Local Tax Rate Austin

Local Tax Rate Austin - The december 2020 total local sales tax rate was also 8.250%. If you have questions about local sales and use tax rate information,. The minimum combined 2025 sales tax rate for austin, texas is 8.25%. In the tabs below, discover new map and latitude/longitude search options alongside the. Welcome to the new sales tax rate locator. Texas has a 6.25% sales tax and travis county collects an additional n/a, so the minimum sales tax rate in travis county is 6.25% (not including. The state of texas assesses a 6.7% gross receipts tax and an 8.25% sales tax on mixed beverages. The combined area local code is used to distinguish unique areas in which a portion of a city overlaps another taxing jurisdiction,. View the printable version of city rates (pdf). The current total local sales tax rate in austin, tx is 8.250%.

The combined area local code is used to distinguish unique areas in which a portion of a city overlaps another taxing jurisdiction,. The current total local sales tax rate in austin, tx is 8.250%. This is the total of state, county, and city sales tax rates. Welcome to the new sales tax rate locator. Texas has a 6.25% sales tax and travis county collects an additional n/a, so the minimum sales tax rate in travis county is 6.25% (not including. View the printable version of city rates (pdf). The minimum combined 2025 sales tax rate for austin, texas is 8.25%. In the tabs below, discover new map and latitude/longitude search options alongside the. The december 2020 total local sales tax rate was also 8.250%. If you have questions about local sales and use tax rate information,.

Welcome to the new sales tax rate locator. The current total local sales tax rate in austin, tx is 8.250%. In the tabs below, discover new map and latitude/longitude search options alongside the. The minimum combined 2025 sales tax rate for austin, texas is 8.25%. This is the total of state, county, and city sales tax rates. View the printable version of city rates (pdf). Texas has a 6.25% sales tax and travis county collects an additional n/a, so the minimum sales tax rate in travis county is 6.25% (not including. The combined area local code is used to distinguish unique areas in which a portion of a city overlaps another taxing jurisdiction,. The december 2020 total local sales tax rate was also 8.250%. The state of texas assesses a 6.7% gross receipts tax and an 8.25% sales tax on mixed beverages.

Elevated Tax & Accounting ETA always on time Tax & Accounting

Welcome to the new sales tax rate locator. The december 2020 total local sales tax rate was also 8.250%. The state of texas assesses a 6.7% gross receipts tax and an 8.25% sales tax on mixed beverages. The minimum combined 2025 sales tax rate for austin, texas is 8.25%. View the printable version of city rates (pdf).

Austin Approves 3.9 Billion Budget With Property Tax Rate Of .4448

The combined area local code is used to distinguish unique areas in which a portion of a city overlaps another taxing jurisdiction,. The state of texas assesses a 6.7% gross receipts tax and an 8.25% sales tax on mixed beverages. Texas has a 6.25% sales tax and travis county collects an additional n/a, so the minimum sales tax rate in.

How is Tax Rate determined to calculate property taxes? Square Deal Blog

The december 2020 total local sales tax rate was also 8.250%. View the printable version of city rates (pdf). Texas has a 6.25% sales tax and travis county collects an additional n/a, so the minimum sales tax rate in travis county is 6.25% (not including. The combined area local code is used to distinguish unique areas in which a portion.

Arkansas Tax Rate Explained Clearly

Welcome to the new sales tax rate locator. The state of texas assesses a 6.7% gross receipts tax and an 8.25% sales tax on mixed beverages. If you have questions about local sales and use tax rate information,. The minimum combined 2025 sales tax rate for austin, texas is 8.25%. This is the total of state, county, and city sales.

Private Limited Company Tax Rate (All You Need to Know)

If you have questions about local sales and use tax rate information,. Welcome to the new sales tax rate locator. The combined area local code is used to distinguish unique areas in which a portion of a city overlaps another taxing jurisdiction,. The state of texas assesses a 6.7% gross receipts tax and an 8.25% sales tax on mixed beverages..

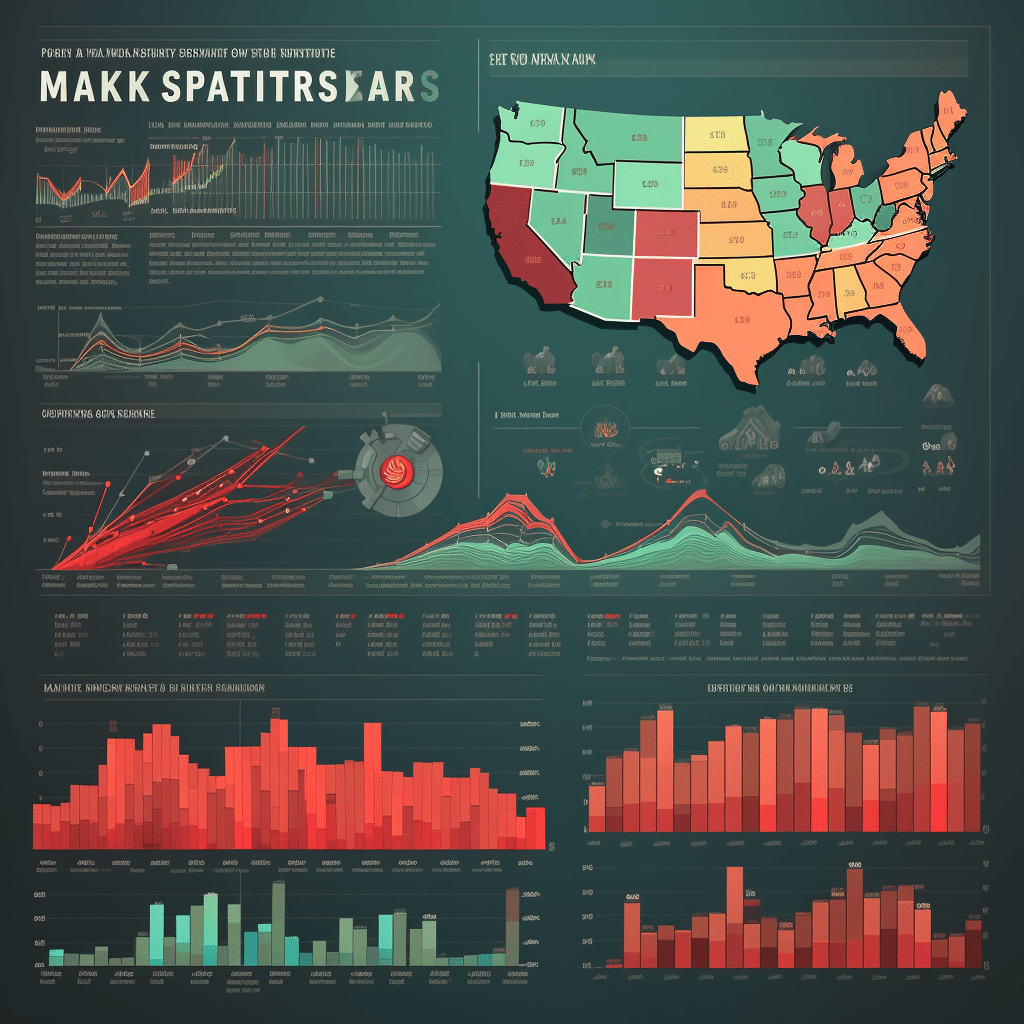

State and Local Sales Tax Rates in 2014 Tax Foundation

Welcome to the new sales tax rate locator. The state of texas assesses a 6.7% gross receipts tax and an 8.25% sales tax on mixed beverages. The current total local sales tax rate in austin, tx is 8.250%. If you have questions about local sales and use tax rate information,. View the printable version of city rates (pdf).

Tax Rate Comparison Olympia CUSD 16

The minimum combined 2025 sales tax rate for austin, texas is 8.25%. Texas has a 6.25% sales tax and travis county collects an additional n/a, so the minimum sales tax rate in travis county is 6.25% (not including. View the printable version of city rates (pdf). The state of texas assesses a 6.7% gross receipts tax and an 8.25% sales.

State local effective tax rates map Infogram

Texas has a 6.25% sales tax and travis county collects an additional n/a, so the minimum sales tax rate in travis county is 6.25% (not including. The minimum combined 2025 sales tax rate for austin, texas is 8.25%. This is the total of state, county, and city sales tax rates. The current total local sales tax rate in austin, tx.

What is my tax rate? Local Governance Reform City of Bathurst

The december 2020 total local sales tax rate was also 8.250%. The minimum combined 2025 sales tax rate for austin, texas is 8.25%. The state of texas assesses a 6.7% gross receipts tax and an 8.25% sales tax on mixed beverages. The combined area local code is used to distinguish unique areas in which a portion of a city overlaps.

Map of Property Tax Rate by ZIP Code Area 2015 — Emily Ross Contractor

The state of texas assesses a 6.7% gross receipts tax and an 8.25% sales tax on mixed beverages. The minimum combined 2025 sales tax rate for austin, texas is 8.25%. The december 2020 total local sales tax rate was also 8.250%. The current total local sales tax rate in austin, tx is 8.250%. This is the total of state, county,.

View The Printable Version Of City Rates (Pdf).

In the tabs below, discover new map and latitude/longitude search options alongside the. The december 2020 total local sales tax rate was also 8.250%. The minimum combined 2025 sales tax rate for austin, texas is 8.25%. Texas has a 6.25% sales tax and travis county collects an additional n/a, so the minimum sales tax rate in travis county is 6.25% (not including.

If You Have Questions About Local Sales And Use Tax Rate Information,.

Welcome to the new sales tax rate locator. This is the total of state, county, and city sales tax rates. The state of texas assesses a 6.7% gross receipts tax and an 8.25% sales tax on mixed beverages. The combined area local code is used to distinguish unique areas in which a portion of a city overlaps another taxing jurisdiction,.

.png)