Real Estate Tax Foreclosure

Real Estate Tax Foreclosure - First, the delinquent amount becomes a lien on the home. Tax foreclosure, also known as tax lien foreclosure, describes the sale of a property after the property owner fails to pay their tax bill,. But what happens if you don't pay your property taxes?

But what happens if you don't pay your property taxes? Tax foreclosure, also known as tax lien foreclosure, describes the sale of a property after the property owner fails to pay their tax bill,. First, the delinquent amount becomes a lien on the home.

But what happens if you don't pay your property taxes? First, the delinquent amount becomes a lien on the home. Tax foreclosure, also known as tax lien foreclosure, describes the sale of a property after the property owner fails to pay their tax bill,.

How To Buy Real Estate At Foreclosure Auctions

Tax foreclosure, also known as tax lien foreclosure, describes the sale of a property after the property owner fails to pay their tax bill,. But what happens if you don't pay your property taxes? First, the delinquent amount becomes a lien on the home.

stop property tax foreclosure

But what happens if you don't pay your property taxes? First, the delinquent amount becomes a lien on the home. Tax foreclosure, also known as tax lien foreclosure, describes the sale of a property after the property owner fails to pay their tax bill,.

How to Stop Property Tax Foreclosure Jarrett Law Firm

Tax foreclosure, also known as tax lien foreclosure, describes the sale of a property after the property owner fails to pay their tax bill,. First, the delinquent amount becomes a lien on the home. But what happens if you don't pay your property taxes?

Homeowners, in foreclosure, face tax implications. What you should know

First, the delinquent amount becomes a lien on the home. But what happens if you don't pay your property taxes? Tax foreclosure, also known as tax lien foreclosure, describes the sale of a property after the property owner fails to pay their tax bill,.

How I Fought A Property Tax Foreclosure Download Free PDF Legal

Tax foreclosure, also known as tax lien foreclosure, describes the sale of a property after the property owner fails to pay their tax bill,. But what happens if you don't pay your property taxes? First, the delinquent amount becomes a lien on the home.

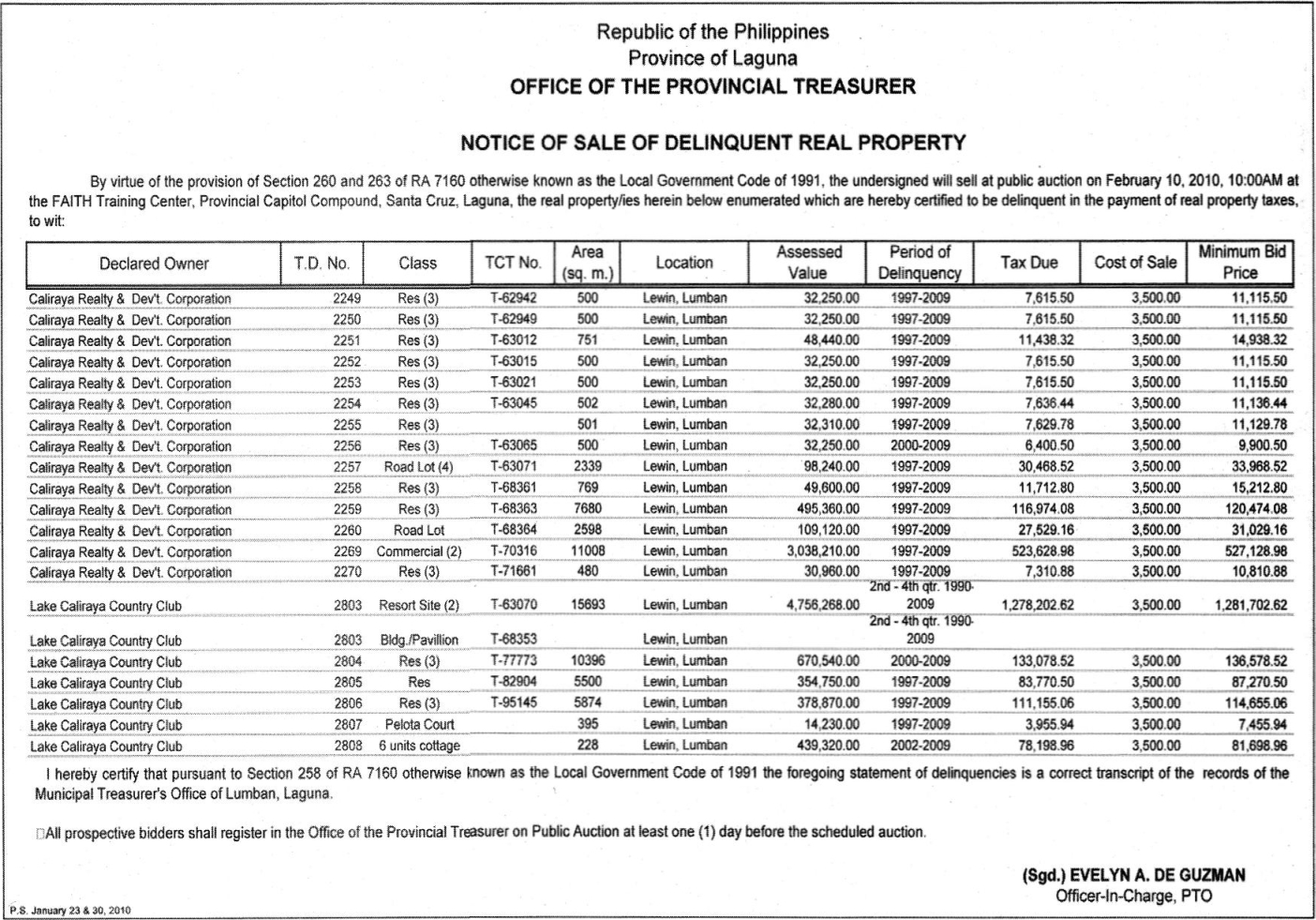

Tax foreclosure sale of delinquent real properties in Laguna slated on

But what happens if you don't pay your property taxes? Tax foreclosure, also known as tax lien foreclosure, describes the sale of a property after the property owner fails to pay their tax bill,. First, the delinquent amount becomes a lien on the home.

What is a property Tax Lien? Real Estate Articles by

But what happens if you don't pay your property taxes? Tax foreclosure, also known as tax lien foreclosure, describes the sale of a property after the property owner fails to pay their tax bill,. First, the delinquent amount becomes a lien on the home.

10 Useful Real Estate Tax Credits for Developers and Investors

First, the delinquent amount becomes a lien on the home. Tax foreclosure, also known as tax lien foreclosure, describes the sale of a property after the property owner fails to pay their tax bill,. But what happens if you don't pay your property taxes?

Foreclosure Information For Real Estate Investors

Tax foreclosure, also known as tax lien foreclosure, describes the sale of a property after the property owner fails to pay their tax bill,. But what happens if you don't pay your property taxes? First, the delinquent amount becomes a lien on the home.

But What Happens If You Don't Pay Your Property Taxes?

Tax foreclosure, also known as tax lien foreclosure, describes the sale of a property after the property owner fails to pay their tax bill,. First, the delinquent amount becomes a lien on the home.