Irs Tax Lien Lookup Free

Irs Tax Lien Lookup Free - Notice of federal tax lien filed (in public records) document filed with the local recording office that identifies tax liabilities owed by the. Search logic mandated by the ucc statute and locates exact matches excluding noise words and abbreviations as provided below. If a property owner fails to pay federal taxes, the irs files a notice of federal tax lien with the state recorder's office to secure. See sources to check your. Learn what a federal tax lien is, how it affects your credit and assets, and how to find out if you have one. Visit irs.gov/payments to find information about making payments and the options available, including those below, for taxpayers who can't.

Search logic mandated by the ucc statute and locates exact matches excluding noise words and abbreviations as provided below. Learn what a federal tax lien is, how it affects your credit and assets, and how to find out if you have one. If a property owner fails to pay federal taxes, the irs files a notice of federal tax lien with the state recorder's office to secure. Visit irs.gov/payments to find information about making payments and the options available, including those below, for taxpayers who can't. See sources to check your. Notice of federal tax lien filed (in public records) document filed with the local recording office that identifies tax liabilities owed by the.

Search logic mandated by the ucc statute and locates exact matches excluding noise words and abbreviations as provided below. Notice of federal tax lien filed (in public records) document filed with the local recording office that identifies tax liabilities owed by the. Learn what a federal tax lien is, how it affects your credit and assets, and how to find out if you have one. Visit irs.gov/payments to find information about making payments and the options available, including those below, for taxpayers who can't. If a property owner fails to pay federal taxes, the irs files a notice of federal tax lien with the state recorder's office to secure. See sources to check your.

When Does The Irs File A Tax Lien?

Learn what a federal tax lien is, how it affects your credit and assets, and how to find out if you have one. Notice of federal tax lien filed (in public records) document filed with the local recording office that identifies tax liabilities owed by the. Search logic mandated by the ucc statute and locates exact matches excluding noise words.

IRS Tax Lien Removal Enterprise consultants group

Visit irs.gov/payments to find information about making payments and the options available, including those below, for taxpayers who can't. Search logic mandated by the ucc statute and locates exact matches excluding noise words and abbreviations as provided below. Learn what a federal tax lien is, how it affects your credit and assets, and how to find out if you have.

Can The IRS Refile A Tax Lien?

If a property owner fails to pay federal taxes, the irs files a notice of federal tax lien with the state recorder's office to secure. Learn what a federal tax lien is, how it affects your credit and assets, and how to find out if you have one. Visit irs.gov/payments to find information about making payments and the options available,.

IRS Federal Tax Lien Semper Tax Relief Tax Settlement Expert

Notice of federal tax lien filed (in public records) document filed with the local recording office that identifies tax liabilities owed by the. If a property owner fails to pay federal taxes, the irs files a notice of federal tax lien with the state recorder's office to secure. See sources to check your. Visit irs.gov/payments to find information about making.

IRS Tax Lien Help Tampa Tax Attorney Darrin t. Mish

Search logic mandated by the ucc statute and locates exact matches excluding noise words and abbreviations as provided below. If a property owner fails to pay federal taxes, the irs files a notice of federal tax lien with the state recorder's office to secure. Notice of federal tax lien filed (in public records) document filed with the local recording office.

A Complete breakdown of IRS tax lien Conto Business

Learn what a federal tax lien is, how it affects your credit and assets, and how to find out if you have one. See sources to check your. Search logic mandated by the ucc statute and locates exact matches excluding noise words and abbreviations as provided below. Visit irs.gov/payments to find information about making payments and the options available, including.

IRS Tax Lien RJS LAW Tax Attorney San Diego California

Learn what a federal tax lien is, how it affects your credit and assets, and how to find out if you have one. See sources to check your. Visit irs.gov/payments to find information about making payments and the options available, including those below, for taxpayers who can't. Notice of federal tax lien filed (in public records) document filed with the.

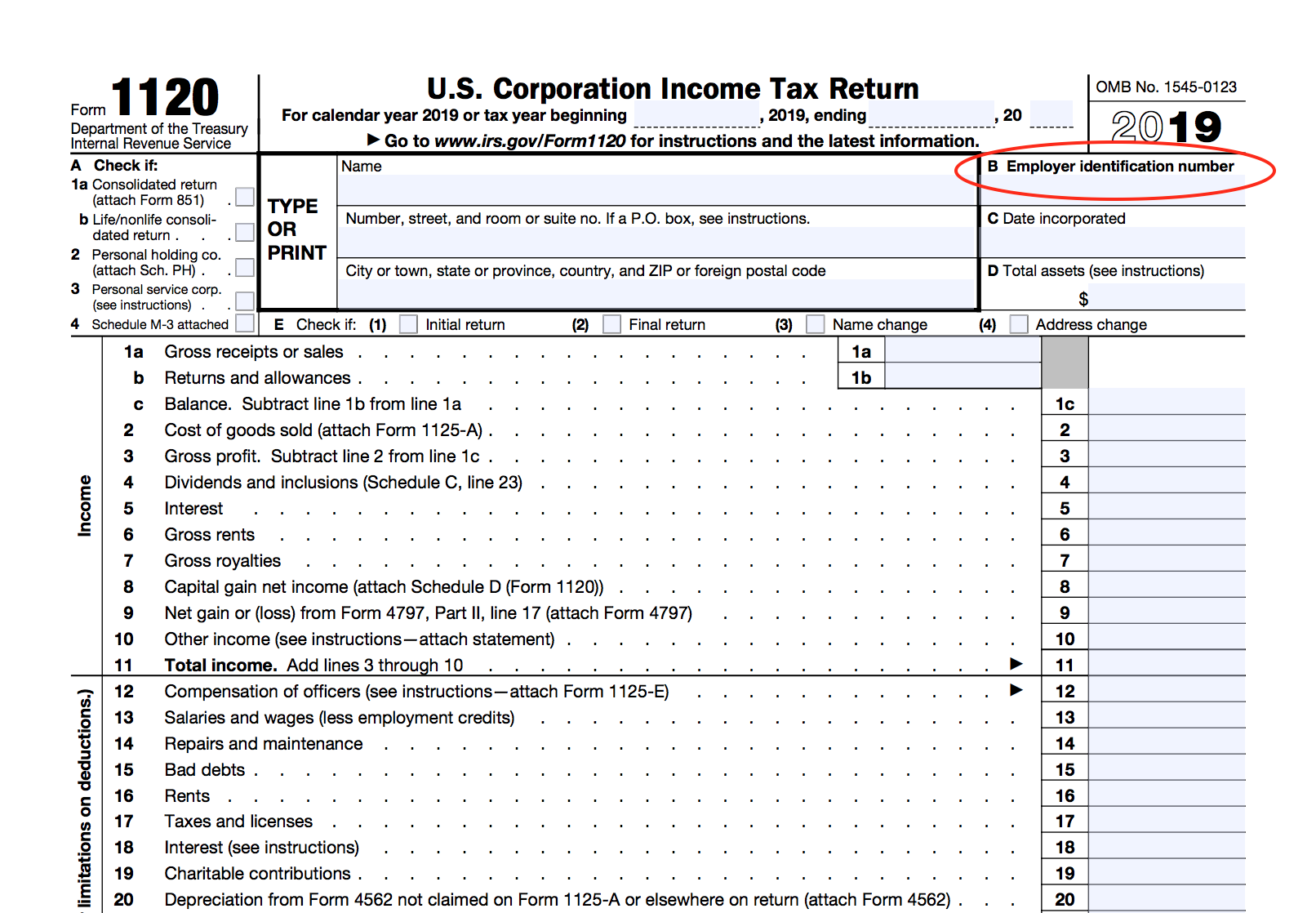

Tax IDentification Number Lookup IRS TIN Number

Search logic mandated by the ucc statute and locates exact matches excluding noise words and abbreviations as provided below. Learn what a federal tax lien is, how it affects your credit and assets, and how to find out if you have one. Visit irs.gov/payments to find information about making payments and the options available, including those below, for taxpayers who.

IRS Federal and State Tax Lien Help — Genesis Tax Consultants

Learn what a federal tax lien is, how it affects your credit and assets, and how to find out if you have one. Search logic mandated by the ucc statute and locates exact matches excluding noise words and abbreviations as provided below. If a property owner fails to pay federal taxes, the irs files a notice of federal tax lien.

How to Tackle IRS Tax Lien or Levy Notice? Internal Revenue Code

If a property owner fails to pay federal taxes, the irs files a notice of federal tax lien with the state recorder's office to secure. Visit irs.gov/payments to find information about making payments and the options available, including those below, for taxpayers who can't. Search logic mandated by the ucc statute and locates exact matches excluding noise words and abbreviations.

Learn What A Federal Tax Lien Is, How It Affects Your Credit And Assets, And How To Find Out If You Have One.

Search logic mandated by the ucc statute and locates exact matches excluding noise words and abbreviations as provided below. If a property owner fails to pay federal taxes, the irs files a notice of federal tax lien with the state recorder's office to secure. Visit irs.gov/payments to find information about making payments and the options available, including those below, for taxpayers who can't. Notice of federal tax lien filed (in public records) document filed with the local recording office that identifies tax liabilities owed by the.