Ohio State Sales Tax Exemption Form

Ohio State Sales Tax Exemption Form - Provide the id number to claim exemption from sales tax that is required by the taxing state. Sales and use tax blanket exemption certificate the purchaser hereby claims exception or exemption on all purchases of tangible personal. Please see the contact information on the relevant department's page or use our contact form. The purchaser hereby claims exception or exemption on all purchases of tangible personal property and selected services made under this. The ohio state university strives to maintain an. If a purchaser claims that tax does not apply to a transaction, the purchaser must provide a fully completed exemption certificate. Ohio accepts the uniform sales and use tax certificate created by the multistate tax commission as a valid exemption certificate. An official state of ohio site. Check with that state to determine your.

Ohio accepts the uniform sales and use tax certificate created by the multistate tax commission as a valid exemption certificate. An official state of ohio site. Sales and use tax blanket exemption certificate the purchaser hereby claims exception or exemption on all purchases of tangible personal. The ohio state university strives to maintain an. If a purchaser claims that tax does not apply to a transaction, the purchaser must provide a fully completed exemption certificate. Provide the id number to claim exemption from sales tax that is required by the taxing state. The purchaser hereby claims exception or exemption on all purchases of tangible personal property and selected services made under this. Check with that state to determine your. Please see the contact information on the relevant department's page or use our contact form.

Check with that state to determine your. The ohio state university strives to maintain an. An official state of ohio site. Provide the id number to claim exemption from sales tax that is required by the taxing state. If a purchaser claims that tax does not apply to a transaction, the purchaser must provide a fully completed exemption certificate. Please see the contact information on the relevant department's page or use our contact form. Ohio accepts the uniform sales and use tax certificate created by the multistate tax commission as a valid exemption certificate. The purchaser hereby claims exception or exemption on all purchases of tangible personal property and selected services made under this. Sales and use tax blanket exemption certificate the purchaser hereby claims exception or exemption on all purchases of tangible personal.

Fillable Ohio Tax Exemption Form Printable Forms Free Online

Please see the contact information on the relevant department's page or use our contact form. Ohio accepts the uniform sales and use tax certificate created by the multistate tax commission as a valid exemption certificate. Provide the id number to claim exemption from sales tax that is required by the taxing state. If a purchaser claims that tax does not.

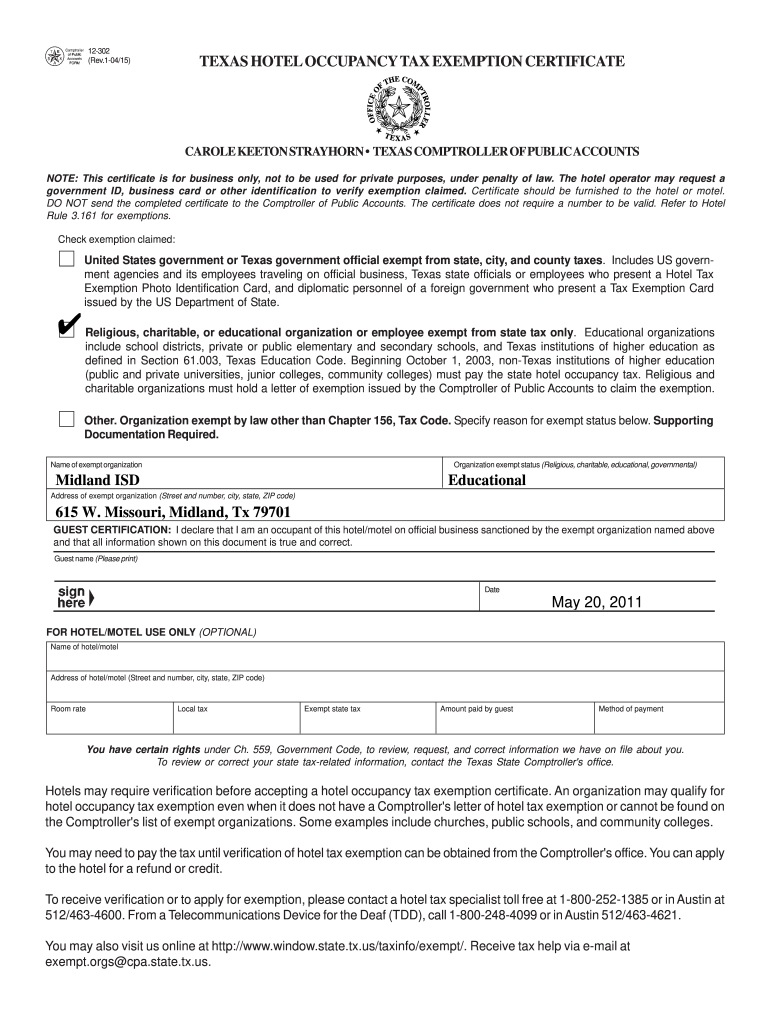

Texas Sales And Use Tax Resale Certificate Example / TaxExempt Forms

Please see the contact information on the relevant department's page or use our contact form. Provide the id number to claim exemption from sales tax that is required by the taxing state. Check with that state to determine your. If a purchaser claims that tax does not apply to a transaction, the purchaser must provide a fully completed exemption certificate..

Ohio Sales Tax Exemption Form 2024 Pdf Ranee Casandra

Check with that state to determine your. Sales and use tax blanket exemption certificate the purchaser hereby claims exception or exemption on all purchases of tangible personal. The purchaser hereby claims exception or exemption on all purchases of tangible personal property and selected services made under this. Ohio accepts the uniform sales and use tax certificate created by the multistate.

Sd Certificate Of Exemption For Sales Tax

Ohio accepts the uniform sales and use tax certificate created by the multistate tax commission as a valid exemption certificate. If a purchaser claims that tax does not apply to a transaction, the purchaser must provide a fully completed exemption certificate. The purchaser hereby claims exception or exemption on all purchases of tangible personal property and selected services made under.

Louisiana sales tax exemption form pdf Fill out & sign online DocHub

Check with that state to determine your. Provide the id number to claim exemption from sales tax that is required by the taxing state. Please see the contact information on the relevant department's page or use our contact form. If a purchaser claims that tax does not apply to a transaction, the purchaser must provide a fully completed exemption certificate..

Texas Sales And Use Tax Resale Certificate Example / 01 315 Form Fill

Sales and use tax blanket exemption certificate the purchaser hereby claims exception or exemption on all purchases of tangible personal. Check with that state to determine your. An official state of ohio site. Ohio accepts the uniform sales and use tax certificate created by the multistate tax commission as a valid exemption certificate. Provide the id number to claim exemption.

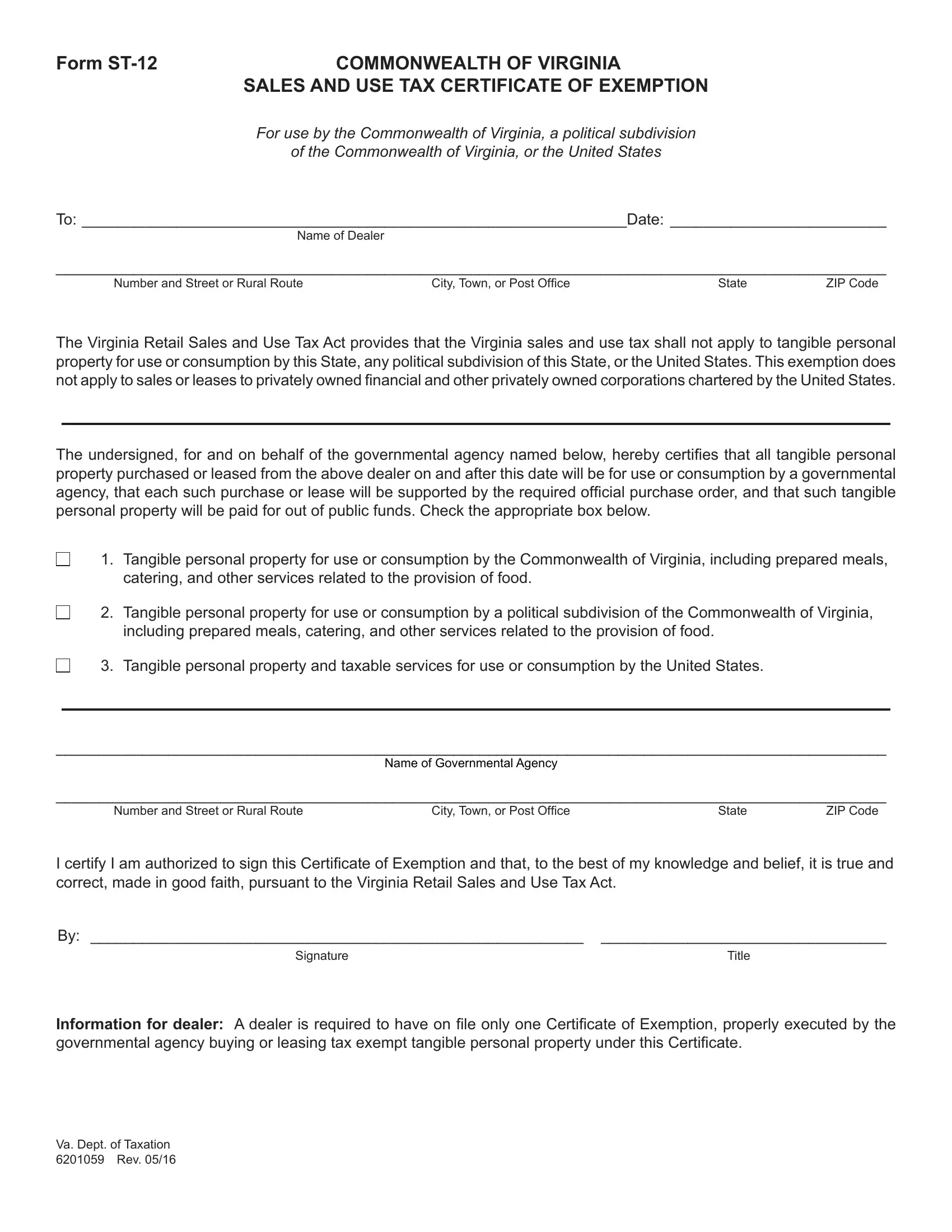

Virginia Sales Tax Exemption PDF Form FormsPal

Sales and use tax blanket exemption certificate the purchaser hereby claims exception or exemption on all purchases of tangible personal. An official state of ohio site. If a purchaser claims that tax does not apply to a transaction, the purchaser must provide a fully completed exemption certificate. Please see the contact information on the relevant department's page or use our.

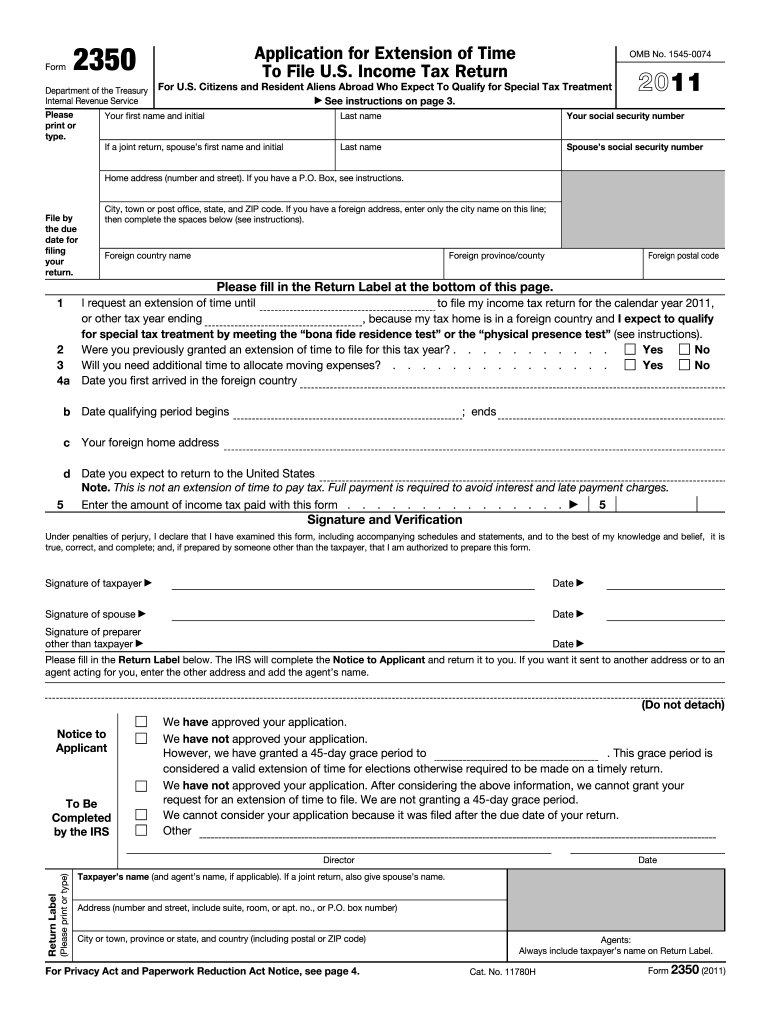

Tax Exempt Form 2350 Fillable Fill Out and Sign Printable PDF

The ohio state university strives to maintain an. Check with that state to determine your. If a purchaser claims that tax does not apply to a transaction, the purchaser must provide a fully completed exemption certificate. Provide the id number to claim exemption from sales tax that is required by the taxing state. Sales and use tax blanket exemption certificate.

Ky Tax Exempt Form Pdf Fill Online, Printable, Fillable, Blank

Check with that state to determine your. The ohio state university strives to maintain an. The purchaser hereby claims exception or exemption on all purchases of tangible personal property and selected services made under this. An official state of ohio site. Provide the id number to claim exemption from sales tax that is required by the taxing state.

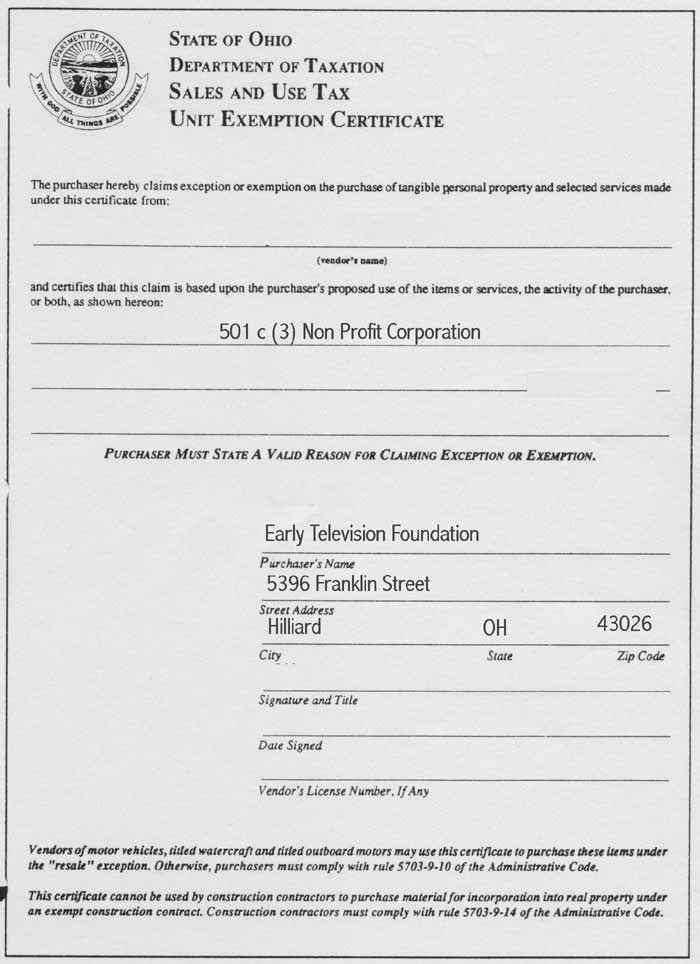

The Early Television Foundation

Provide the id number to claim exemption from sales tax that is required by the taxing state. Check with that state to determine your. An official state of ohio site. Sales and use tax blanket exemption certificate the purchaser hereby claims exception or exemption on all purchases of tangible personal. If a purchaser claims that tax does not apply to.

Check With That State To Determine Your.

Please see the contact information on the relevant department's page or use our contact form. Sales and use tax blanket exemption certificate the purchaser hereby claims exception or exemption on all purchases of tangible personal. The purchaser hereby claims exception or exemption on all purchases of tangible personal property and selected services made under this. Ohio accepts the uniform sales and use tax certificate created by the multistate tax commission as a valid exemption certificate.

If A Purchaser Claims That Tax Does Not Apply To A Transaction, The Purchaser Must Provide A Fully Completed Exemption Certificate.

Provide the id number to claim exemption from sales tax that is required by the taxing state. An official state of ohio site. The ohio state university strives to maintain an.