Maryland Local Tax

Maryland Local Tax - You can click on any city or county for more details, including the nonresident income tax rate and tax forms. Withholding is a combination of the state income tax, which has rates graduated per taxable income, (see chart. Listed below are the actual 2025 local income tax rates. Median local tax rates of maryland’s 23 counties and baltimore city. The local income tax is. Local tax is based on taxable income and not on maryland state tax. We have information on the local income tax rates in 24 localities in maryland. Counties are responsible for the county tax rates, local towns and cities are responsible for their tax rates, and the state is responsible for the state’s tax rates. We provide separate tables for the convenience of employers who do. Each tax rate is reported to the.

Maryland's 23 counties and baltimore city levy a local income tax which we collect on the state income tax return as a convenience for local governments. We provide separate tables for the convenience of employers who do. You can click on any city or county for more details, including the nonresident income tax rate and tax forms. We have information on the local income tax rates in 24 localities in maryland. Local tax is based on taxable income and not on maryland state tax. Withholding is a combination of the state income tax, which has rates graduated per taxable income, (see chart. Median local tax rates of maryland’s 23 counties and baltimore city. The local income tax is. Listed below are the actual 2025 local income tax rates. Counties are responsible for the county tax rates, local towns and cities are responsible for their tax rates, and the state is responsible for the state’s tax rates.

We provide separate tables for the convenience of employers who do. Listed below are the actual 2025 local income tax rates. Maryland's 23 counties and baltimore city levy a local income tax which we collect on the state income tax return as a convenience for local governments. We have information on the local income tax rates in 24 localities in maryland. You can click on any city or county for more details, including the nonresident income tax rate and tax forms. Local tax is based on taxable income and not on maryland state tax. The local income tax is. Withholding is a combination of the state income tax, which has rates graduated per taxable income, (see chart. Counties are responsible for the county tax rates, local towns and cities are responsible for their tax rates, and the state is responsible for the state’s tax rates. Median local tax rates of maryland’s 23 counties and baltimore city.

Maryland Tax Tables 2018

The local income tax is. Counties are responsible for the county tax rates, local towns and cities are responsible for their tax rates, and the state is responsible for the state’s tax rates. We provide separate tables for the convenience of employers who do. Local tax is based on taxable income and not on maryland state tax. You can click.

Maryland Tax Calculator 2024 2025

You can click on any city or county for more details, including the nonresident income tax rate and tax forms. We have information on the local income tax rates in 24 localities in maryland. Local tax is based on taxable income and not on maryland state tax. We provide separate tables for the convenience of employers who do. The local.

TAX Consultancy Firm Gurugram

Each tax rate is reported to the. Local tax is based on taxable income and not on maryland state tax. We have information on the local income tax rates in 24 localities in maryland. We provide separate tables for the convenience of employers who do. Listed below are the actual 2025 local income tax rates.

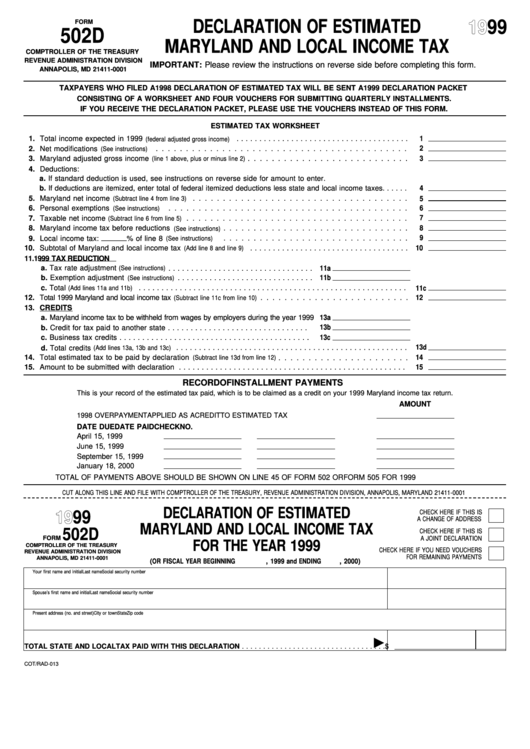

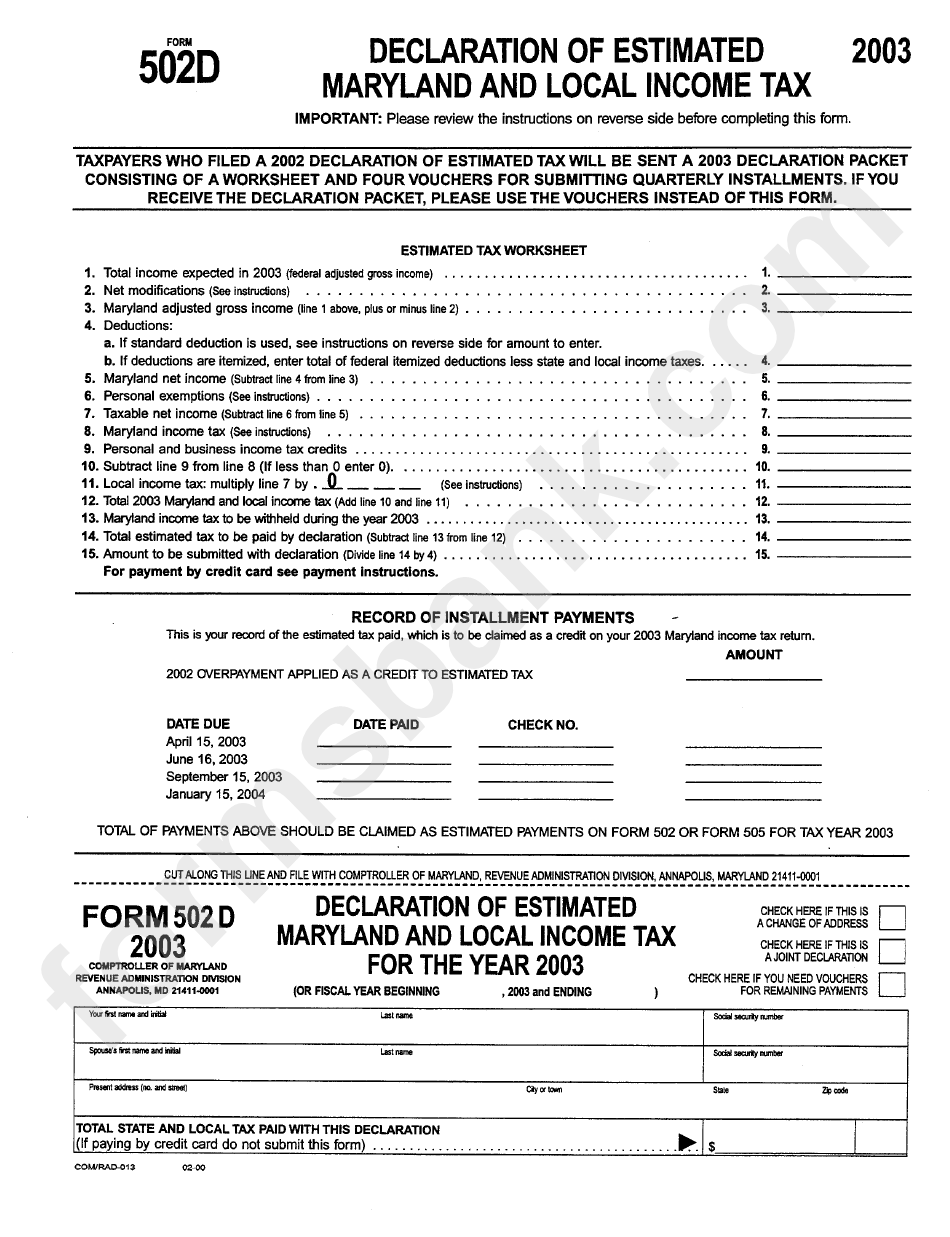

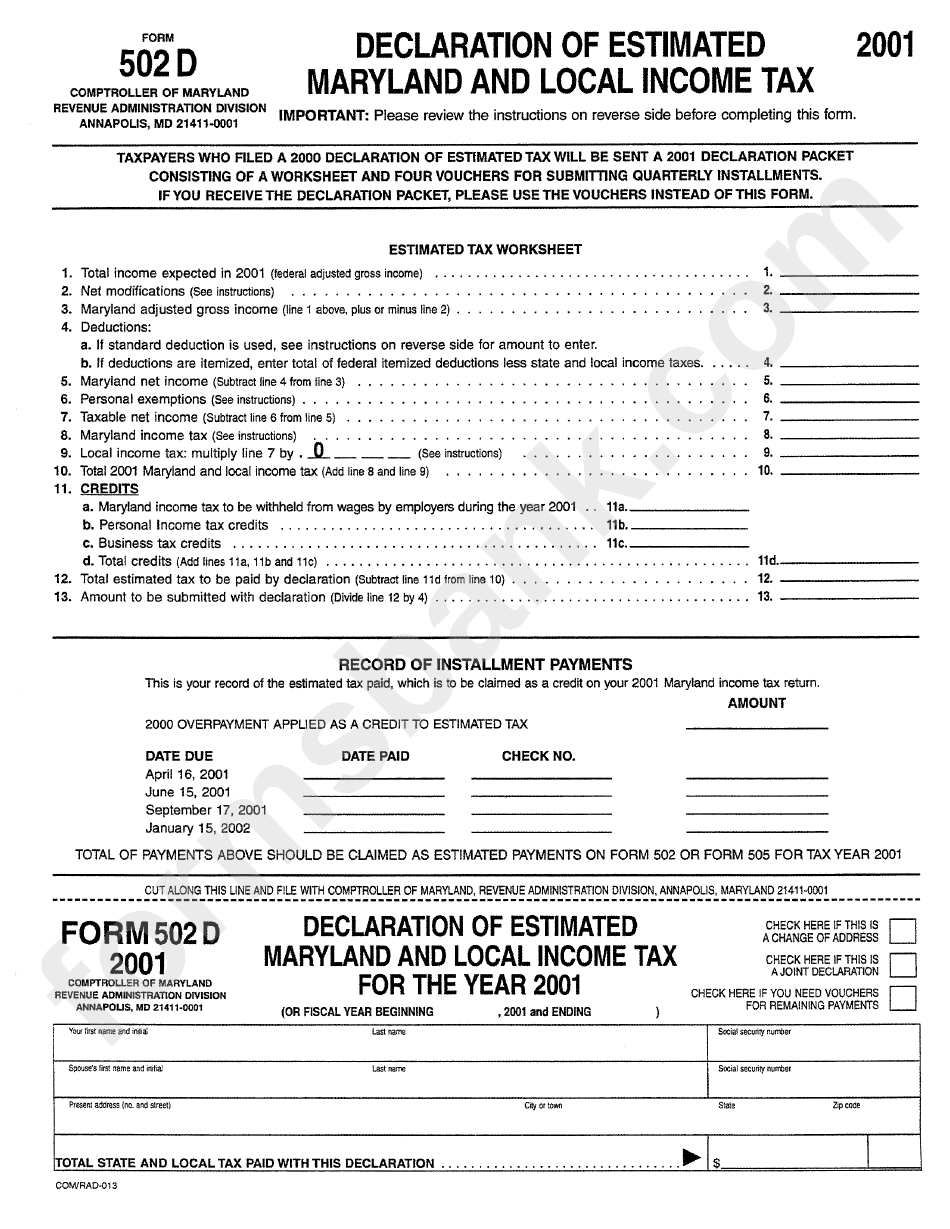

Fillable Form 502 D Declaration Of Estimated Maryland And Local

We have information on the local income tax rates in 24 localities in maryland. We provide separate tables for the convenience of employers who do. Withholding is a combination of the state income tax, which has rates graduated per taxable income, (see chart. Maryland's 23 counties and baltimore city levy a local income tax which we collect on the state.

Maryland Tax Free Day 2024 Jenda Karrie

We provide separate tables for the convenience of employers who do. Median local tax rates of maryland’s 23 counties and baltimore city. We have information on the local income tax rates in 24 localities in maryland. The local income tax is. Each tax rate is reported to the.

Maryland Local Tax Reform Details & Analysis

Withholding is a combination of the state income tax, which has rates graduated per taxable income, (see chart. Counties are responsible for the county tax rates, local towns and cities are responsible for their tax rates, and the state is responsible for the state’s tax rates. Each tax rate is reported to the. You can click on any city or.

State local effective tax rates map Infogram

We have information on the local income tax rates in 24 localities in maryland. Counties are responsible for the county tax rates, local towns and cities are responsible for their tax rates, and the state is responsible for the state’s tax rates. The local income tax is. You can click on any city or county for more details, including the.

Form 502d Declaration Of Estimated Maryland And Local Tax

Withholding is a combination of the state income tax, which has rates graduated per taxable income, (see chart. Median local tax rates of maryland’s 23 counties and baltimore city. Each tax rate is reported to the. We provide separate tables for the convenience of employers who do. Local tax is based on taxable income and not on maryland state tax.

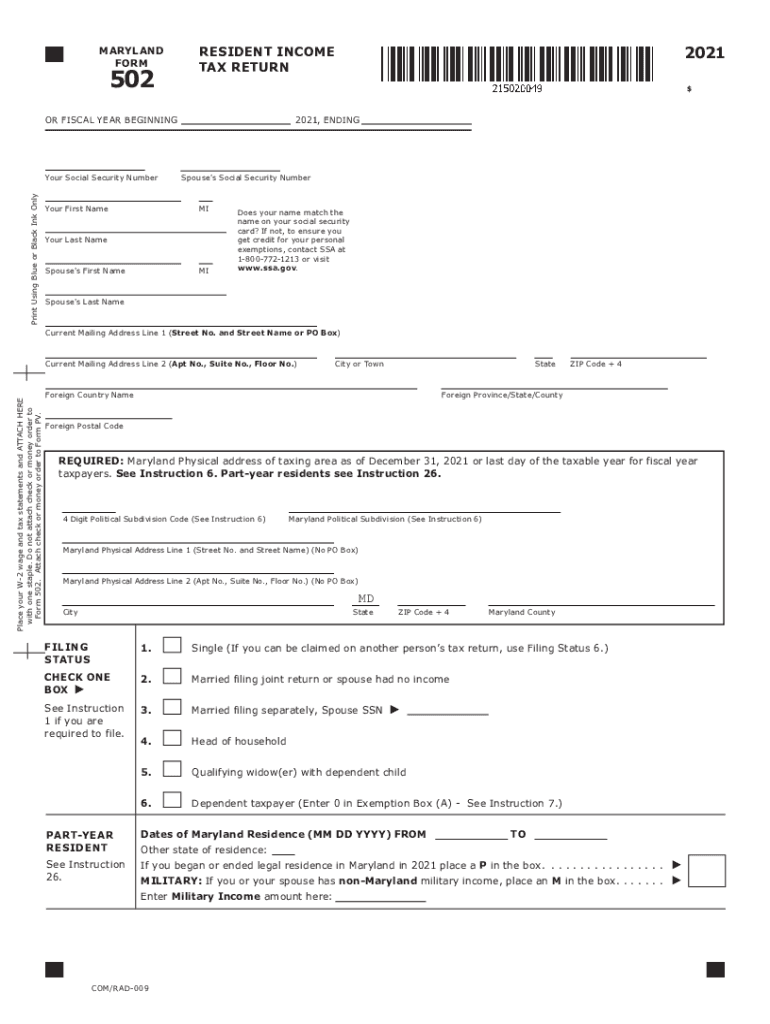

Maryland Tax Form 2024 Cornie Krystyna

You can click on any city or county for more details, including the nonresident income tax rate and tax forms. We provide separate tables for the convenience of employers who do. The local income tax is. Counties are responsible for the county tax rates, local towns and cities are responsible for their tax rates, and the state is responsible for.

Form 502d Declaration Of Estimated Maryland And Local Tax

The local income tax is. Each tax rate is reported to the. You can click on any city or county for more details, including the nonresident income tax rate and tax forms. Median local tax rates of maryland’s 23 counties and baltimore city. Counties are responsible for the county tax rates, local towns and cities are responsible for their tax.

We Have Information On The Local Income Tax Rates In 24 Localities In Maryland.

Listed below are the actual 2025 local income tax rates. Local tax is based on taxable income and not on maryland state tax. You can click on any city or county for more details, including the nonresident income tax rate and tax forms. Each tax rate is reported to the.

The Local Income Tax Is.

Maryland's 23 counties and baltimore city levy a local income tax which we collect on the state income tax return as a convenience for local governments. Median local tax rates of maryland’s 23 counties and baltimore city. Counties are responsible for the county tax rates, local towns and cities are responsible for their tax rates, and the state is responsible for the state’s tax rates. Withholding is a combination of the state income tax, which has rates graduated per taxable income, (see chart.