Minnesota Form M3

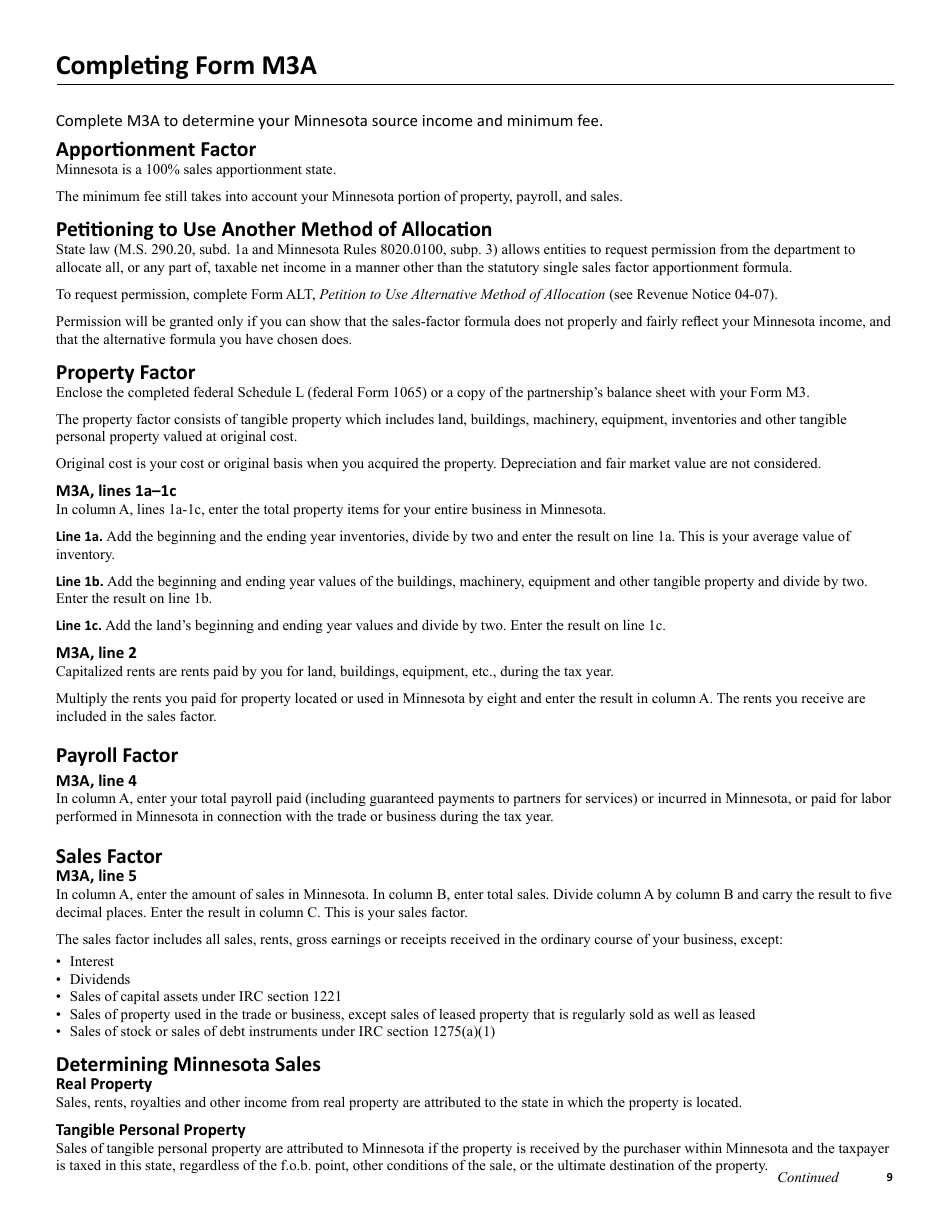

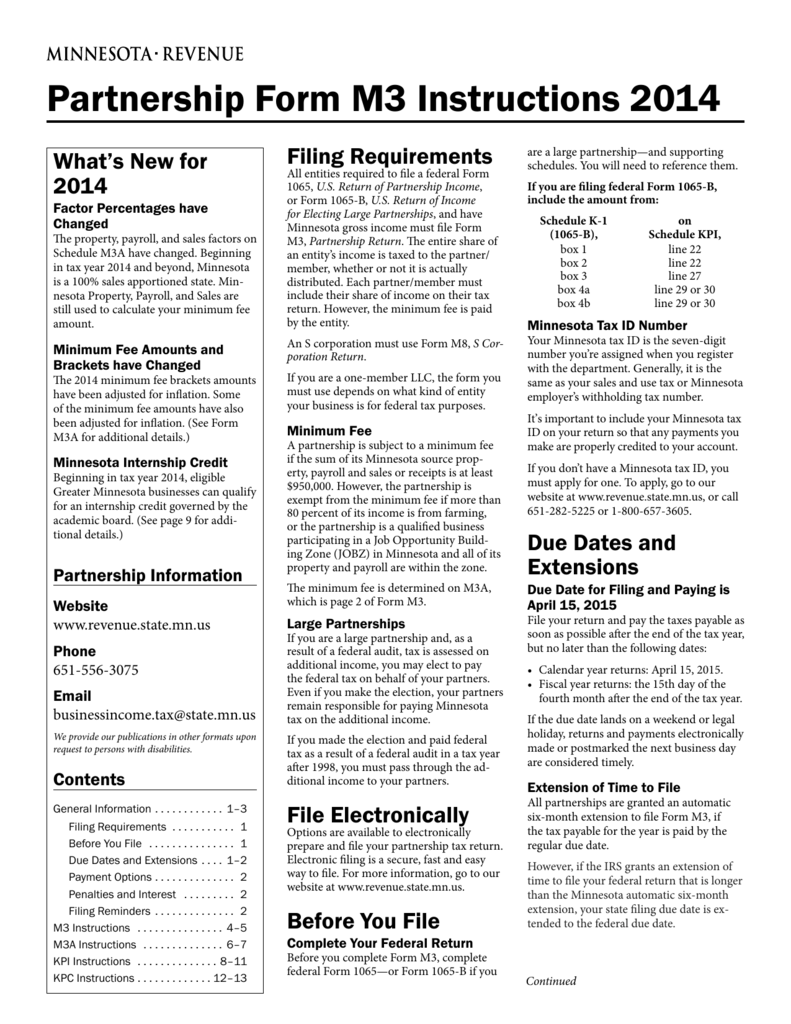

Minnesota Form M3 - All partnerships must complete m3a to determine its minnesota source income and minimum fee. All entities required to file a federal form 1065, u.s. Here is how tax filing requirements are broken down for various minnesota business entities: See m3a instructions beginning on page 9. If you choose not to use the. Minnesota s corporation & partnership tax deadlines for 2024. Return of partnership income, and have minnesota gross income must file form m3,. For state tax purposes, the partnership completes form m3, partnership return and files it with the department of revenue along with a copy of. If you don’t have a minnesota id number, you must first apply for one. You must file in minnesota by march 15, 2025.

Mail form m3 and all completed minnesota and federal forms and schedules using a mailing label (see page 19). Here is how tax filing requirements are broken down for various minnesota business entities: If you don’t have a minnesota id number, you must first apply for one. You must file in minnesota by march 15, 2025. Return of partnership income, and have minnesota gross income must file form m3,. All entities required to file a federal form 1065, u.s. Minnesota s corporation & partnership tax deadlines for 2024. If you choose not to use the. See m3a instructions beginning on page 9. All partnerships must complete m3a to determine its minnesota source income and minimum fee.

Fein and minnesota id are required. All entities required to file a federal form 1065, u.s. For state tax purposes, the partnership completes form m3, partnership return and files it with the department of revenue along with a copy of. If you choose not to use the. If you don’t have a minnesota id number, you must first apply for one. Return of partnership income, and have minnesota gross income must file form m3,. Minnesota s corporation & partnership tax deadlines for 2024. All partnerships must complete m3a to determine its minnesota source income and minimum fee. Mail form m3 and all completed minnesota and federal forms and schedules using a mailing label (see page 19). Here is how tax filing requirements are broken down for various minnesota business entities:

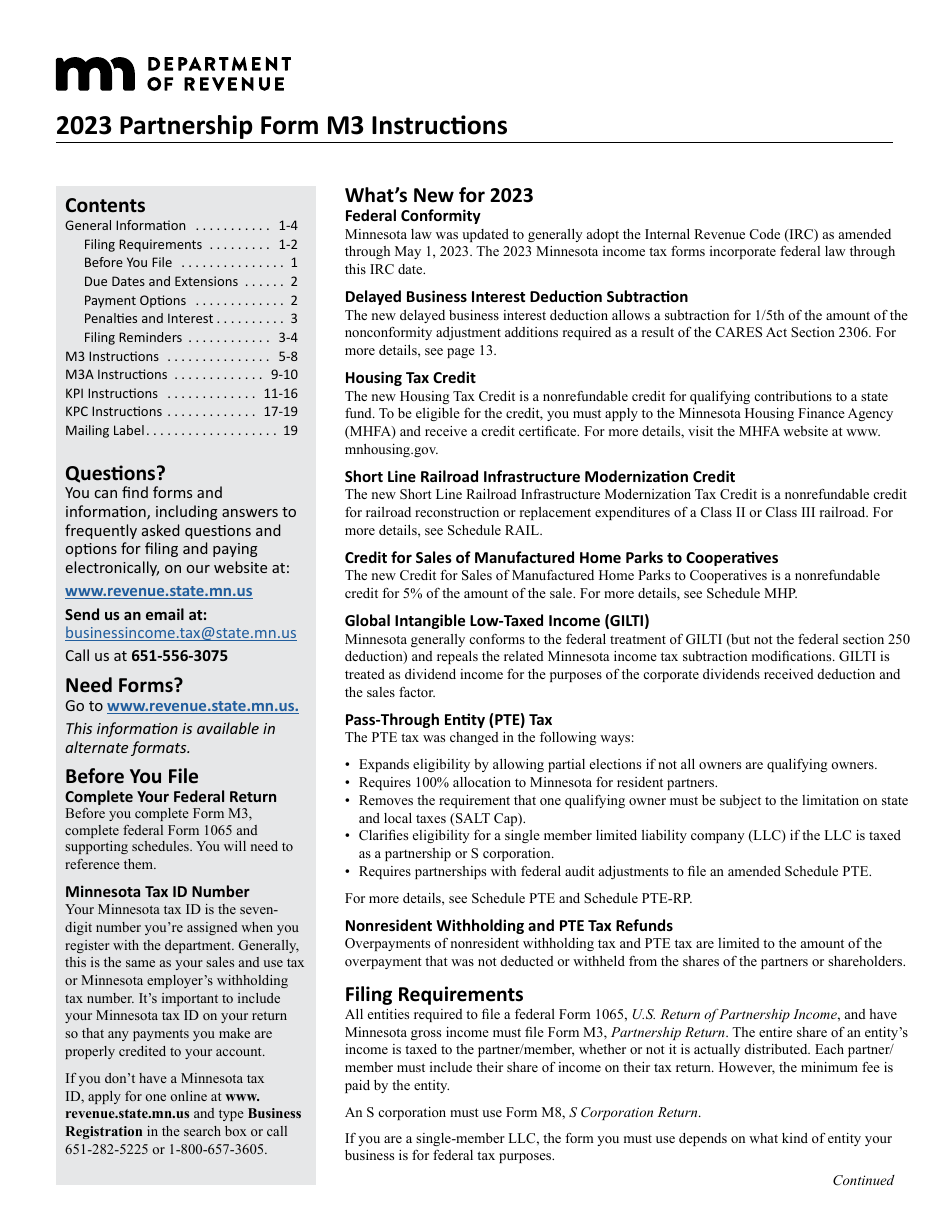

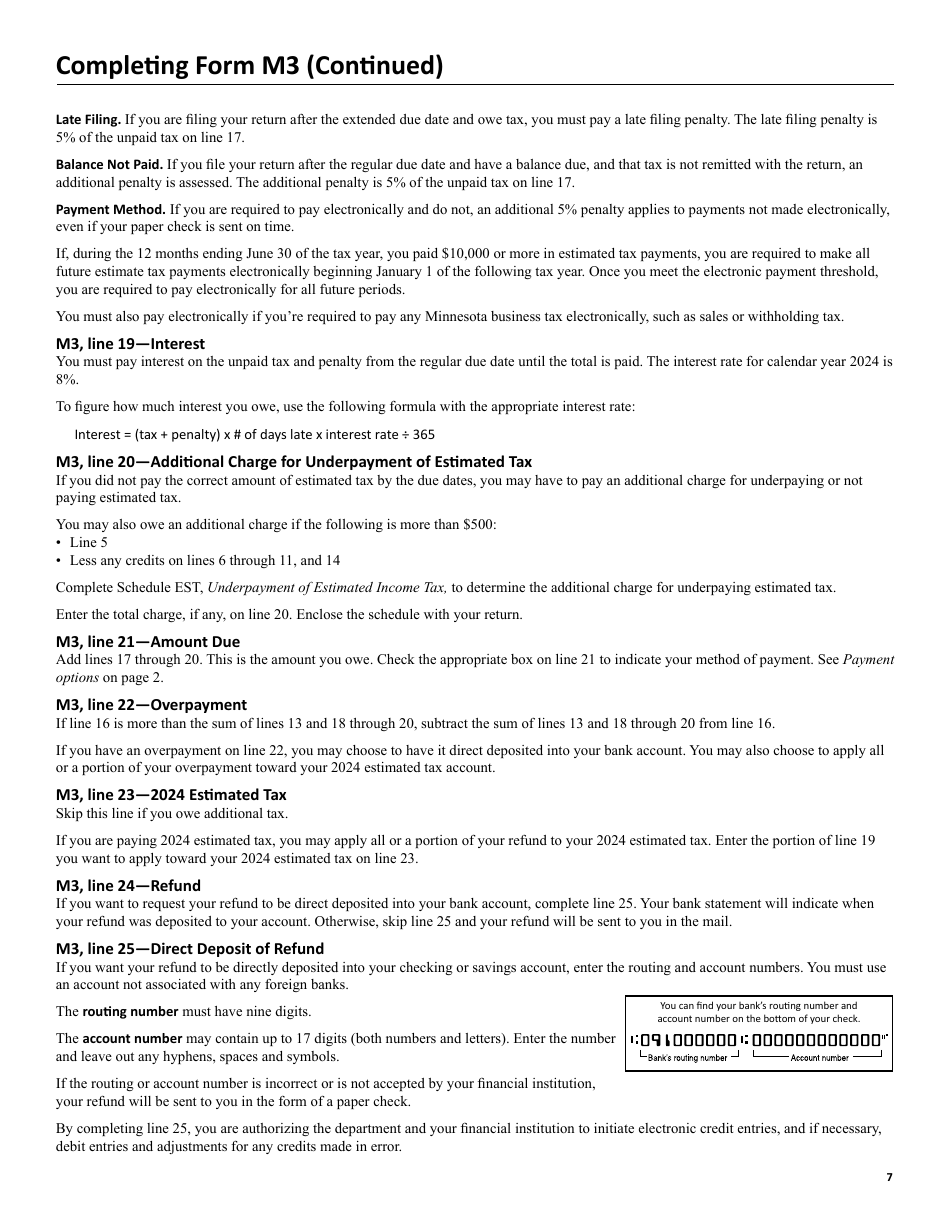

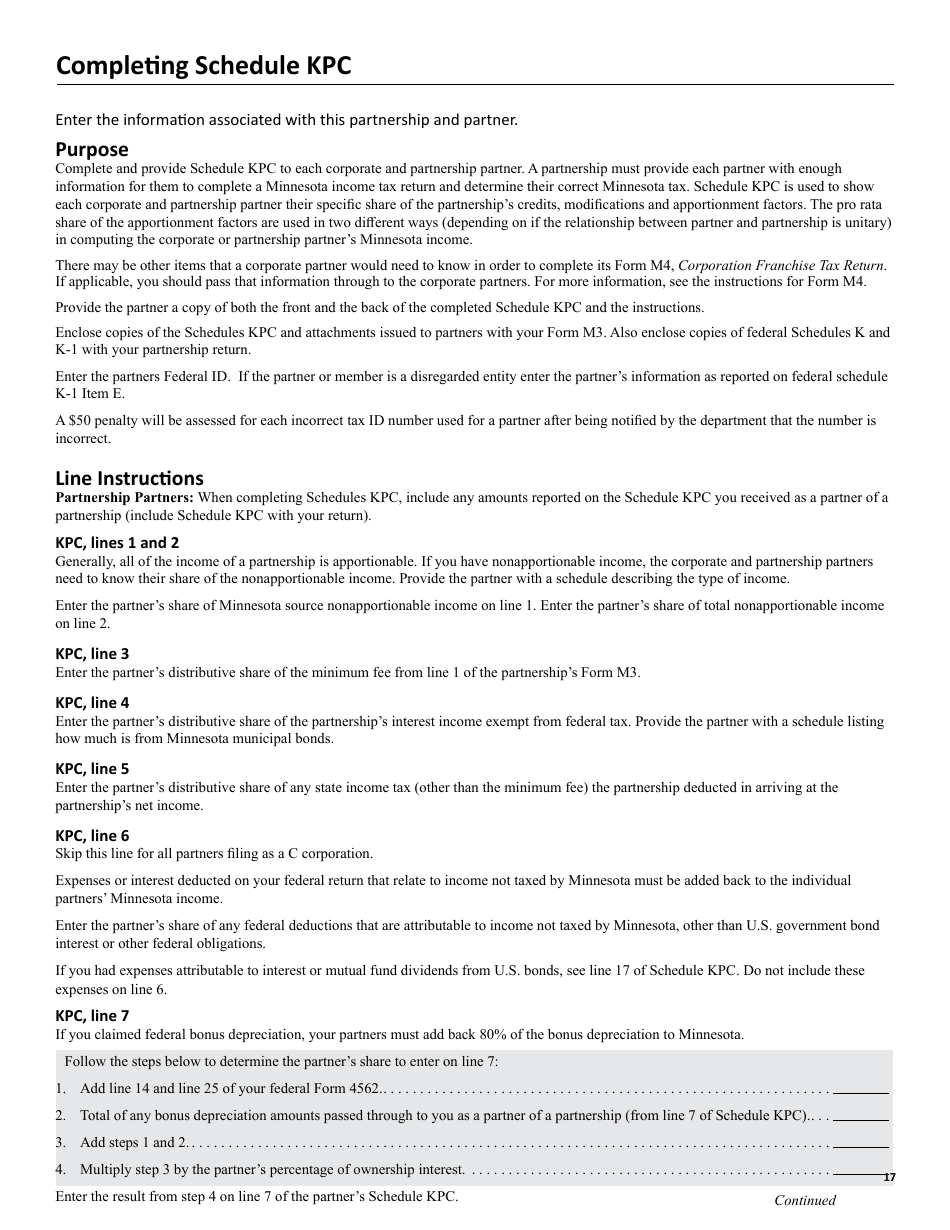

Download Instructions for Form M3 Partnership Return PDF, 2023

You must file in minnesota by march 15, 2025. Here is how tax filing requirements are broken down for various minnesota business entities: If you choose not to use the. Minnesota s corporation & partnership tax deadlines for 2024. Return of partnership income, and have minnesota gross income must file form m3,.

Download Instructions for Form M3 Partnership Return PDF, 2023

See m3a instructions beginning on page 9. If you don’t have a minnesota id number, you must first apply for one. Minnesota s corporation & partnership tax deadlines for 2024. If you choose not to use the. Return of partnership income, and have minnesota gross income must file form m3,.

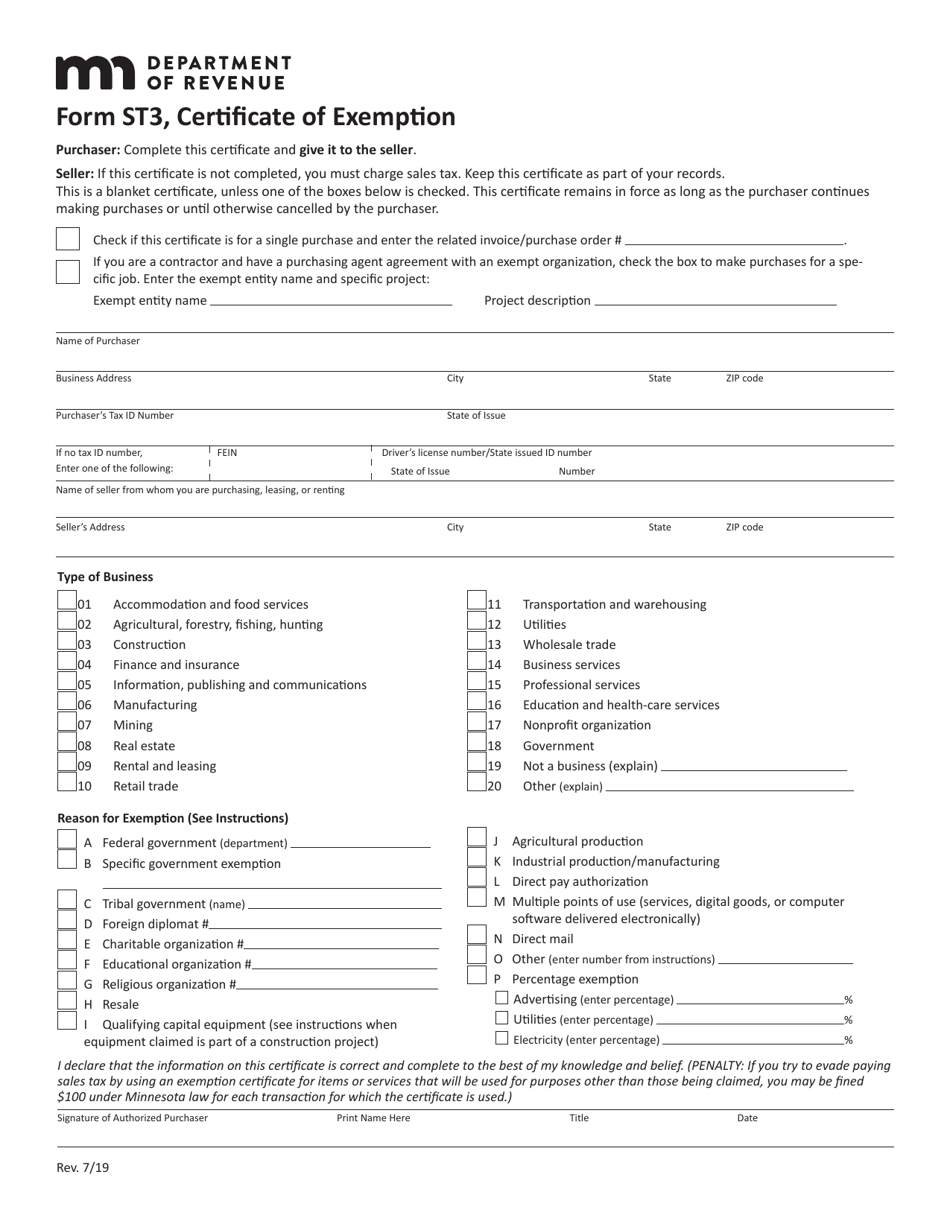

Minnesota St3 Form Fillable Printable Forms Free Online

Fein and minnesota id are required. Return of partnership income, and have minnesota gross income must file form m3,. All partnerships must complete m3a to determine its minnesota source income and minimum fee. For state tax purposes, the partnership completes form m3, partnership return and files it with the department of revenue along with a copy of. Here is how.

M3_example Minnesota

All entities required to file a federal form 1065, u.s. If you choose not to use the. Here is how tax filing requirements are broken down for various minnesota business entities: All partnerships must complete m3a to determine its minnesota source income and minimum fee. You must file in minnesota by march 15, 2025.

Download Instructions for Form M3 Partnership Return PDF, 2023

See m3a instructions beginning on page 9. You must file in minnesota by march 15, 2025. Mail form m3 and all completed minnesota and federal forms and schedules using a mailing label (see page 19). For state tax purposes, the partnership completes form m3, partnership return and files it with the department of revenue along with a copy of. Minnesota.

Download Instructions for Form M3 Partnership Return PDF, 2023

Here is how tax filing requirements are broken down for various minnesota business entities: All entities required to file a federal form 1065, u.s. If you don’t have a minnesota id number, you must first apply for one. All partnerships must complete m3a to determine its minnesota source income and minimum fee. For state tax purposes, the partnership completes form.

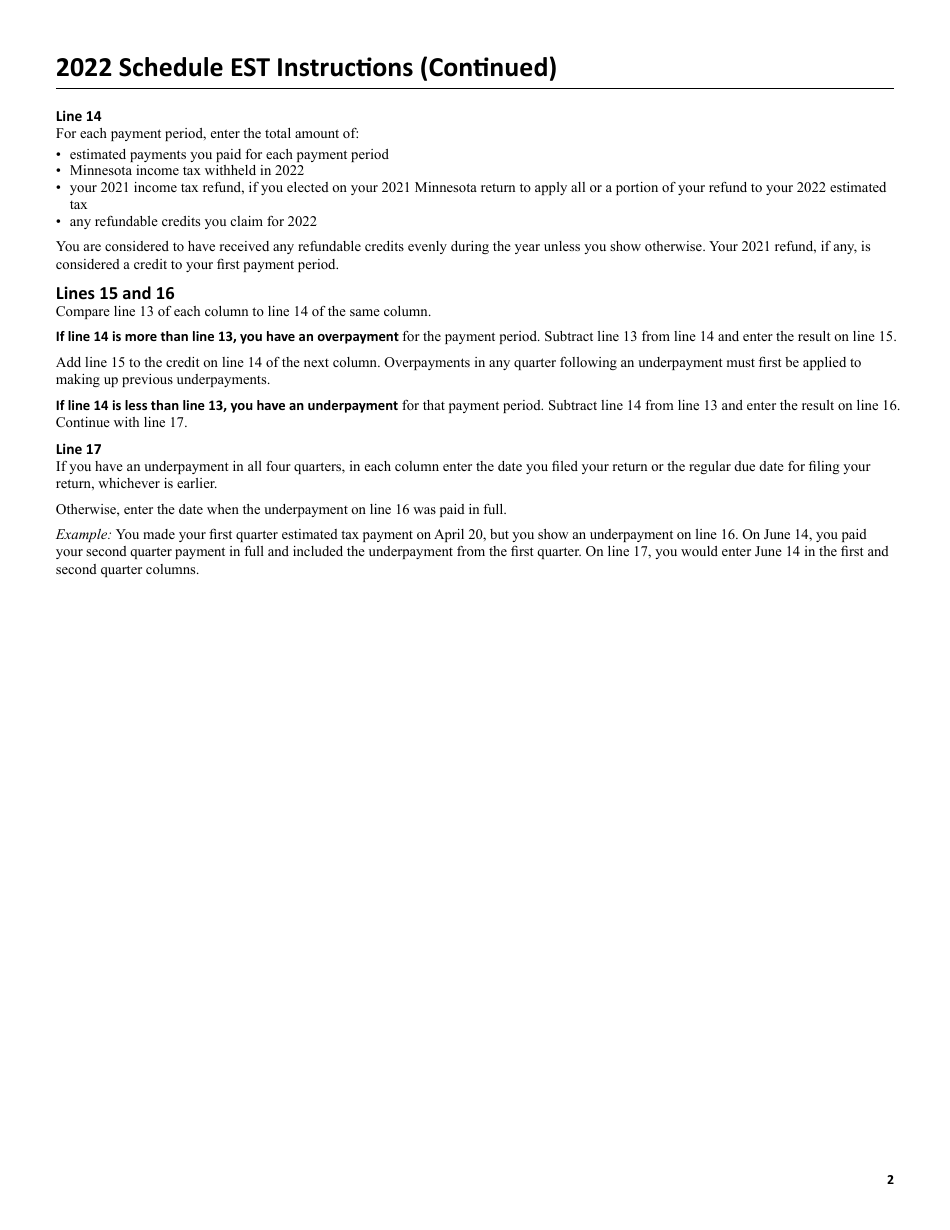

Form EST 2022 Fill Out, Sign Online and Download Fillable PDF

You must file in minnesota by march 15, 2025. Minnesota s corporation & partnership tax deadlines for 2024. Here is how tax filing requirements are broken down for various minnesota business entities: Fein and minnesota id are required. If you choose not to use the.

Minnesota State Tax Form 2023 Printable Forms Free Online

If you choose not to use the. All entities required to file a federal form 1065, u.s. Here is how tax filing requirements are broken down for various minnesota business entities: Fein and minnesota id are required. For state tax purposes, the partnership completes form m3, partnership return and files it with the department of revenue along with a copy.

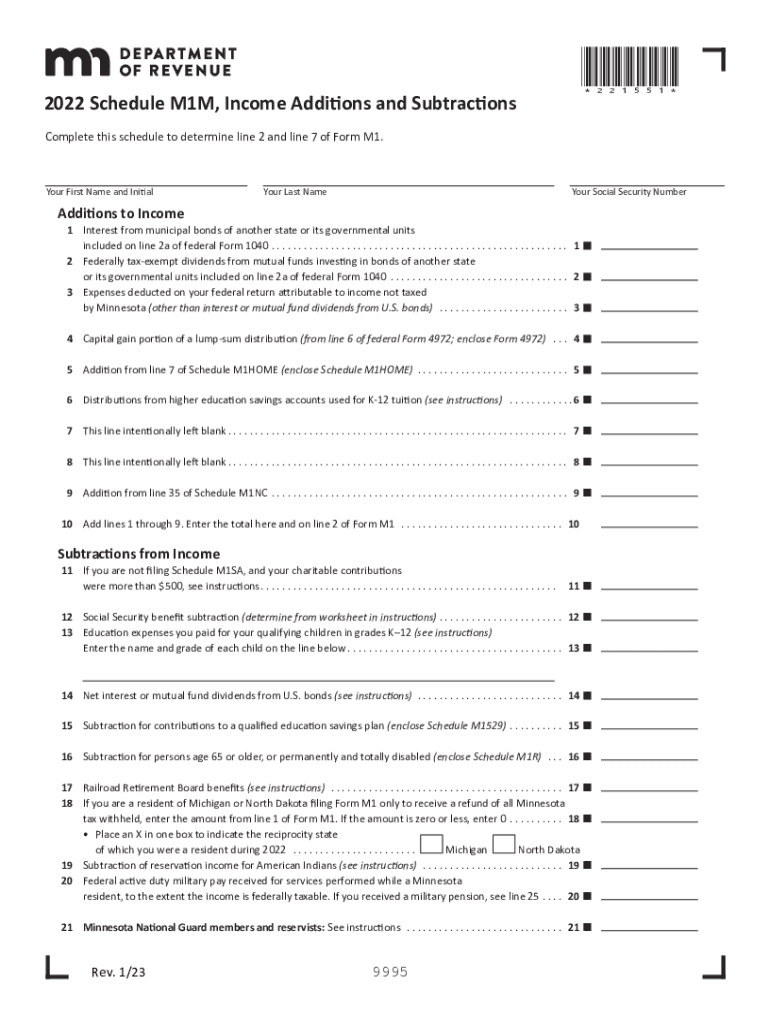

2022 Form MN DoR Schedule M1M Fill Online, Printable, Fillable, Blank

Fein and minnesota id are required. Return of partnership income, and have minnesota gross income must file form m3,. If you choose not to use the. You must file in minnesota by march 15, 2025. See m3a instructions beginning on page 9.

(Form M3) instructions Minnesota Department of Revenue

Mail form m3 and all completed minnesota and federal forms and schedules using a mailing label (see page 19). For state tax purposes, the partnership completes form m3, partnership return and files it with the department of revenue along with a copy of. All partnerships must complete m3a to determine its minnesota source income and minimum fee. Return of partnership.

You Must File In Minnesota By March 15, 2025.

See m3a instructions beginning on page 9. Here is how tax filing requirements are broken down for various minnesota business entities: If you don’t have a minnesota id number, you must first apply for one. Minnesota s corporation & partnership tax deadlines for 2024.

If You Choose Not To Use The.

For state tax purposes, the partnership completes form m3, partnership return and files it with the department of revenue along with a copy of. All partnerships must complete m3a to determine its minnesota source income and minimum fee. Mail form m3 and all completed minnesota and federal forms and schedules using a mailing label (see page 19). Return of partnership income, and have minnesota gross income must file form m3,.

All Entities Required To File A Federal Form 1065, U.s.

Fein and minnesota id are required.