Orange County Ca Tax Liens

Orange County Ca Tax Liens - To obtain recorded documents such as deeds, judgments and liens contact the county of orange at the following area offices: This lien prevents the assessee from recording. Review and pay your property taxes online by echeck using your bank account (no cost) or a credit card (2.29% convenience fee with a. If unsecured taxes become delinquent, a tax lien may be recorded in the name of the assessee. These properties has become subject. Search by property address parcel number (apn) tax default number To redeem the certificate, the owner of the property must pay the tax collector all delinquent taxes plus accrued interests, and. If your property tax payment is not received in the tax collector’s office by 4:30 p.m., friday, may 31, 2023, a lien will be placed against your property.

If your property tax payment is not received in the tax collector’s office by 4:30 p.m., friday, may 31, 2023, a lien will be placed against your property. This lien prevents the assessee from recording. If unsecured taxes become delinquent, a tax lien may be recorded in the name of the assessee. Search by property address parcel number (apn) tax default number To obtain recorded documents such as deeds, judgments and liens contact the county of orange at the following area offices: Review and pay your property taxes online by echeck using your bank account (no cost) or a credit card (2.29% convenience fee with a. To redeem the certificate, the owner of the property must pay the tax collector all delinquent taxes plus accrued interests, and. These properties has become subject.

These properties has become subject. To obtain recorded documents such as deeds, judgments and liens contact the county of orange at the following area offices: This lien prevents the assessee from recording. To redeem the certificate, the owner of the property must pay the tax collector all delinquent taxes plus accrued interests, and. Search by property address parcel number (apn) tax default number If unsecured taxes become delinquent, a tax lien may be recorded in the name of the assessee. If your property tax payment is not received in the tax collector’s office by 4:30 p.m., friday, may 31, 2023, a lien will be placed against your property. Review and pay your property taxes online by echeck using your bank account (no cost) or a credit card (2.29% convenience fee with a.

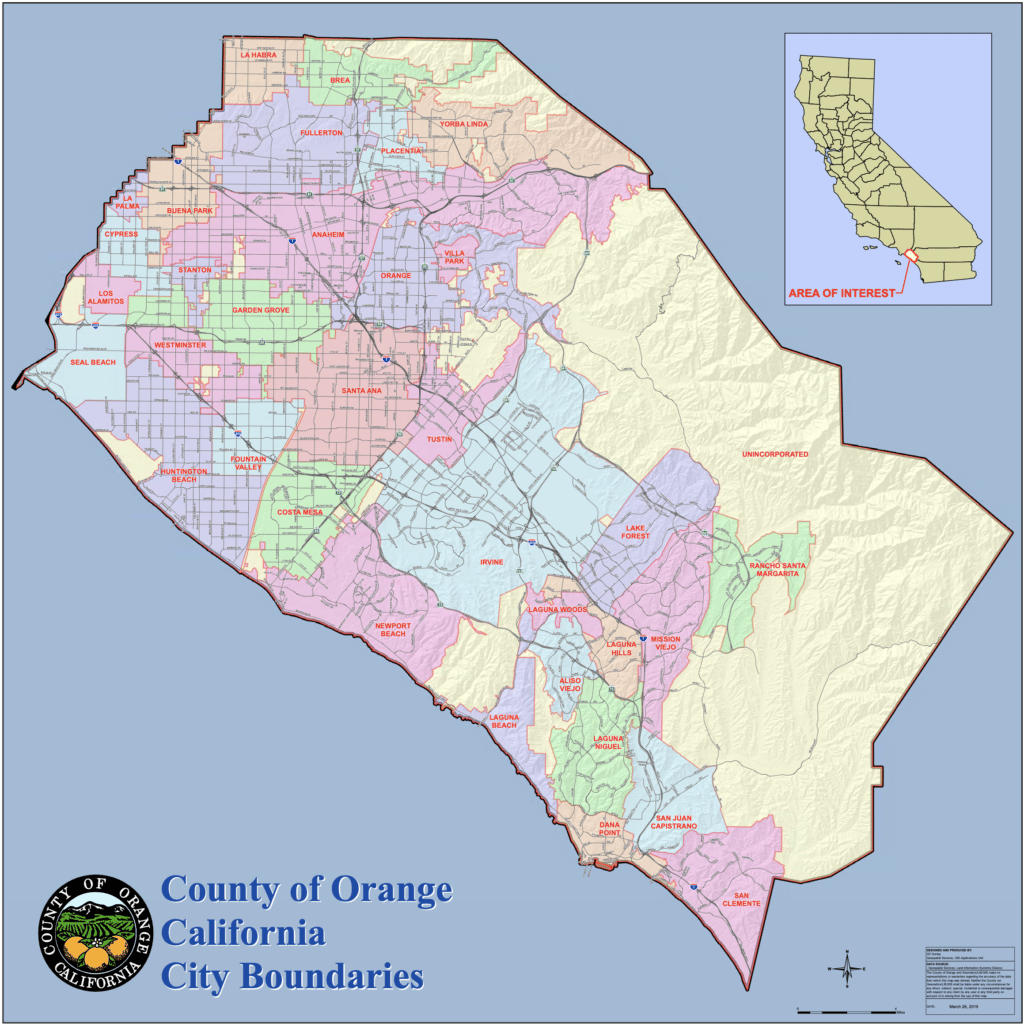

Cities in Orange County, California

Search by property address parcel number (apn) tax default number To obtain recorded documents such as deeds, judgments and liens contact the county of orange at the following area offices: If your property tax payment is not received in the tax collector’s office by 4:30 p.m., friday, may 31, 2023, a lien will be placed against your property. Review and.

Orange County

Search by property address parcel number (apn) tax default number This lien prevents the assessee from recording. If unsecured taxes become delinquent, a tax lien may be recorded in the name of the assessee. These properties has become subject. If your property tax payment is not received in the tax collector’s office by 4:30 p.m., friday, may 31, 2023, a.

Orange County Tax Collector In California Lamarcounty.us

These properties has become subject. To redeem the certificate, the owner of the property must pay the tax collector all delinquent taxes plus accrued interests, and. If your property tax payment is not received in the tax collector’s office by 4:30 p.m., friday, may 31, 2023, a lien will be placed against your property. Review and pay your property taxes.

A Closer Look Orange County Tax Collector’s Office

To obtain recorded documents such as deeds, judgments and liens contact the county of orange at the following area offices: Search by property address parcel number (apn) tax default number These properties has become subject. If your property tax payment is not received in the tax collector’s office by 4:30 p.m., friday, may 31, 2023, a lien will be placed.

Race, Diversity, and Ethnicity in Orange County, CA

To redeem the certificate, the owner of the property must pay the tax collector all delinquent taxes plus accrued interests, and. If unsecured taxes become delinquent, a tax lien may be recorded in the name of the assessee. Review and pay your property taxes online by echeck using your bank account (no cost) or a credit card (2.29% convenience fee.

The Highest and Lowest Areas in Orange County, CA

To obtain recorded documents such as deeds, judgments and liens contact the county of orange at the following area offices: If unsecured taxes become delinquent, a tax lien may be recorded in the name of the assessee. If your property tax payment is not received in the tax collector’s office by 4:30 p.m., friday, may 31, 2023, a lien will.

Orange County CA Heroes Housing

Review and pay your property taxes online by echeck using your bank account (no cost) or a credit card (2.29% convenience fee with a. These properties has become subject. This lien prevents the assessee from recording. If unsecured taxes become delinquent, a tax lien may be recorded in the name of the assessee. To obtain recorded documents such as deeds,.

Orange County California Community Economic Development

To redeem the certificate, the owner of the property must pay the tax collector all delinquent taxes plus accrued interests, and. Review and pay your property taxes online by echeck using your bank account (no cost) or a credit card (2.29% convenience fee with a. To obtain recorded documents such as deeds, judgments and liens contact the county of orange.

Cities in Orange County, California

This lien prevents the assessee from recording. To redeem the certificate, the owner of the property must pay the tax collector all delinquent taxes plus accrued interests, and. Review and pay your property taxes online by echeck using your bank account (no cost) or a credit card (2.29% convenience fee with a. If your property tax payment is not received.

Orange County Ca Tax Deadline 2024 Rena Krista

Review and pay your property taxes online by echeck using your bank account (no cost) or a credit card (2.29% convenience fee with a. Search by property address parcel number (apn) tax default number To redeem the certificate, the owner of the property must pay the tax collector all delinquent taxes plus accrued interests, and. These properties has become subject..

This Lien Prevents The Assessee From Recording.

If unsecured taxes become delinquent, a tax lien may be recorded in the name of the assessee. To obtain recorded documents such as deeds, judgments and liens contact the county of orange at the following area offices: Search by property address parcel number (apn) tax default number These properties has become subject.

If Your Property Tax Payment Is Not Received In The Tax Collector’s Office By 4:30 P.m., Friday, May 31, 2023, A Lien Will Be Placed Against Your Property.

Review and pay your property taxes online by echeck using your bank account (no cost) or a credit card (2.29% convenience fee with a. To redeem the certificate, the owner of the property must pay the tax collector all delinquent taxes plus accrued interests, and.