Pa Local Earned Income Tax

Pa Local Earned Income Tax - An individual employee’s local earned income tax (eit) rate is determined by comparing the employee’s “total resident eit rate” (for the. Under section 512 of the act (53 p.s. The local earned income tax (eit) was enacted in 1965 under act 511, the state law that gives municipalities and school districts the legal. Learn about act 32 and local earned income tax (eit) for employers and employees in pennsylvania. Learn about the definition, exemptions, credits and filing requirements of local earned income tax in pennsylvania. Find psd codes, eit rates, tax.

Learn about act 32 and local earned income tax (eit) for employers and employees in pennsylvania. Find psd codes, eit rates, tax. The local earned income tax (eit) was enacted in 1965 under act 511, the state law that gives municipalities and school districts the legal. Learn about the definition, exemptions, credits and filing requirements of local earned income tax in pennsylvania. An individual employee’s local earned income tax (eit) rate is determined by comparing the employee’s “total resident eit rate” (for the. Under section 512 of the act (53 p.s.

An individual employee’s local earned income tax (eit) rate is determined by comparing the employee’s “total resident eit rate” (for the. The local earned income tax (eit) was enacted in 1965 under act 511, the state law that gives municipalities and school districts the legal. Under section 512 of the act (53 p.s. Learn about act 32 and local earned income tax (eit) for employers and employees in pennsylvania. Learn about the definition, exemptions, credits and filing requirements of local earned income tax in pennsylvania. Find psd codes, eit rates, tax.

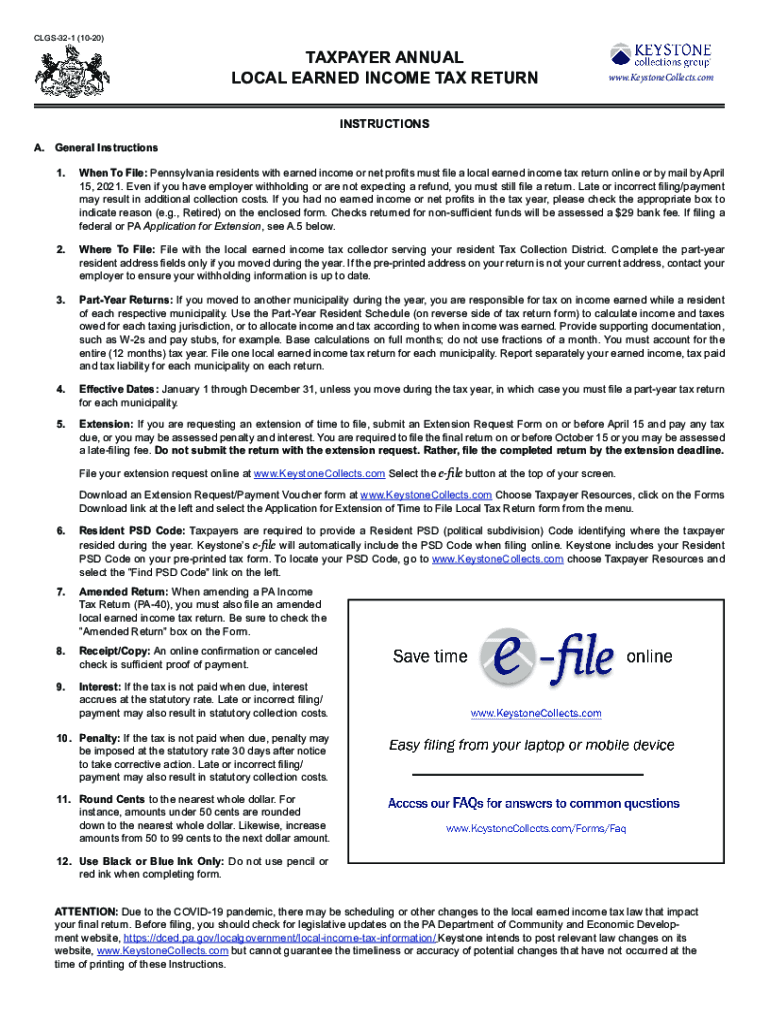

Local Earned Tax Return Form printable pdf download

Find psd codes, eit rates, tax. Learn about the definition, exemptions, credits and filing requirements of local earned income tax in pennsylvania. Learn about act 32 and local earned income tax (eit) for employers and employees in pennsylvania. The local earned income tax (eit) was enacted in 1965 under act 511, the state law that gives municipalities and school districts.

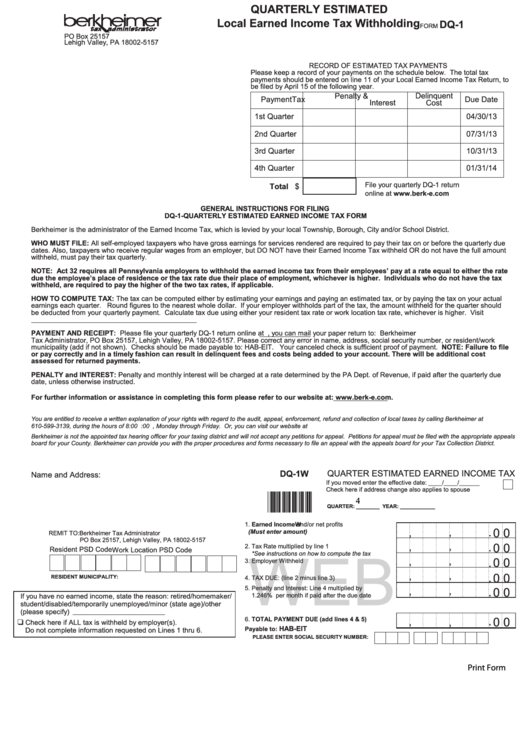

Pennsylvania Local Earned Tax Withholding Form

The local earned income tax (eit) was enacted in 1965 under act 511, the state law that gives municipalities and school districts the legal. An individual employee’s local earned income tax (eit) rate is determined by comparing the employee’s “total resident eit rate” (for the. Under section 512 of the act (53 p.s. Find psd codes, eit rates, tax. Learn.

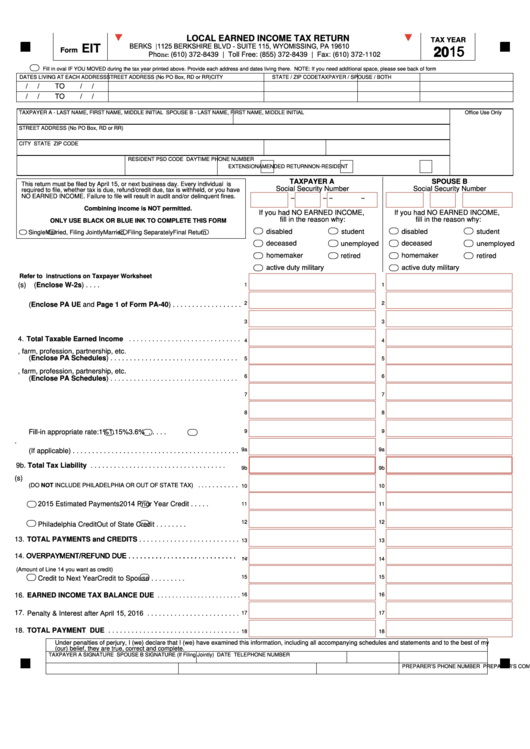

Fillable Local Earned Tax Return Pa Eit 2015 printable pdf download

An individual employee’s local earned income tax (eit) rate is determined by comparing the employee’s “total resident eit rate” (for the. Under section 512 of the act (53 p.s. Find psd codes, eit rates, tax. Learn about the definition, exemptions, credits and filing requirements of local earned income tax in pennsylvania. The local earned income tax (eit) was enacted in.

Tax Forms Pa Local Tax Forms

Find psd codes, eit rates, tax. The local earned income tax (eit) was enacted in 1965 under act 511, the state law that gives municipalities and school districts the legal. Learn about act 32 and local earned income tax (eit) for employers and employees in pennsylvania. Learn about the definition, exemptions, credits and filing requirements of local earned income tax.

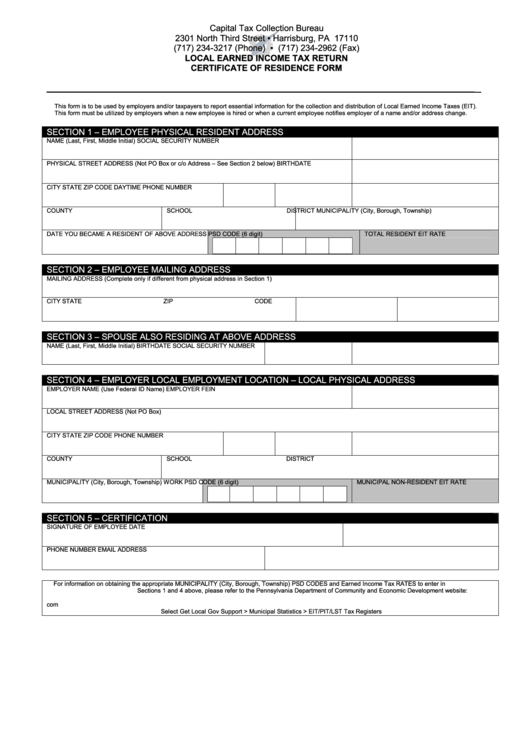

Fillable Local Earned Tax Return Certificate Of Residence Form

Find psd codes, eit rates, tax. The local earned income tax (eit) was enacted in 1965 under act 511, the state law that gives municipalities and school districts the legal. Learn about act 32 and local earned income tax (eit) for employers and employees in pennsylvania. An individual employee’s local earned income tax (eit) rate is determined by comparing the.

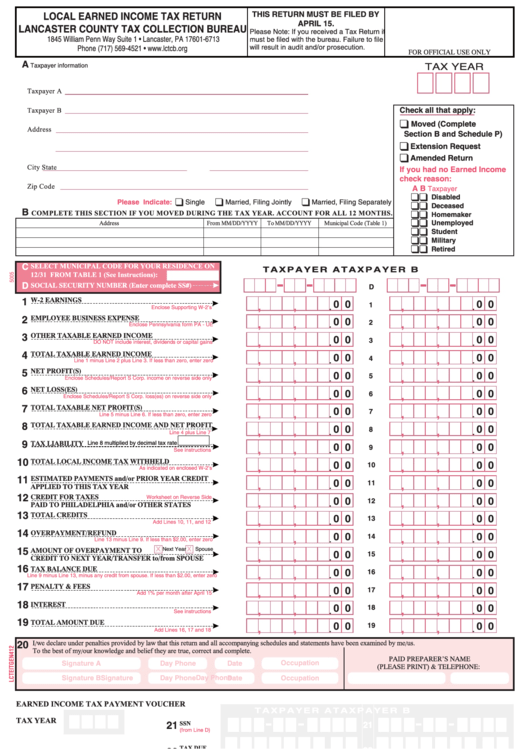

Local Earned Tax Return Form Lancaster County 2005 Printable

Learn about the definition, exemptions, credits and filing requirements of local earned income tax in pennsylvania. Find psd codes, eit rates, tax. Learn about act 32 and local earned income tax (eit) for employers and employees in pennsylvania. Under section 512 of the act (53 p.s. An individual employee’s local earned income tax (eit) rate is determined by comparing the.

tax return sample Fill out & sign online DocHub

The local earned income tax (eit) was enacted in 1965 under act 511, the state law that gives municipalities and school districts the legal. An individual employee’s local earned income tax (eit) rate is determined by comparing the employee’s “total resident eit rate” (for the. Learn about the definition, exemptions, credits and filing requirements of local earned income tax in.

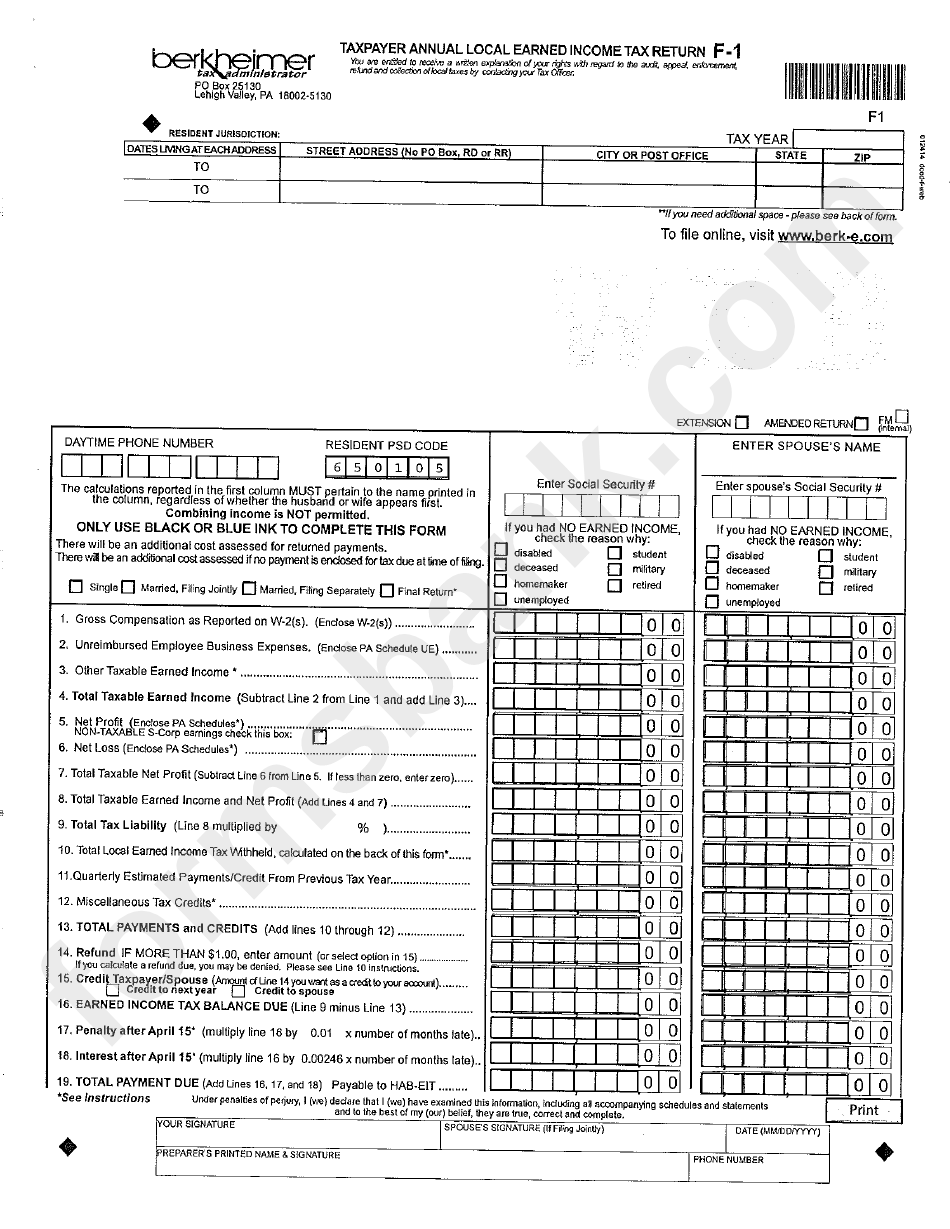

Form F1 Taxpayer Annual Local Earned Tax Return printable pdf

Learn about act 32 and local earned income tax (eit) for employers and employees in pennsylvania. An individual employee’s local earned income tax (eit) rate is determined by comparing the employee’s “total resident eit rate” (for the. Under section 512 of the act (53 p.s. Find psd codes, eit rates, tax. Learn about the definition, exemptions, credits and filing requirements.

Cumberland County Pa Local Earned Tax Return

An individual employee’s local earned income tax (eit) rate is determined by comparing the employee’s “total resident eit rate” (for the. The local earned income tax (eit) was enacted in 1965 under act 511, the state law that gives municipalities and school districts the legal. Learn about the definition, exemptions, credits and filing requirements of local earned income tax in.

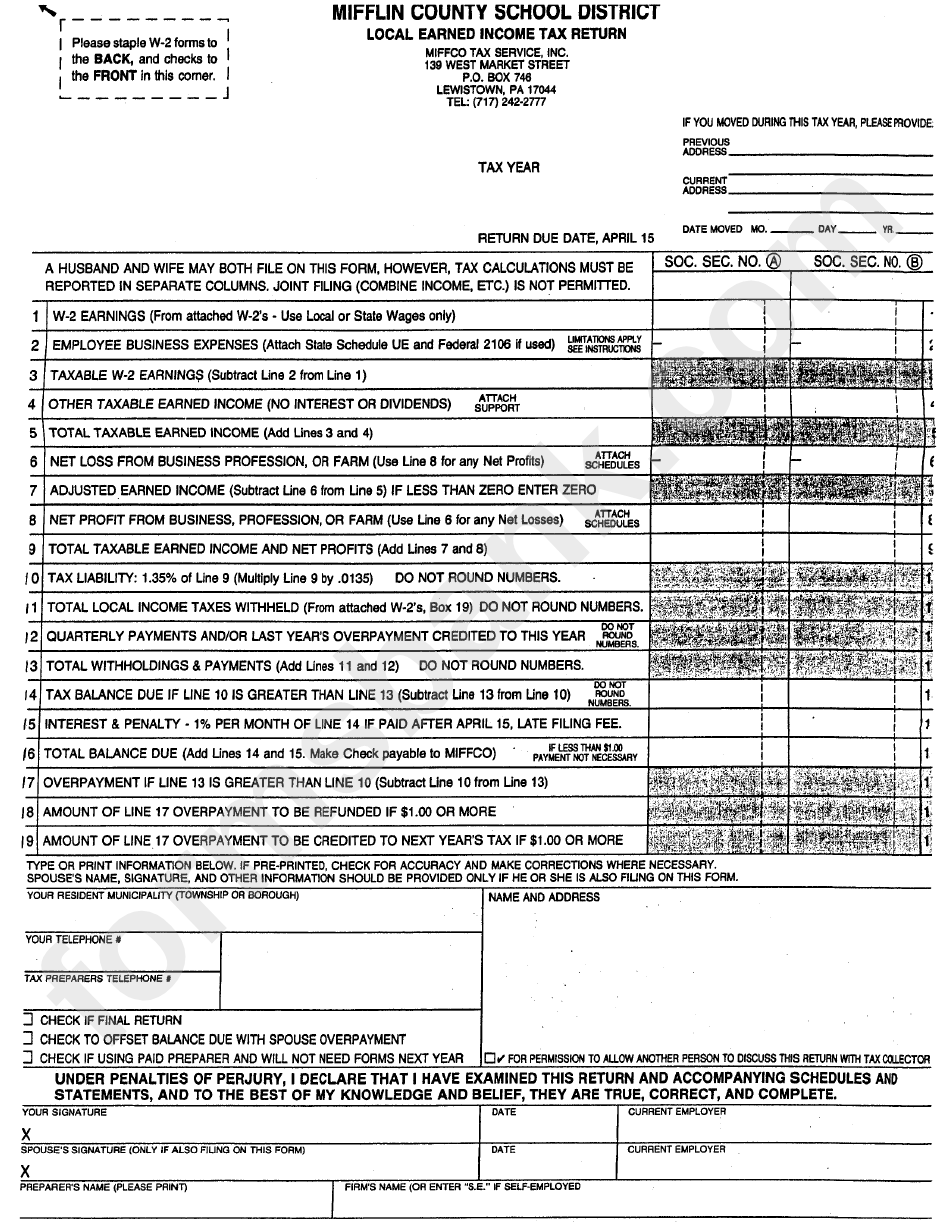

Local Earned Tax Return Form Pennsylvania Mifflin County

Learn about the definition, exemptions, credits and filing requirements of local earned income tax in pennsylvania. Under section 512 of the act (53 p.s. Find psd codes, eit rates, tax. The local earned income tax (eit) was enacted in 1965 under act 511, the state law that gives municipalities and school districts the legal. Learn about act 32 and local.

Find Psd Codes, Eit Rates, Tax.

Learn about act 32 and local earned income tax (eit) for employers and employees in pennsylvania. The local earned income tax (eit) was enacted in 1965 under act 511, the state law that gives municipalities and school districts the legal. An individual employee’s local earned income tax (eit) rate is determined by comparing the employee’s “total resident eit rate” (for the. Under section 512 of the act (53 p.s.