Minimal Activity Business License Tn

Minimal Activity Business License Tn - The “application for business tax license or minimal activity license” is available for. You can now apply for a new business license online! Minimal activity license annually for $15 from the local county and/or city clerk. Businesses with less than $3,000 in gross receipts per year may. Between $3,000 and $100,000* in gross sales. Minimal activity business licenses are for businesses that gross more than $3,000 to $100,000 annually. Businesses with annual gross receipts of more than $3,000 but less than $100,000 within a jurisdiction are required to. Under $3,000 in gross sales. It takes up to 10 business days for the department of revenue to register your business. To obtain the annual license,.

It takes up to 10 business days for the department of revenue to register your business. Under $3,000 in gross sales. Minimal activity business licenses are for businesses that gross more than $3,000 to $100,000 annually. Businesses with more than $3,000 but less than $100,000 in gross receipts during the tax year must obtain a minimal activity license. You can now apply for a new business license online! Businesses with annual gross receipts of more than $3,000 but less than $100,000 within a jurisdiction are required to. To obtain the annual license,. Minimal activity license annually for $15 from the local county and/or city clerk. Between $3,000 and $100,000* in gross sales. Businesses with less than $3,000 in gross receipts per year may.

Businesses with more than $3,000 but less than $100,000 in gross receipts during the tax year must obtain a minimal activity license. The “application for business tax license or minimal activity license” is available for. Minimal activity business licenses are for businesses that gross more than $3,000 to $100,000 annually. Businesses with less than $3,000 in gross receipts per year may. You can now apply for a new business license online! Businesses with annual gross receipts of more than $3,000 but less than $100,000 within a jurisdiction are required to. Under $3,000 in gross sales. It takes up to 10 business days for the department of revenue to register your business. To obtain the annual license,. Between $3,000 and $100,000* in gross sales.

How to Get a Business License in Tennessee

Under $3,000 in gross sales. Between $3,000 and $100,000* in gross sales. Businesses with less than $3,000 in gross receipts per year may. It takes up to 10 business days for the department of revenue to register your business. To obtain the annual license,.

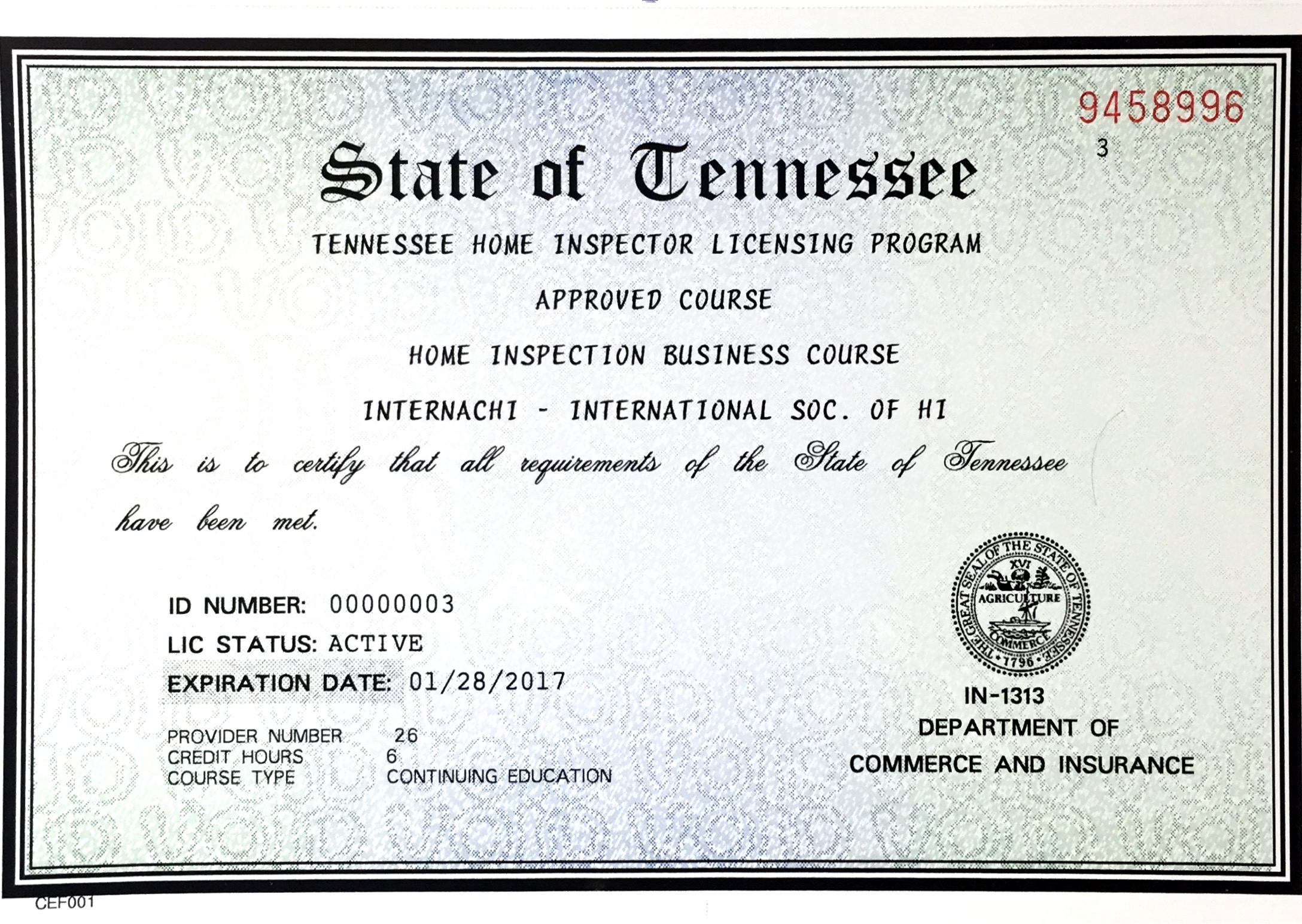

Insurance License In Tn Financial Report

The “application for business tax license or minimal activity license” is available for. Businesses with more than $3,000 but less than $100,000 in gross receipts during the tax year must obtain a minimal activity license. Minimal activity license annually for $15 from the local county and/or city clerk. You can now apply for a new business license online! Under $3,000.

How much are TN fishing licenses? Daisy Outdoors

Minimal activity business licenses are for businesses that gross more than $3,000 to $100,000 annually. To obtain the annual license,. Businesses with less than $3,000 in gross receipts per year may. It takes up to 10 business days for the department of revenue to register your business. Businesses with more than $3,000 but less than $100,000 in gross receipts during.

How To Get A Business License In Tn Leah Beachum's Template

It takes up to 10 business days for the department of revenue to register your business. Businesses with more than $3,000 but less than $100,000 in gross receipts during the tax year must obtain a minimal activity license. Minimal activity license annually for $15 from the local county and/or city clerk. To obtain the annual license,. The “application for business.

TN Contractor’s License Exp. 123122 C3 Industrial

Minimal activity business licenses are for businesses that gross more than $3,000 to $100,000 annually. To obtain the annual license,. It takes up to 10 business days for the department of revenue to register your business. Minimal activity license annually for $15 from the local county and/or city clerk. Between $3,000 and $100,000* in gross sales.

Business License Knoxville Tn Biusnsse

The “application for business tax license or minimal activity license” is available for. Businesses with annual gross receipts of more than $3,000 but less than $100,000 within a jurisdiction are required to. Minimal activity business licenses are for businesses that gross more than $3,000 to $100,000 annually. Under $3,000 in gross sales. Businesses with more than $3,000 but less than.

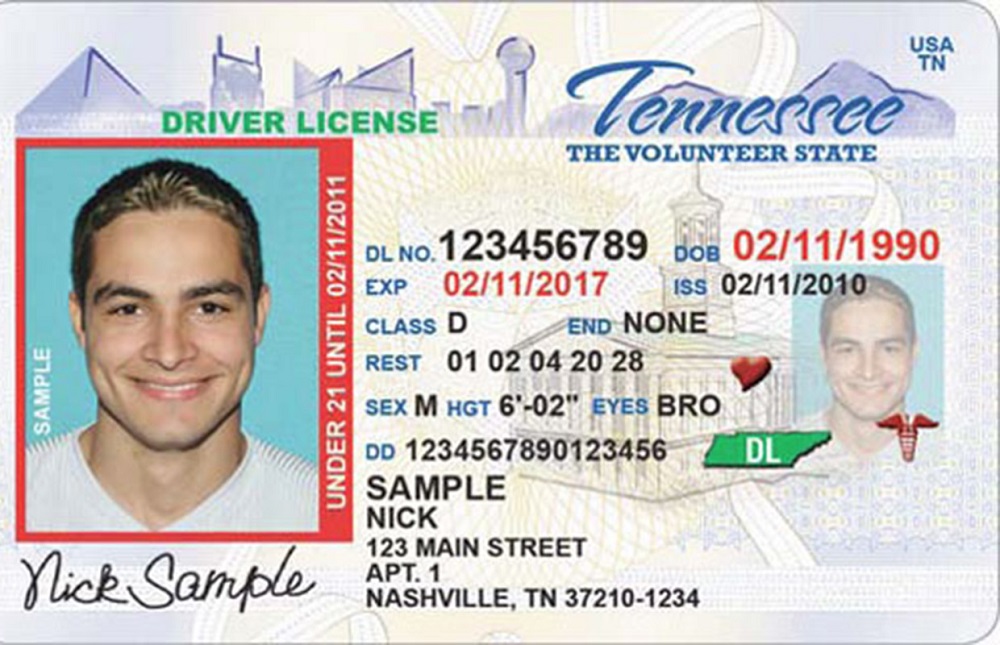

TN DOS Drivers License Rules Driving Guide

Businesses with more than $3,000 but less than $100,000 in gross receipts during the tax year must obtain a minimal activity license. To obtain the annual license,. Minimal activity business licenses are for businesses that gross more than $3,000 to $100,000 annually. You can now apply for a new business license online! It takes up to 10 business days for.

Tennessee Business License License Lookup

Businesses with more than $3,000 but less than $100,000 in gross receipts during the tax year must obtain a minimal activity license. Minimal activity license annually for $15 from the local county and/or city clerk. Businesses with less than $3,000 in gross receipts per year may. It takes up to 10 business days for the department of revenue to register.

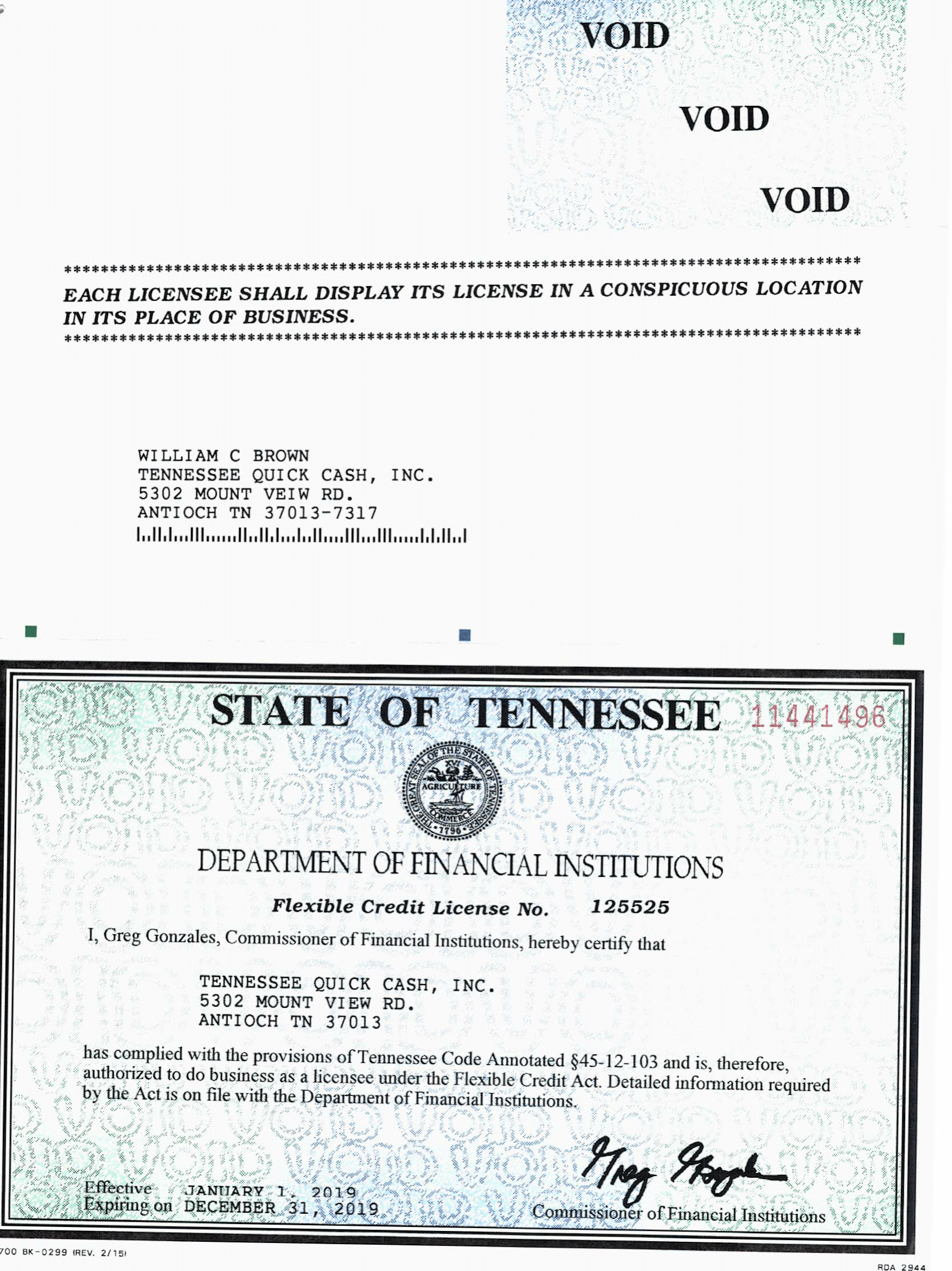

License Tennessee Quick Cash

Businesses with annual gross receipts of more than $3,000 but less than $100,000 within a jurisdiction are required to. Minimal activity business licenses are for businesses that gross more than $3,000 to $100,000 annually. It takes up to 10 business days for the department of revenue to register your business. Between $3,000 and $100,000* in gross sales. Businesses with more.

How To Get A Business License In Tn Leah Beachum's Template

Businesses with less than $3,000 in gross receipts per year may. You can now apply for a new business license online! Businesses with more than $3,000 but less than $100,000 in gross receipts during the tax year must obtain a minimal activity license. Minimal activity license annually for $15 from the local county and/or city clerk. Minimal activity business licenses.

Between $3,000 And $100,000* In Gross Sales.

It takes up to 10 business days for the department of revenue to register your business. You can now apply for a new business license online! Minimal activity license annually for $15 from the local county and/or city clerk. To obtain the annual license,.

Businesses With Annual Gross Receipts Of More Than $3,000 But Less Than $100,000 Within A Jurisdiction Are Required To.

Businesses with less than $3,000 in gross receipts per year may. The “application for business tax license or minimal activity license” is available for. Businesses with more than $3,000 but less than $100,000 in gross receipts during the tax year must obtain a minimal activity license. Under $3,000 in gross sales.