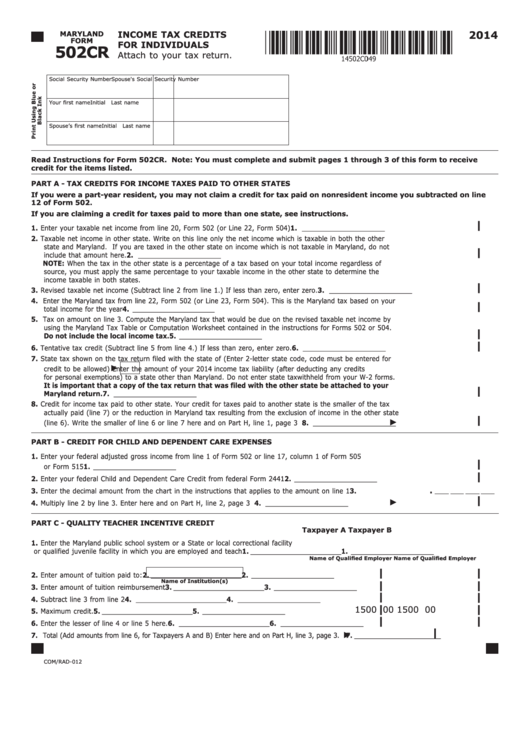

Maryland Form 502Cr 2022

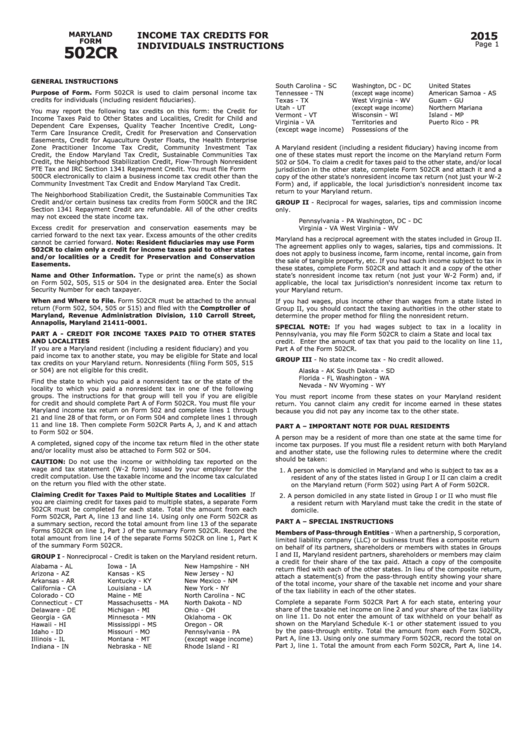

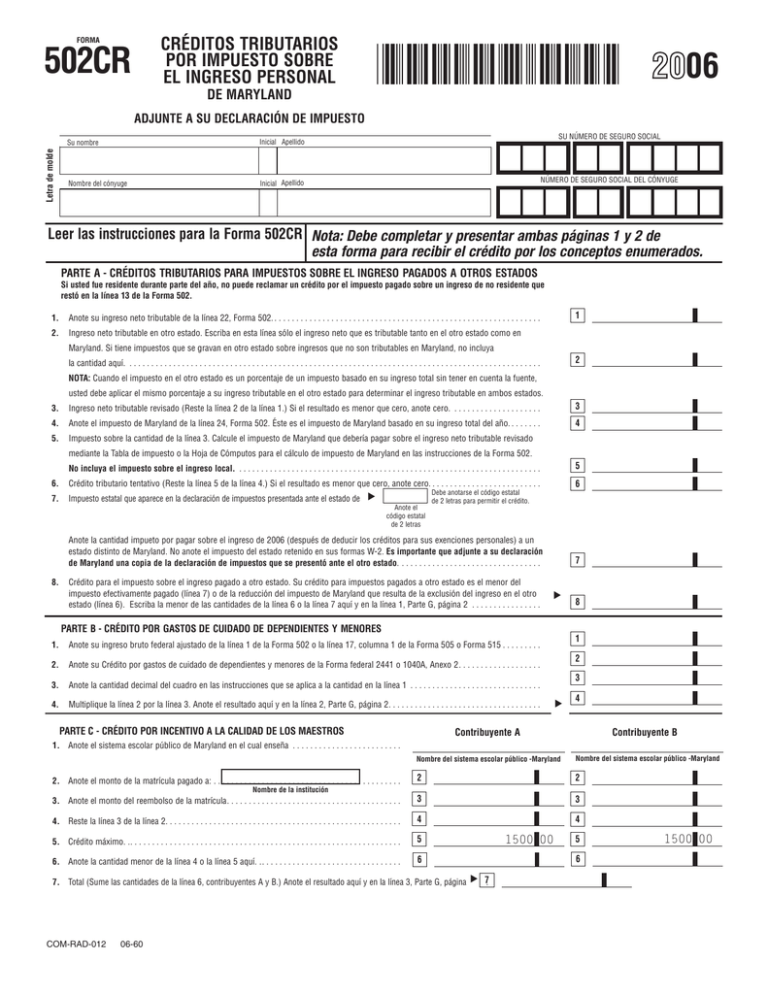

Maryland Form 502Cr 2022 - Forms are available for downloading in the resident individuals income tax forms section below. Taxable net income in other state. All other areas must be entered on the first 502cr. A person who is domiciled in maryland and who is subject to tax as a resident of any of the states listed in group i or ii can claim a credit on the. Additional 502crs may be entered for parts a and e only. Attach to your tax return. You must complete and submit pages 1 through 4 of this form to receive credit. Instructions for filing personal state and. Enter your taxable net income from line 20, form 502 (or line 10, form 504). Read instructions for form 502cr.

Additional 502crs may be entered for parts a and e only. Enter your taxable net income from line 20, form 502 (or line 10, form 504). Taxable net income in other state. Instructions for filing personal state and. All other areas must be entered on the first 502cr. A person who is domiciled in maryland and who is subject to tax as a resident of any of the states listed in group i or ii can claim a credit on the. Attach to your tax return. You must complete and submit pages 1 through 4 of this form to receive credit. Read instructions for form 502cr. Forms are available for downloading in the resident individuals income tax forms section below.

A person who is domiciled in maryland and who is subject to tax as a resident of any of the states listed in group i or ii can claim a credit on the. You must complete and submit pages 1 through 4 of this form to receive credit. All other areas must be entered on the first 502cr. Additional 502crs may be entered for parts a and e only. Instructions for filing personal state and. Taxable net income in other state. Attach to your tax return. Forms are available for downloading in the resident individuals income tax forms section below. Read instructions for form 502cr. Enter your taxable net income from line 20, form 502 (or line 10, form 504).

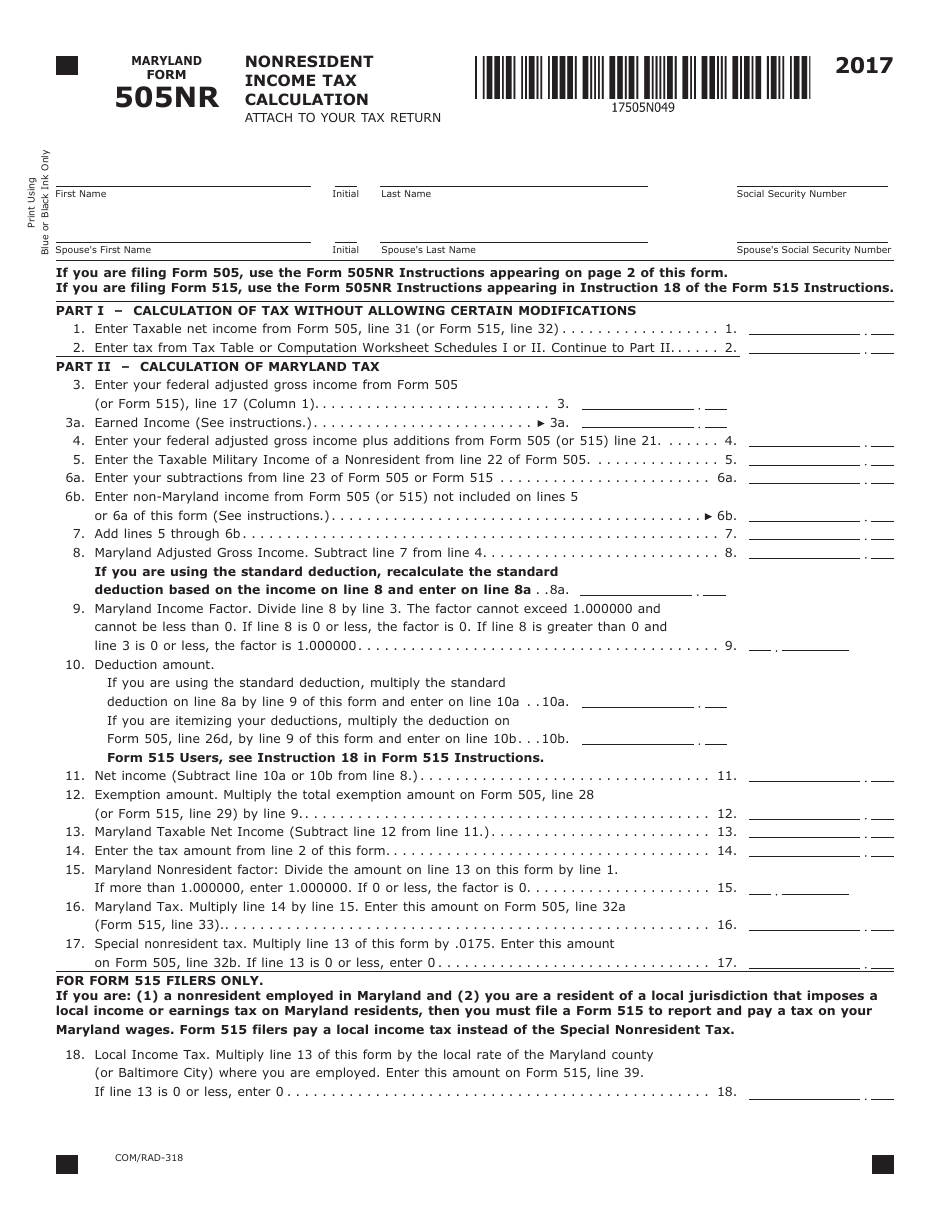

Maryland Form 505NR Download Fillable PDF or Fill Online

Attach to your tax return. A person who is domiciled in maryland and who is subject to tax as a resident of any of the states listed in group i or ii can claim a credit on the. You must complete and submit pages 1 through 4 of this form to receive credit. All other areas must be entered on.

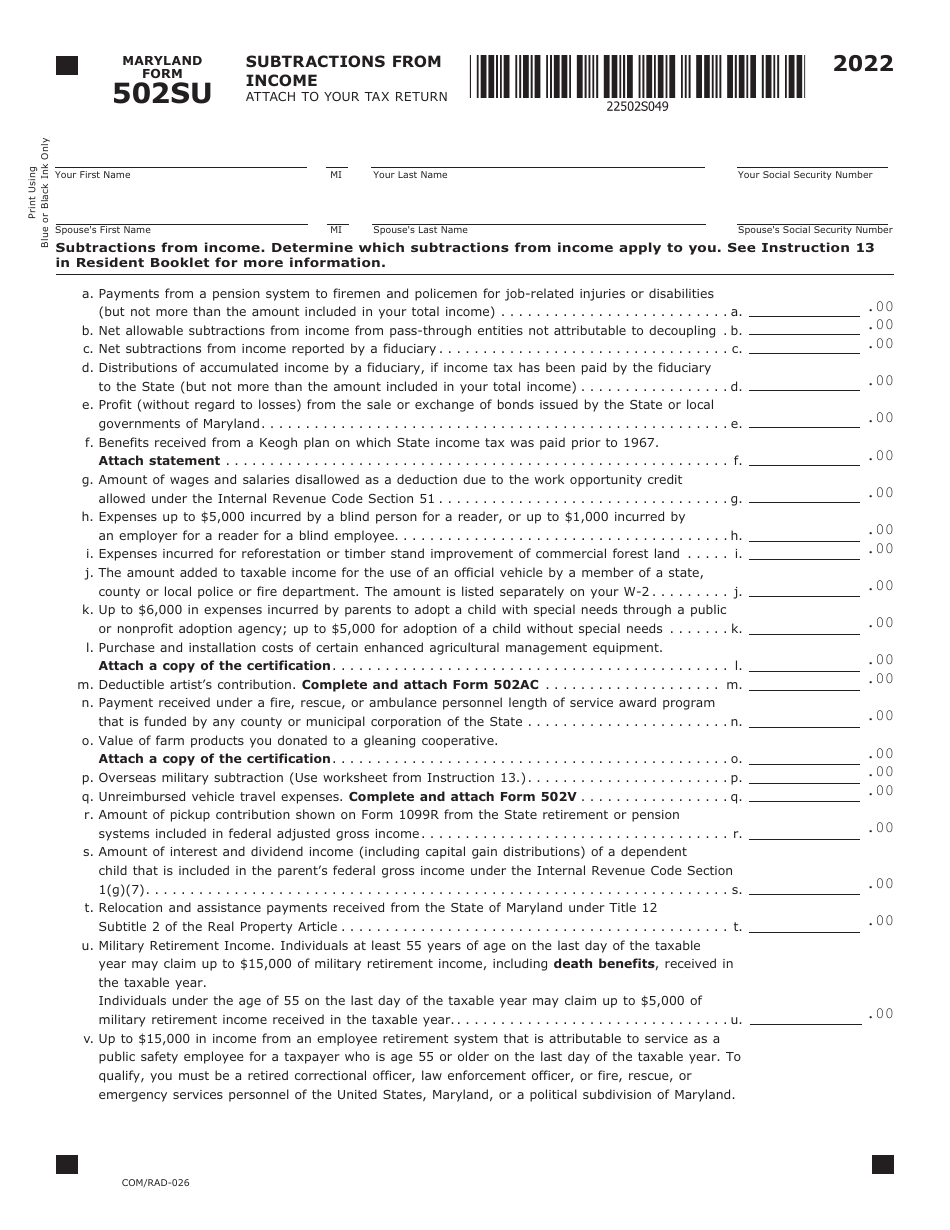

Maryland Form 502SU 2022 Fill Out, Sign Online and

Taxable net income in other state. Instructions for filing personal state and. Enter your taxable net income from line 20, form 502 (or line 10, form 504). Read instructions for form 502cr. Forms are available for downloading in the resident individuals income tax forms section below.

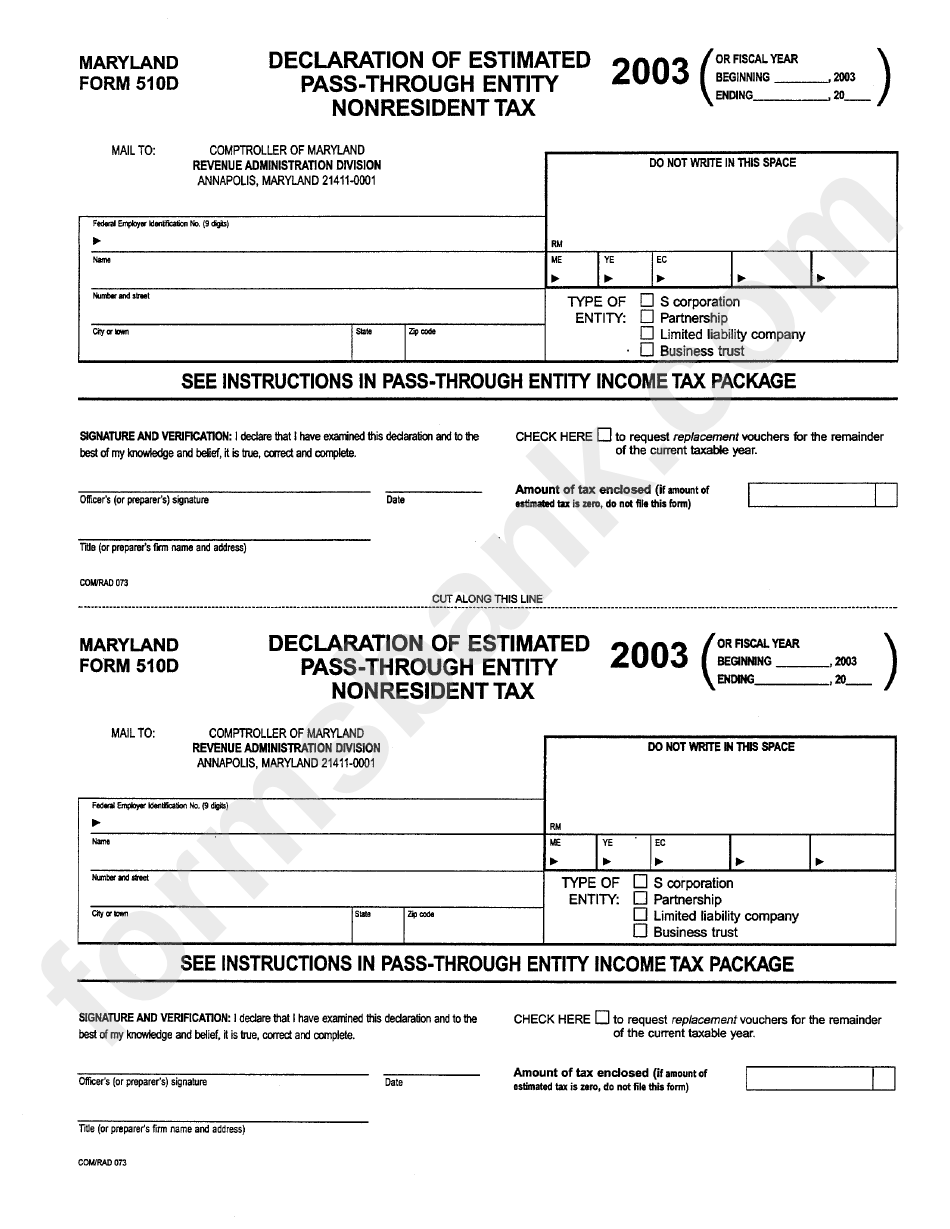

Maryland Tax Forms Printable Printable Forms Free Online

A person who is domiciled in maryland and who is subject to tax as a resident of any of the states listed in group i or ii can claim a credit on the. Attach to your tax return. All other areas must be entered on the first 502cr. Additional 502crs may be entered for parts a and e only. Enter.

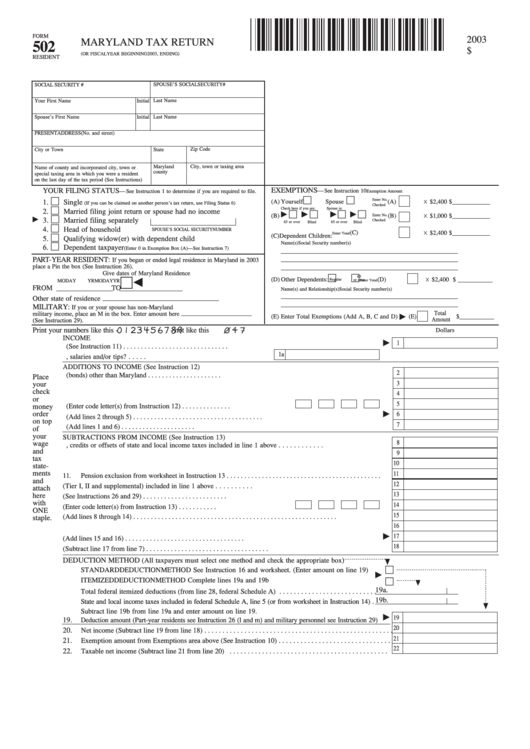

Blank Fillable Maryland Tax Return 502 Fillable Form 2024

Additional 502crs may be entered for parts a and e only. Instructions for filing personal state and. Attach to your tax return. All other areas must be entered on the first 502cr. You must complete and submit pages 1 through 4 of this form to receive credit.

Fillable Maryland Form 502cr Tax Credits For Individuals

Read instructions for form 502cr. Enter your taxable net income from line 20, form 502 (or line 10, form 504). Attach to your tax return. Taxable net income in other state. Instructions for filing personal state and.

Fillable Online Maryland Form 502CR Tax Credits for Individuals

Read instructions for form 502cr. A person who is domiciled in maryland and who is subject to tax as a resident of any of the states listed in group i or ii can claim a credit on the. Attach to your tax return. All other areas must be entered on the first 502cr. Additional 502crs may be entered for parts.

Instructions For Maryland Form 502cr Tax Credits For

You must complete and submit pages 1 through 4 of this form to receive credit. Additional 502crs may be entered for parts a and e only. Enter your taxable net income from line 20, form 502 (or line 10, form 504). Taxable net income in other state. A person who is domiciled in maryland and who is subject to tax.

502CR Maryland Tax Forms and Instructions

All other areas must be entered on the first 502cr. Forms are available for downloading in the resident individuals income tax forms section below. Read instructions for form 502cr. You must complete and submit pages 1 through 4 of this form to receive credit. Enter your taxable net income from line 20, form 502 (or line 10, form 504).

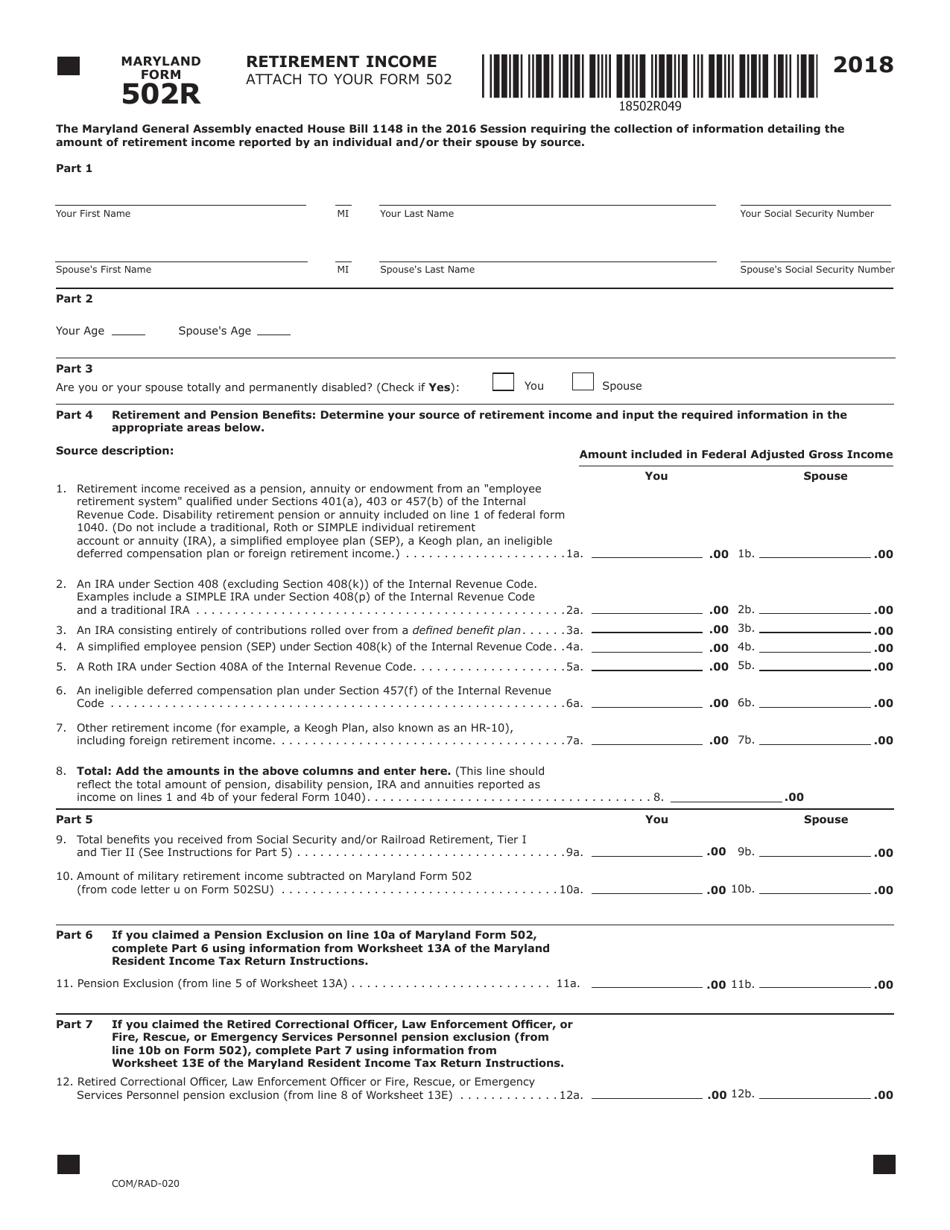

Form COM/RAD020 (Maryland Form 502R) 2018 Fill Out, Sign Online

All other areas must be entered on the first 502cr. Forms are available for downloading in the resident individuals income tax forms section below. Taxable net income in other state. Instructions for filing personal state and. Enter your taxable net income from line 20, form 502 (or line 10, form 504).

Fill Free fillable forms Comptroller of Maryland

Additional 502crs may be entered for parts a and e only. A person who is domiciled in maryland and who is subject to tax as a resident of any of the states listed in group i or ii can claim a credit on the. Instructions for filing personal state and. Attach to your tax return. All other areas must be.

You Must Complete And Submit Pages 1 Through 4 Of This Form To Receive Credit.

Taxable net income in other state. A person who is domiciled in maryland and who is subject to tax as a resident of any of the states listed in group i or ii can claim a credit on the. Attach to your tax return. Enter your taxable net income from line 20, form 502 (or line 10, form 504).

Additional 502Crs May Be Entered For Parts A And E Only.

Instructions for filing personal state and. All other areas must be entered on the first 502cr. Forms are available for downloading in the resident individuals income tax forms section below. Read instructions for form 502cr.