Maryland State Tax Lien Payoff

Maryland State Tax Lien Payoff - This can be done by emailing. Click here for additional information about our liability offset program. With the case number search, you may use either the. Contact our office to receive a current payoff amount. To pay off your tax lien: This system may be used to make bill payments on individual income tax liabilities using electronic funds withdrawal (direct debit / e. This notice is to advise you that a lien has been filed with the clerk of. A tax lien gives the state tax. To search for a certificate of tax lien, you may search by case number or debtor name.

This system may be used to make bill payments on individual income tax liabilities using electronic funds withdrawal (direct debit / e. With the case number search, you may use either the. To search for a certificate of tax lien, you may search by case number or debtor name. This notice is to advise you that a lien has been filed with the clerk of. Contact our office to receive a current payoff amount. A tax lien gives the state tax. This can be done by emailing. To pay off your tax lien: Click here for additional information about our liability offset program.

Contact our office to receive a current payoff amount. To search for a certificate of tax lien, you may search by case number or debtor name. This system may be used to make bill payments on individual income tax liabilities using electronic funds withdrawal (direct debit / e. Click here for additional information about our liability offset program. This can be done by emailing. This notice is to advise you that a lien has been filed with the clerk of. A tax lien gives the state tax. To pay off your tax lien: With the case number search, you may use either the.

maryland tax lien SH Block Tax Services

To search for a certificate of tax lien, you may search by case number or debtor name. To pay off your tax lien: This system may be used to make bill payments on individual income tax liabilities using electronic funds withdrawal (direct debit / e. Click here for additional information about our liability offset program. With the case number search,.

Tax Lien Texas State Tax Lien

A tax lien gives the state tax. This notice is to advise you that a lien has been filed with the clerk of. Contact our office to receive a current payoff amount. This can be done by emailing. With the case number search, you may use either the.

Lien Release Request Letter To Bank

To search for a certificate of tax lien, you may search by case number or debtor name. To pay off your tax lien: With the case number search, you may use either the. This system may be used to make bill payments on individual income tax liabilities using electronic funds withdrawal (direct debit / e. This can be done by.

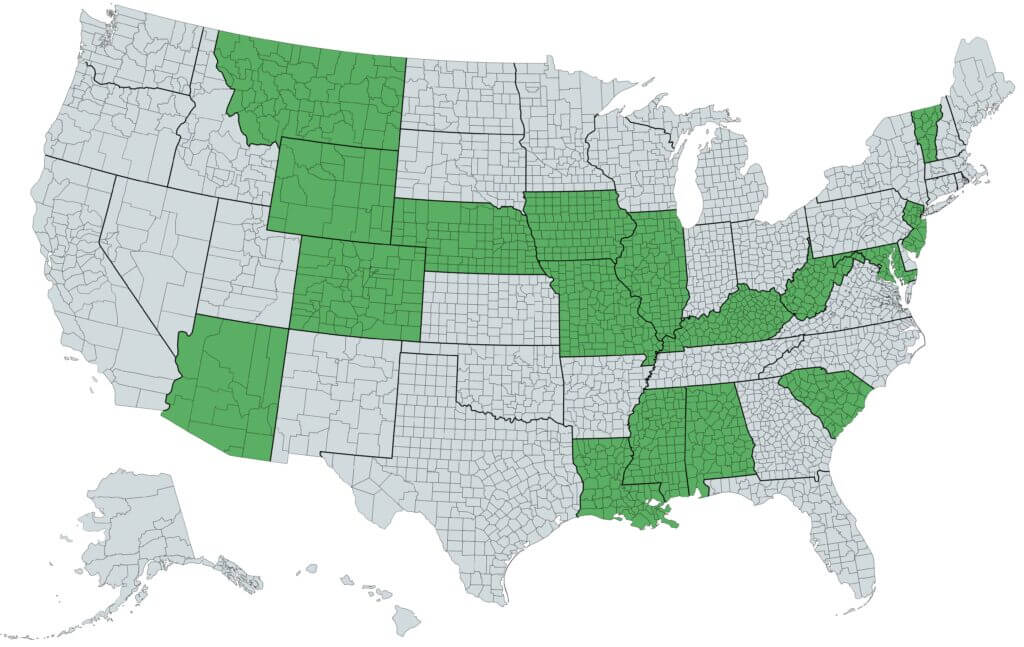

The Essential List of Tax Lien Certificate States Tax Lien

This can be done by emailing. This system may be used to make bill payments on individual income tax liabilities using electronic funds withdrawal (direct debit / e. With the case number search, you may use either the. Contact our office to receive a current payoff amount. To search for a certificate of tax lien, you may search by case.

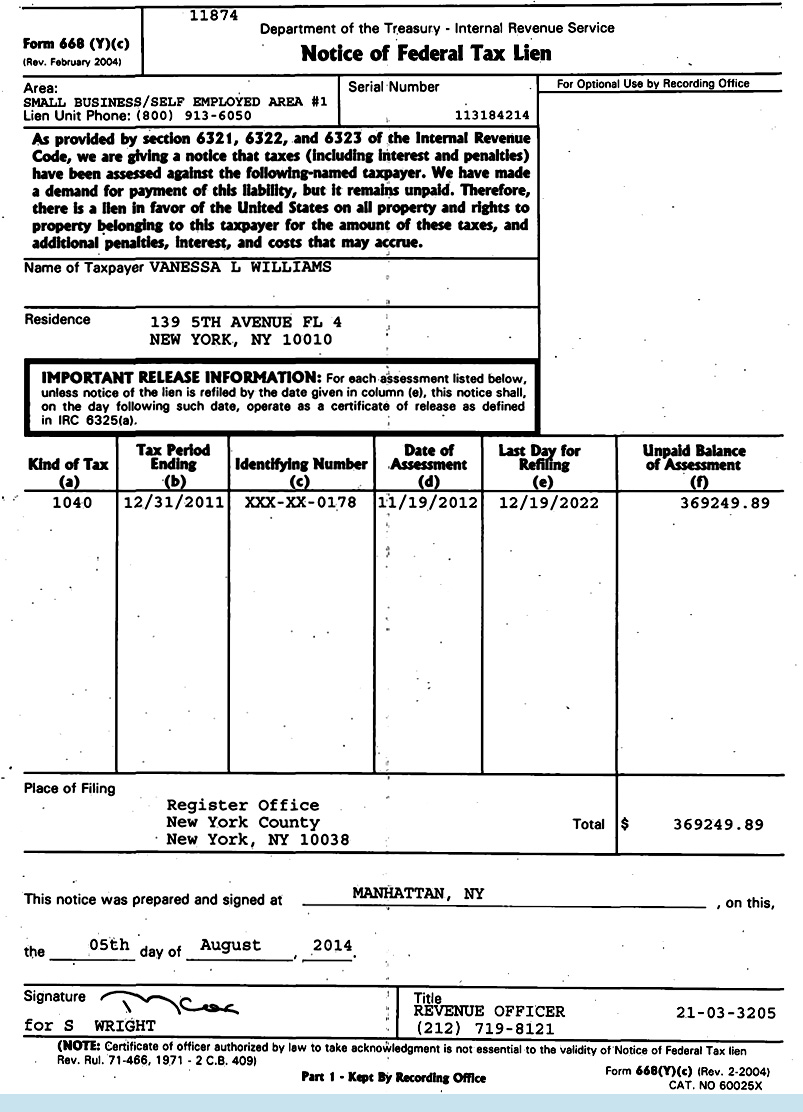

obtain a federal tax lien payoff Wilson Rogers & Company

A tax lien gives the state tax. With the case number search, you may use either the. This can be done by emailing. This notice is to advise you that a lien has been filed with the clerk of. Contact our office to receive a current payoff amount.

The Importance of Hiring a Tax Lien Attorney for Your Insurance

With the case number search, you may use either the. Contact our office to receive a current payoff amount. This notice is to advise you that a lien has been filed with the clerk of. This can be done by emailing. A tax lien gives the state tax.

Irs lien payoff request form 8821 Fill out & sign online DocHub

This system may be used to make bill payments on individual income tax liabilities using electronic funds withdrawal (direct debit / e. Contact our office to receive a current payoff amount. This notice is to advise you that a lien has been filed with the clerk of. To search for a certificate of tax lien, you may search by case.

Tax Lien Tax Lien Washington State

This can be done by emailing. To pay off your tax lien: A tax lien gives the state tax. To search for a certificate of tax lien, you may search by case number or debtor name. This system may be used to make bill payments on individual income tax liabilities using electronic funds withdrawal (direct debit / e.

Federal tax lien on foreclosed property laderdriver

With the case number search, you may use either the. To search for a certificate of tax lien, you may search by case number or debtor name. A tax lien gives the state tax. This can be done by emailing. This notice is to advise you that a lien has been filed with the clerk of.

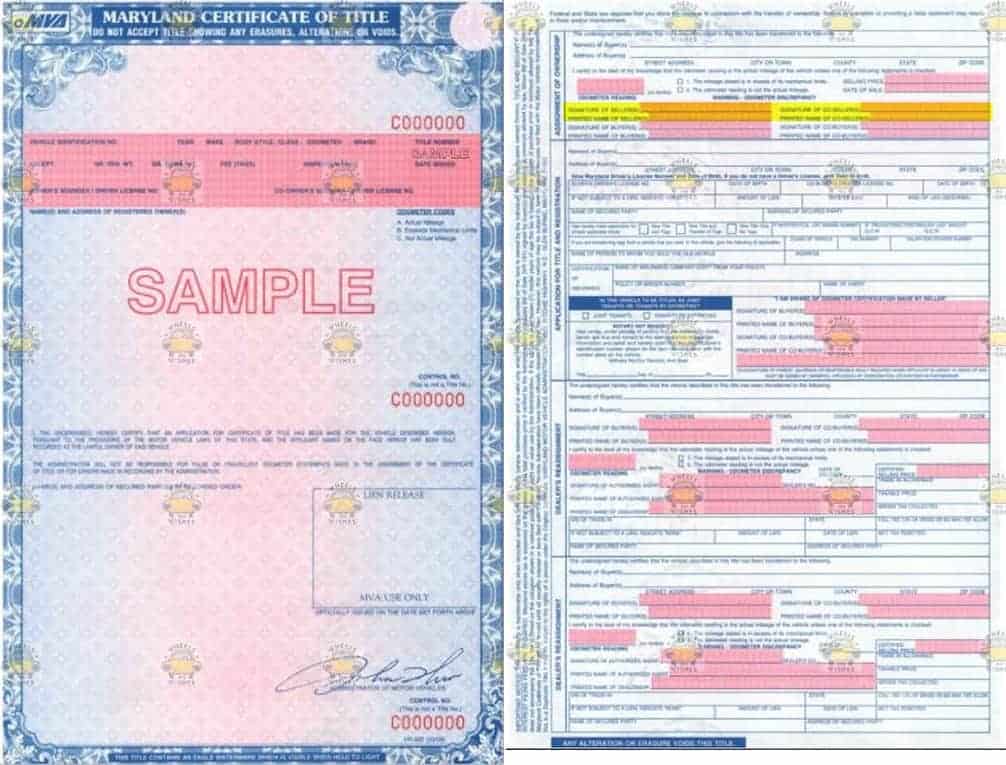

Maryland Vehicle Donation Title Questions

This notice is to advise you that a lien has been filed with the clerk of. Contact our office to receive a current payoff amount. With the case number search, you may use either the. Click here for additional information about our liability offset program. A tax lien gives the state tax.

A Tax Lien Gives The State Tax.

Contact our office to receive a current payoff amount. This system may be used to make bill payments on individual income tax liabilities using electronic funds withdrawal (direct debit / e. With the case number search, you may use either the. To pay off your tax lien:

Click Here For Additional Information About Our Liability Offset Program.

To search for a certificate of tax lien, you may search by case number or debtor name. This can be done by emailing. This notice is to advise you that a lien has been filed with the clerk of.