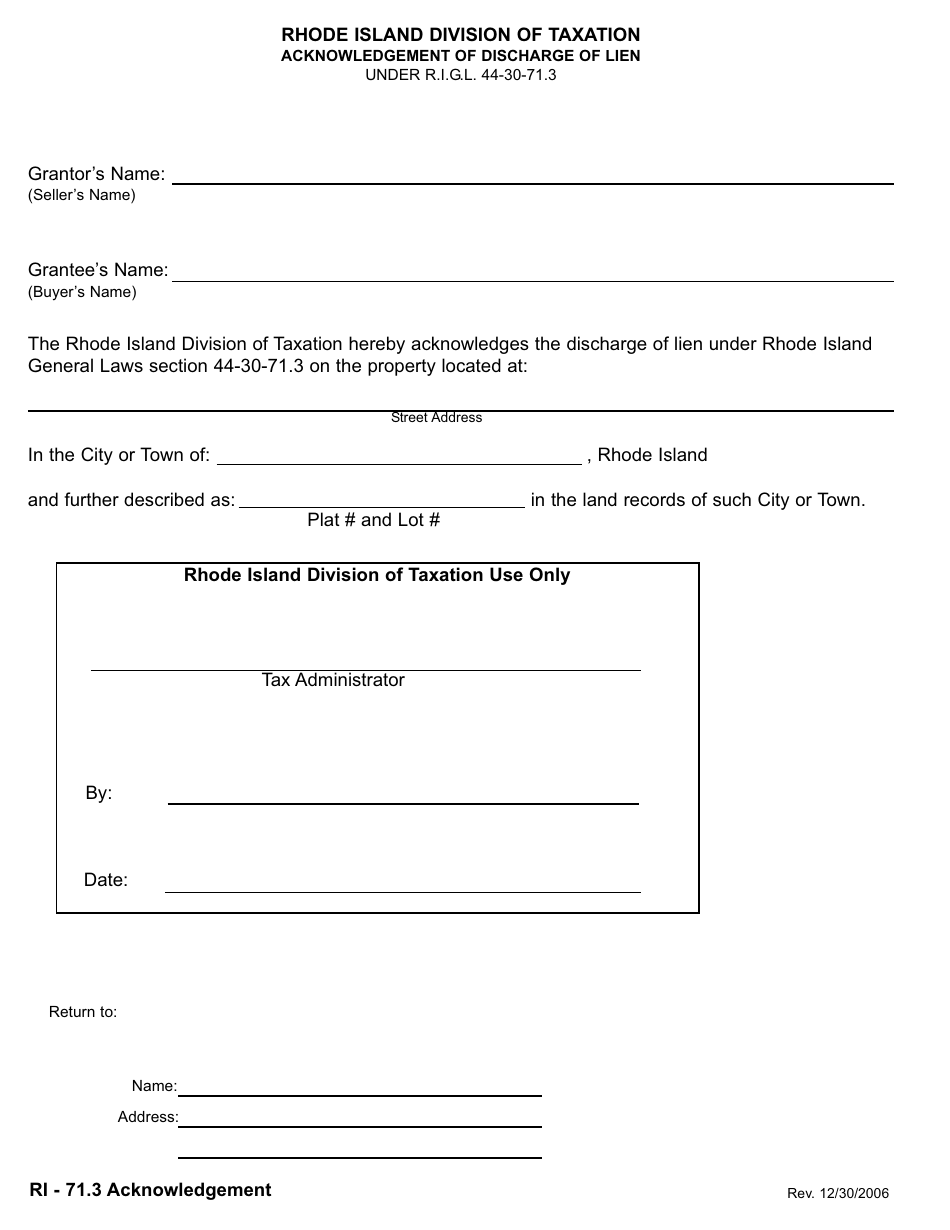

Rhode Island Acknowledgement of Discharge of Lien Fill Out, Sign

In rhode island, municipal real estate tax sales are a crucial mechanism used by local governments to collect delinquent. (a) taxes assessed against any person in any city or town for either personal property or real estate shall. Tax sale information for bidders. View information and requirements about the town of bristol. When an owner of real estate becomes delinquent.

Rhode Island Mechanics Liens Everything You Need to Know to Get Paid

In rhode island, municipal real estate tax sales are a crucial mechanism used by local governments to collect delinquent. View information and requirements about the town of bristol. Using the best available information, the rhode island division of taxation has sent formal notice, by regular and certified. When an owner of real estate becomes delinquent in the payment of their.

Rhode Island Division of Taxation May 2020

(a) taxes assessed against any person in any city or town for either personal property or real estate shall. View monthly rhode island tax lien list recorded with appropriate city or town. View information and requirements about the town of bristol. Tax titles on real estate. Tax sale information for bidders.

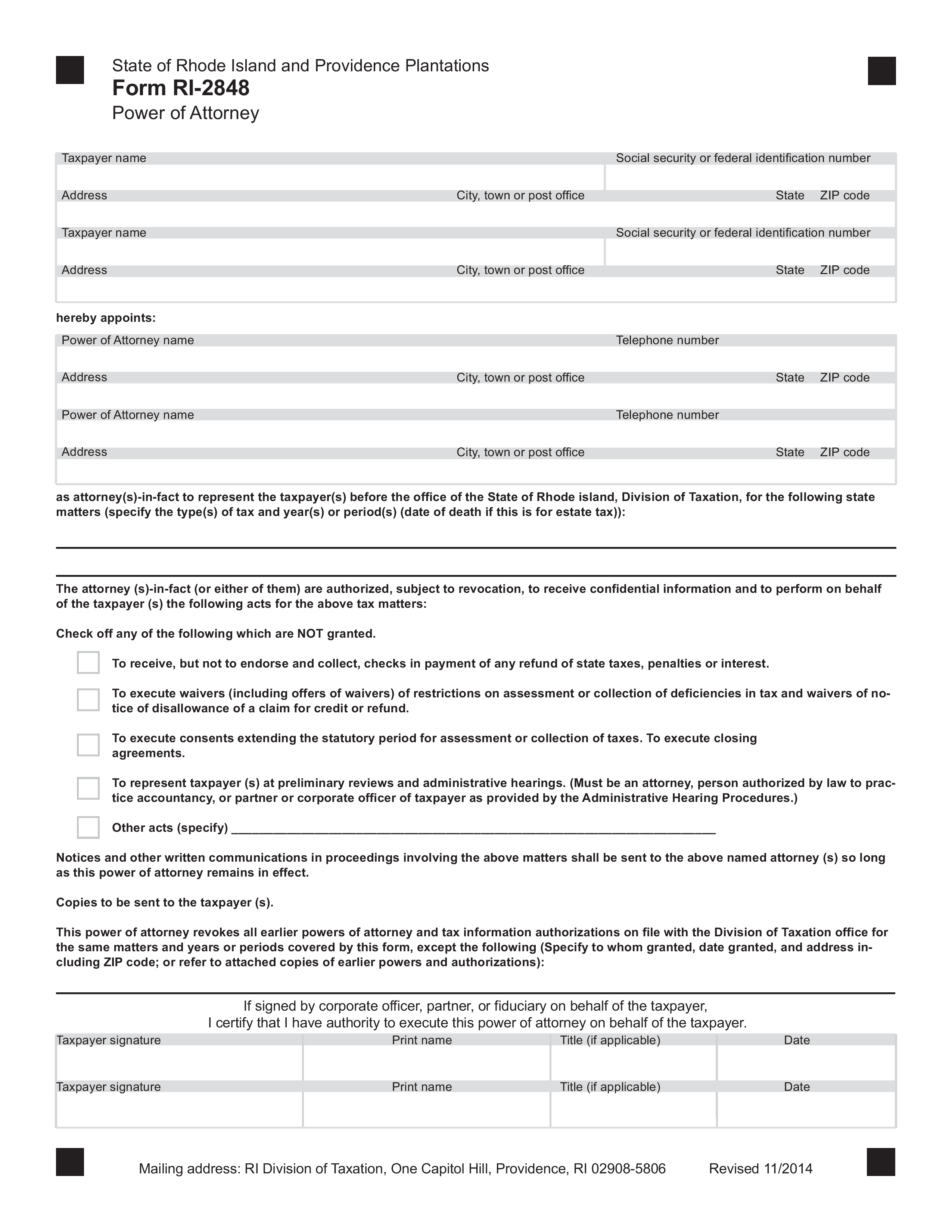

Free Rhode Island Tax Power of Attorney Form (Form RI2848)

Legally, a tax is a lien in favor of the city that arises by operation of law upon the date of assessment. Tax sale information for bidders. When an owner of real estate becomes delinquent in the payment of their real estate taxes, the municipal government at. (a) taxes assessed against any person in any city or town for either.

In Rhode Island, Municipal Real Estate Tax Sales Are A Crucial Mechanism Used By Local Governments To Collect Delinquent.

When an owner of real estate becomes delinquent in the payment of their real estate taxes, the municipal government at. View information and requirements about the town of bristol. Legally, a tax is a lien in favor of the city that arises by operation of law upon the date of assessment. Tax titles on real estate.

(A) Taxes Assessed Against Any Person In Any City Or Town For Either Personal Property Or Real Estate Shall.

View monthly rhode island tax lien list recorded with appropriate city or town. Tax sale information for bidders. Using the best available information, the rhode island division of taxation has sent formal notice, by regular and certified.