Maryland Law License Federal Tax Lien Or Judgment

Maryland Law License Federal Tax Lien Or Judgment - Maryland law is, of course, similar. The certificate of lien filed with the recorder of deeds attaches to the taxpayer's real and personal property. On april 30, 2019, maryland’s governor signed into law senate bill 484 establishing automatic termination time frames. On february 3, 2015, the court of special appeals reversed the circuit court ruling, instead finding that judgment liens for taxes owed to maryland. If the debt isn't paid, the creditor may be able to seize the. It remains to be seen whether foreclosing on tenants by the entirety property to satisfy a tax. The certificate of lien filed with the. A lien is a lawful claim against property that guarantees payment of a debt.

Maryland law is, of course, similar. If the debt isn't paid, the creditor may be able to seize the. It remains to be seen whether foreclosing on tenants by the entirety property to satisfy a tax. On april 30, 2019, maryland’s governor signed into law senate bill 484 establishing automatic termination time frames. A lien is a lawful claim against property that guarantees payment of a debt. The certificate of lien filed with the recorder of deeds attaches to the taxpayer's real and personal property. On february 3, 2015, the court of special appeals reversed the circuit court ruling, instead finding that judgment liens for taxes owed to maryland. The certificate of lien filed with the.

A lien is a lawful claim against property that guarantees payment of a debt. Maryland law is, of course, similar. The certificate of lien filed with the recorder of deeds attaches to the taxpayer's real and personal property. It remains to be seen whether foreclosing on tenants by the entirety property to satisfy a tax. The certificate of lien filed with the. On april 30, 2019, maryland’s governor signed into law senate bill 484 establishing automatic termination time frames. On february 3, 2015, the court of special appeals reversed the circuit court ruling, instead finding that judgment liens for taxes owed to maryland. If the debt isn't paid, the creditor may be able to seize the.

The Ultimate Maryland Tax Lien FAQ The Pendergraft Firm, LLC.

A lien is a lawful claim against property that guarantees payment of a debt. On april 30, 2019, maryland’s governor signed into law senate bill 484 establishing automatic termination time frames. The certificate of lien filed with the. The certificate of lien filed with the recorder of deeds attaches to the taxpayer's real and personal property. Maryland law is, of.

IRS Federal and State Tax Lien Help — Genesis Tax Consultants

On april 30, 2019, maryland’s governor signed into law senate bill 484 establishing automatic termination time frames. It remains to be seen whether foreclosing on tenants by the entirety property to satisfy a tax. The certificate of lien filed with the recorder of deeds attaches to the taxpayer's real and personal property. If the debt isn't paid, the creditor may.

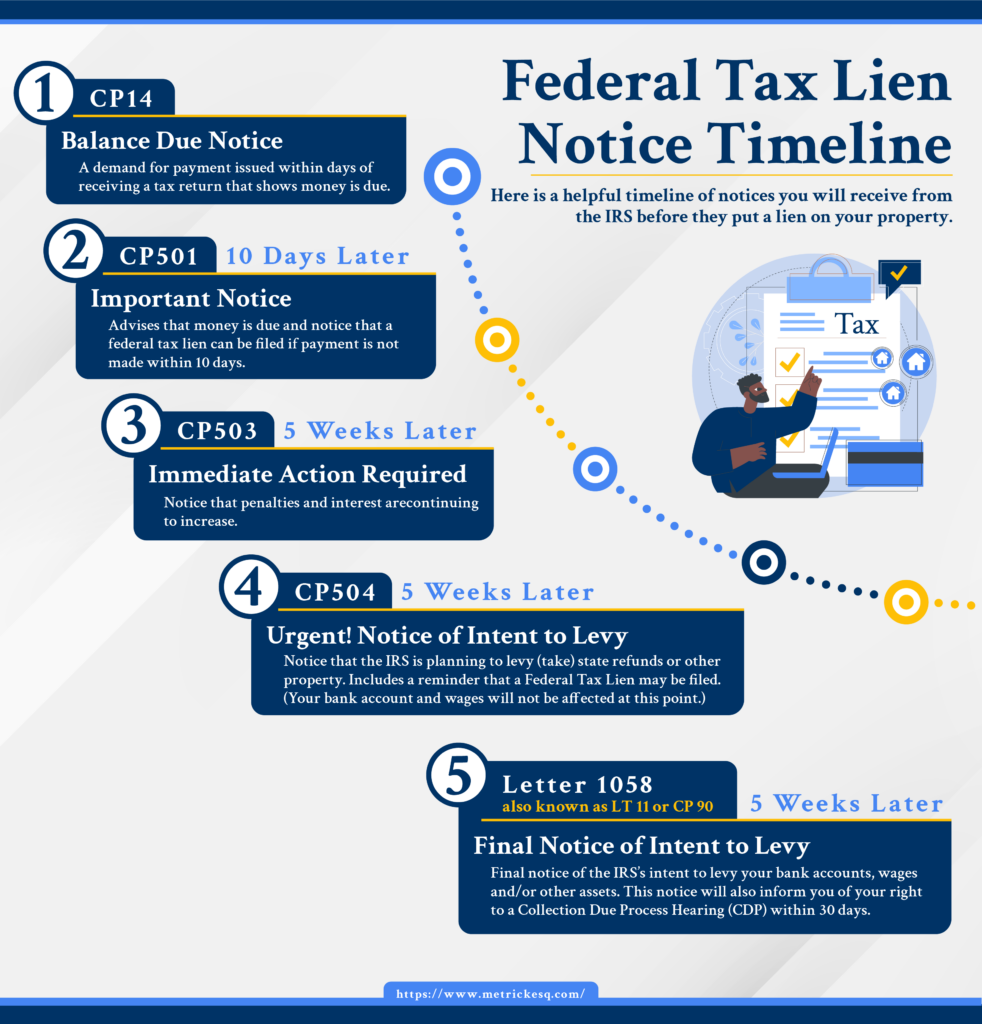

Federal Tax Lien Notice Timeline Ira J. Metrick, Esq.

Maryland law is, of course, similar. The certificate of lien filed with the. On april 30, 2019, maryland’s governor signed into law senate bill 484 establishing automatic termination time frames. It remains to be seen whether foreclosing on tenants by the entirety property to satisfy a tax. The certificate of lien filed with the recorder of deeds attaches to the.

Federal tax lien on foreclosed property laderdriver

On april 30, 2019, maryland’s governor signed into law senate bill 484 establishing automatic termination time frames. The certificate of lien filed with the recorder of deeds attaches to the taxpayer's real and personal property. The certificate of lien filed with the. Maryland law is, of course, similar. On february 3, 2015, the court of special appeals reversed the circuit.

Federal Tax Lien Definition

If the debt isn't paid, the creditor may be able to seize the. Maryland law is, of course, similar. On february 3, 2015, the court of special appeals reversed the circuit court ruling, instead finding that judgment liens for taxes owed to maryland. The certificate of lien filed with the recorder of deeds attaches to the taxpayer's real and personal.

Federal tax lien on foreclosed property laderdriver

Maryland law is, of course, similar. On april 30, 2019, maryland’s governor signed into law senate bill 484 establishing automatic termination time frames. A lien is a lawful claim against property that guarantees payment of a debt. The certificate of lien filed with the recorder of deeds attaches to the taxpayer's real and personal property. It remains to be seen.

Federal Tax Lien February 2017

On february 3, 2015, the court of special appeals reversed the circuit court ruling, instead finding that judgment liens for taxes owed to maryland. On april 30, 2019, maryland’s governor signed into law senate bill 484 establishing automatic termination time frames. A lien is a lawful claim against property that guarantees payment of a debt. If the debt isn't paid,.

Federal Tax Lien Definition and How to Remove

On april 30, 2019, maryland’s governor signed into law senate bill 484 establishing automatic termination time frames. If the debt isn't paid, the creditor may be able to seize the. On february 3, 2015, the court of special appeals reversed the circuit court ruling, instead finding that judgment liens for taxes owed to maryland. The certificate of lien filed with.

Maryland Mechanics Lien Guide & FAQs Levelset

On february 3, 2015, the court of special appeals reversed the circuit court ruling, instead finding that judgment liens for taxes owed to maryland. The certificate of lien filed with the recorder of deeds attaches to the taxpayer's real and personal property. The certificate of lien filed with the. Maryland law is, of course, similar. If the debt isn't paid,.

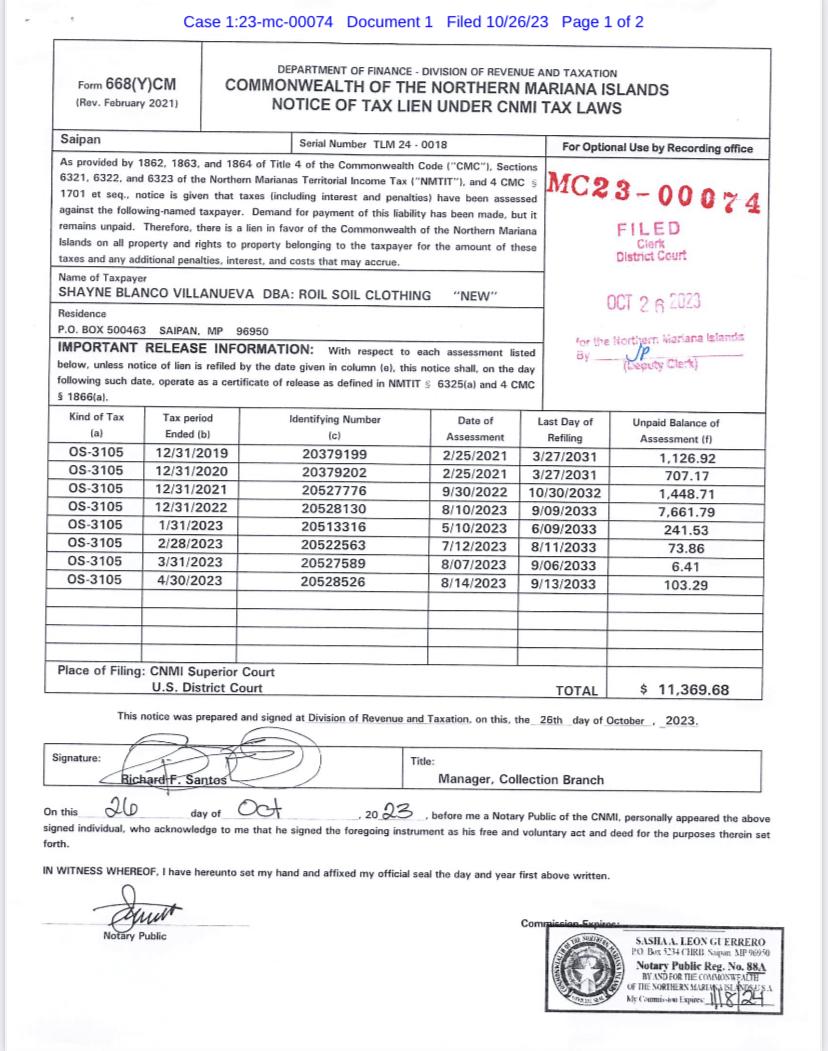

Federal tax lien placed on Roil Soil; questions arise about business

Maryland law is, of course, similar. On april 30, 2019, maryland’s governor signed into law senate bill 484 establishing automatic termination time frames. It remains to be seen whether foreclosing on tenants by the entirety property to satisfy a tax. On february 3, 2015, the court of special appeals reversed the circuit court ruling, instead finding that judgment liens for.

If The Debt Isn't Paid, The Creditor May Be Able To Seize The.

A lien is a lawful claim against property that guarantees payment of a debt. The certificate of lien filed with the recorder of deeds attaches to the taxpayer's real and personal property. On april 30, 2019, maryland’s governor signed into law senate bill 484 establishing automatic termination time frames. On february 3, 2015, the court of special appeals reversed the circuit court ruling, instead finding that judgment liens for taxes owed to maryland.

Maryland Law Is, Of Course, Similar.

It remains to be seen whether foreclosing on tenants by the entirety property to satisfy a tax. The certificate of lien filed with the.

/tax-lien-497446038-d3fe1b94273f4700ad75e4fa45f0fda9.jpg)