Kentucky Locality Tax

Kentucky Locality Tax - Kentucky local income tax rates on top of kentucky’s state flat income tax rate of 4.0 in 2024, some of its counties and cities also. Many cities and counties require a local business license and/or impose an occupational tax or other type of tax on individuals and firms. Residents of louisville pay a flat city income tax of 2.20% on earned income, in addition to the kentucky income tax and the federal income. File your current year return electronically ky file allows everyone to. Click here for more information. You can click on any city or county for more details, including the. Ky constitution and krs 92.280 require every city to annually tax all real and personal property within their jurisdiction unless specifically. Keeping you updated on tax law changes. We have information on the local income tax rates in 218 localities in kentucky.

Ky constitution and krs 92.280 require every city to annually tax all real and personal property within their jurisdiction unless specifically. File your current year return electronically ky file allows everyone to. Residents of louisville pay a flat city income tax of 2.20% on earned income, in addition to the kentucky income tax and the federal income. Keeping you updated on tax law changes. You can click on any city or county for more details, including the. Kentucky local income tax rates on top of kentucky’s state flat income tax rate of 4.0 in 2024, some of its counties and cities also. Many cities and counties require a local business license and/or impose an occupational tax or other type of tax on individuals and firms. Click here for more information. We have information on the local income tax rates in 218 localities in kentucky.

We have information on the local income tax rates in 218 localities in kentucky. Kentucky local income tax rates on top of kentucky’s state flat income tax rate of 4.0 in 2024, some of its counties and cities also. Keeping you updated on tax law changes. File your current year return electronically ky file allows everyone to. Click here for more information. You can click on any city or county for more details, including the. Ky constitution and krs 92.280 require every city to annually tax all real and personal property within their jurisdiction unless specifically. Residents of louisville pay a flat city income tax of 2.20% on earned income, in addition to the kentucky income tax and the federal income. Many cities and counties require a local business license and/or impose an occupational tax or other type of tax on individuals and firms.

How to Get Kentucky Sales Tax Permit A Comprehensive Guide

Kentucky local income tax rates on top of kentucky’s state flat income tax rate of 4.0 in 2024, some of its counties and cities also. We have information on the local income tax rates in 218 localities in kentucky. Residents of louisville pay a flat city income tax of 2.20% on earned income, in addition to the kentucky income tax.

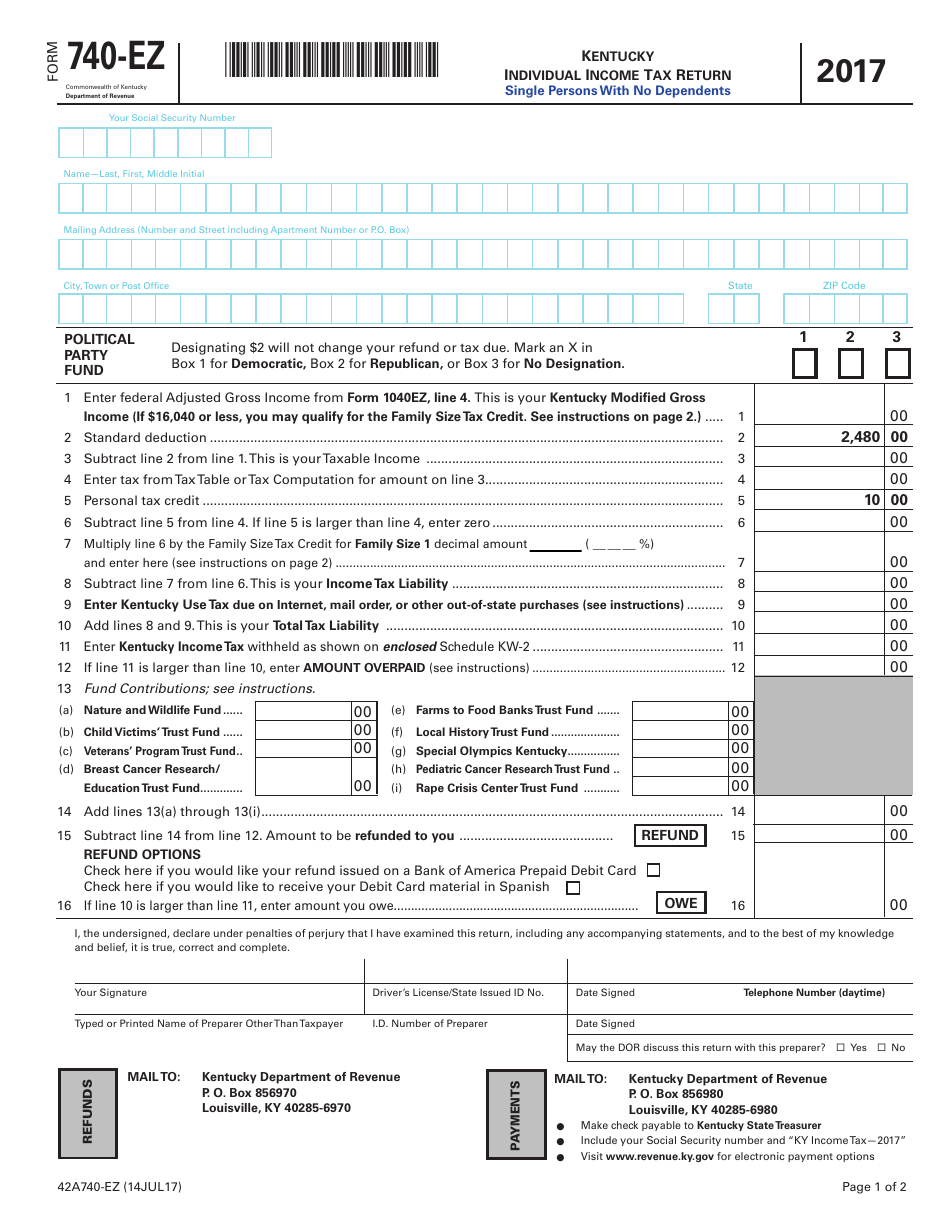

Form 740EZ 2017 Fill Out, Sign Online and Download Fillable PDF

Many cities and counties require a local business license and/or impose an occupational tax or other type of tax on individuals and firms. We have information on the local income tax rates in 218 localities in kentucky. Residents of louisville pay a flat city income tax of 2.20% on earned income, in addition to the kentucky income tax and the.

Ultimate Kentucky Sales Tax Guide Zamp

Keeping you updated on tax law changes. File your current year return electronically ky file allows everyone to. We have information on the local income tax rates in 218 localities in kentucky. Residents of louisville pay a flat city income tax of 2.20% on earned income, in addition to the kentucky income tax and the federal income. You can click.

Locality Homes

Many cities and counties require a local business license and/or impose an occupational tax or other type of tax on individuals and firms. Residents of louisville pay a flat city income tax of 2.20% on earned income, in addition to the kentucky income tax and the federal income. Click here for more information. Ky constitution and krs 92.280 require every.

2025 NonLocality BAH Rates

Kentucky local income tax rates on top of kentucky’s state flat income tax rate of 4.0 in 2024, some of its counties and cities also. Keeping you updated on tax law changes. Residents of louisville pay a flat city income tax of 2.20% on earned income, in addition to the kentucky income tax and the federal income. Many cities and.

35+ Thrilling Locality Quotes That Will Unlock Your True Potential

Click here for more information. File your current year return electronically ky file allows everyone to. Ky constitution and krs 92.280 require every city to annually tax all real and personal property within their jurisdiction unless specifically. Residents of louisville pay a flat city income tax of 2.20% on earned income, in addition to the kentucky income tax and the.

Locality

Residents of louisville pay a flat city income tax of 2.20% on earned income, in addition to the kentucky income tax and the federal income. Click here for more information. You can click on any city or county for more details, including the. We have information on the local income tax rates in 218 localities in kentucky. File your current.

News Locality Bank

File your current year return electronically ky file allows everyone to. Click here for more information. We have information on the local income tax rates in 218 localities in kentucky. Ky constitution and krs 92.280 require every city to annually tax all real and personal property within their jurisdiction unless specifically. Kentucky local income tax rates on top of kentucky’s.

Sparks Tax and Accounting Services Topeka KS

Residents of louisville pay a flat city income tax of 2.20% on earned income, in addition to the kentucky income tax and the federal income. Kentucky local income tax rates on top of kentucky’s state flat income tax rate of 4.0 in 2024, some of its counties and cities also. Click here for more information. Keeping you updated on tax.

TAX Consultancy Firm Gurugram

You can click on any city or county for more details, including the. Ky constitution and krs 92.280 require every city to annually tax all real and personal property within their jurisdiction unless specifically. Kentucky local income tax rates on top of kentucky’s state flat income tax rate of 4.0 in 2024, some of its counties and cities also. Residents.

You Can Click On Any City Or County For More Details, Including The.

Keeping you updated on tax law changes. Click here for more information. File your current year return electronically ky file allows everyone to. Kentucky local income tax rates on top of kentucky’s state flat income tax rate of 4.0 in 2024, some of its counties and cities also.

We Have Information On The Local Income Tax Rates In 218 Localities In Kentucky.

Ky constitution and krs 92.280 require every city to annually tax all real and personal property within their jurisdiction unless specifically. Residents of louisville pay a flat city income tax of 2.20% on earned income, in addition to the kentucky income tax and the federal income. Many cities and counties require a local business license and/or impose an occupational tax or other type of tax on individuals and firms.