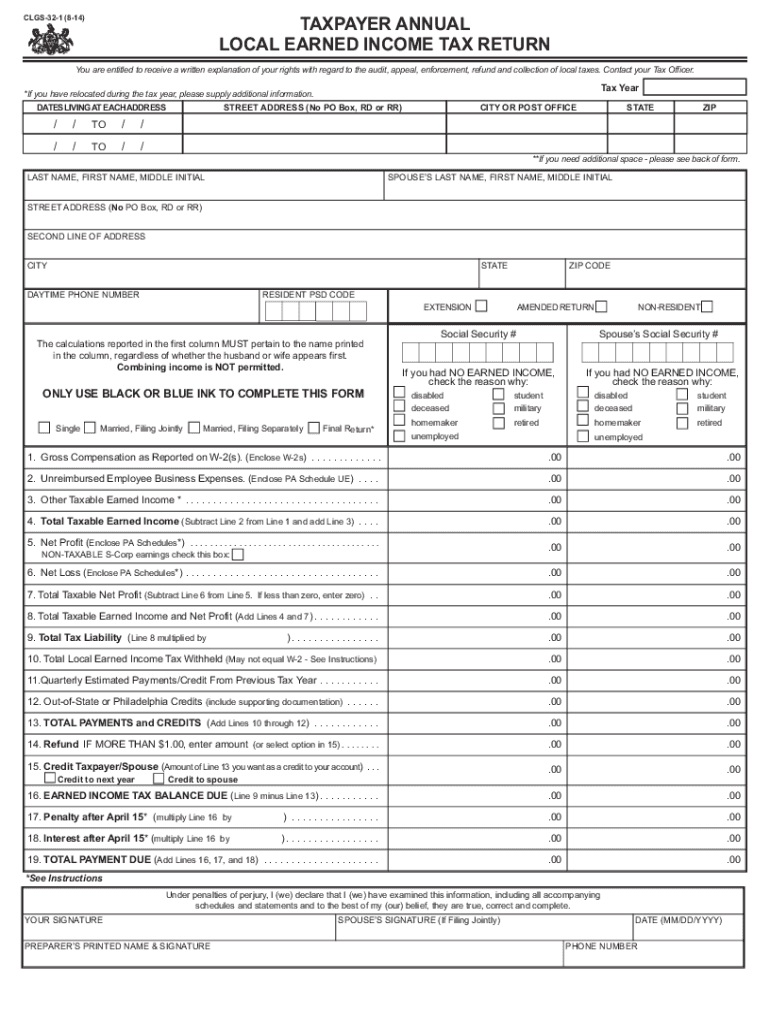

Local Income Tax Forms For Pa

Local Income Tax Forms For Pa - Remit to the local earned income tax collector for every tax collection district in which you lived during the year. Locate and download forms needed to complete your filing and payment processes. Pennsylvania residents with earned income or net profits must file a local earned income tax return online or by mail by april 15. Employers with worksites located in pennsylvania are required. The pennsylvania local income tax exchange (palite) system allows taxpayers in participating localities to quickly prepare a tax return, which. To get started, refine your search using the search settings. Employers with worksites located in pennsylvania are required to withhold and remit the local. Dced local government services act 32: Part year resident eit worksheet use this form if you have moved during the tax year to allocate earnings/tax to each residence. Local income tax requirements for employers.

Pennsylvania residents with earned income or net profits must file a local earned income tax return online or by mail by april 15. To get started, refine your search using the search settings. Locate and download forms needed to complete your filing and payment processes. Dced local government services act 32: Remit to the local earned income tax collector for every tax collection district in which you lived during the year. Part year resident eit worksheet use this form if you have moved during the tax year to allocate earnings/tax to each residence. Local income tax requirements for employers. The pennsylvania local income tax exchange (palite) system allows taxpayers in participating localities to quickly prepare a tax return, which. Employers with worksites located in pennsylvania are required to withhold and remit the local. Employers with worksites located in pennsylvania are required.

Employers with worksites located in pennsylvania are required to withhold and remit the local. Local income tax requirements for employers. Dced local government services act 32: To get started, refine your search using the search settings. Part year resident eit worksheet use this form if you have moved during the tax year to allocate earnings/tax to each residence. The pennsylvania local income tax exchange (palite) system allows taxpayers in participating localities to quickly prepare a tax return, which. Pennsylvania residents with earned income or net profits must file a local earned income tax return online or by mail by april 15. Employers with worksites located in pennsylvania are required. Locate and download forms needed to complete your filing and payment processes. Remit to the local earned income tax collector for every tax collection district in which you lived during the year.

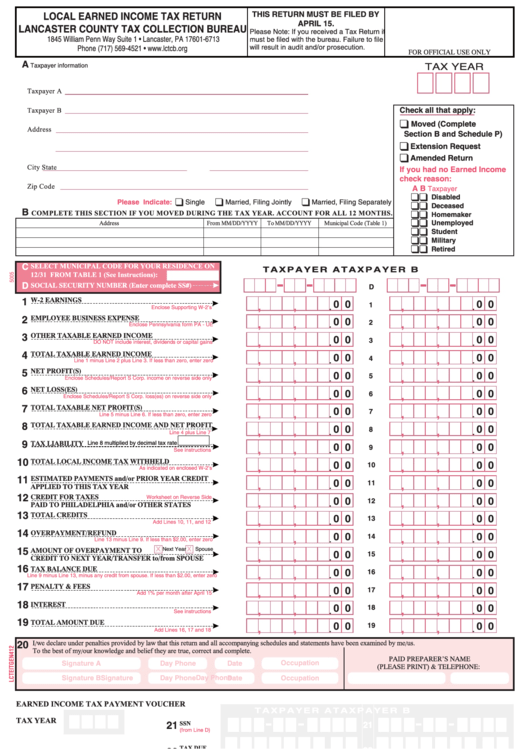

Cumberland County Pa Local Earned Tax Return

Employers with worksites located in pennsylvania are required to withhold and remit the local. Pennsylvania residents with earned income or net profits must file a local earned income tax return online or by mail by april 15. Employers with worksites located in pennsylvania are required. To get started, refine your search using the search settings. Local income tax requirements for.

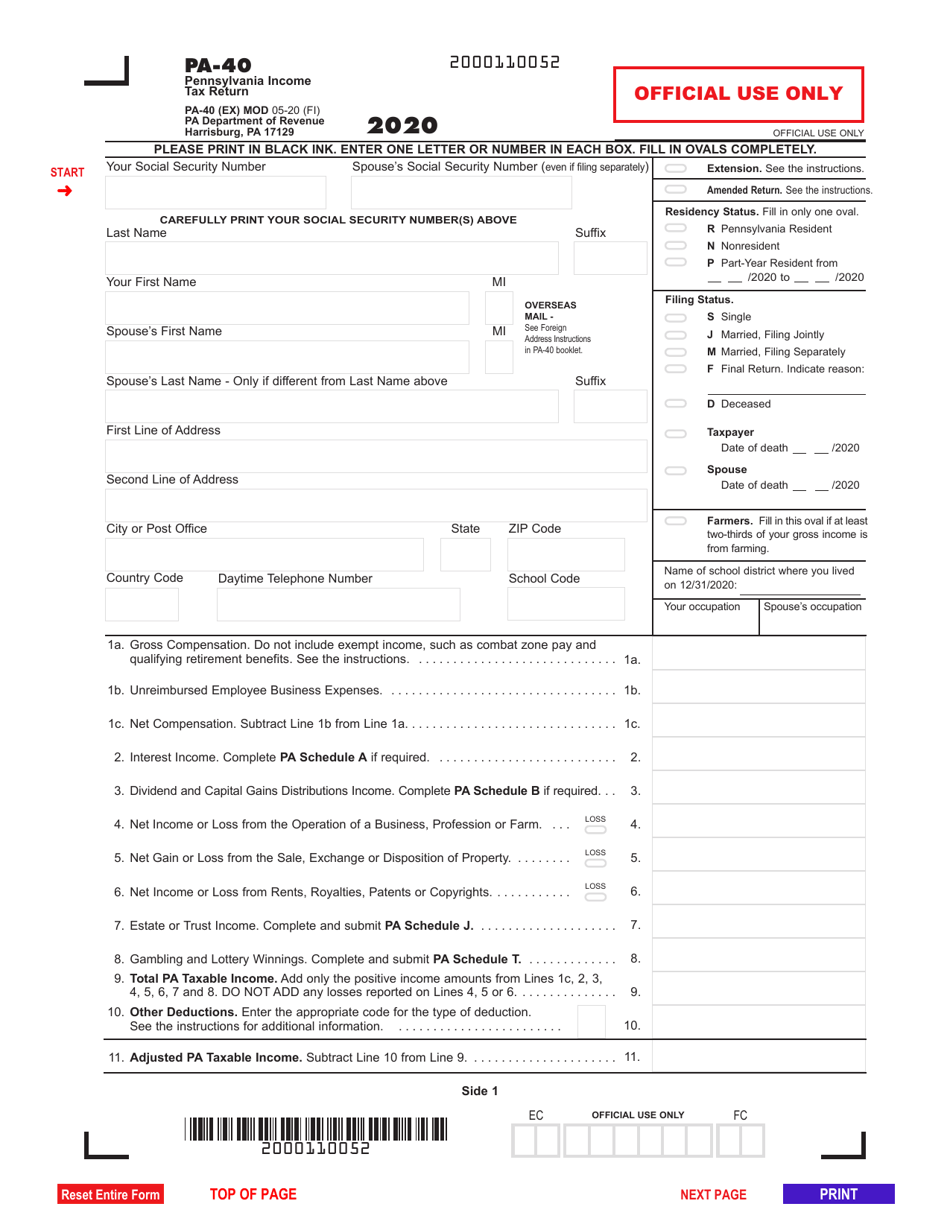

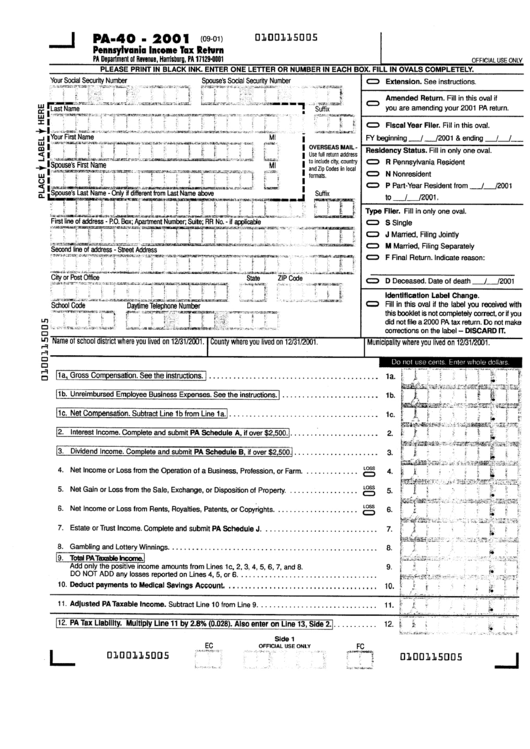

Pa Tax Forms Printable Printable Forms Free Online

To get started, refine your search using the search settings. Local income tax requirements for employers. Employers with worksites located in pennsylvania are required to withhold and remit the local. Remit to the local earned income tax collector for every tax collection district in which you lived during the year. Locate and download forms needed to complete your filing and.

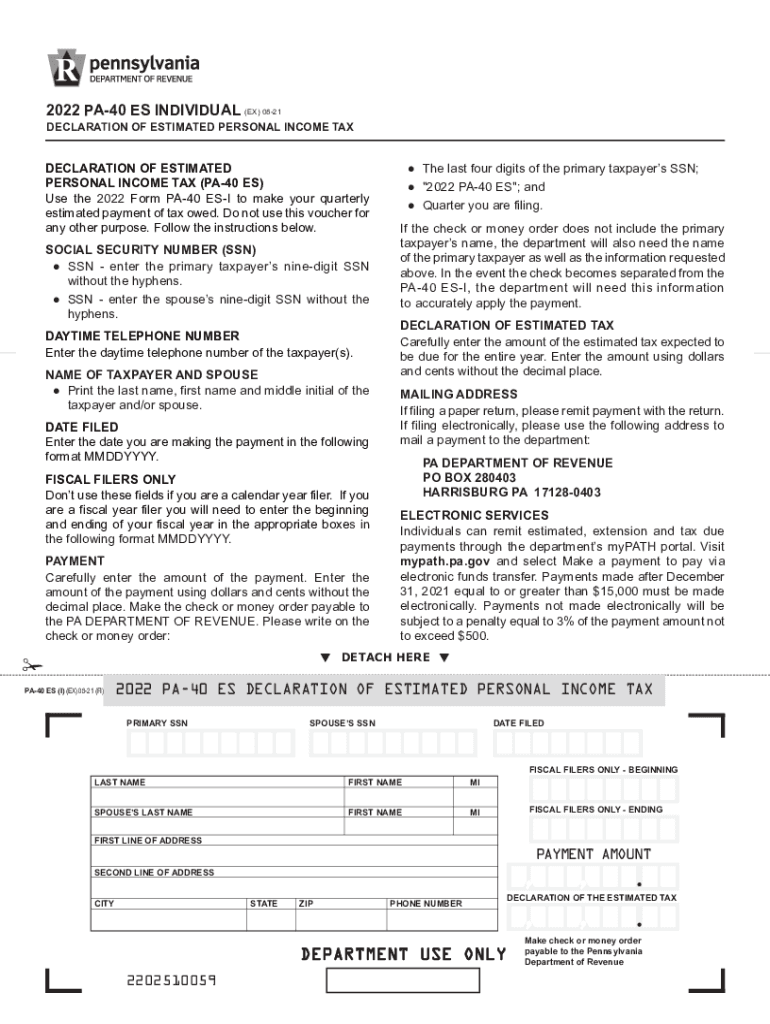

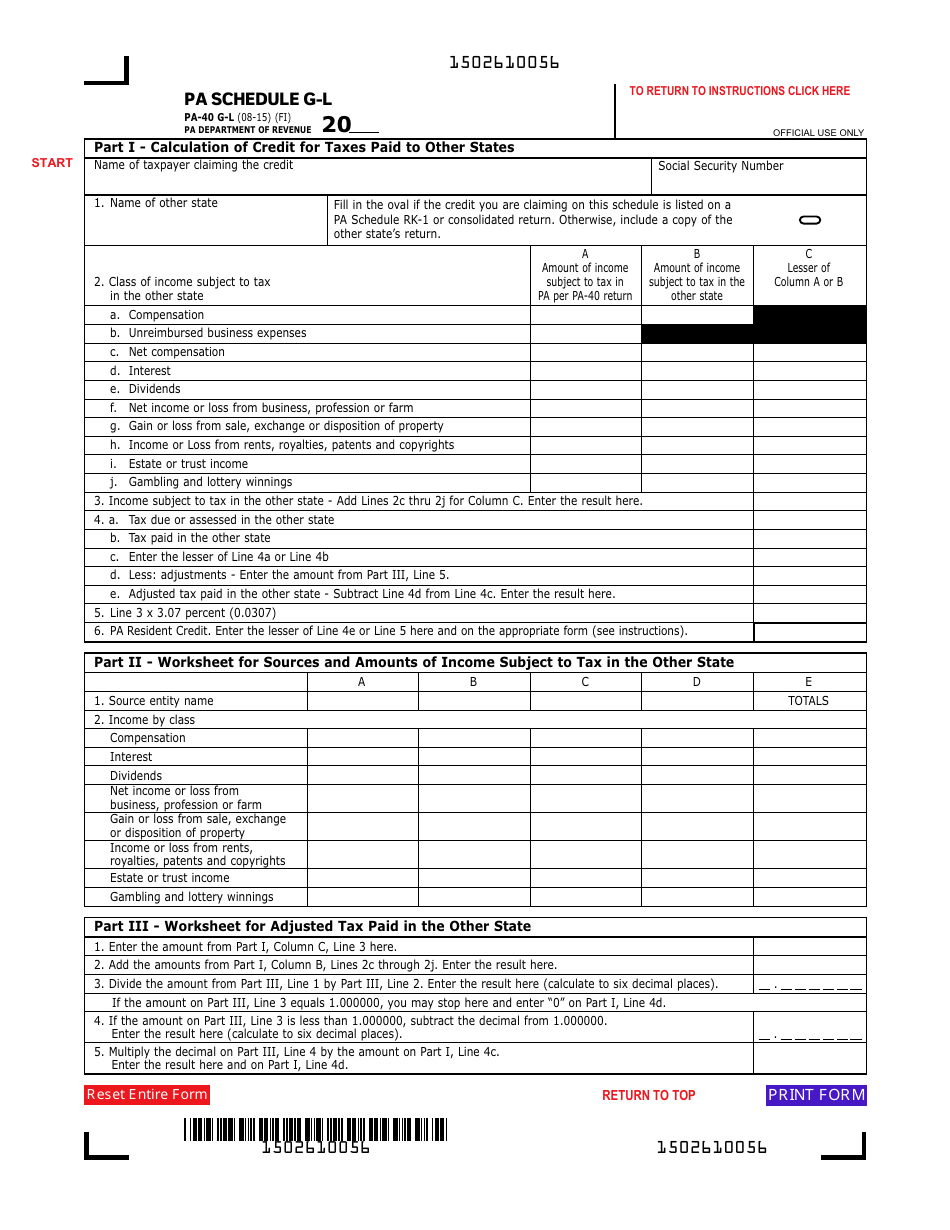

20162024 Form PA DCED CLGS321 Fill Online, Printable, Fillable

Local income tax requirements for employers. The pennsylvania local income tax exchange (palite) system allows taxpayers in participating localities to quickly prepare a tax return, which. Employers with worksites located in pennsylvania are required to withhold and remit the local. Dced local government services act 32: Locate and download forms needed to complete your filing and payment processes.

Printable Pa Tax Forms 2023 Printable Forms Free Online

Employers with worksites located in pennsylvania are required. Local income tax requirements for employers. Pennsylvania residents with earned income or net profits must file a local earned income tax return online or by mail by april 15. Part year resident eit worksheet use this form if you have moved during the tax year to allocate earnings/tax to each residence. To.

Printable Pa Tax Forms

Employers with worksites located in pennsylvania are required. Part year resident eit worksheet use this form if you have moved during the tax year to allocate earnings/tax to each residence. Employers with worksites located in pennsylvania are required to withhold and remit the local. Dced local government services act 32: Remit to the local earned income tax collector for every.

Local Earned Tax Return Form Lancaster County 2005 Printable

Employers with worksites located in pennsylvania are required to withhold and remit the local. Locate and download forms needed to complete your filing and payment processes. Remit to the local earned income tax collector for every tax collection district in which you lived during the year. Pennsylvania residents with earned income or net profits must file a local earned income.

Fillable Tax Form Instructions Printable Forms Free Online

Remit to the local earned income tax collector for every tax collection district in which you lived during the year. Part year resident eit worksheet use this form if you have moved during the tax year to allocate earnings/tax to each residence. Locate and download forms needed to complete your filing and payment processes. Pennsylvania residents with earned income or.

Taxpayer Annual Local Earned Tax Return PA Department Of

Pennsylvania residents with earned income or net profits must file a local earned income tax return online or by mail by april 15. Locate and download forms needed to complete your filing and payment processes. Local income tax requirements for employers. Employers with worksites located in pennsylvania are required to withhold and remit the local. Dced local government services act.

Printable Pennsylvania State Tax Forms Printable Forms Free Online

Pennsylvania residents with earned income or net profits must file a local earned income tax return online or by mail by april 15. Remit to the local earned income tax collector for every tax collection district in which you lived during the year. Local income tax requirements for employers. Part year resident eit worksheet use this form if you have.

Form Pa40 Pennsylvania Tax Return 2001 printable pdf download

Employers with worksites located in pennsylvania are required. Pennsylvania residents with earned income or net profits must file a local earned income tax return online or by mail by april 15. To get started, refine your search using the search settings. Locate and download forms needed to complete your filing and payment processes. Dced local government services act 32:

Local Income Tax Requirements For Employers.

To get started, refine your search using the search settings. Locate and download forms needed to complete your filing and payment processes. Dced local government services act 32: Part year resident eit worksheet use this form if you have moved during the tax year to allocate earnings/tax to each residence.

Employers With Worksites Located In Pennsylvania Are Required.

The pennsylvania local income tax exchange (palite) system allows taxpayers in participating localities to quickly prepare a tax return, which. Remit to the local earned income tax collector for every tax collection district in which you lived during the year. Employers with worksites located in pennsylvania are required to withhold and remit the local. Pennsylvania residents with earned income or net profits must file a local earned income tax return online or by mail by april 15.