Nh Tax Liens

Nh Tax Liens - Is new hampshire a tax lien state? Liens may be placed upon your real estate, personal property, and property interests including bank accounts, accounts receivable, security. The town, to protect its ability to collect all taxes due, must proceed to perfect a lien on your property if all taxes for a year are. The process is completely regulated by nh state laws (aka rsas). New hampshire, currently has 732 tax liens available as of january 5. A tax lien is placed on any property with an overdue tax balance. Tax liens are placed on property if all or any portion of your taxes are not paid by march following your december bill. If taxes remain unpaid on the lien date, a lien will be placed on the property. This combines all principal, interest, and costs due into one new.

New hampshire, currently has 732 tax liens available as of january 5. Liens may be placed upon your real estate, personal property, and property interests including bank accounts, accounts receivable, security. If taxes remain unpaid on the lien date, a lien will be placed on the property. This combines all principal, interest, and costs due into one new. Is new hampshire a tax lien state? A tax lien is placed on any property with an overdue tax balance. The process is completely regulated by nh state laws (aka rsas). The town, to protect its ability to collect all taxes due, must proceed to perfect a lien on your property if all taxes for a year are. Tax liens are placed on property if all or any portion of your taxes are not paid by march following your december bill.

Tax liens are placed on property if all or any portion of your taxes are not paid by march following your december bill. Is new hampshire a tax lien state? New hampshire, currently has 732 tax liens available as of january 5. The process is completely regulated by nh state laws (aka rsas). The town, to protect its ability to collect all taxes due, must proceed to perfect a lien on your property if all taxes for a year are. If taxes remain unpaid on the lien date, a lien will be placed on the property. This combines all principal, interest, and costs due into one new. A tax lien is placed on any property with an overdue tax balance. Liens may be placed upon your real estate, personal property, and property interests including bank accounts, accounts receivable, security.

Grafton, NH Auction Dec. 3, 2022 NH Tax Deed & Property Auctions

Tax liens are placed on property if all or any portion of your taxes are not paid by march following your december bill. New hampshire, currently has 732 tax liens available as of january 5. The town, to protect its ability to collect all taxes due, must proceed to perfect a lien on your property if all taxes for a.

New Hampshire Tax Collectors Association tax collector New

If taxes remain unpaid on the lien date, a lien will be placed on the property. Is new hampshire a tax lien state? The process is completely regulated by nh state laws (aka rsas). Liens may be placed upon your real estate, personal property, and property interests including bank accounts, accounts receivable, security. A tax lien is placed on any.

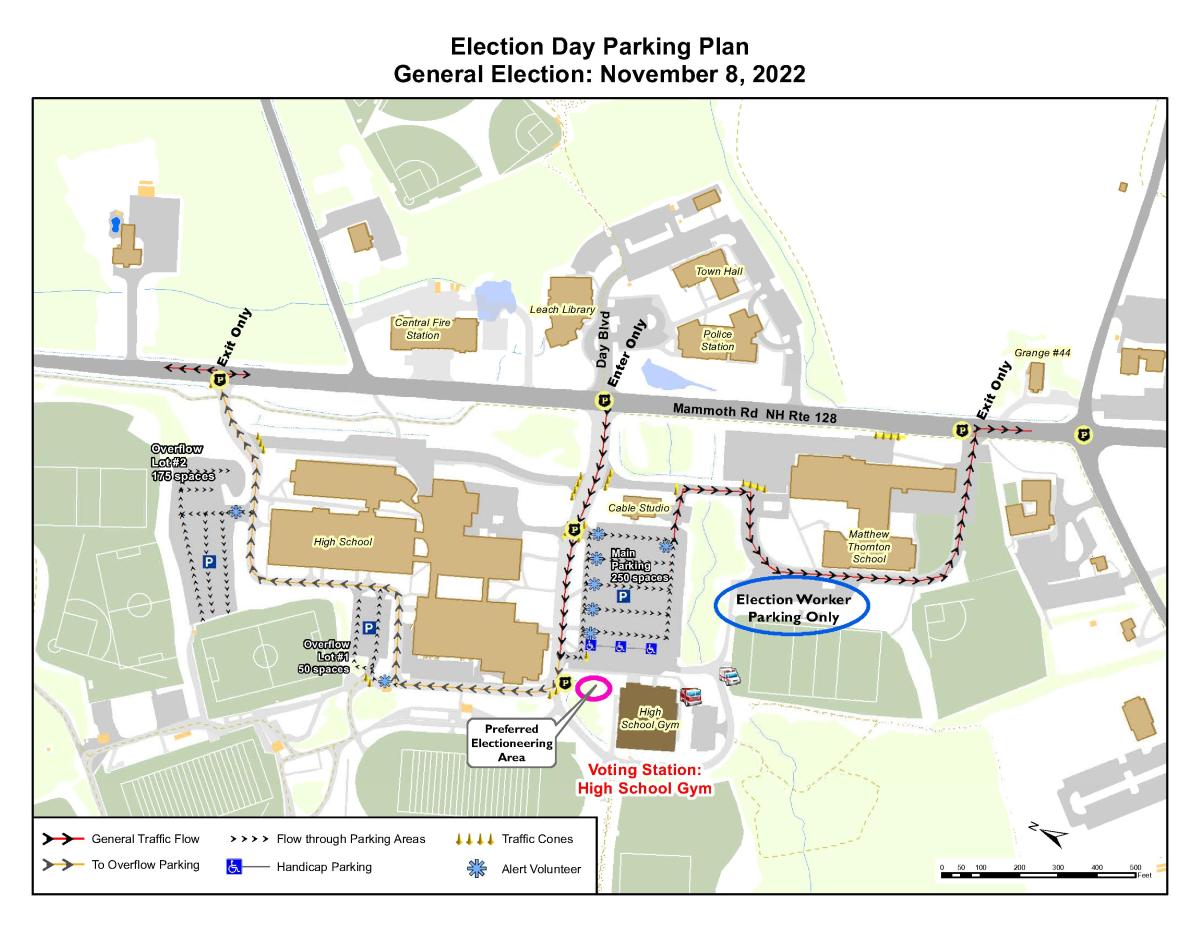

Town Clerk/Tax Collector Londonderry, NH

A tax lien is placed on any property with an overdue tax balance. The town, to protect its ability to collect all taxes due, must proceed to perfect a lien on your property if all taxes for a year are. The process is completely regulated by nh state laws (aka rsas). Tax liens are placed on property if all or.

Tax Collector Town of Lancaster, NH Life as You Make it.

This combines all principal, interest, and costs due into one new. The town, to protect its ability to collect all taxes due, must proceed to perfect a lien on your property if all taxes for a year are. Is new hampshire a tax lien state? A tax lien is placed on any property with an overdue tax balance. Tax liens.

Tax Liens An Overview CheckBook IRA LLC

If taxes remain unpaid on the lien date, a lien will be placed on the property. The process is completely regulated by nh state laws (aka rsas). A tax lien is placed on any property with an overdue tax balance. New hampshire, currently has 732 tax liens available as of january 5. Tax liens are placed on property if all.

Grafton, NH Auction Dec. 3, 2022 NH Tax Deed & Property Auctions

Tax liens are placed on property if all or any portion of your taxes are not paid by march following your december bill. This combines all principal, interest, and costs due into one new. Is new hampshire a tax lien state? If taxes remain unpaid on the lien date, a lien will be placed on the property. Liens may be.

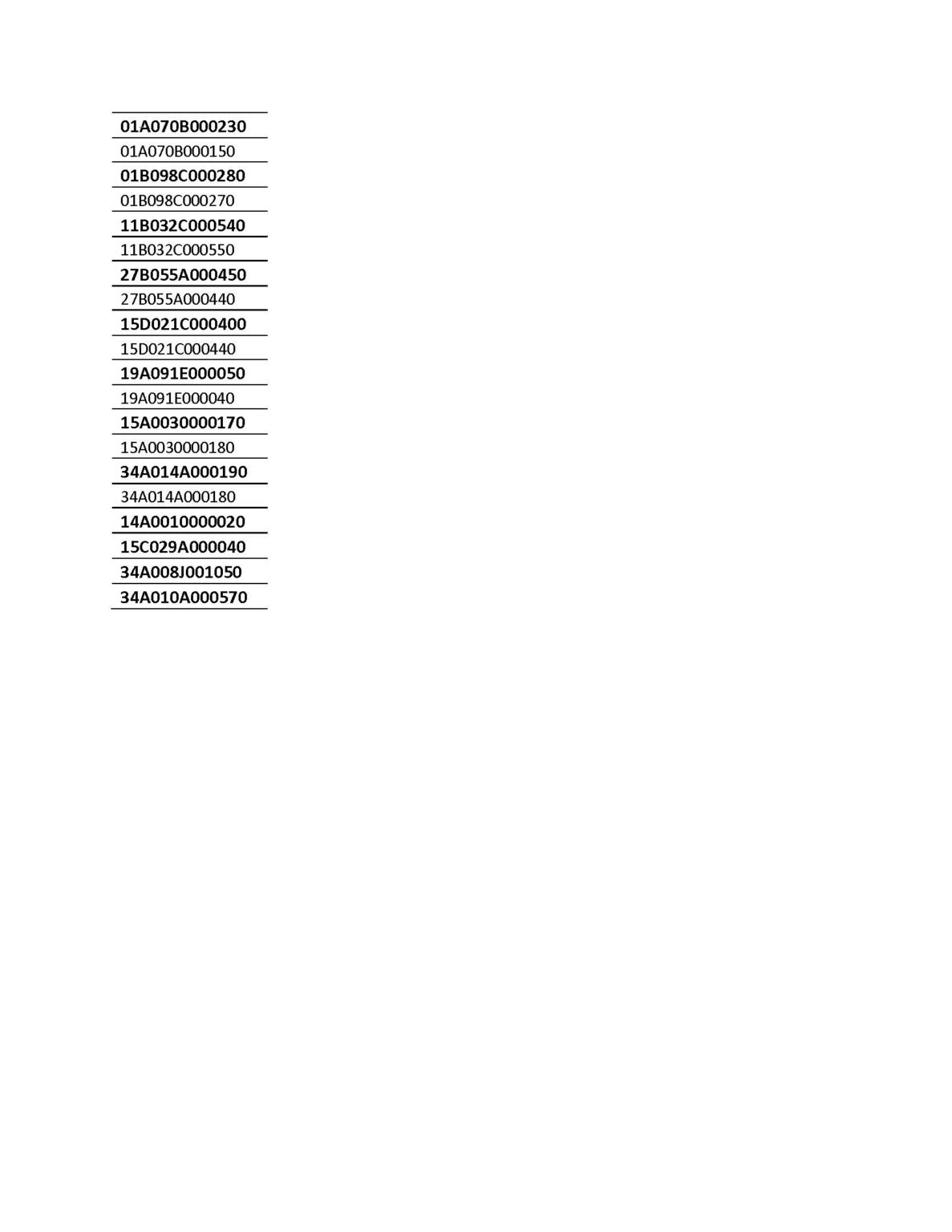

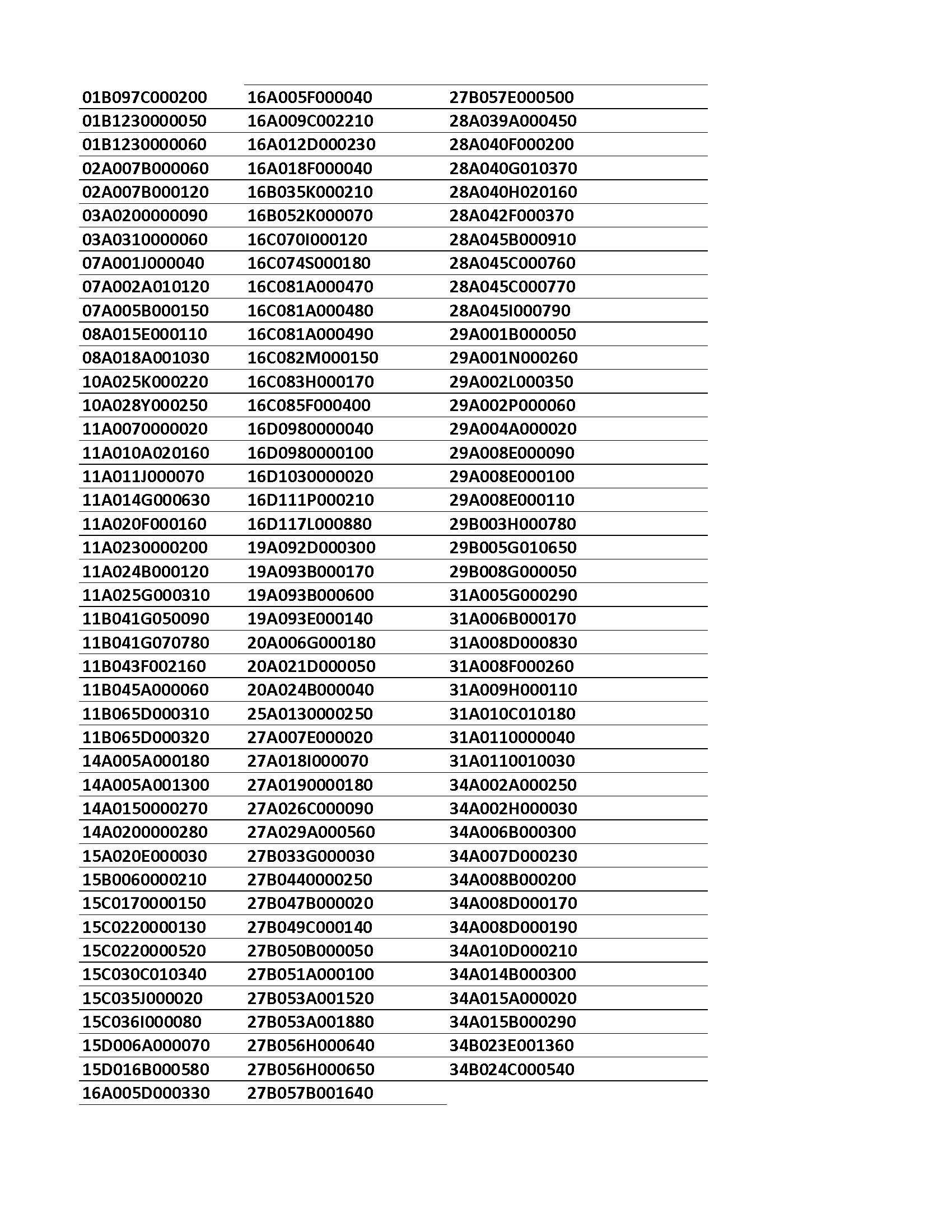

TAX LIENS PENDING CERTIFICATE FILING Treasurer

The process is completely regulated by nh state laws (aka rsas). The town, to protect its ability to collect all taxes due, must proceed to perfect a lien on your property if all taxes for a year are. This combines all principal, interest, and costs due into one new. Liens may be placed upon your real estate, personal property, and.

Grafton, NH Auction Dec. 3, 2022 NH Tax Deed & Property Auctions

Liens may be placed upon your real estate, personal property, and property interests including bank accounts, accounts receivable, security. The process is completely regulated by nh state laws (aka rsas). This combines all principal, interest, and costs due into one new. If taxes remain unpaid on the lien date, a lien will be placed on the property. New hampshire, currently.

TAX LIENS PENDING CERTIFICATE FILING Treasurer

Is new hampshire a tax lien state? A tax lien is placed on any property with an overdue tax balance. Tax liens are placed on property if all or any portion of your taxes are not paid by march following your december bill. If taxes remain unpaid on the lien date, a lien will be placed on the property. The.

Tax Liens and Deeds Live Class Pips Path

New hampshire, currently has 732 tax liens available as of january 5. A tax lien is placed on any property with an overdue tax balance. Liens may be placed upon your real estate, personal property, and property interests including bank accounts, accounts receivable, security. This combines all principal, interest, and costs due into one new. Is new hampshire a tax.

A Tax Lien Is Placed On Any Property With An Overdue Tax Balance.

Liens may be placed upon your real estate, personal property, and property interests including bank accounts, accounts receivable, security. The process is completely regulated by nh state laws (aka rsas). Is new hampshire a tax lien state? New hampshire, currently has 732 tax liens available as of january 5.

If Taxes Remain Unpaid On The Lien Date, A Lien Will Be Placed On The Property.

This combines all principal, interest, and costs due into one new. The town, to protect its ability to collect all taxes due, must proceed to perfect a lien on your property if all taxes for a year are. Tax liens are placed on property if all or any portion of your taxes are not paid by march following your december bill.