Rental Property Sale Tax Form

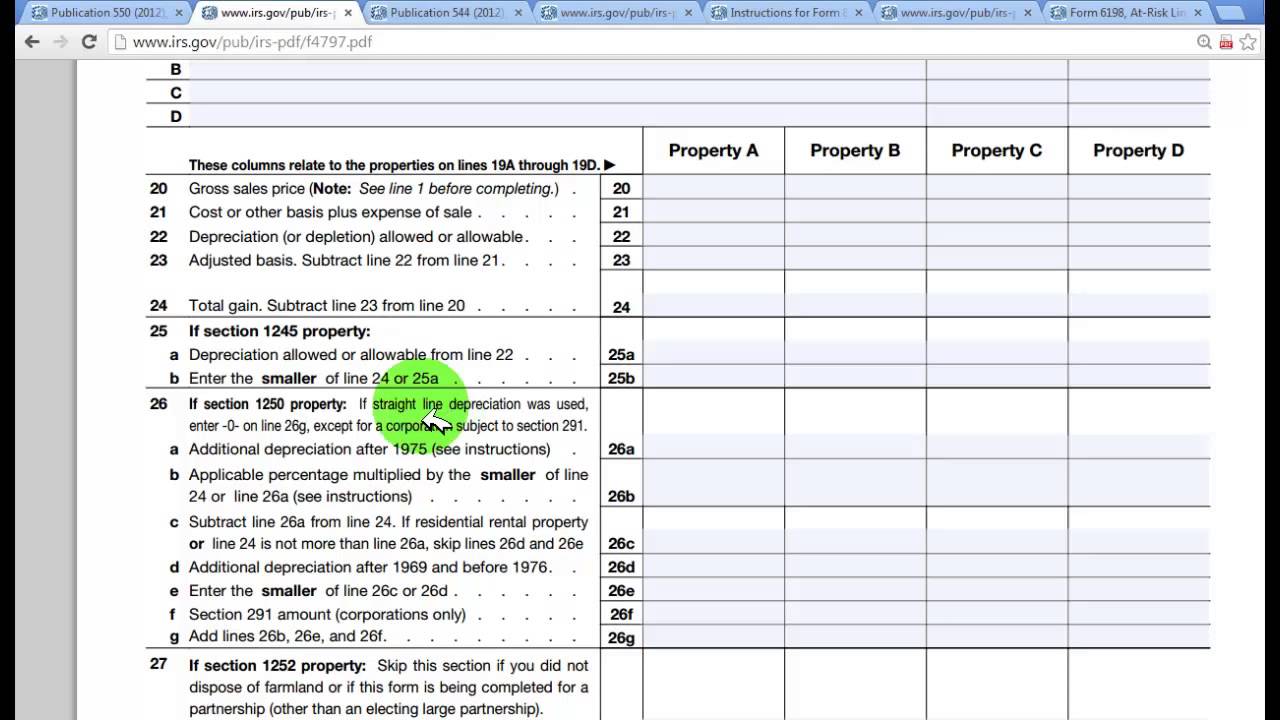

Rental Property Sale Tax Form - Report the gain or loss on the sale of rental property on form 4797, sales of business property or on form 8949, sales and other. When reporting a property that has been used as both a rental and a primary residence, you will need to include a form 4797 and a sale of main home. We'll ask you to report the sale when you get to the expenses/assets (depreciation) section, along with any other pertinent info (like income and.

We'll ask you to report the sale when you get to the expenses/assets (depreciation) section, along with any other pertinent info (like income and. Report the gain or loss on the sale of rental property on form 4797, sales of business property or on form 8949, sales and other. When reporting a property that has been used as both a rental and a primary residence, you will need to include a form 4797 and a sale of main home.

When reporting a property that has been used as both a rental and a primary residence, you will need to include a form 4797 and a sale of main home. Report the gain or loss on the sale of rental property on form 4797, sales of business property or on form 8949, sales and other. We'll ask you to report the sale when you get to the expenses/assets (depreciation) section, along with any other pertinent info (like income and.

How Much Tax Will You Have To Pay On The Sale Of Your Rental Property

Report the gain or loss on the sale of rental property on form 4797, sales of business property or on form 8949, sales and other. When reporting a property that has been used as both a rental and a primary residence, you will need to include a form 4797 and a sale of main home. We'll ask you to report.

Calculating cost basis on rental property sale JasminCarrie

We'll ask you to report the sale when you get to the expenses/assets (depreciation) section, along with any other pertinent info (like income and. When reporting a property that has been used as both a rental and a primary residence, you will need to include a form 4797 and a sale of main home. Report the gain or loss on.

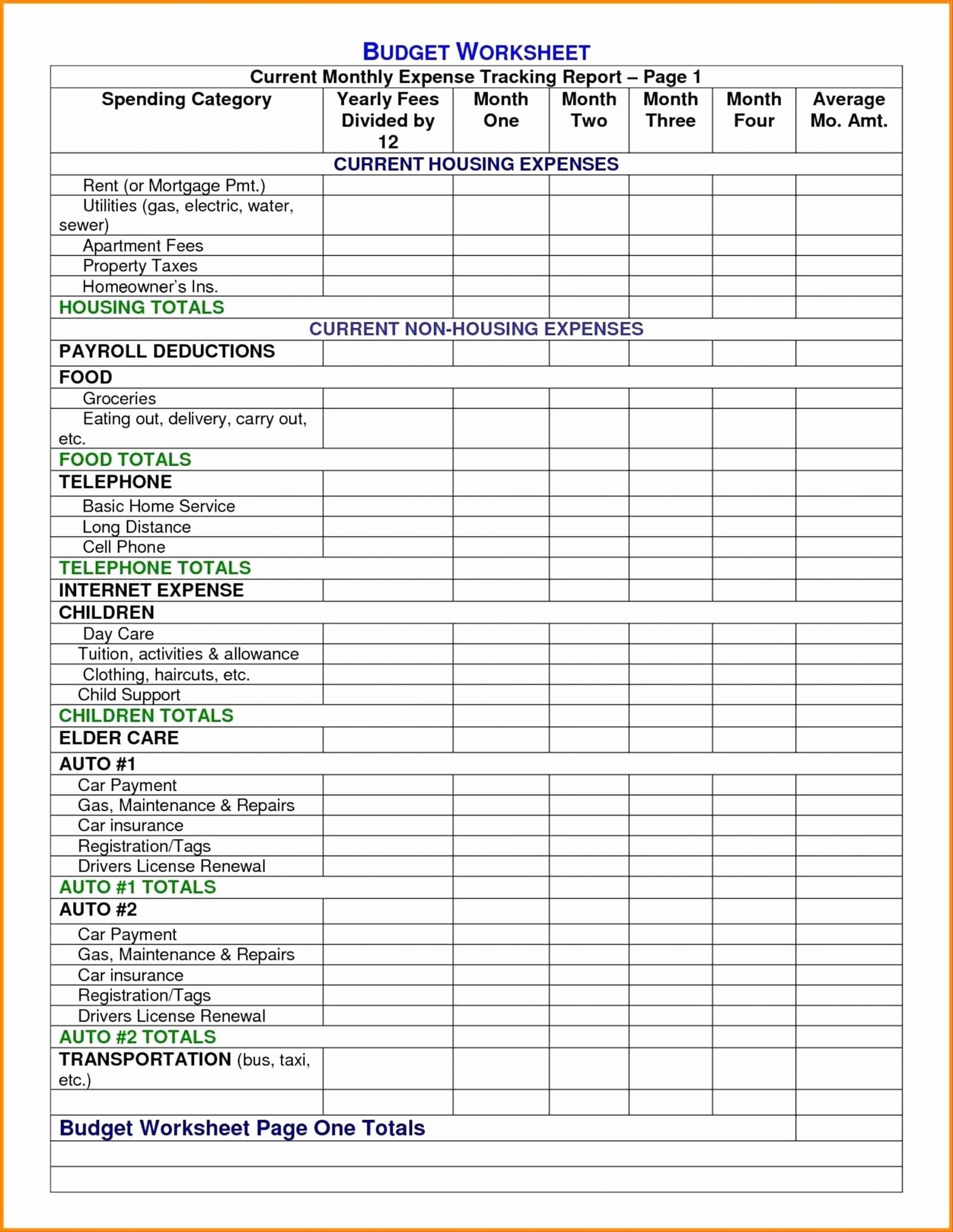

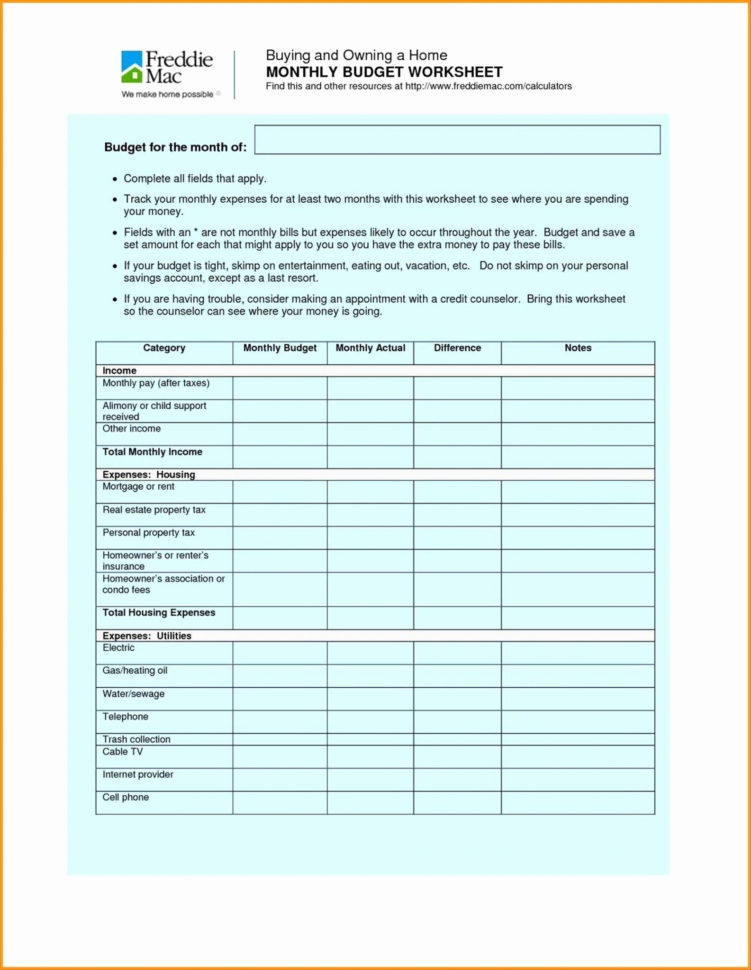

Rental Property Tax Deductions Worksheet Yooob —

Report the gain or loss on the sale of rental property on form 4797, sales of business property or on form 8949, sales and other. When reporting a property that has been used as both a rental and a primary residence, you will need to include a form 4797 and a sale of main home. We'll ask you to report.

Florida Property Tax H&R Block

We'll ask you to report the sale when you get to the expenses/assets (depreciation) section, along with any other pertinent info (like income and. Report the gain or loss on the sale of rental property on form 4797, sales of business property or on form 8949, sales and other. When reporting a property that has been used as both a.

Rental Property Tax Deductions Worksheet —

We'll ask you to report the sale when you get to the expenses/assets (depreciation) section, along with any other pertinent info (like income and. When reporting a property that has been used as both a rental and a primary residence, you will need to include a form 4797 and a sale of main home. Report the gain or loss on.

Tax Treatment of Sale of Rental Property YouTube

When reporting a property that has been used as both a rental and a primary residence, you will need to include a form 4797 and a sale of main home. We'll ask you to report the sale when you get to the expenses/assets (depreciation) section, along with any other pertinent info (like income and. Report the gain or loss on.

5 Tips to Lower Your Property Tax Bill The Radishing Review

Report the gain or loss on the sale of rental property on form 4797, sales of business property or on form 8949, sales and other. When reporting a property that has been used as both a rental and a primary residence, you will need to include a form 4797 and a sale of main home. We'll ask you to report.

How to Report the Sale of a U.S. Rental Property Madan CA

Report the gain or loss on the sale of rental property on form 4797, sales of business property or on form 8949, sales and other. We'll ask you to report the sale when you get to the expenses/assets (depreciation) section, along with any other pertinent info (like income and. When reporting a property that has been used as both a.

Tax Benefits of Owning Rental Property

Report the gain or loss on the sale of rental property on form 4797, sales of business property or on form 8949, sales and other. We'll ask you to report the sale when you get to the expenses/assets (depreciation) section, along with any other pertinent info (like income and. When reporting a property that has been used as both a.

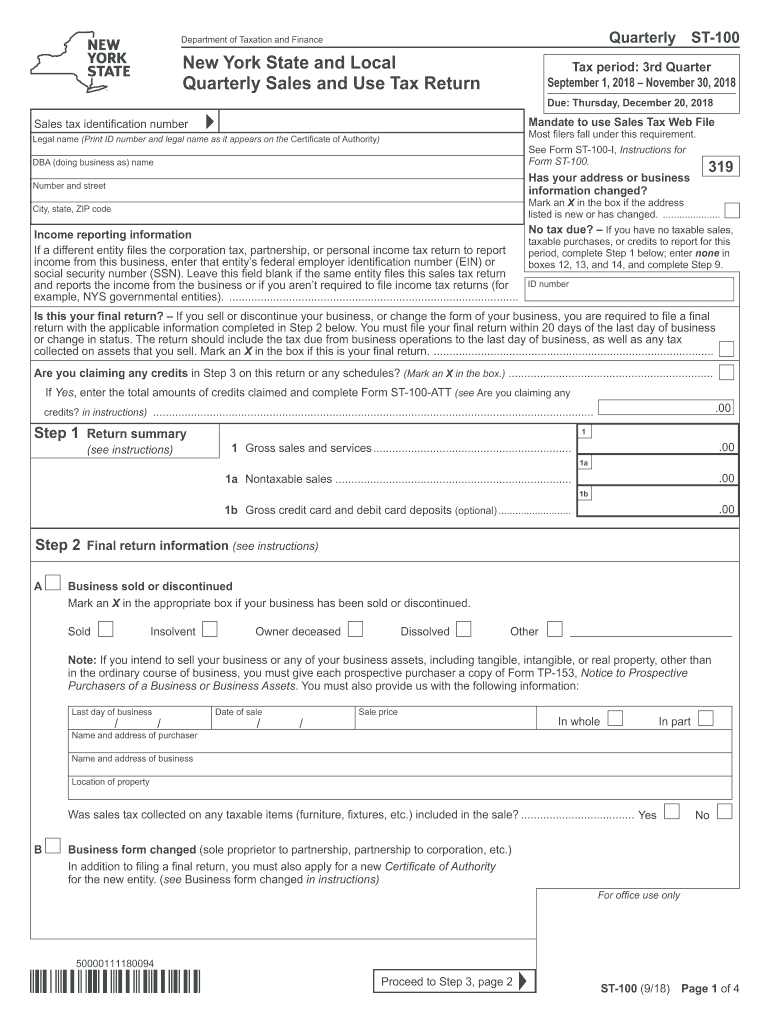

2018 Form NY DTF ST100 Fill Online, Printable, Fillable, Blank pdfFiller

Report the gain or loss on the sale of rental property on form 4797, sales of business property or on form 8949, sales and other. When reporting a property that has been used as both a rental and a primary residence, you will need to include a form 4797 and a sale of main home. We'll ask you to report.

When Reporting A Property That Has Been Used As Both A Rental And A Primary Residence, You Will Need To Include A Form 4797 And A Sale Of Main Home.

Report the gain or loss on the sale of rental property on form 4797, sales of business property or on form 8949, sales and other. We'll ask you to report the sale when you get to the expenses/assets (depreciation) section, along with any other pertinent info (like income and.