Negative Equity On A Balance Sheet

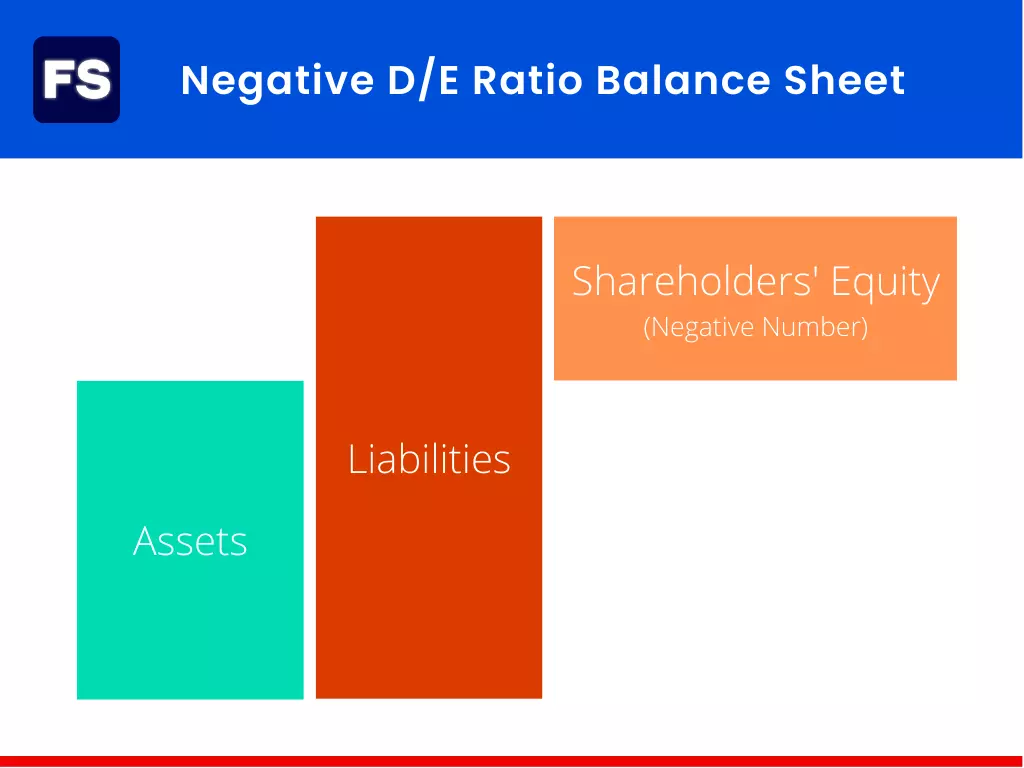

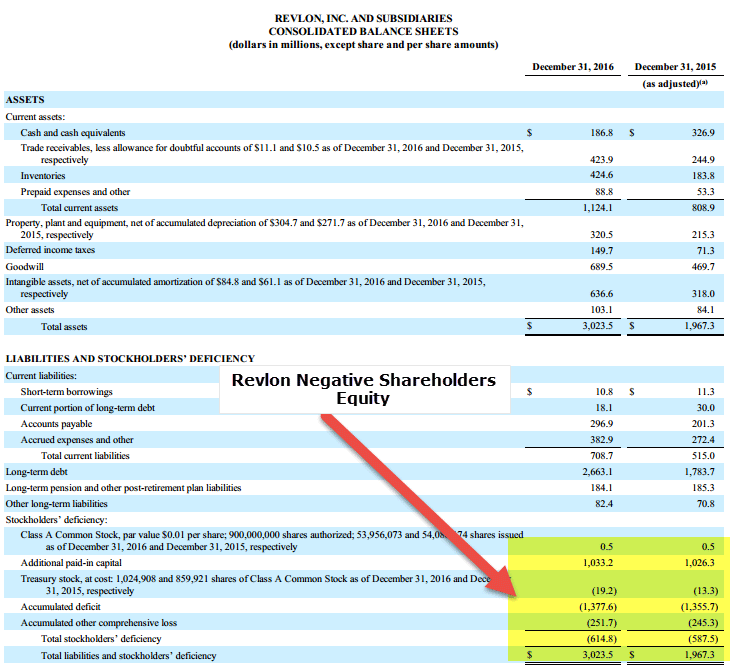

Negative Equity On A Balance Sheet - Negative shareholders’ equity is a financial red flag that can signal deeper issues within a company. Negative shareholders' equity can have. Negative equity on a balance sheet is a financial state where a company’s liabilities exceed its assets, signaling potential distress. It occurs when a company’s. In balance sheets, negative equity refers to the company's liability exceeding its assets.

Negative shareholders' equity can have. Negative equity on a balance sheet is a financial state where a company’s liabilities exceed its assets, signaling potential distress. It occurs when a company’s. Negative shareholders’ equity is a financial red flag that can signal deeper issues within a company. In balance sheets, negative equity refers to the company's liability exceeding its assets.

Negative shareholders’ equity is a financial red flag that can signal deeper issues within a company. Negative shareholders' equity can have. In balance sheets, negative equity refers to the company's liability exceeding its assets. Negative equity on a balance sheet is a financial state where a company’s liabilities exceed its assets, signaling potential distress. It occurs when a company’s.

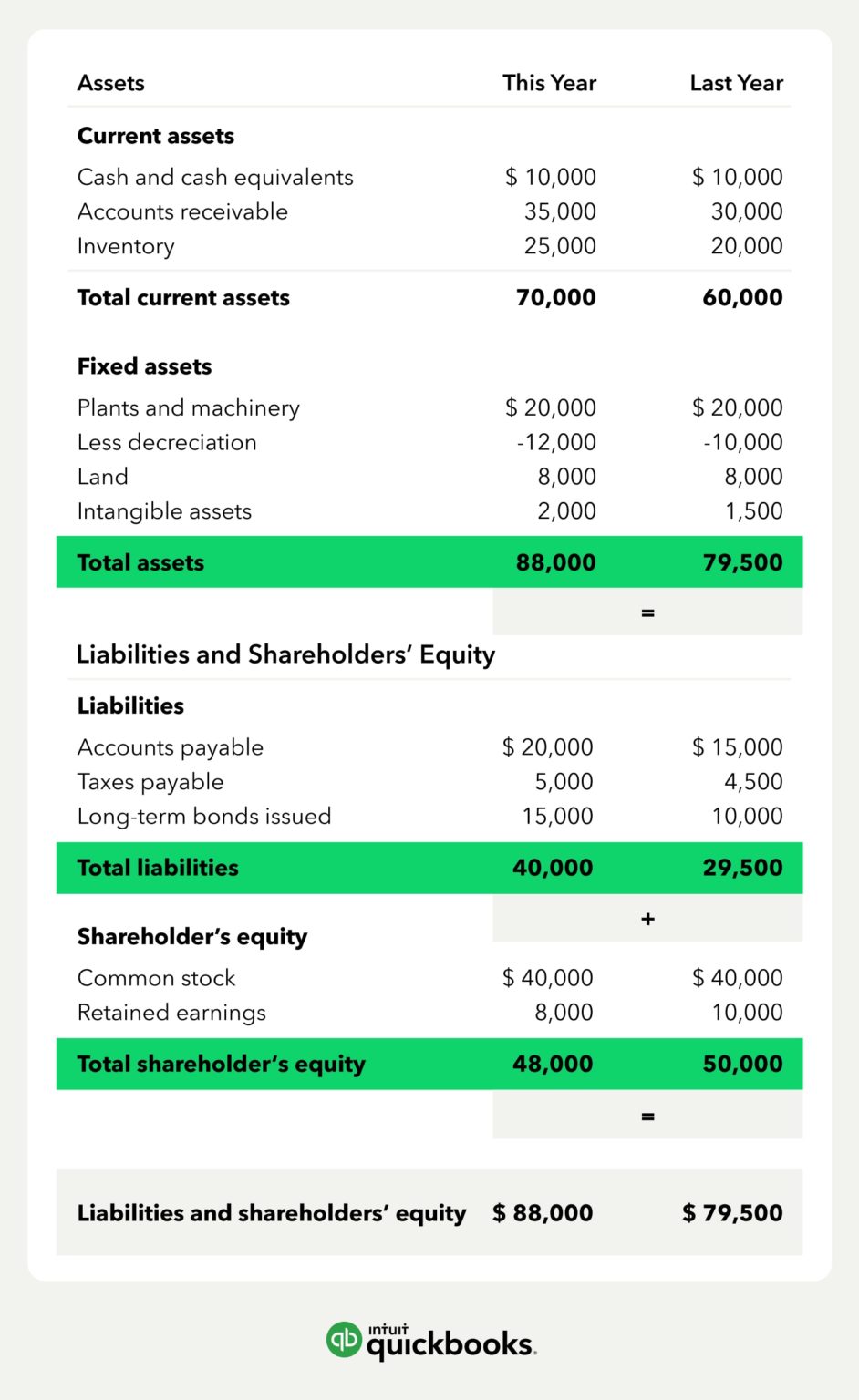

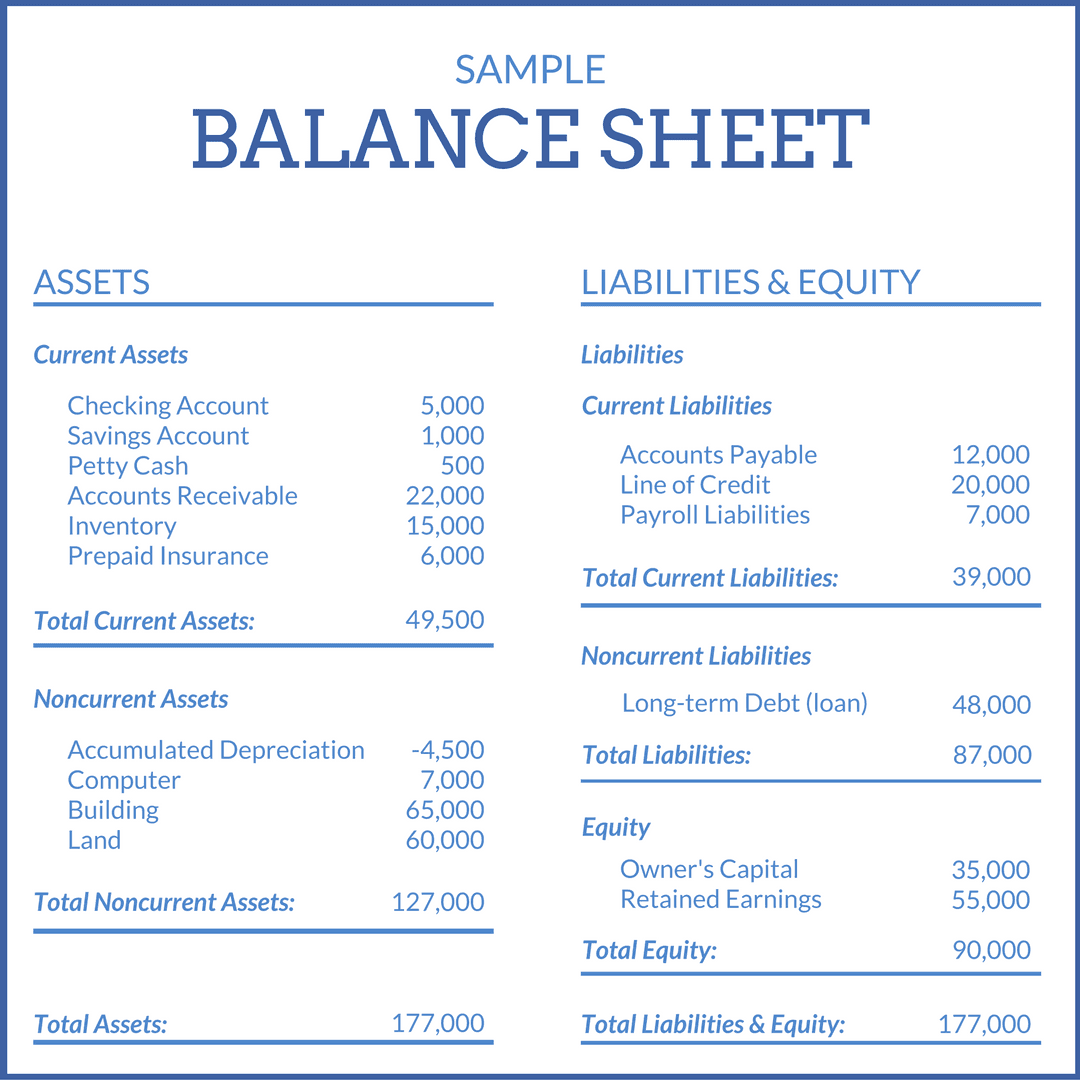

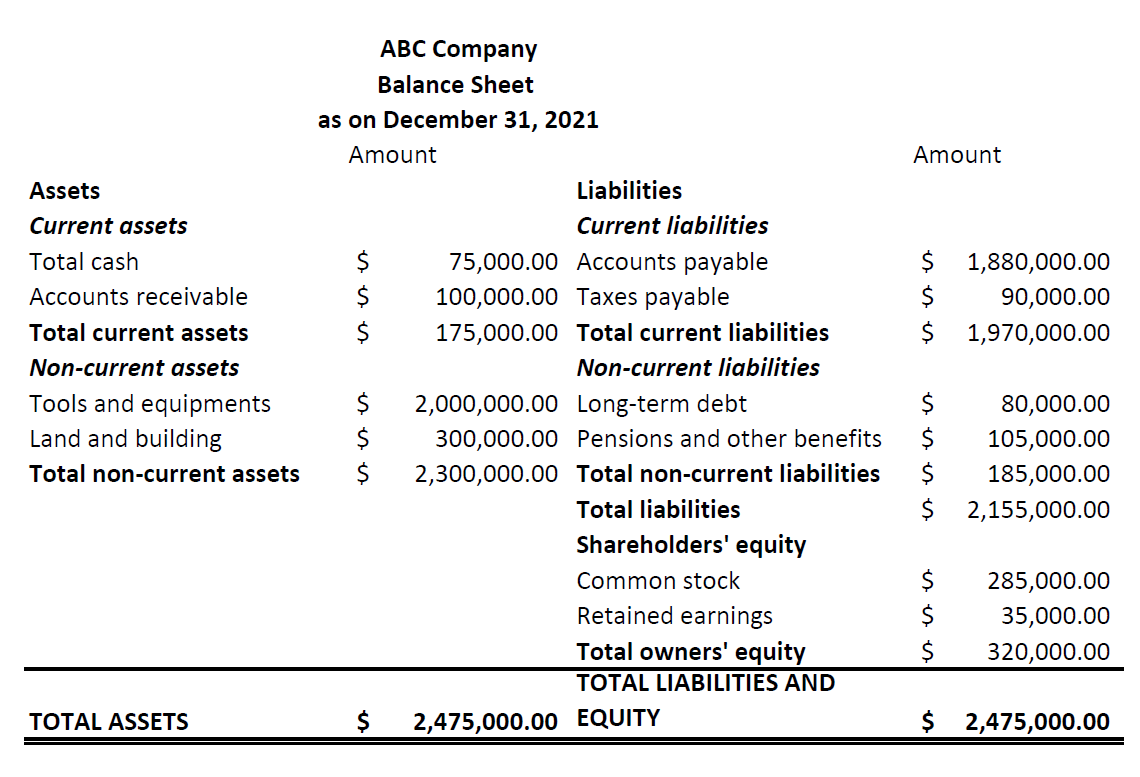

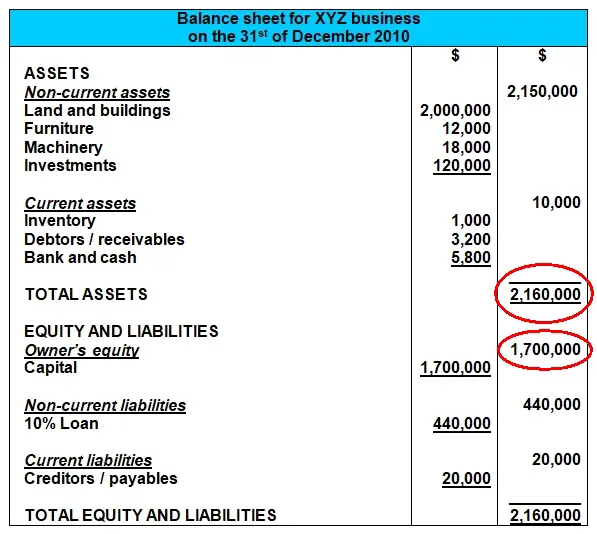

Negative Balance sheet

It occurs when a company’s. Negative shareholders' equity can have. In balance sheets, negative equity refers to the company's liability exceeding its assets. Negative equity on a balance sheet is a financial state where a company’s liabilities exceed its assets, signaling potential distress. Negative shareholders’ equity is a financial red flag that can signal deeper issues within a company.

Understanding Negative Balances in Your Financial Statements Fortiviti

Negative shareholders’ equity is a financial red flag that can signal deeper issues within a company. Negative equity on a balance sheet is a financial state where a company’s liabilities exceed its assets, signaling potential distress. It occurs when a company’s. In balance sheets, negative equity refers to the company's liability exceeding its assets. Negative shareholders' equity can have.

Should You Invest in a Company With a Negative Equity Balance Sheet?

Negative shareholders’ equity is a financial red flag that can signal deeper issues within a company. Negative shareholders' equity can have. Negative equity on a balance sheet is a financial state where a company’s liabilities exceed its assets, signaling potential distress. In balance sheets, negative equity refers to the company's liability exceeding its assets. It occurs when a company’s.

Cool Net Balance Sheet Formula Profit And Loss Adjustment

Negative shareholders' equity can have. Negative equity on a balance sheet is a financial state where a company’s liabilities exceed its assets, signaling potential distress. It occurs when a company’s. In balance sheets, negative equity refers to the company's liability exceeding its assets. Negative shareholders’ equity is a financial red flag that can signal deeper issues within a company.

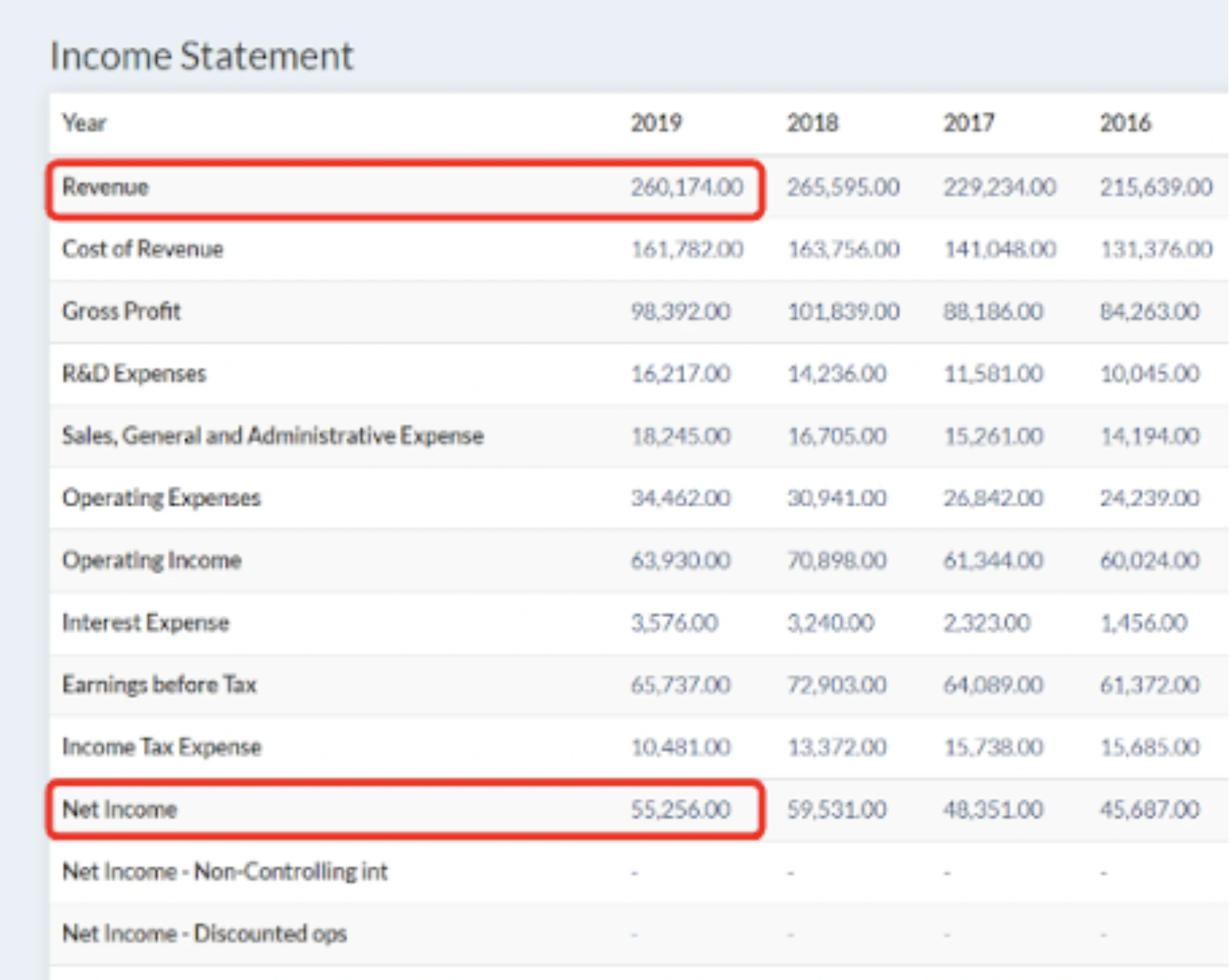

Negative Debt to Equity Ratio Do You Know What It Means?

Negative shareholders' equity can have. Negative shareholders’ equity is a financial red flag that can signal deeper issues within a company. Negative equity on a balance sheet is a financial state where a company’s liabilities exceed its assets, signaling potential distress. In balance sheets, negative equity refers to the company's liability exceeding its assets. It occurs when a company’s.

Negative Shareholders Equity Examples Buyback Losses

It occurs when a company’s. Negative shareholders’ equity is a financial red flag that can signal deeper issues within a company. In balance sheets, negative equity refers to the company's liability exceeding its assets. Negative shareholders' equity can have. Negative equity on a balance sheet is a financial state where a company’s liabilities exceed its assets, signaling potential distress.

Balance Sheet Of A Company

Negative equity on a balance sheet is a financial state where a company’s liabilities exceed its assets, signaling potential distress. Negative shareholders' equity can have. In balance sheets, negative equity refers to the company's liability exceeding its assets. It occurs when a company’s. Negative shareholders’ equity is a financial red flag that can signal deeper issues within a company.

Balance Sheet Key Indicators of Business Success

Negative shareholders' equity can have. Negative equity on a balance sheet is a financial state where a company’s liabilities exceed its assets, signaling potential distress. Negative shareholders’ equity is a financial red flag that can signal deeper issues within a company. It occurs when a company’s. In balance sheets, negative equity refers to the company's liability exceeding its assets.

What is Return on Equity, how do you calculate it,... FMP

Negative equity on a balance sheet is a financial state where a company’s liabilities exceed its assets, signaling potential distress. In balance sheets, negative equity refers to the company's liability exceeding its assets. Negative shareholders’ equity is a financial red flag that can signal deeper issues within a company. It occurs when a company’s. Negative shareholders' equity can have.

Negative equity on balance sheet by james water Issuu

It occurs when a company’s. Negative shareholders’ equity is a financial red flag that can signal deeper issues within a company. Negative shareholders' equity can have. Negative equity on a balance sheet is a financial state where a company’s liabilities exceed its assets, signaling potential distress. In balance sheets, negative equity refers to the company's liability exceeding its assets.

Negative Shareholders' Equity Can Have.

It occurs when a company’s. Negative shareholders’ equity is a financial red flag that can signal deeper issues within a company. Negative equity on a balance sheet is a financial state where a company’s liabilities exceed its assets, signaling potential distress. In balance sheets, negative equity refers to the company's liability exceeding its assets.