Printable Simple Promissory Note Template

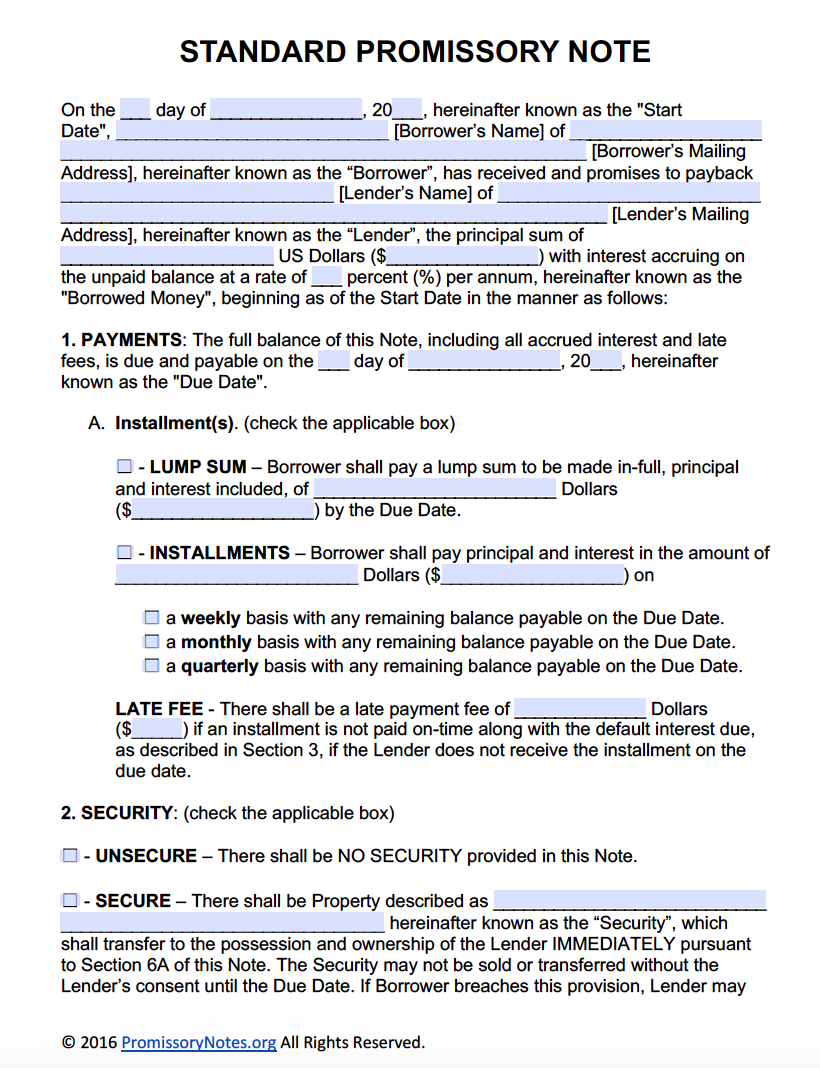

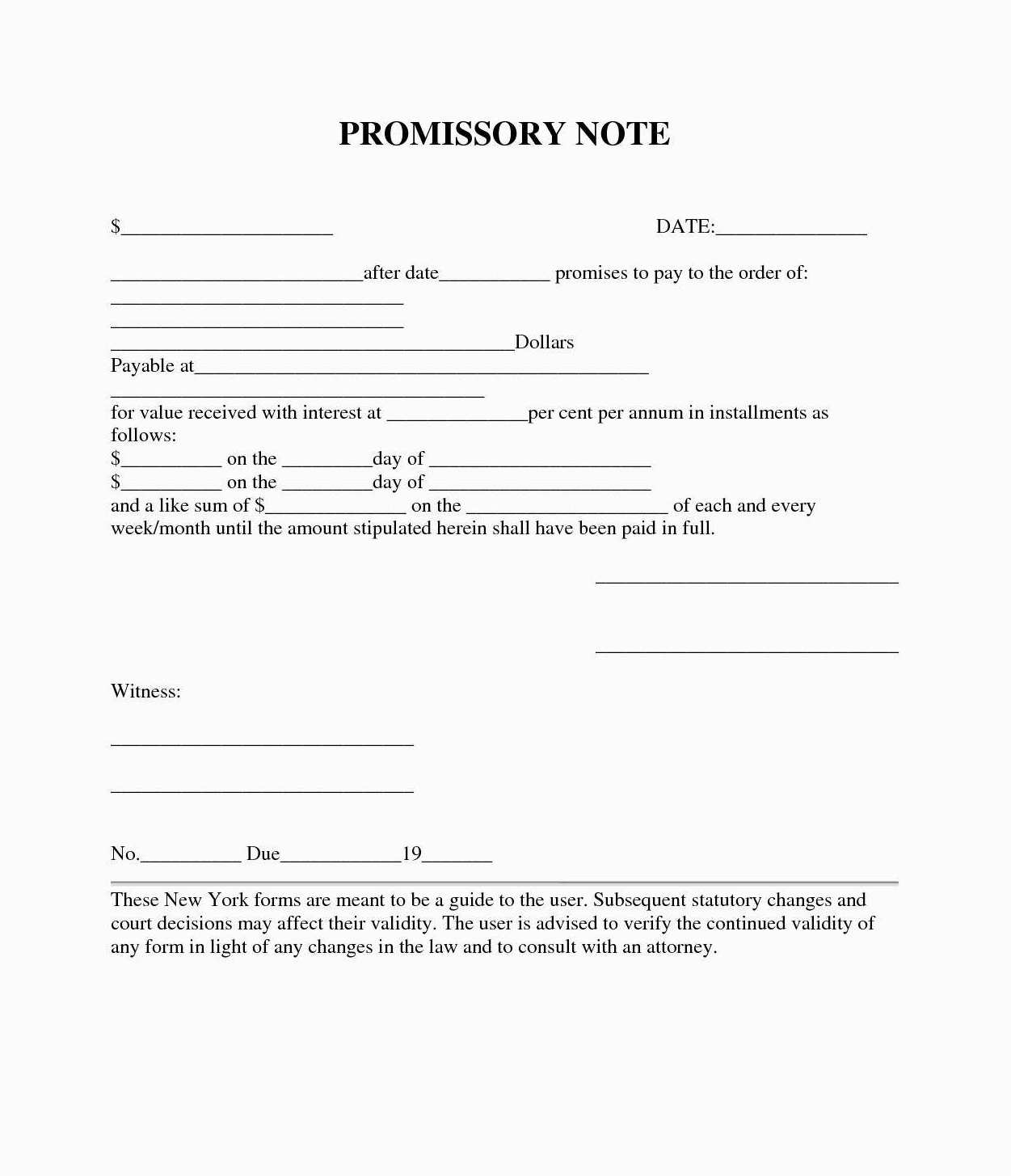

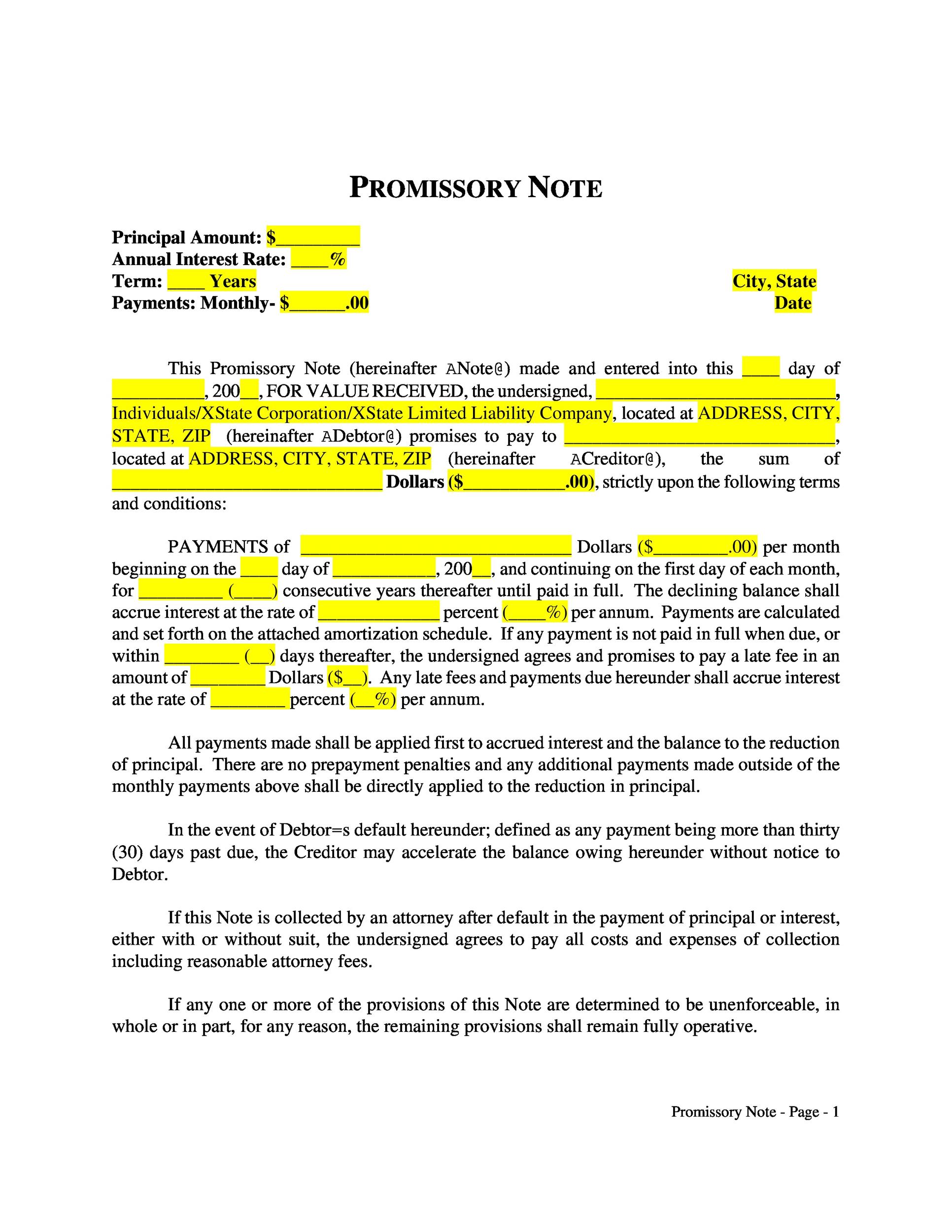

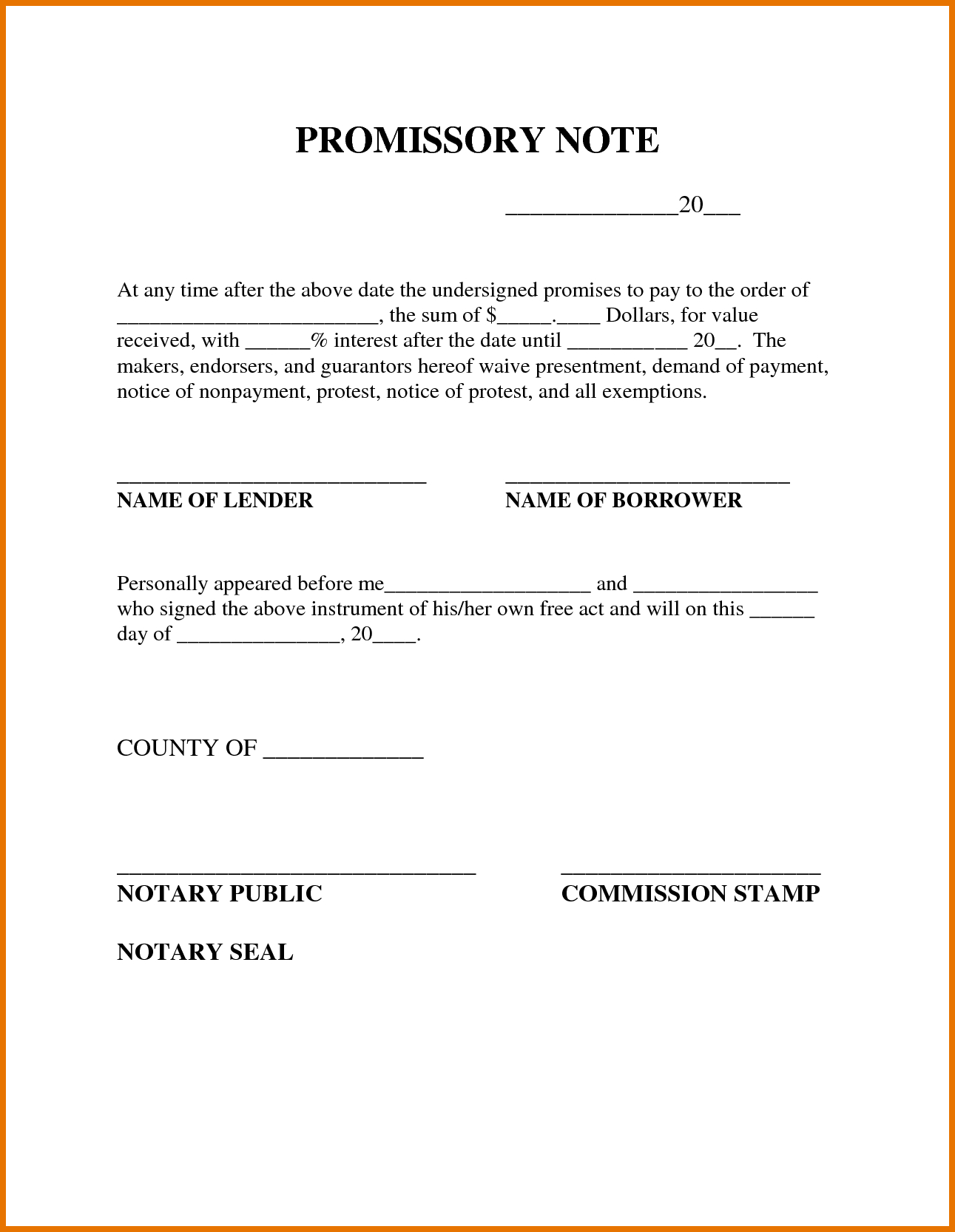

Printable Simple Promissory Note Template - A promissory note is a written promise to pay back money owed within a specific timeframe. A promissory note offers clarity and protection by outlining loan terms such as repayment schedules, interest rates, and collateral. A promissory note is a note issued by the borrower to the lender agreeing to pay money advanced to him/her. The borrower receives the funds after the note is signed and agrees to make payments under the terms and conditions of the note. Standard promissory note on the ___ day of _____, 20___, hereinafter known as the start date, _____ [borrower’s name] of _____ _____ [borrower’s mailing address], hereinafter known as the “borrower”, has received and promises to. There should be an unconditional and clear promise to repay a specific amount to a specific person. It’s a simple document with few details like; The amount of the loan, interest rate, maturity date and in case of default,. This simple yet powerful document fosters trust and.

There should be an unconditional and clear promise to repay a specific amount to a specific person. Standard promissory note on the ___ day of _____, 20___, hereinafter known as the start date, _____ [borrower’s name] of _____ _____ [borrower’s mailing address], hereinafter known as the “borrower”, has received and promises to. The amount of the loan, interest rate, maturity date and in case of default,. A promissory note offers clarity and protection by outlining loan terms such as repayment schedules, interest rates, and collateral. A promissory note is a written promise to pay back money owed within a specific timeframe. The borrower receives the funds after the note is signed and agrees to make payments under the terms and conditions of the note. It’s a simple document with few details like; This simple yet powerful document fosters trust and. A promissory note is a note issued by the borrower to the lender agreeing to pay money advanced to him/her.

It’s a simple document with few details like; Standard promissory note on the ___ day of _____, 20___, hereinafter known as the start date, _____ [borrower’s name] of _____ _____ [borrower’s mailing address], hereinafter known as the “borrower”, has received and promises to. A promissory note offers clarity and protection by outlining loan terms such as repayment schedules, interest rates, and collateral. A promissory note is a note issued by the borrower to the lender agreeing to pay money advanced to him/her. The borrower receives the funds after the note is signed and agrees to make payments under the terms and conditions of the note. The amount of the loan, interest rate, maturity date and in case of default,. A promissory note is a written promise to pay back money owed within a specific timeframe. There should be an unconditional and clear promise to repay a specific amount to a specific person. This simple yet powerful document fosters trust and.

20 Free Unsecured Promissory Note Templates [Word PDF]

A promissory note is a written promise to pay back money owed within a specific timeframe. The amount of the loan, interest rate, maturity date and in case of default,. It’s a simple document with few details like; There should be an unconditional and clear promise to repay a specific amount to a specific person. A promissory note is a.

Printable Promissory Note

A promissory note is a written promise to pay back money owed within a specific timeframe. This simple yet powerful document fosters trust and. The amount of the loan, interest rate, maturity date and in case of default,. The borrower receives the funds after the note is signed and agrees to make payments under the terms and conditions of the.

45 FREE Promissory Note Templates & Forms [Word & PDF] Template Lab

A promissory note is a written promise to pay back money owed within a specific timeframe. It’s a simple document with few details like; A promissory note is a note issued by the borrower to the lender agreeing to pay money advanced to him/her. This simple yet powerful document fosters trust and. The borrower receives the funds after the note.

Printable Simple Promissory Note Template

There should be an unconditional and clear promise to repay a specific amount to a specific person. The borrower receives the funds after the note is signed and agrees to make payments under the terms and conditions of the note. This simple yet powerful document fosters trust and. The amount of the loan, interest rate, maturity date and in case.

45 FREE Promissory Note Templates & Forms [Word & PDF] ᐅ TemplateLab

It’s a simple document with few details like; This simple yet powerful document fosters trust and. A promissory note offers clarity and protection by outlining loan terms such as repayment schedules, interest rates, and collateral. A promissory note is a note issued by the borrower to the lender agreeing to pay money advanced to him/her. There should be an unconditional.

45 FREE Promissory Note Templates & Forms [Word & PDF] ᐅ TemplateLab

A promissory note offers clarity and protection by outlining loan terms such as repayment schedules, interest rates, and collateral. This simple yet powerful document fosters trust and. A promissory note is a note issued by the borrower to the lender agreeing to pay money advanced to him/her. It’s a simple document with few details like; Standard promissory note on the.

Printable Promissory Note Template

Standard promissory note on the ___ day of _____, 20___, hereinafter known as the start date, _____ [borrower’s name] of _____ _____ [borrower’s mailing address], hereinafter known as the “borrower”, has received and promises to. A promissory note is a written promise to pay back money owed within a specific timeframe. There should be an unconditional and clear promise to.

Promissory Note Template Free Word Templates

A promissory note is a note issued by the borrower to the lender agreeing to pay money advanced to him/her. There should be an unconditional and clear promise to repay a specific amount to a specific person. This simple yet powerful document fosters trust and. The amount of the loan, interest rate, maturity date and in case of default,. It’s.

Printable Promissory Note Template

The amount of the loan, interest rate, maturity date and in case of default,. A promissory note is a written promise to pay back money owed within a specific timeframe. This simple yet powerful document fosters trust and. There should be an unconditional and clear promise to repay a specific amount to a specific person. A promissory note offers clarity.

Promissory Note Template

It’s a simple document with few details like; The amount of the loan, interest rate, maturity date and in case of default,. There should be an unconditional and clear promise to repay a specific amount to a specific person. This simple yet powerful document fosters trust and. A promissory note is a note issued by the borrower to the lender.

A Promissory Note Is A Written Promise To Pay Back Money Owed Within A Specific Timeframe.

It’s a simple document with few details like; The borrower receives the funds after the note is signed and agrees to make payments under the terms and conditions of the note. Standard promissory note on the ___ day of _____, 20___, hereinafter known as the start date, _____ [borrower’s name] of _____ _____ [borrower’s mailing address], hereinafter known as the “borrower”, has received and promises to. A promissory note is a note issued by the borrower to the lender agreeing to pay money advanced to him/her.

A Promissory Note Offers Clarity And Protection By Outlining Loan Terms Such As Repayment Schedules, Interest Rates, And Collateral.

There should be an unconditional and clear promise to repay a specific amount to a specific person. The amount of the loan, interest rate, maturity date and in case of default,. This simple yet powerful document fosters trust and.

![20 Free Unsecured Promissory Note Templates [Word PDF]](https://www.doctemplates.net/wp-content/uploads/2019/08/Blank-Printable-Promissory-Note.jpg)

![45 FREE Promissory Note Templates & Forms [Word & PDF] Template Lab](https://templatelab.com/wp-content/uploads/2016/09/promissory-note-template-29.jpg)

![45 FREE Promissory Note Templates & Forms [Word & PDF] ᐅ TemplateLab](https://templatelab.com/wp-content/uploads/2016/09/promissory-note-template-41.jpg)

![45 FREE Promissory Note Templates & Forms [Word & PDF] ᐅ TemplateLab](https://templatelab.com/wp-content/uploads/2016/09/promissory-note-template-32.jpg)