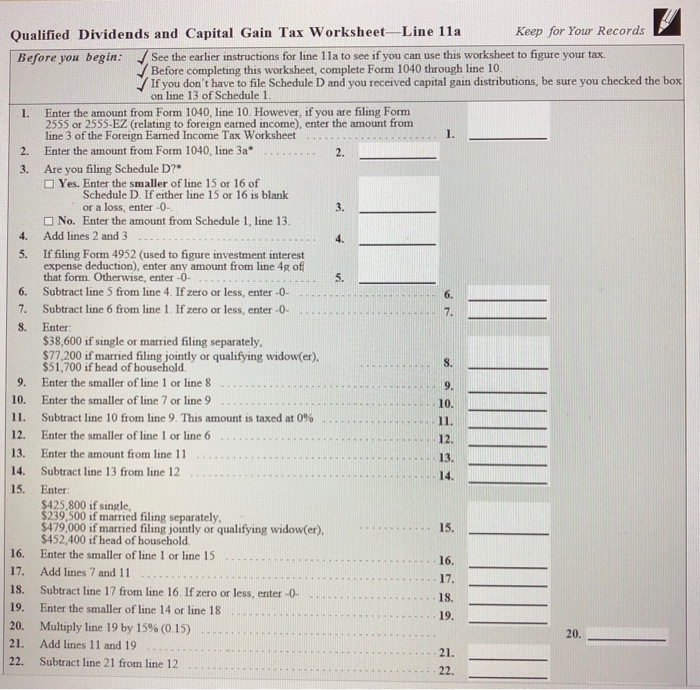

Qualified Dividends And Capital Gain Tax Worksheet Line 16

Qualified Dividends And Capital Gain Tax Worksheet Line 16 - For the desktop version you can switch to. Use the tax tables in the form 1040 instructions. • if line 16 is a In the online version you need to save your return as a pdf file and include all worksheets to see it. Use 1 of the following methods to calculate the tax for line 16 of form 1040. Line 9 tells you the amount in the 0% qualified dividend/ltcg bracket, line 18 tells you the amount in the 15% qualified dividend/ltcg. Then, go to line 17 below. Learn how to complete schedule d (form 1040) to report capital gains and losses from various transactions. V/ see the instructions for line 16 in the instructions to see if you can use this worksheet to figure your tax. V / if you do not have.

Then, go to line 17 below. Use 1 of the following methods to calculate the tax for line 16 of form 1040. Use the tax tables in the form 1040 instructions. See when to use form 8949, form. For the desktop version you can switch to. V / if you do not have. • if line 16 is a V/ see the instructions for line 16 in the instructions to see if you can use this worksheet to figure your tax. Line 9 tells you the amount in the 0% qualified dividend/ltcg bracket, line 18 tells you the amount in the 15% qualified dividend/ltcg. Learn how to complete schedule d (form 1040) to report capital gains and losses from various transactions.

See when to use form 8949, form. Use the tax tables in the form 1040 instructions. Use 1 of the following methods to calculate the tax for line 16 of form 1040. • if line 16 is a For the desktop version you can switch to. V / if you do not have. V/ see the instructions for line 16 in the instructions to see if you can use this worksheet to figure your tax. Learn how to complete schedule d (form 1040) to report capital gains and losses from various transactions. Then, go to line 17 below. Line 9 tells you the amount in the 0% qualified dividend/ltcg bracket, line 18 tells you the amount in the 15% qualified dividend/ltcg.

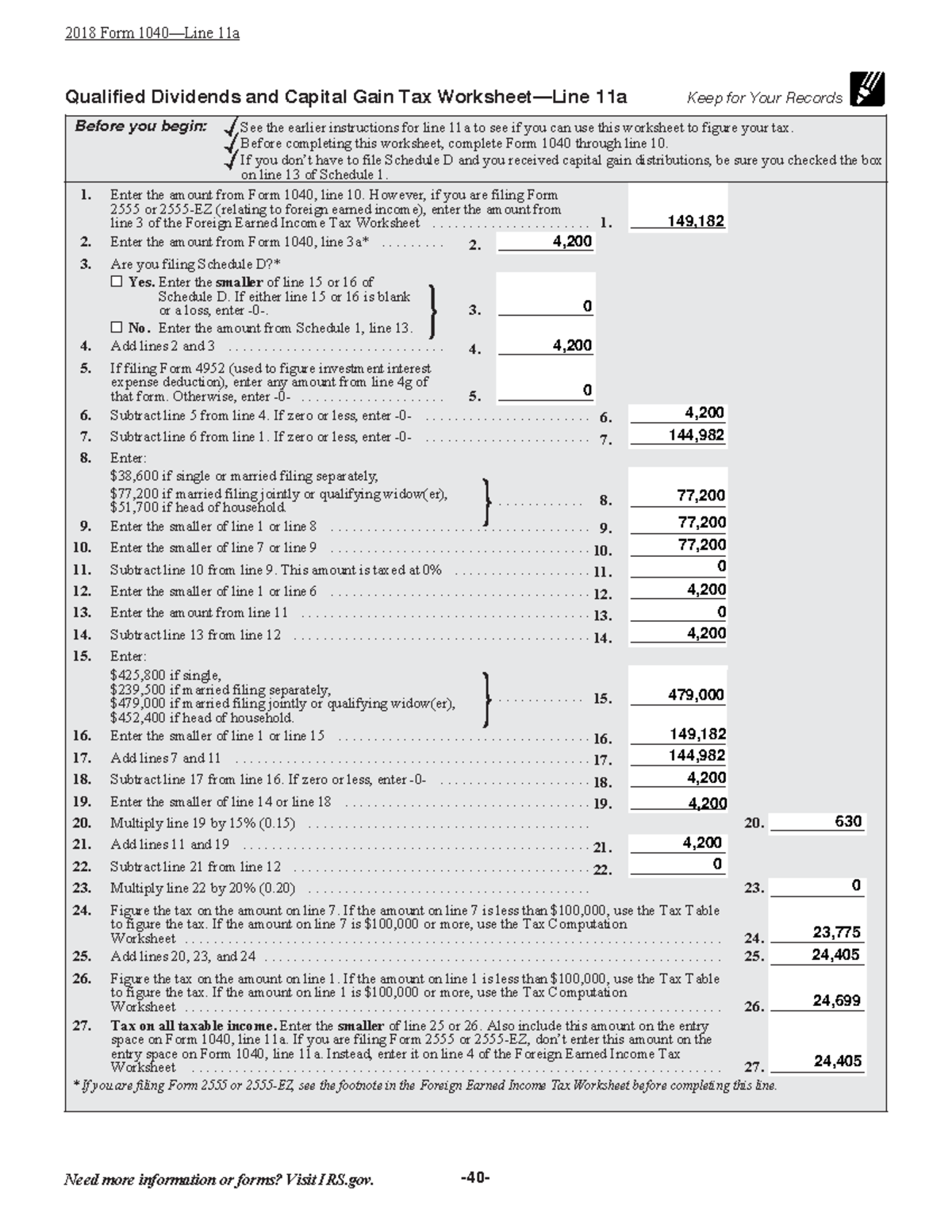

Qualified Dividends And Capital Gain Tax Worksheet Line 16 2

• if line 16 is a Learn how to complete schedule d (form 1040) to report capital gains and losses from various transactions. Use the tax tables in the form 1040 instructions. V/ see the instructions for line 16 in the instructions to see if you can use this worksheet to figure your tax. See when to use form 8949,.

Qualified Dividends And Capital Gains Worksheet Line 16

Use 1 of the following methods to calculate the tax for line 16 of form 1040. V/ see the instructions for line 16 in the instructions to see if you can use this worksheet to figure your tax. Use the tax tables in the form 1040 instructions. V / if you do not have. Then, go to line 17 below.

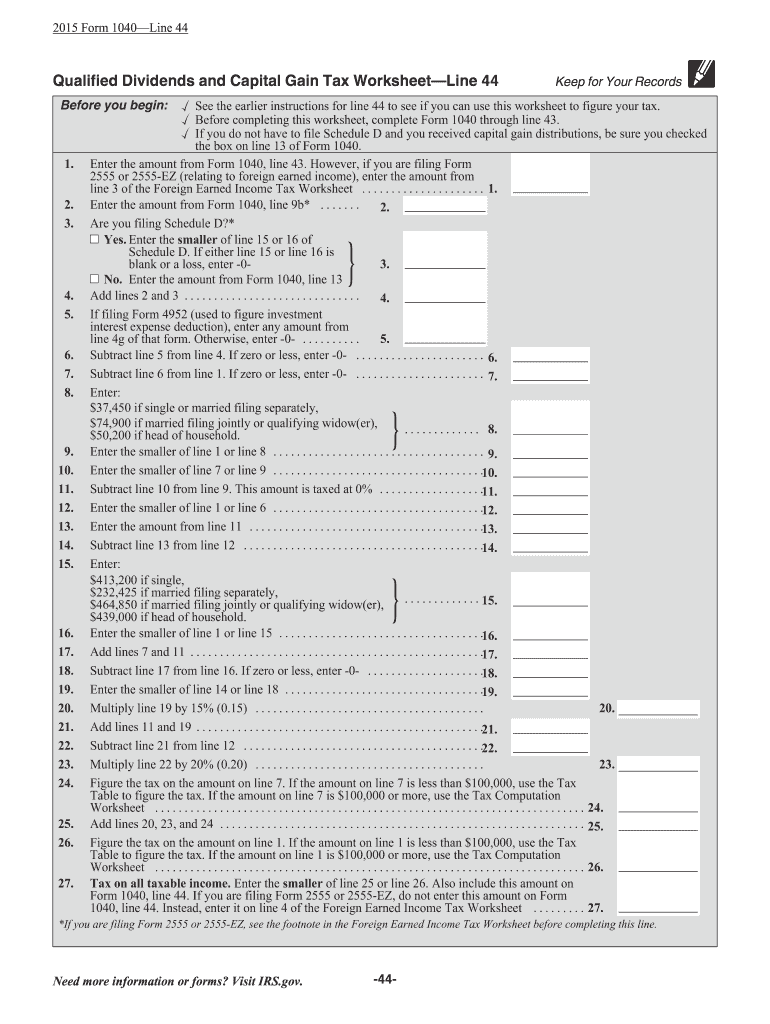

Qualified Dividends And Capital Gain Tax Worksheetline 16

Line 9 tells you the amount in the 0% qualified dividend/ltcg bracket, line 18 tells you the amount in the 15% qualified dividend/ltcg. Use the tax tables in the form 1040 instructions. Use 1 of the following methods to calculate the tax for line 16 of form 1040. V/ see the instructions for line 16 in the instructions to see.

Qualified Dividends And Capital Gain Tax Worksheet Line 16

For the desktop version you can switch to. Line 9 tells you the amount in the 0% qualified dividend/ltcg bracket, line 18 tells you the amount in the 15% qualified dividend/ltcg. Use the tax tables in the form 1040 instructions. Use 1 of the following methods to calculate the tax for line 16 of form 1040. V / if you.

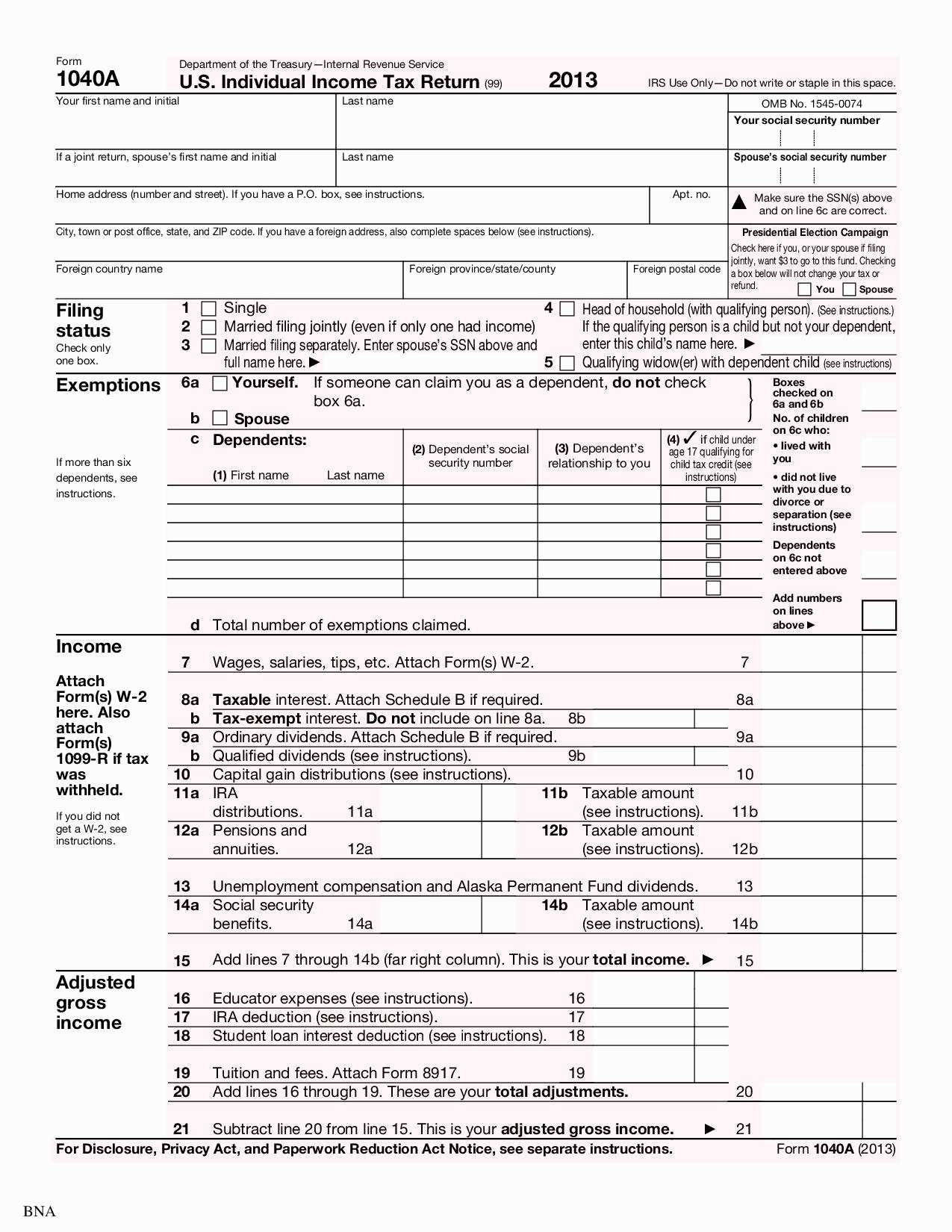

Qualified Dividends And Capital Gain Tax Worksheet Line 16 2

Use the tax tables in the form 1040 instructions. For the desktop version you can switch to. Line 9 tells you the amount in the 0% qualified dividend/ltcg bracket, line 18 tells you the amount in the 15% qualified dividend/ltcg. Learn how to complete schedule d (form 1040) to report capital gains and losses from various transactions. • if line.

The Qualified Dividends & Capital Gain Tax Worksheet White Coat

See when to use form 8949, form. Use the tax tables in the form 1040 instructions. For the desktop version you can switch to. V / if you do not have. V/ see the instructions for line 16 in the instructions to see if you can use this worksheet to figure your tax.

Capital Gain Tax Worksheet Line 16

See when to use form 8949, form. Line 9 tells you the amount in the 0% qualified dividend/ltcg bracket, line 18 tells you the amount in the 15% qualified dividend/ltcg. • if line 16 is a In the online version you need to save your return as a pdf file and include all worksheets to see it. Use the tax.

Qualified Dividends And Capital Gains Sheet

• if line 16 is a Line 9 tells you the amount in the 0% qualified dividend/ltcg bracket, line 18 tells you the amount in the 15% qualified dividend/ltcg. Use 1 of the following methods to calculate the tax for line 16 of form 1040. In the online version you need to save your return as a pdf file and.

Capital Gains And Qualified Dividends Worksheet

For the desktop version you can switch to. Use the tax tables in the form 1040 instructions. Use 1 of the following methods to calculate the tax for line 16 of form 1040. • if line 16 is a V/ see the instructions for line 16 in the instructions to see if you can use this worksheet to figure your.

In The Online Version You Need To Save Your Return As A Pdf File And Include All Worksheets To See It.

Learn how to complete schedule d (form 1040) to report capital gains and losses from various transactions. V/ see the instructions for line 16 in the instructions to see if you can use this worksheet to figure your tax. Use the tax tables in the form 1040 instructions. For the desktop version you can switch to.

• If Line 16 Is A

See when to use form 8949, form. Line 9 tells you the amount in the 0% qualified dividend/ltcg bracket, line 18 tells you the amount in the 15% qualified dividend/ltcg. Use 1 of the following methods to calculate the tax for line 16 of form 1040. V / if you do not have.