Local Business Tax Receipt Orange County Florida

Local Business Tax Receipt Orange County Florida - Business tax receipt payments are due on october 1st of each year. Taxes not paid by that date will be subject to penalties. If you would like to. To find your business, enter a business tax receipt id number or search by name, address, city, or zip. All businesses must have both city and county business tax receipts. You can only search for one. If you would like to search for business tax receipts in orange county, please use the following search options. Get an orange county business tax receipt. This page explains the process of obtaining a business tax receipt for the purpose of operating a business in orange county, florida. All businesses operating in these municipalities must obtain a local business tax receipt prior to obtaining an orange county business tax.

Business tax receipt payments are due on october 1st of each year. This page explains the process of obtaining a business tax receipt for the purpose of operating a business in orange county, florida. Taxes not paid by that date will be subject to penalties. If you would like to. Get an orange county business tax receipt. All businesses must have both city and county business tax receipts. To find your business, enter a business tax receipt id number or search by name, address, city, or zip. All businesses operating in these municipalities must obtain a local business tax receipt prior to obtaining an orange county business tax. If you would like to search for business tax receipts in orange county, please use the following search options. You can only search for one.

Taxes not paid by that date will be subject to penalties. If you would like to. Business tax receipt payments are due on october 1st of each year. All businesses must have both city and county business tax receipts. To find your business, enter a business tax receipt id number or search by name, address, city, or zip. All businesses operating in these municipalities must obtain a local business tax receipt prior to obtaining an orange county business tax. This page explains the process of obtaining a business tax receipt for the purpose of operating a business in orange county, florida. Get an orange county business tax receipt. If you would like to search for business tax receipts in orange county, please use the following search options. You can only search for one.

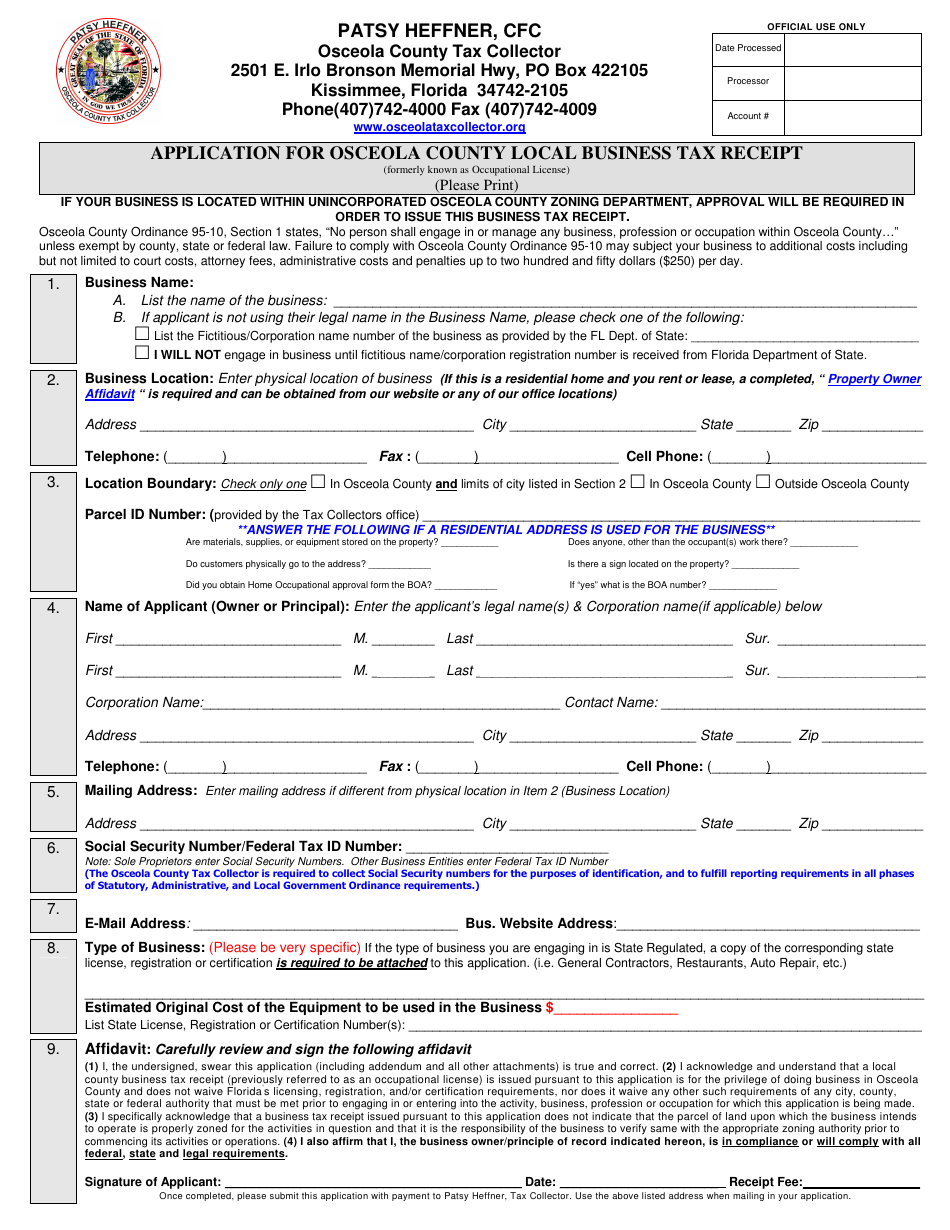

Osceola County, Florida Application for Osceola County Local Business

If you would like to. All businesses operating in these municipalities must obtain a local business tax receipt prior to obtaining an orange county business tax. To find your business, enter a business tax receipt id number or search by name, address, city, or zip. Taxes not paid by that date will be subject to penalties. Get an orange county.

How to Register for Your Florida County's Annual Local Business Tax Receipt

This page explains the process of obtaining a business tax receipt for the purpose of operating a business in orange county, florida. If you would like to search for business tax receipts in orange county, please use the following search options. All businesses operating in these municipalities must obtain a local business tax receipt prior to obtaining an orange county.

Tax Receipt Template

This page explains the process of obtaining a business tax receipt for the purpose of operating a business in orange county, florida. If you would like to. You can only search for one. Business tax receipt payments are due on october 1st of each year. All businesses must have both city and county business tax receipts.

broward county business tax receipt search Hardesty

You can only search for one. All businesses operating in these municipalities must obtain a local business tax receipt prior to obtaining an orange county business tax. This page explains the process of obtaining a business tax receipt for the purpose of operating a business in orange county, florida. If you would like to search for business tax receipts in.

broward county business tax receipt form Johnie Suggs

All businesses operating in these municipalities must obtain a local business tax receipt prior to obtaining an orange county business tax. You can only search for one. If you would like to. This page explains the process of obtaining a business tax receipt for the purpose of operating a business in orange county, florida. Business tax receipt payments are due.

Orange County Probate Form Acknowledgment Of Receipt

Get an orange county business tax receipt. If you would like to search for business tax receipts in orange county, please use the following search options. Business tax receipt payments are due on october 1st of each year. To find your business, enter a business tax receipt id number or search by name, address, city, or zip. This page explains.

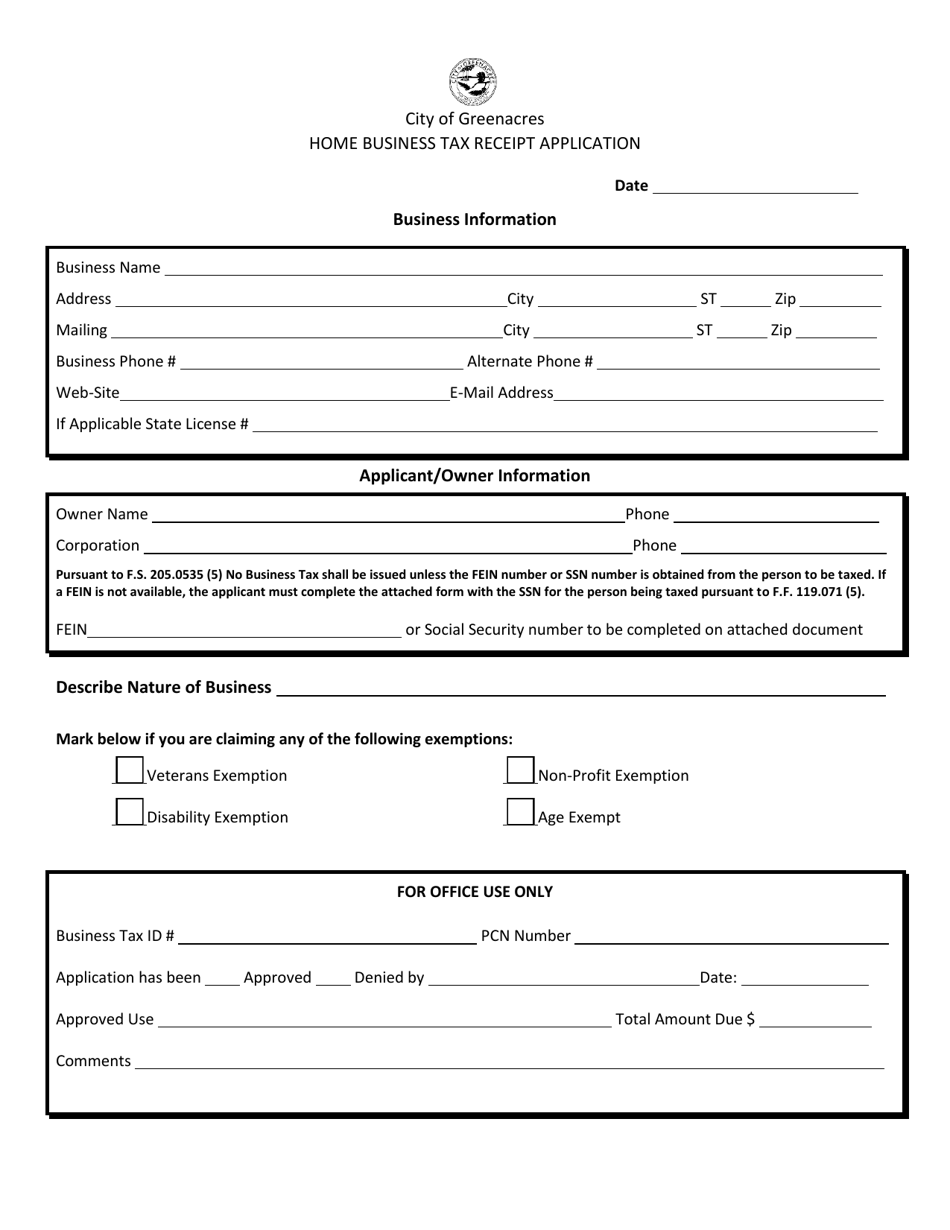

City of Greenacres, Florida Home Business Tax Receipt Application

Taxes not paid by that date will be subject to penalties. If you would like to. This page explains the process of obtaining a business tax receipt for the purpose of operating a business in orange county, florida. To find your business, enter a business tax receipt id number or search by name, address, city, or zip. If you would.

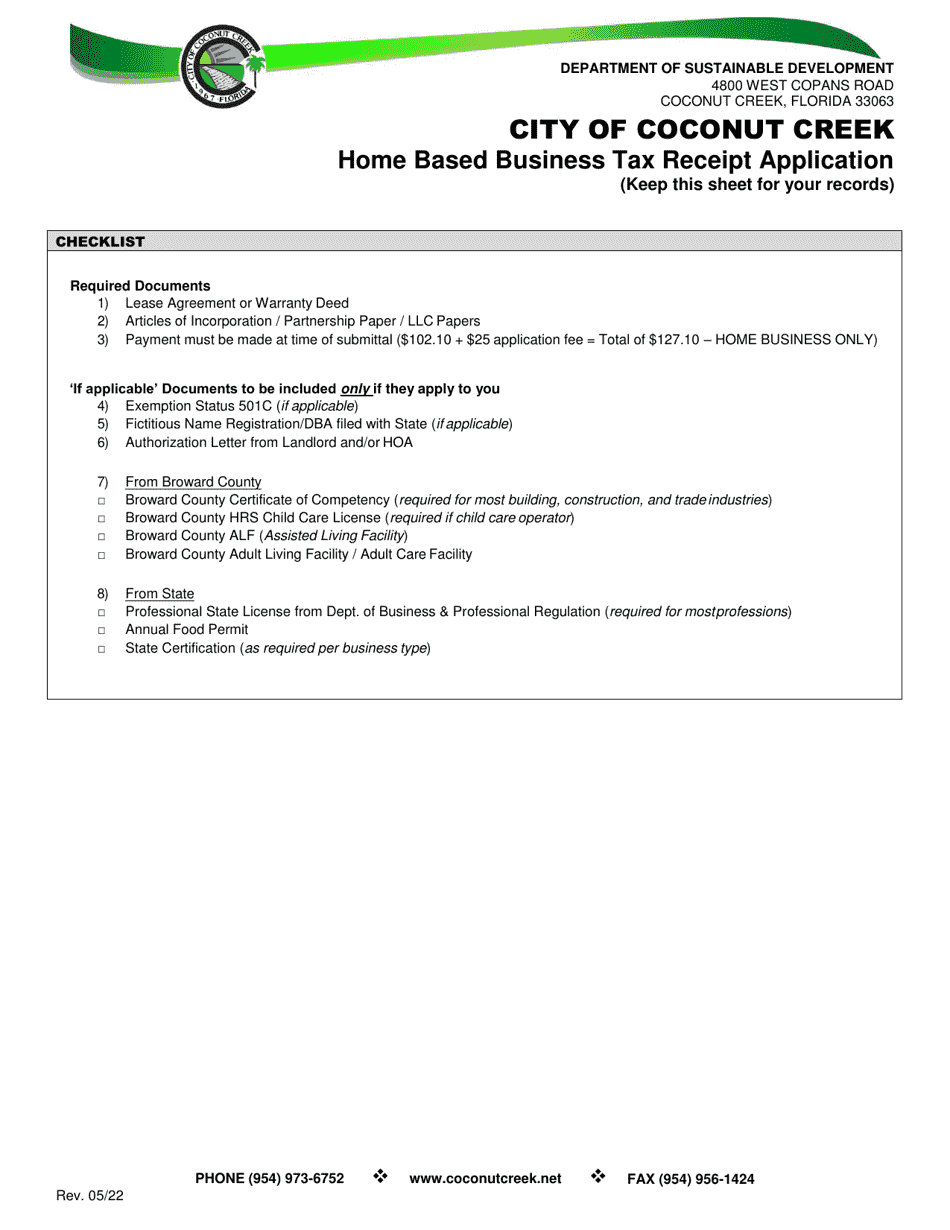

City of Coconut Creek, Florida Home Based Business Tax Receipt

To find your business, enter a business tax receipt id number or search by name, address, city, or zip. This page explains the process of obtaining a business tax receipt for the purpose of operating a business in orange county, florida. If you would like to. You can only search for one. All businesses must have both city and county.

Miami Dade County Business Tax Receipt Master of Documents

This page explains the process of obtaining a business tax receipt for the purpose of operating a business in orange county, florida. You can only search for one. If you would like to search for business tax receipts in orange county, please use the following search options. If you would like to. Taxes not paid by that date will be.

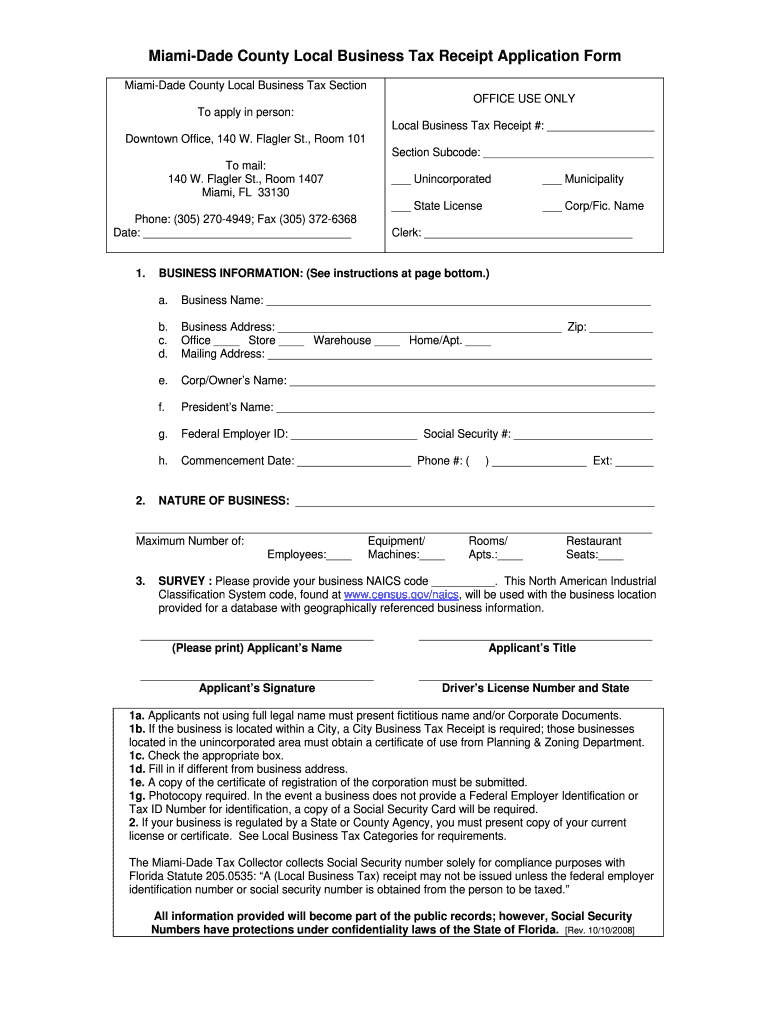

2008 FL Local Business Tax Receipt Application Form MiamiDade County

Business tax receipt payments are due on october 1st of each year. To find your business, enter a business tax receipt id number or search by name, address, city, or zip. Get an orange county business tax receipt. All businesses operating in these municipalities must obtain a local business tax receipt prior to obtaining an orange county business tax. You.

This Page Explains The Process Of Obtaining A Business Tax Receipt For The Purpose Of Operating A Business In Orange County, Florida.

Taxes not paid by that date will be subject to penalties. All businesses operating in these municipalities must obtain a local business tax receipt prior to obtaining an orange county business tax. Get an orange county business tax receipt. If you would like to.

You Can Only Search For One.

To find your business, enter a business tax receipt id number or search by name, address, city, or zip. Business tax receipt payments are due on october 1st of each year. If you would like to search for business tax receipts in orange county, please use the following search options. All businesses must have both city and county business tax receipts.