Most Local Tax Money Is Spent On

Most Local Tax Money Is Spent On - Tax expenditures describe revenue losses attributable to provisions of federal tax laws which allow a special exclusion, exemption, or. However, most state and local public welfare spending is financed by federal transfers. In 2021, $585 billion (68 percent) of public welfare.

In 2021, $585 billion (68 percent) of public welfare. However, most state and local public welfare spending is financed by federal transfers. Tax expenditures describe revenue losses attributable to provisions of federal tax laws which allow a special exclusion, exemption, or.

In 2021, $585 billion (68 percent) of public welfare. However, most state and local public welfare spending is financed by federal transfers. Tax expenditures describe revenue losses attributable to provisions of federal tax laws which allow a special exclusion, exemption, or.

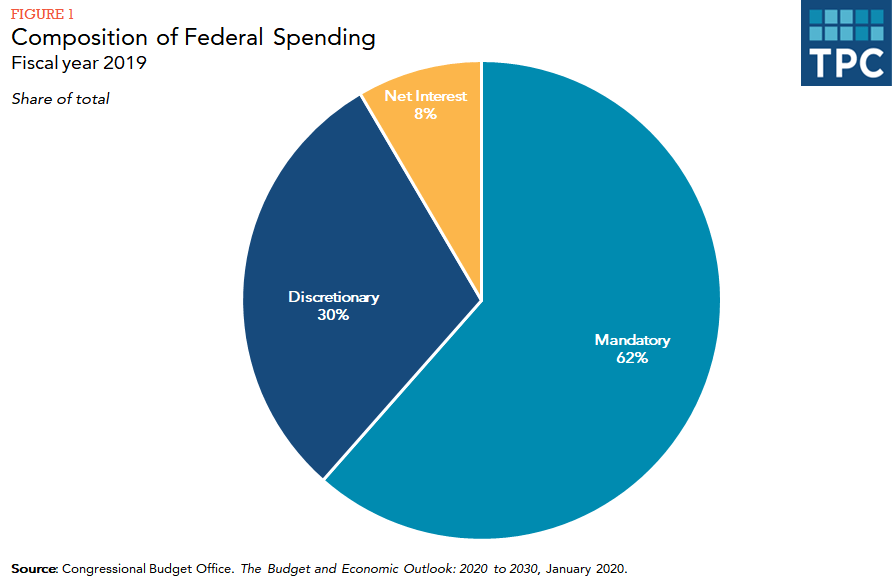

How does the federal government spend its money? Tax Policy Center

Tax expenditures describe revenue losses attributable to provisions of federal tax laws which allow a special exclusion, exemption, or. However, most state and local public welfare spending is financed by federal transfers. In 2021, $585 billion (68 percent) of public welfare.

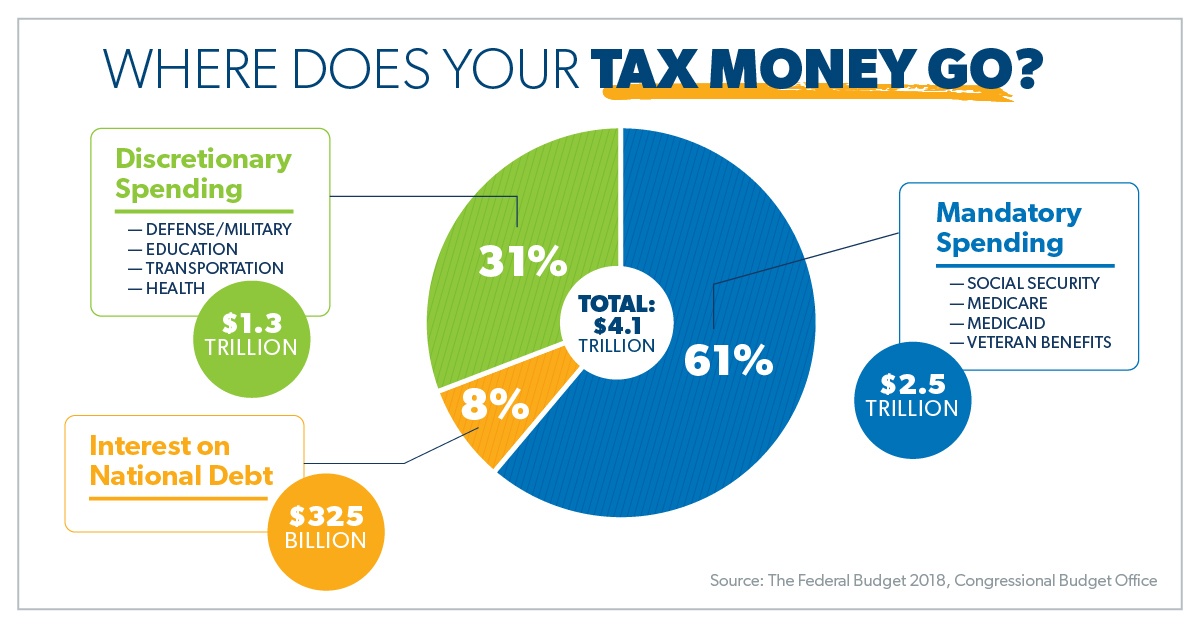

Where Does Your Tax Money Go?

However, most state and local public welfare spending is financed by federal transfers. Tax expenditures describe revenue losses attributable to provisions of federal tax laws which allow a special exclusion, exemption, or. In 2021, $585 billion (68 percent) of public welfare.

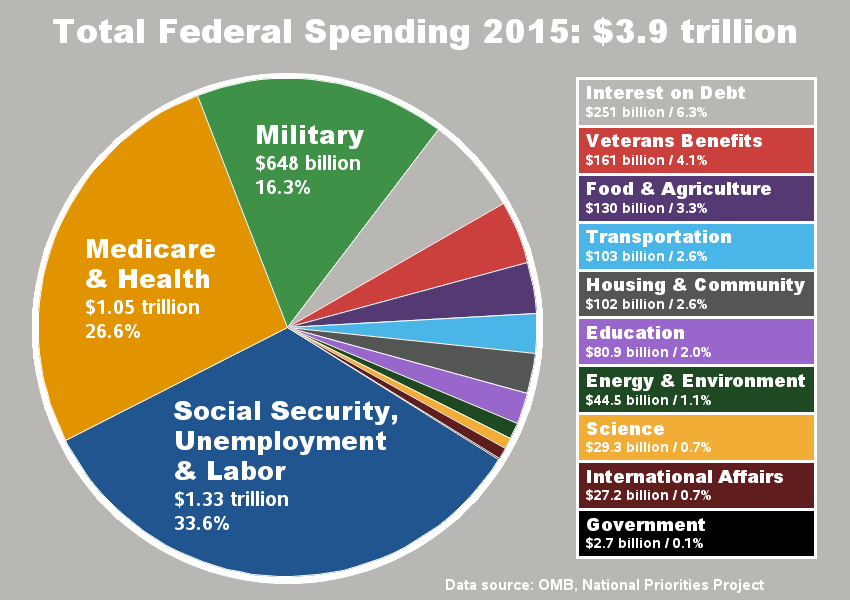

How are your tax dollars spent? Let's graph it! SAS Training Post

However, most state and local public welfare spending is financed by federal transfers. In 2021, $585 billion (68 percent) of public welfare. Tax expenditures describe revenue losses attributable to provisions of federal tax laws which allow a special exclusion, exemption, or.

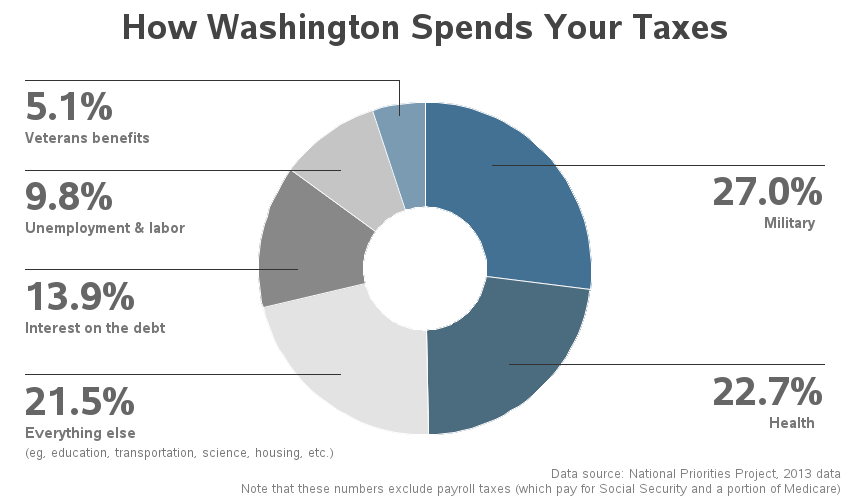

Where Do Your Tax Dollars Go?

In 2021, $585 billion (68 percent) of public welfare. Tax expenditures describe revenue losses attributable to provisions of federal tax laws which allow a special exclusion, exemption, or. However, most state and local public welfare spending is financed by federal transfers.

How is Tax Revenue Spent in Canada? by Junior Economist Medium

However, most state and local public welfare spending is financed by federal transfers. In 2021, $585 billion (68 percent) of public welfare. Tax expenditures describe revenue losses attributable to provisions of federal tax laws which allow a special exclusion, exemption, or.

How are your tax dollars spent? Let's graph it! SAS Training Post

Tax expenditures describe revenue losses attributable to provisions of federal tax laws which allow a special exclusion, exemption, or. In 2021, $585 billion (68 percent) of public welfare. However, most state and local public welfare spending is financed by federal transfers.

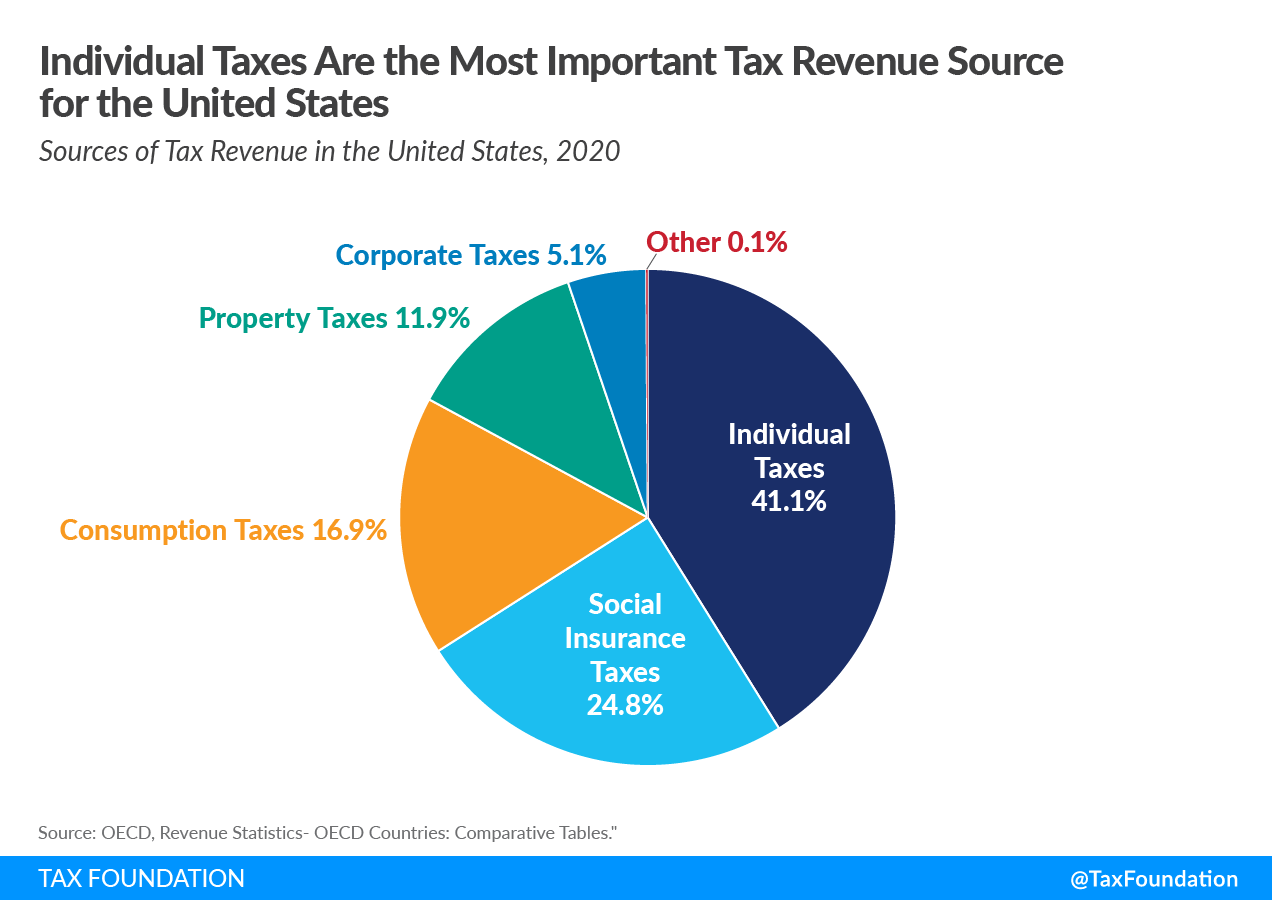

Sources of US Tax Revenue by Tax Type, 2022 Tax Foundation

In 2021, $585 billion (68 percent) of public welfare. Tax expenditures describe revenue losses attributable to provisions of federal tax laws which allow a special exclusion, exemption, or. However, most state and local public welfare spending is financed by federal transfers.

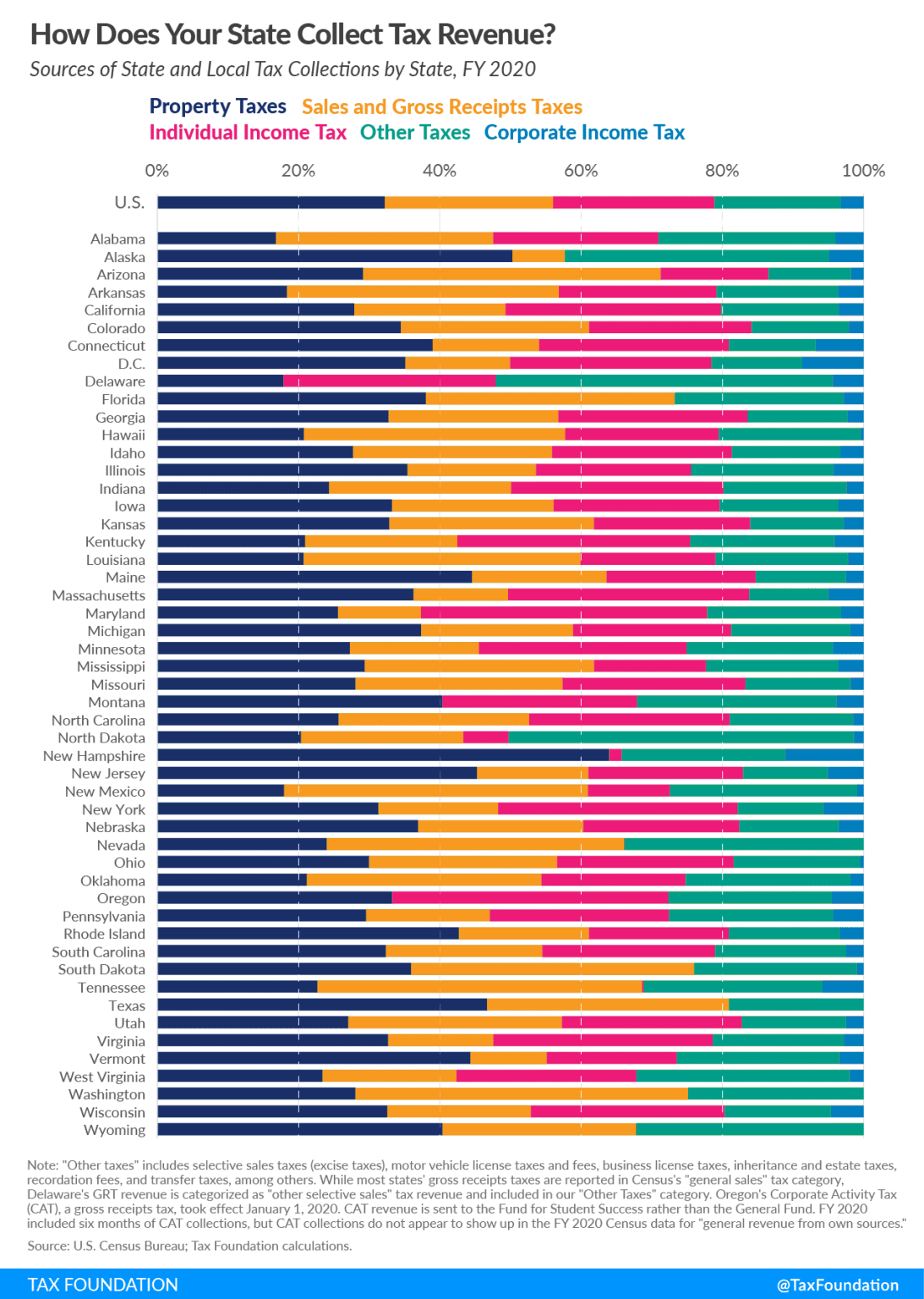

State and Local Tax Collections State and Local Tax Revenue by State

However, most state and local public welfare spending is financed by federal transfers. Tax expenditures describe revenue losses attributable to provisions of federal tax laws which allow a special exclusion, exemption, or. In 2021, $585 billion (68 percent) of public welfare.

Where Tax Dollars are Spent TurboTax Tax Tips & Videos

Tax expenditures describe revenue losses attributable to provisions of federal tax laws which allow a special exclusion, exemption, or. In 2021, $585 billion (68 percent) of public welfare. However, most state and local public welfare spending is financed by federal transfers.

How Our Tax Dollars Are Spent Chart A Visual Reference of Charts

However, most state and local public welfare spending is financed by federal transfers. In 2021, $585 billion (68 percent) of public welfare. Tax expenditures describe revenue losses attributable to provisions of federal tax laws which allow a special exclusion, exemption, or.

In 2021, $585 Billion (68 Percent) Of Public Welfare.

However, most state and local public welfare spending is financed by federal transfers. Tax expenditures describe revenue losses attributable to provisions of federal tax laws which allow a special exclusion, exemption, or.

.png)