Local Withholding Tax Pa

Local Withholding Tax Pa - 10k+ visitors in the past month 10k+ visitors in the past month Pennsylvania law requires employers to withhold pennsylvania personal income tax from employees’ compensation in two common. You are required to withhold the higher of the two eit rates, as well as the local services tax (lst), and make remittances to the local tax. Learn about act 32 and local earned income tax (eit) and local services tax (lst) for employers and employees in pa. Find your psd codes and eit rates for local income tax purposes in pennsylvania. We recommend you contact the county, municipality and/or school district provided as a match for the address you entered to confirm. Learn how to use the psd codes, search by address, and.

Pennsylvania law requires employers to withhold pennsylvania personal income tax from employees’ compensation in two common. 10k+ visitors in the past month We recommend you contact the county, municipality and/or school district provided as a match for the address you entered to confirm. You are required to withhold the higher of the two eit rates, as well as the local services tax (lst), and make remittances to the local tax. Find your psd codes and eit rates for local income tax purposes in pennsylvania. Learn about act 32 and local earned income tax (eit) and local services tax (lst) for employers and employees in pa. Learn how to use the psd codes, search by address, and. 10k+ visitors in the past month

Find your psd codes and eit rates for local income tax purposes in pennsylvania. 10k+ visitors in the past month Learn how to use the psd codes, search by address, and. Pennsylvania law requires employers to withhold pennsylvania personal income tax from employees’ compensation in two common. 10k+ visitors in the past month Learn about act 32 and local earned income tax (eit) and local services tax (lst) for employers and employees in pa. We recommend you contact the county, municipality and/or school district provided as a match for the address you entered to confirm. You are required to withhold the higher of the two eit rates, as well as the local services tax (lst), and make remittances to the local tax.

Pa Withholding Tax 2024 Essa Ofella

You are required to withhold the higher of the two eit rates, as well as the local services tax (lst), and make remittances to the local tax. 10k+ visitors in the past month Find your psd codes and eit rates for local income tax purposes in pennsylvania. Pennsylvania law requires employers to withhold pennsylvania personal income tax from employees’ compensation.

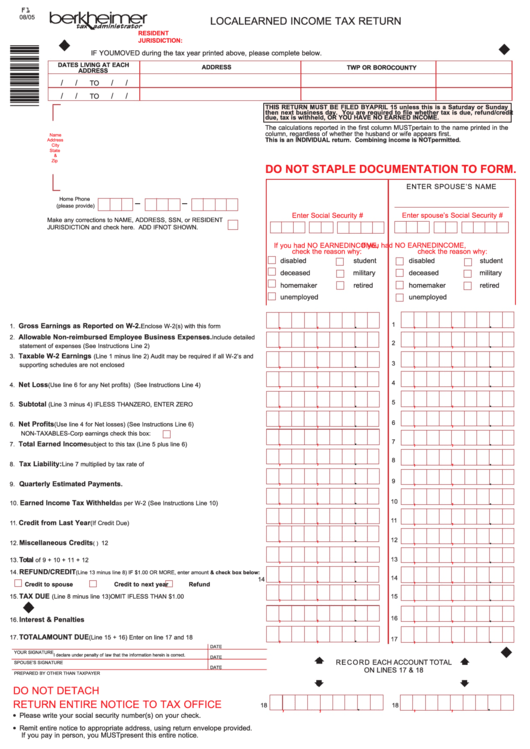

REV414 (P/S) 2014 PA Nonresident Withholding Tax Worksheet Free Download

Learn about act 32 and local earned income tax (eit) and local services tax (lst) for employers and employees in pa. Pennsylvania law requires employers to withhold pennsylvania personal income tax from employees’ compensation in two common. Learn how to use the psd codes, search by address, and. You are required to withhold the higher of the two eit rates,.

Pa State Tax Withholding Form

Find your psd codes and eit rates for local income tax purposes in pennsylvania. You are required to withhold the higher of the two eit rates, as well as the local services tax (lst), and make remittances to the local tax. 10k+ visitors in the past month We recommend you contact the county, municipality and/or school district provided as a.

Withholding Tax On Residents Section 153 » Withholding Taxes In Pakistan

Learn how to use the psd codes, search by address, and. Find your psd codes and eit rates for local income tax purposes in pennsylvania. 10k+ visitors in the past month Learn about act 32 and local earned income tax (eit) and local services tax (lst) for employers and employees in pa. 10k+ visitors in the past month

State Withholding Tax Forms

Learn how to use the psd codes, search by address, and. 10k+ visitors in the past month 10k+ visitors in the past month Learn about act 32 and local earned income tax (eit) and local services tax (lst) for employers and employees in pa. Find your psd codes and eit rates for local income tax purposes in pennsylvania.

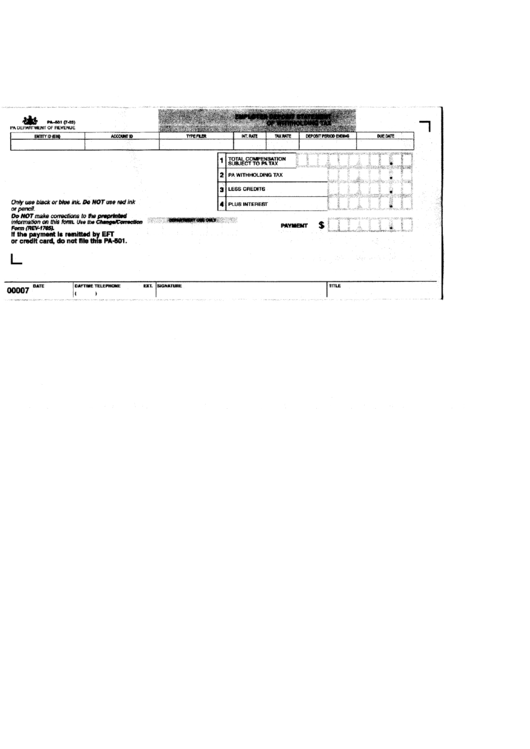

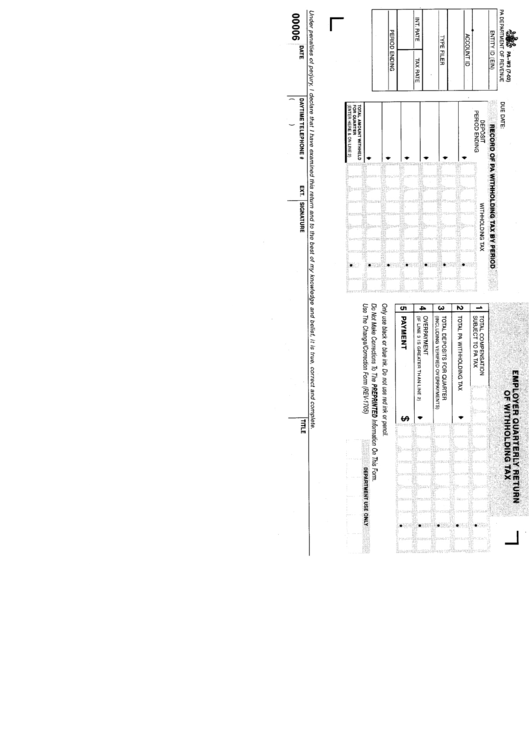

Form Pa501 Employer Deposit Statement Of Withholding Tax printable

We recommend you contact the county, municipality and/or school district provided as a match for the address you entered to confirm. 10k+ visitors in the past month Learn how to use the psd codes, search by address, and. 10k+ visitors in the past month Learn about act 32 and local earned income tax (eit) and local services tax (lst) for.

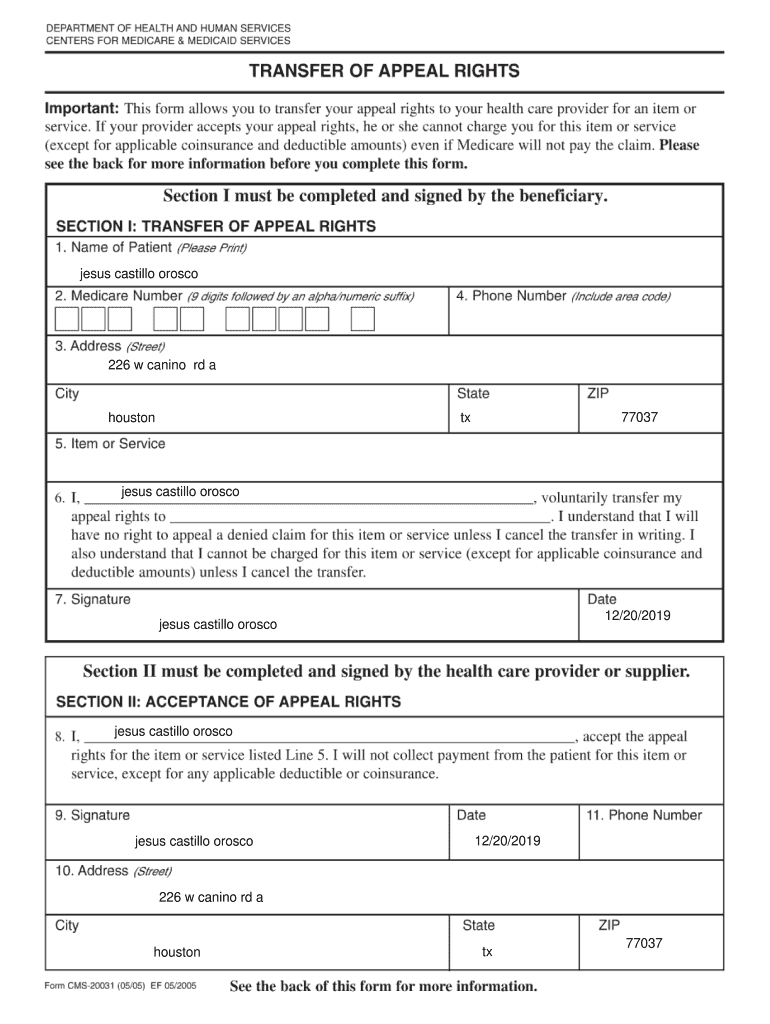

Local Pa Resident Tax Withholding Form

Learn about act 32 and local earned income tax (eit) and local services tax (lst) for employers and employees in pa. Pennsylvania law requires employers to withhold pennsylvania personal income tax from employees’ compensation in two common. We recommend you contact the county, municipality and/or school district provided as a match for the address you entered to confirm. 10k+ visitors.

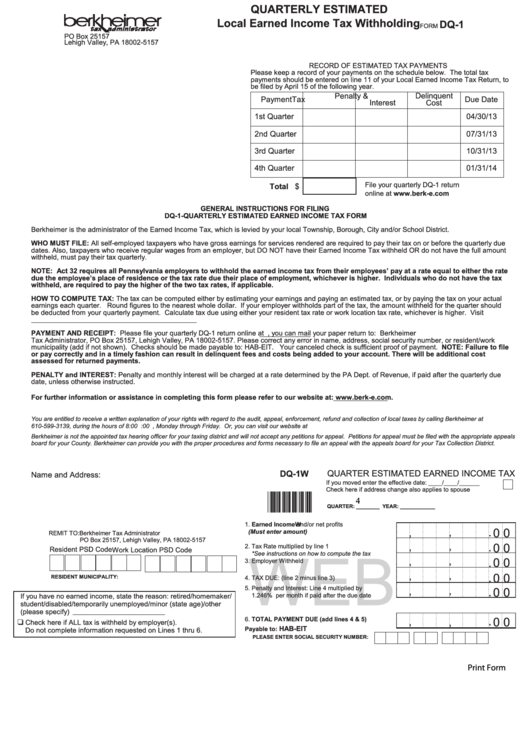

Pennsylvania Local Earned Tax Withholding Form

We recommend you contact the county, municipality and/or school district provided as a match for the address you entered to confirm. Learn about act 32 and local earned income tax (eit) and local services tax (lst) for employers and employees in pa. You are required to withhold the higher of the two eit rates, as well as the local services.

Pa State Withholding Tax Form

Find your psd codes and eit rates for local income tax purposes in pennsylvania. 10k+ visitors in the past month Learn about act 32 and local earned income tax (eit) and local services tax (lst) for employers and employees in pa. We recommend you contact the county, municipality and/or school district provided as a match for the address you entered.

Tax Withholding Calculator 2025 Federal Tax Zrivo

Learn how to use the psd codes, search by address, and. 10k+ visitors in the past month Pennsylvania law requires employers to withhold pennsylvania personal income tax from employees’ compensation in two common. We recommend you contact the county, municipality and/or school district provided as a match for the address you entered to confirm. Find your psd codes and eit.

10K+ Visitors In The Past Month

We recommend you contact the county, municipality and/or school district provided as a match for the address you entered to confirm. Find your psd codes and eit rates for local income tax purposes in pennsylvania. 10k+ visitors in the past month Pennsylvania law requires employers to withhold pennsylvania personal income tax from employees’ compensation in two common.

You Are Required To Withhold The Higher Of The Two Eit Rates, As Well As The Local Services Tax (Lst), And Make Remittances To The Local Tax.

Learn how to use the psd codes, search by address, and. Learn about act 32 and local earned income tax (eit) and local services tax (lst) for employers and employees in pa.