Michigan Tax Foreclosure Lawsuit

Michigan Tax Foreclosure Lawsuit - Across michigan, there are several lawsuits in state and federal court arguing that former property owners, not counties, deserve. Numerous michigan counties have agreed to a class action lawsuit settlement to resolve claims that they failed to distribute. The michigan supreme court has ruled that michigan homeowners who lost their property due to unpaid property taxes prior to 2020 are. A judge has approved a settlement that returns most of the profits from property sales after some michigan homeowners lost.

Across michigan, there are several lawsuits in state and federal court arguing that former property owners, not counties, deserve. A judge has approved a settlement that returns most of the profits from property sales after some michigan homeowners lost. The michigan supreme court has ruled that michigan homeowners who lost their property due to unpaid property taxes prior to 2020 are. Numerous michigan counties have agreed to a class action lawsuit settlement to resolve claims that they failed to distribute.

A judge has approved a settlement that returns most of the profits from property sales after some michigan homeowners lost. The michigan supreme court has ruled that michigan homeowners who lost their property due to unpaid property taxes prior to 2020 are. Numerous michigan counties have agreed to a class action lawsuit settlement to resolve claims that they failed to distribute. Across michigan, there are several lawsuits in state and federal court arguing that former property owners, not counties, deserve.

Stop Foreclosure In Michigan Michigan Foreclosure Process

Numerous michigan counties have agreed to a class action lawsuit settlement to resolve claims that they failed to distribute. Across michigan, there are several lawsuits in state and federal court arguing that former property owners, not counties, deserve. The michigan supreme court has ruled that michigan homeowners who lost their property due to unpaid property taxes prior to 2020 are..

Protect Your Home From Tax Liens and Foreclosure in Texas

The michigan supreme court has ruled that michigan homeowners who lost their property due to unpaid property taxes prior to 2020 are. A judge has approved a settlement that returns most of the profits from property sales after some michigan homeowners lost. Across michigan, there are several lawsuits in state and federal court arguing that former property owners, not counties,.

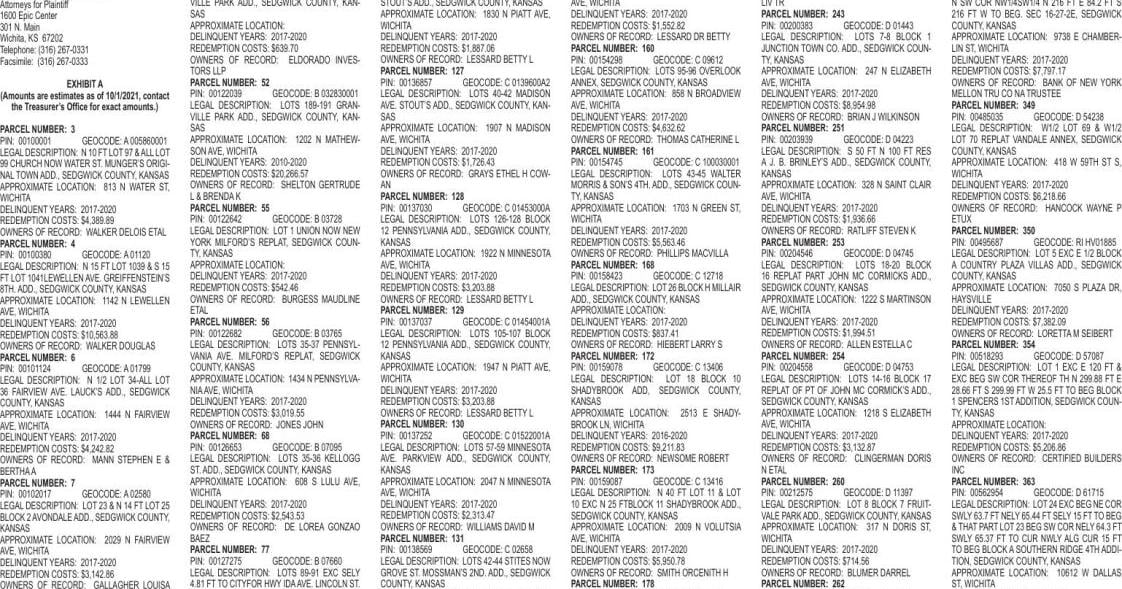

110222 Notice of Sale Tax Foreclosure Case 21 CV 1759 Sedgwick

Numerous michigan counties have agreed to a class action lawsuit settlement to resolve claims that they failed to distribute. Across michigan, there are several lawsuits in state and federal court arguing that former property owners, not counties, deserve. A judge has approved a settlement that returns most of the profits from property sales after some michigan homeowners lost. The michigan.

High court to wade into tax foreclosure war in Michigan as repayments begin

Across michigan, there are several lawsuits in state and federal court arguing that former property owners, not counties, deserve. Numerous michigan counties have agreed to a class action lawsuit settlement to resolve claims that they failed to distribute. A judge has approved a settlement that returns most of the profits from property sales after some michigan homeowners lost. The michigan.

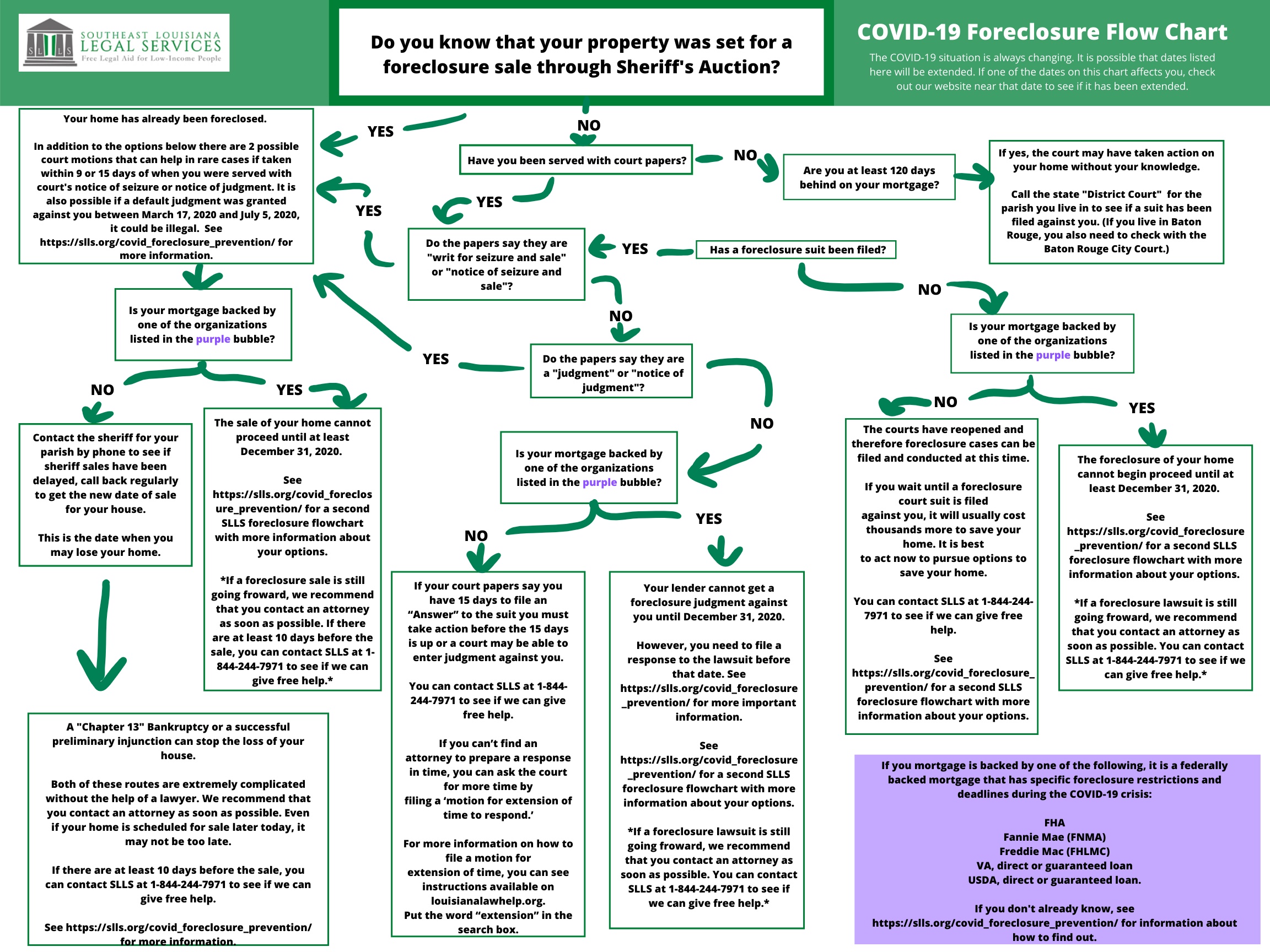

Updated Foreclosure Flow Chart SLLS

Numerous michigan counties have agreed to a class action lawsuit settlement to resolve claims that they failed to distribute. Across michigan, there are several lawsuits in state and federal court arguing that former property owners, not counties, deserve. A judge has approved a settlement that returns most of the profits from property sales after some michigan homeowners lost. The michigan.

Tax Foreclosure Sales Gaston County, NC

The michigan supreme court has ruled that michigan homeowners who lost their property due to unpaid property taxes prior to 2020 are. A judge has approved a settlement that returns most of the profits from property sales after some michigan homeowners lost. Across michigan, there are several lawsuits in state and federal court arguing that former property owners, not counties,.

Michigan Tax Foreclosure Assistance

Across michigan, there are several lawsuits in state and federal court arguing that former property owners, not counties, deserve. A judge has approved a settlement that returns most of the profits from property sales after some michigan homeowners lost. Numerous michigan counties have agreed to a class action lawsuit settlement to resolve claims that they failed to distribute. The michigan.

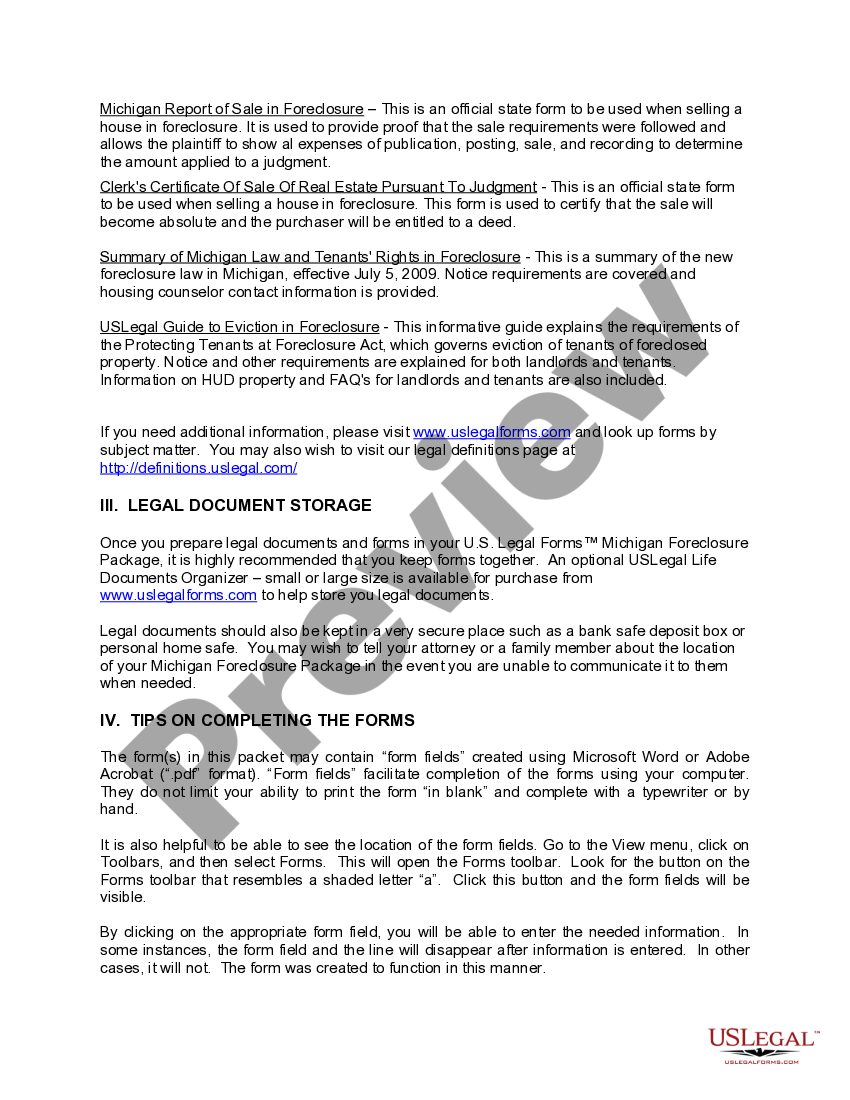

Michigan Foreclosure Package US Legal Forms

A judge has approved a settlement that returns most of the profits from property sales after some michigan homeowners lost. Numerous michigan counties have agreed to a class action lawsuit settlement to resolve claims that they failed to distribute. The michigan supreme court has ruled that michigan homeowners who lost their property due to unpaid property taxes prior to 2020.

Gambling Among Top Tax Revenue Driving Industries In Michigan

Numerous michigan counties have agreed to a class action lawsuit settlement to resolve claims that they failed to distribute. A judge has approved a settlement that returns most of the profits from property sales after some michigan homeowners lost. Across michigan, there are several lawsuits in state and federal court arguing that former property owners, not counties, deserve. The michigan.

Lost property to tax foreclosure in Michigan? Watch these legal cases.

A judge has approved a settlement that returns most of the profits from property sales after some michigan homeowners lost. Numerous michigan counties have agreed to a class action lawsuit settlement to resolve claims that they failed to distribute. Across michigan, there are several lawsuits in state and federal court arguing that former property owners, not counties, deserve. The michigan.

Numerous Michigan Counties Have Agreed To A Class Action Lawsuit Settlement To Resolve Claims That They Failed To Distribute.

The michigan supreme court has ruled that michigan homeowners who lost their property due to unpaid property taxes prior to 2020 are. A judge has approved a settlement that returns most of the profits from property sales after some michigan homeowners lost. Across michigan, there are several lawsuits in state and federal court arguing that former property owners, not counties, deserve.