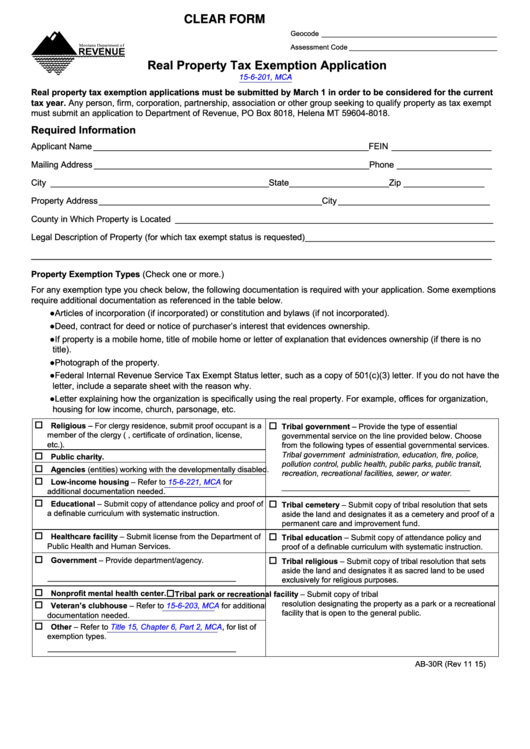

Nys Real Property Tax Exemption Forms

Nys Real Property Tax Exemption Forms - The real property tax law requires all properties in each municipality (except in new york city and nassau county) to be assessed at a uniform. Exemption applications must be filed with your local assessor’s office. See our municipal profiles for your local assessor’s. 141 rows exemption applications must be filed with your local assessor’s office. Access various tax forms such a changing your name, exemptions, grievances and more. See our municipal profiles for your local assessor’s. For a list of available property tax exemptions in new york state, see assessor manuals, exemption administration, part 1:. The application packets linked below include all relevant forms and instructions needed to apply for each type of exemption.

The application packets linked below include all relevant forms and instructions needed to apply for each type of exemption. See our municipal profiles for your local assessor’s. 141 rows exemption applications must be filed with your local assessor’s office. See our municipal profiles for your local assessor’s. The real property tax law requires all properties in each municipality (except in new york city and nassau county) to be assessed at a uniform. Exemption applications must be filed with your local assessor’s office. For a list of available property tax exemptions in new york state, see assessor manuals, exemption administration, part 1:. Access various tax forms such a changing your name, exemptions, grievances and more.

For a list of available property tax exemptions in new york state, see assessor manuals, exemption administration, part 1:. Access various tax forms such a changing your name, exemptions, grievances and more. See our municipal profiles for your local assessor’s. The real property tax law requires all properties in each municipality (except in new york city and nassau county) to be assessed at a uniform. See our municipal profiles for your local assessor’s. 141 rows exemption applications must be filed with your local assessor’s office. Exemption applications must be filed with your local assessor’s office. The application packets linked below include all relevant forms and instructions needed to apply for each type of exemption.

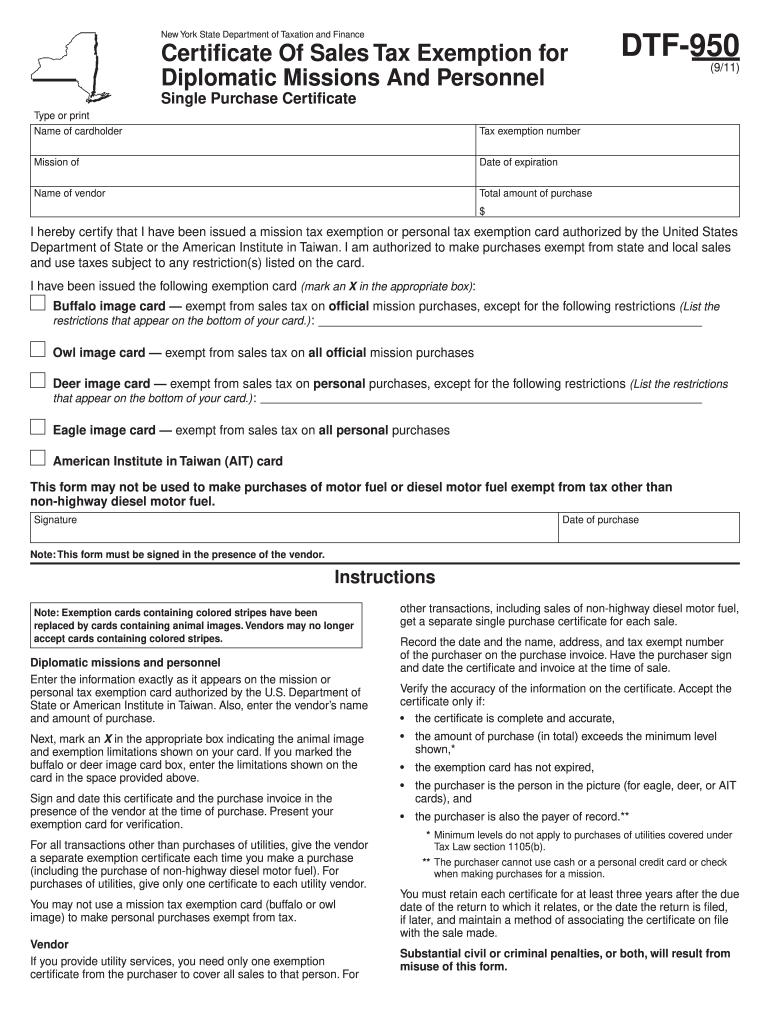

Form St 127 Nys And Local Sales And Use Tax Exemption Certificate

Exemption applications must be filed with your local assessor’s office. See our municipal profiles for your local assessor’s. Access various tax forms such a changing your name, exemptions, grievances and more. The application packets linked below include all relevant forms and instructions needed to apply for each type of exemption. For a list of available property tax exemptions in new.

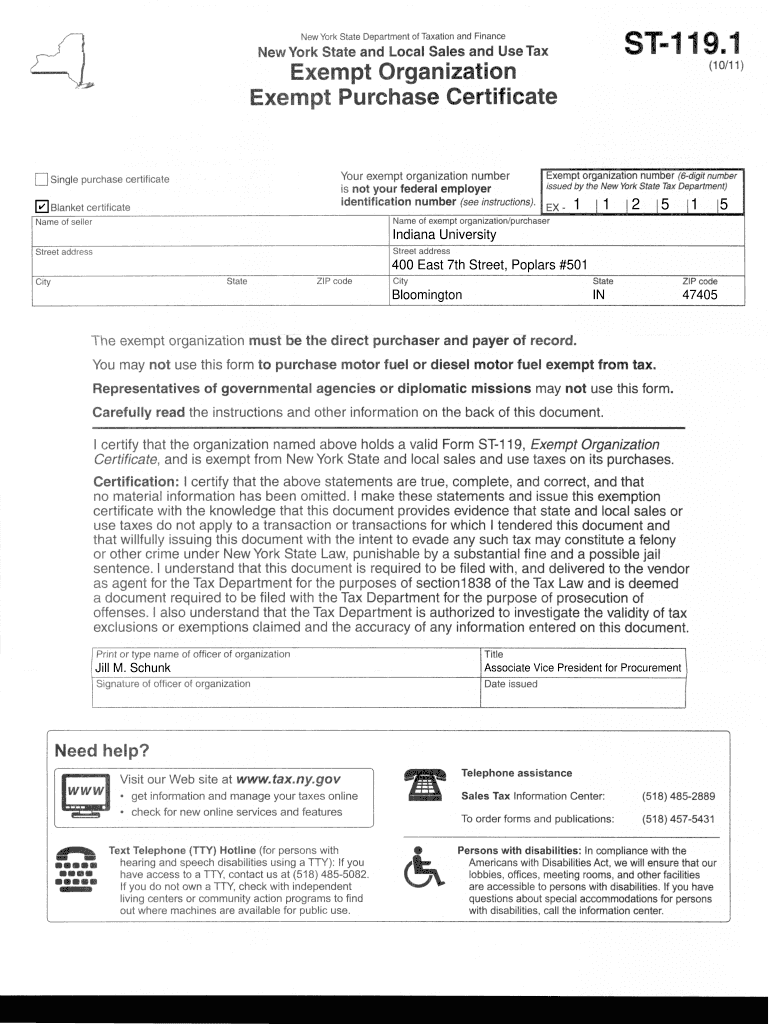

New York State Tax Exempt Form St 119

The real property tax law requires all properties in each municipality (except in new york city and nassau county) to be assessed at a uniform. See our municipal profiles for your local assessor’s. See our municipal profiles for your local assessor’s. 141 rows exemption applications must be filed with your local assessor’s office. Access various tax forms such a changing.

Nys Tax Exempt Form St125

141 rows exemption applications must be filed with your local assessor’s office. The application packets linked below include all relevant forms and instructions needed to apply for each type of exemption. For a list of available property tax exemptions in new york state, see assessor manuals, exemption administration, part 1:. The real property tax law requires all properties in each.

Top 21 Property Tax Exemption Form Templates free to download in PDF format

See our municipal profiles for your local assessor’s. See our municipal profiles for your local assessor’s. Access various tax forms such a changing your name, exemptions, grievances and more. The application packets linked below include all relevant forms and instructions needed to apply for each type of exemption. 141 rows exemption applications must be filed with your local assessor’s office.

Nys tax exempt form Fill out & sign online DocHub

See our municipal profiles for your local assessor’s. See our municipal profiles for your local assessor’s. For a list of available property tax exemptions in new york state, see assessor manuals, exemption administration, part 1:. The real property tax law requires all properties in each municipality (except in new york city and nassau county) to be assessed at a uniform..

Agricultural Tax Exempt Form Nys

Access various tax forms such a changing your name, exemptions, grievances and more. 141 rows exemption applications must be filed with your local assessor’s office. The application packets linked below include all relevant forms and instructions needed to apply for each type of exemption. See our municipal profiles for your local assessor’s. For a list of available property tax exemptions.

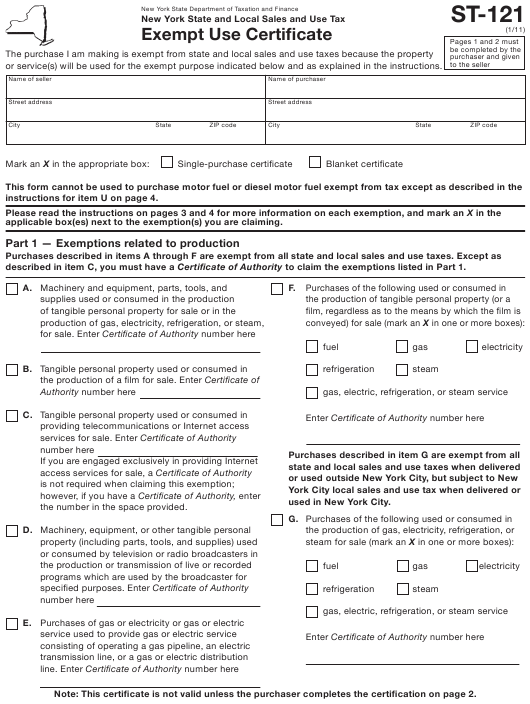

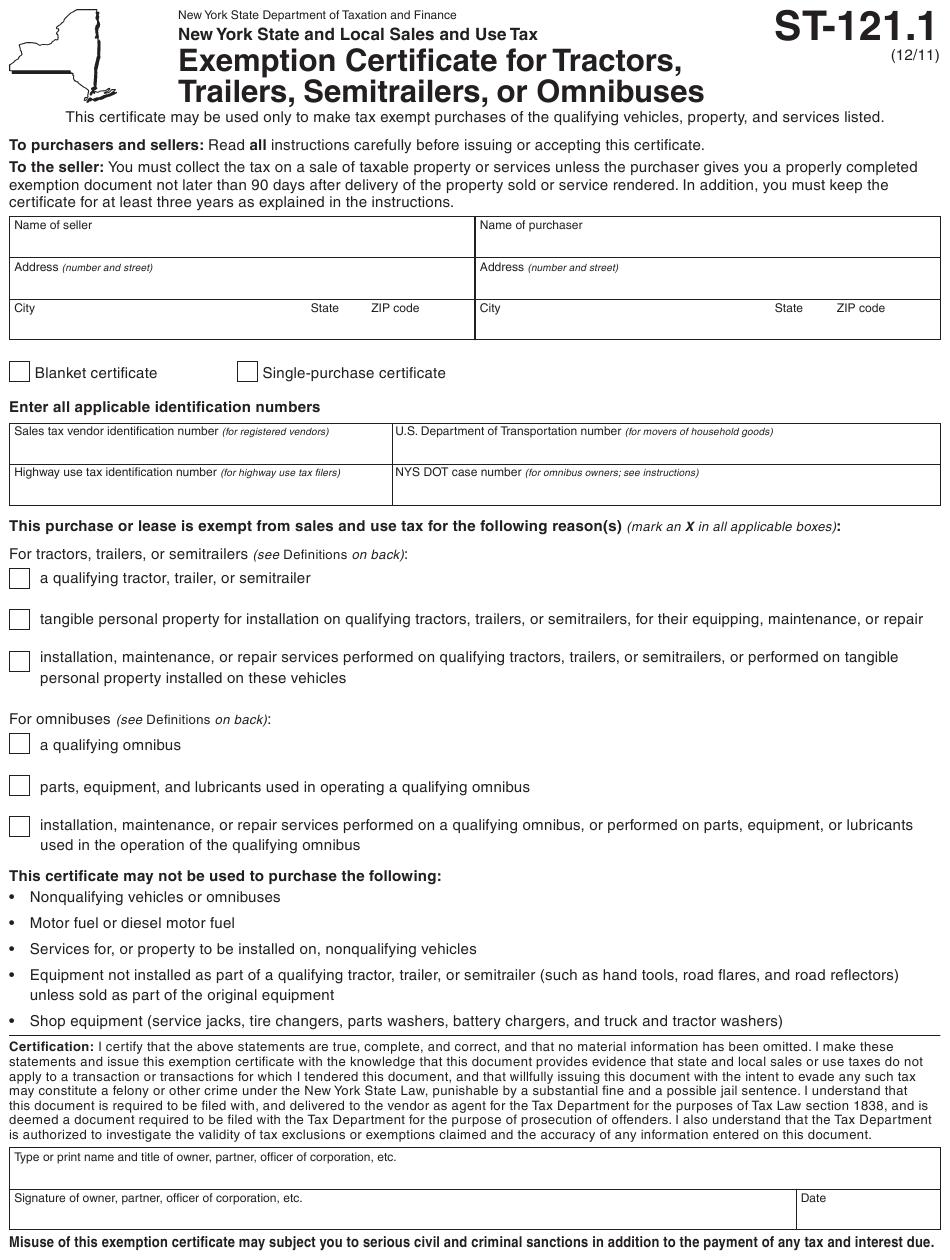

St 121 Fillable Form Printable Forms Free Online

See our municipal profiles for your local assessor’s. 141 rows exemption applications must be filed with your local assessor’s office. Access various tax forms such a changing your name, exemptions, grievances and more. Exemption applications must be filed with your local assessor’s office. For a list of available property tax exemptions in new york state, see assessor manuals, exemption administration,.

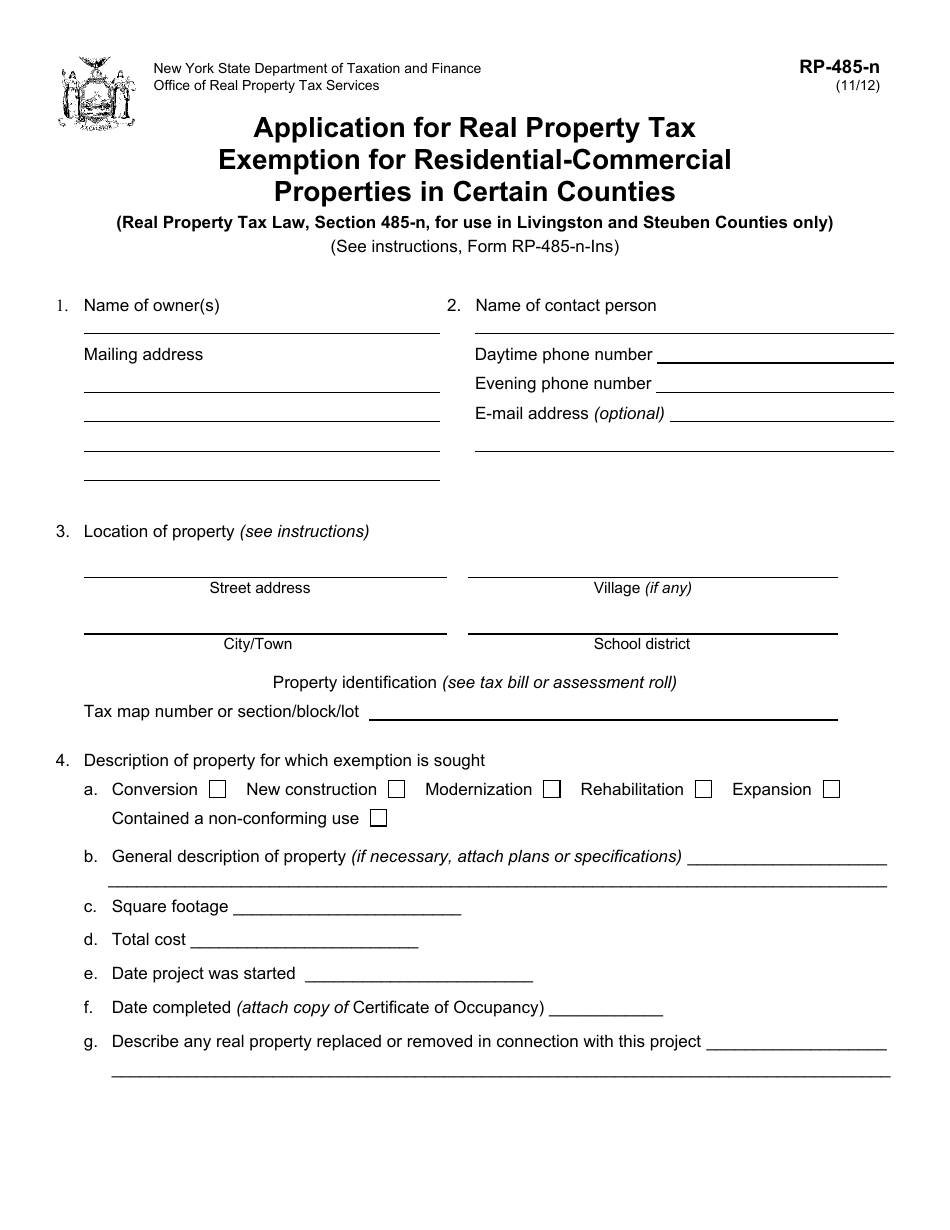

Form RP485N Fill Out, Sign Online and Download Fillable PDF, New

For a list of available property tax exemptions in new york state, see assessor manuals, exemption administration, part 1:. Exemption applications must be filed with your local assessor’s office. See our municipal profiles for your local assessor’s. The application packets linked below include all relevant forms and instructions needed to apply for each type of exemption. See our municipal profiles.

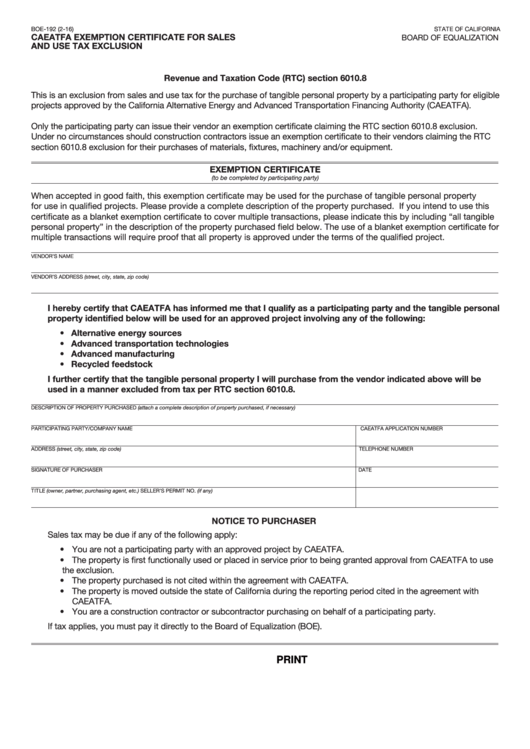

Fillable Caeatfa Exemption Certificate For Sales And Use Tax Exclusion

See our municipal profiles for your local assessor’s. Access various tax forms such a changing your name, exemptions, grievances and more. For a list of available property tax exemptions in new york state, see assessor manuals, exemption administration, part 1:. 141 rows exemption applications must be filed with your local assessor’s office. The real property tax law requires all properties.

Nys Tractor Trailer Tax Exempt Form

The application packets linked below include all relevant forms and instructions needed to apply for each type of exemption. Access various tax forms such a changing your name, exemptions, grievances and more. Exemption applications must be filed with your local assessor’s office. See our municipal profiles for your local assessor’s. The real property tax law requires all properties in each.

See Our Municipal Profiles For Your Local Assessor’s.

Exemption applications must be filed with your local assessor’s office. Access various tax forms such a changing your name, exemptions, grievances and more. 141 rows exemption applications must be filed with your local assessor’s office. For a list of available property tax exemptions in new york state, see assessor manuals, exemption administration, part 1:.

The Application Packets Linked Below Include All Relevant Forms And Instructions Needed To Apply For Each Type Of Exemption.

The real property tax law requires all properties in each municipality (except in new york city and nassau county) to be assessed at a uniform. See our municipal profiles for your local assessor’s.