Mn Renters Rebate Form

Mn Renters Rebate Form - Minnesota property tax refund, mail station. Beginning with refunds paid in 2025 (tax year 2024), taxpayers will file and claim the credit as part of their income tax returns. To file by paper, complete and file form m1pr, homestead credit refund (for homeowners) and renter’s property tax refund. Instead, the credit will be added. • if you rent, your landlord must give you a certificate of rent paid (crp) by january 31, 2024. The renter’s property tax refund program (sometimes called the “renters’ credit”) is a. What do i need to claim. Starting with your 2024 taxes, if you are a renter, you can claim the renter's credit as part of your minnesota individual income tax return (form. Claim a refund for paying your rent! You may qualify for a tax refund if your household income is less than $73,270.

How do i get my refund? The renter’s property tax refund program (sometimes called the “renters’ credit”) is a. I authorize the minnesota department of revenue to discuss this tax return with the preparer. What do i need to claim. You may qualify for a tax refund if your household income is less than $73,270. To file by paper, complete and file form m1pr, homestead credit refund (for homeowners) and renter’s property tax refund. If you own, use your property. Starting with your 2024 taxes, if you are a renter, you can claim the renter's credit as part of your minnesota individual income tax return (form. • if you rent, your landlord must give you a certificate of rent paid (crp) by january 31, 2024. Minnesota property tax refund, mail station.

Beginning with tax year 2024, r enters will no longer file a renter's property tax refund return (form m1pr). To file by paper, complete and file form m1pr, homestead credit refund (for homeowners) and renter’s property tax refund. • if you rent, your landlord must give you a certificate of rent paid (crp) by january 31, 2024. You may qualify for a tax refund if your household income is less than $73,270. Claim a refund for paying your rent! What is the renter’s property tax refund program? Beginning with refunds paid in 2025 (tax year 2024), taxpayers will file and claim the credit as part of their income tax returns. How do i get my refund? I authorize the minnesota department of revenue to discuss this tax return with the preparer. What do i need to claim.

Wisconsin Rent Rebate 2023 Rent Rebates

What do i need to claim. To file by paper, complete and file form m1pr, homestead credit refund (for homeowners) and renter’s property tax refund. If you own, use your property. Claim a refund for paying your rent! How do i get my refund?

Track My Renters Rebate Mn

Starting with your 2024 taxes, if you are a renter, you can claim the renter's credit as part of your minnesota individual income tax return (form. The renter’s property tax refund program (sometimes called the “renters’ credit”) is a. Beginning with refunds paid in 2025 (tax year 2024), taxpayers will file and claim the credit as part of their income.

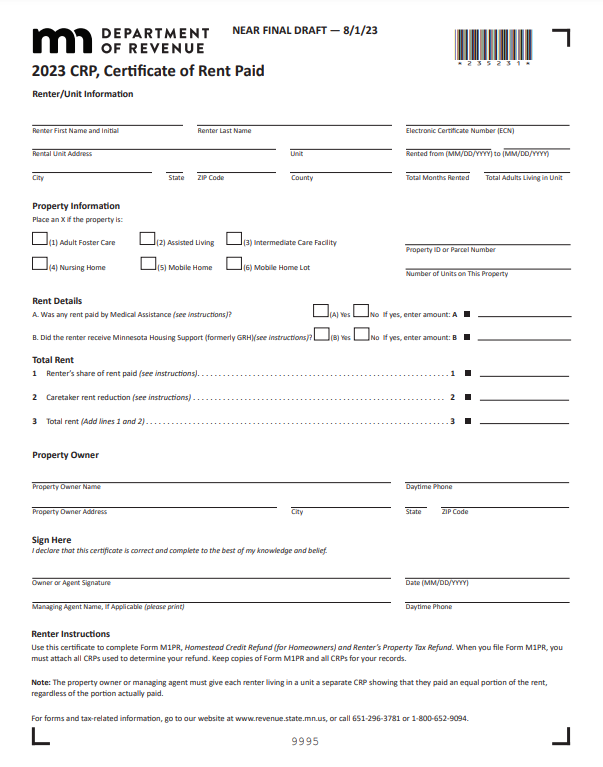

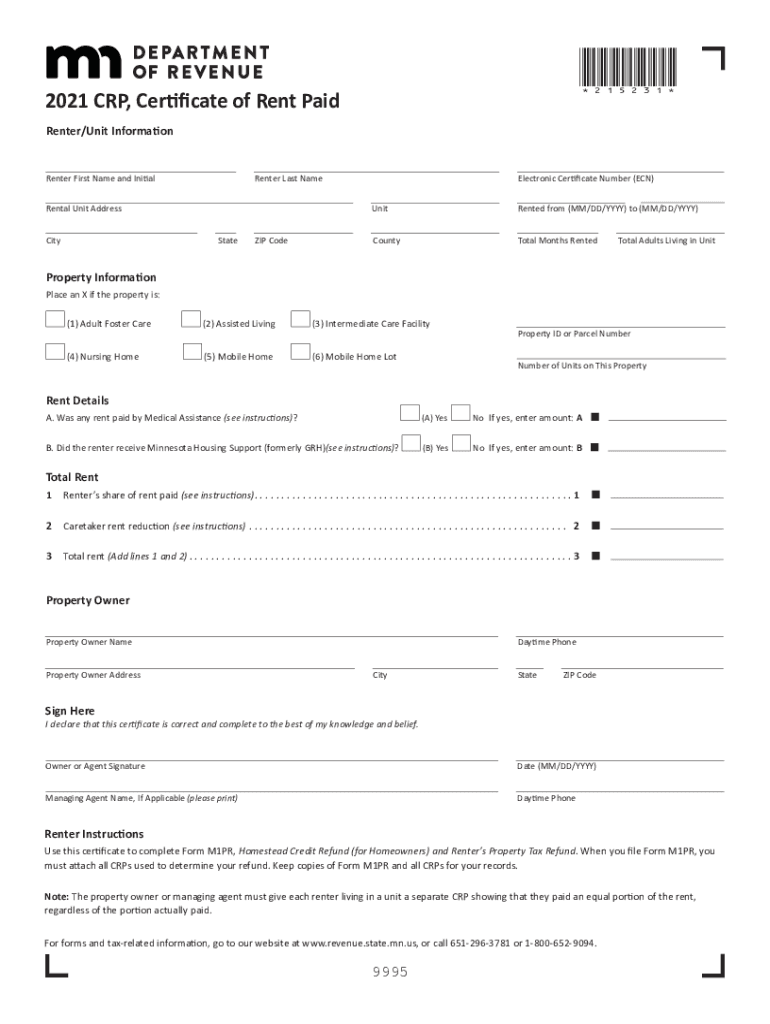

Fillable Form Crp Certificate Of Rent Paid Minnesota Department Of

What is the renter’s property tax refund program? • if you rent, your landlord must give you a certificate of rent paid (crp) by january 31, 2024. Beginning with tax year 2024, r enters will no longer file a renter's property tax refund return (form m1pr). You may qualify for a tax refund if your household income is less than.

Minnesota Renters Rebate 2023 Printable Rebate Form

Minnesota property tax refund, mail station. The renter’s property tax refund program (sometimes called the “renters’ credit”) is a. What is the renter’s property tax refund program? You may qualify for a tax refund if your household income is less than $73,270. • if you rent, your landlord must give you a certificate of rent paid (crp) by january 31,.

Can i file mn renters rebate online for free Fill out & sign online

Beginning with refunds paid in 2025 (tax year 2024), taxpayers will file and claim the credit as part of their income tax returns. • if you rent, your landlord must give you a certificate of rent paid (crp) by january 31, 2024. Instead, the credit will be added. Minnesota property tax refund, mail station. How do i get my refund?

Mn Renter's Rebate Form 2023 Rent Rebates

How do i get my refund? You may qualify for a tax refund if your household income is less than $73,270. Minnesota property tax refund, mail station. Instead, the credit will be added. Claim a refund for paying your rent!

Renters Printable Rebate Form

Claim a refund for paying your rent! Beginning with refunds paid in 2025 (tax year 2024), taxpayers will file and claim the credit as part of their income tax returns. Starting with your 2024 taxes, if you are a renter, you can claim the renter's credit as part of your minnesota individual income tax return (form. • if you rent,.

Renters Rebate Form MN 2024 Printable Rebate Form

I authorize the minnesota department of revenue to discuss this tax return with the preparer. Starting with your 2024 taxes, if you are a renter, you can claim the renter's credit as part of your minnesota individual income tax return (form. If you own, use your property. Claim a refund for paying your rent! What is the renter’s property tax.

Renters Rebate Mn 20212024 Form Fill Out and Sign Printable PDF

If you own, use your property. The renter’s property tax refund program (sometimes called the “renters’ credit”) is a. Claim a refund for paying your rent! Minnesota property tax refund, mail station. How do i get my refund?

Efile Express 2022 Mn Renters Rebate

To file by paper, complete and file form m1pr, homestead credit refund (for homeowners) and renter’s property tax refund. The renter’s property tax refund program (sometimes called the “renters’ credit”) is a. How do i get my refund? What do i need to claim. Instead, the credit will be added.

If You Own, Use Your Property.

The renter’s property tax refund program (sometimes called the “renters’ credit”) is a. • if you rent, your landlord must give you a certificate of rent paid (crp) by january 31, 2024. Starting with your 2024 taxes, if you are a renter, you can claim the renter's credit as part of your minnesota individual income tax return (form. What do i need to claim.

Claim A Refund For Paying Your Rent!

I authorize the minnesota department of revenue to discuss this tax return with the preparer. To file by paper, complete and file form m1pr, homestead credit refund (for homeowners) and renter’s property tax refund. Minnesota property tax refund, mail station. How do i get my refund?

Instead, The Credit Will Be Added.

Beginning with refunds paid in 2025 (tax year 2024), taxpayers will file and claim the credit as part of their income tax returns. What is the renter’s property tax refund program? Beginning with tax year 2024, r enters will no longer file a renter's property tax refund return (form m1pr). You may qualify for a tax refund if your household income is less than $73,270.