Irs Company Name Change

Irs Company Name Change - Although changing the name of your business does not. Find the chart of actions. When you file your business taxes, the irs uses your ein and business name to identify your business. You need a new ein, in general, when you change your entity’s ownership or structure. If you decide to change. You don’t need a new ein if you just. Learn how to submit a name change for your business to the irs and whether you need a new ein or a final return. Generally, businesses need a new ein when their ownership or structure has changed.

Find the chart of actions. You need a new ein, in general, when you change your entity’s ownership or structure. When you file your business taxes, the irs uses your ein and business name to identify your business. You don’t need a new ein if you just. Generally, businesses need a new ein when their ownership or structure has changed. Although changing the name of your business does not. Learn how to submit a name change for your business to the irs and whether you need a new ein or a final return. If you decide to change.

You don’t need a new ein if you just. When you file your business taxes, the irs uses your ein and business name to identify your business. You need a new ein, in general, when you change your entity’s ownership or structure. Find the chart of actions. If you decide to change. Generally, businesses need a new ein when their ownership or structure has changed. Although changing the name of your business does not. Learn how to submit a name change for your business to the irs and whether you need a new ein or a final return.

Irs Business Name Change Form 8822b Armando Friend's Template

You need a new ein, in general, when you change your entity’s ownership or structure. Although changing the name of your business does not. When you file your business taxes, the irs uses your ein and business name to identify your business. Generally, businesses need a new ein when their ownership or structure has changed. Learn how to submit a.

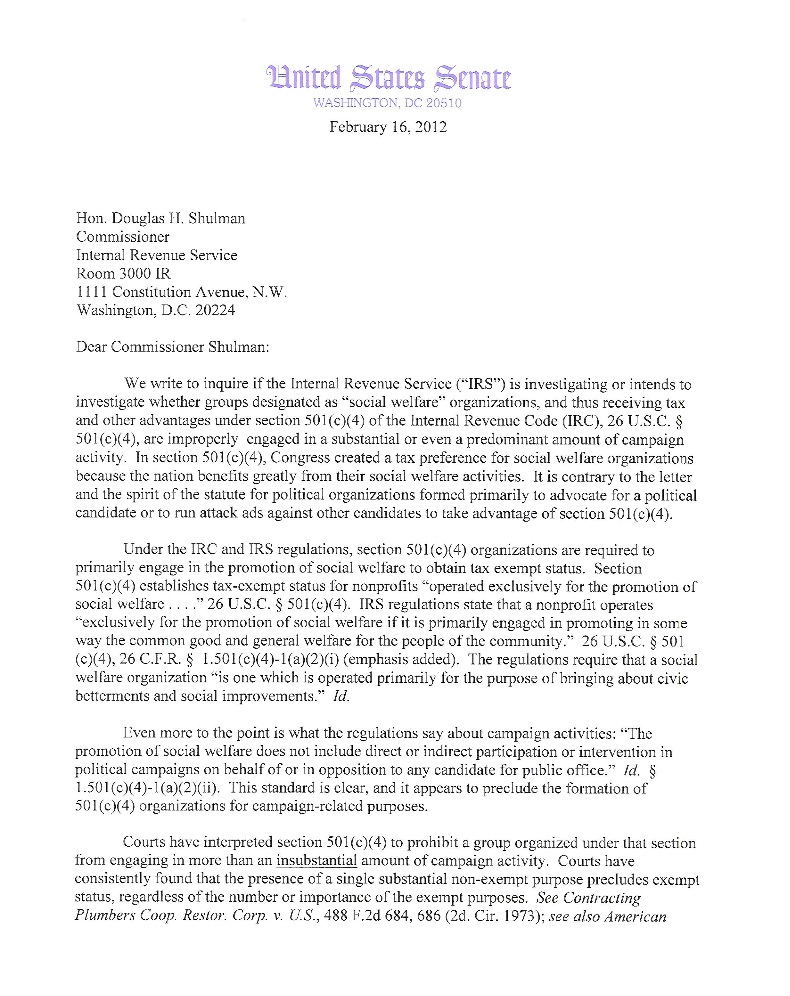

Letter To Irs Free Printable Documents

If you decide to change. Find the chart of actions. You don’t need a new ein if you just. Learn how to submit a name change for your business to the irs and whether you need a new ein or a final return. Generally, businesses need a new ein when their ownership or structure has changed.

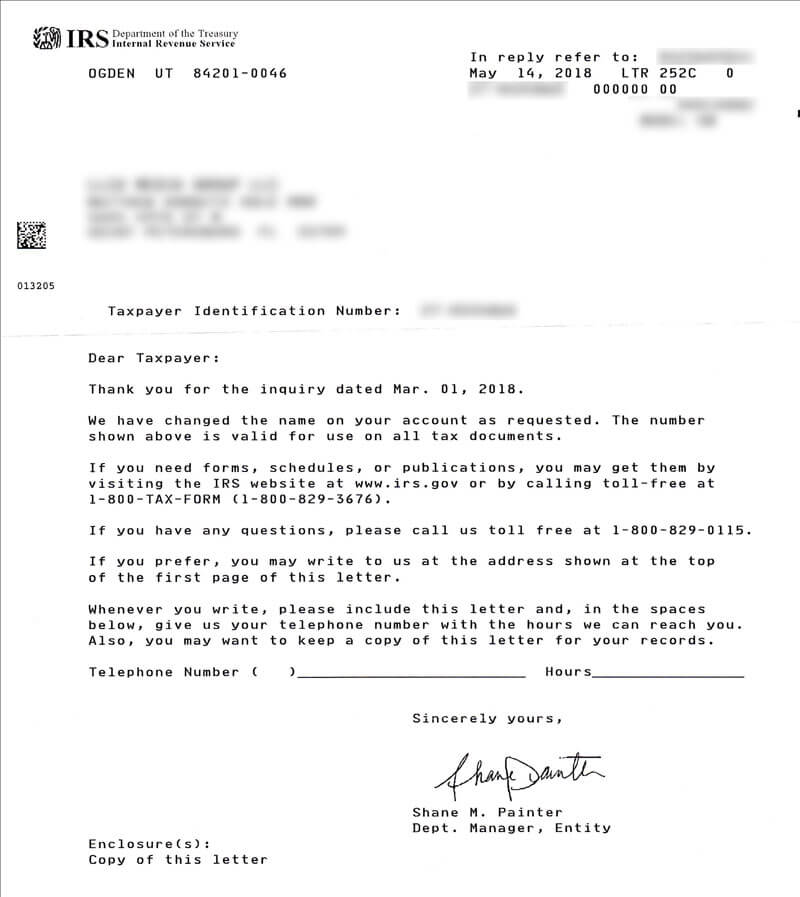

IRS Business Name Change

Find the chart of actions. If you decide to change. You need a new ein, in general, when you change your entity’s ownership or structure. When you file your business taxes, the irs uses your ein and business name to identify your business. Although changing the name of your business does not.

IRS Name Change How to file the IRS 8822 MissNowMrs

If you decide to change. Generally, businesses need a new ein when their ownership or structure has changed. Learn how to submit a name change for your business to the irs and whether you need a new ein or a final return. You don’t need a new ein if you just. When you file your business taxes, the irs uses.

Irs Business Name Change Letter Template

You need a new ein, in general, when you change your entity’s ownership or structure. Find the chart of actions. Although changing the name of your business does not. When you file your business taxes, the irs uses your ein and business name to identify your business. If you decide to change.

Irs Business Name Change Letter Template

If you decide to change. Find the chart of actions. Although changing the name of your business does not. When you file your business taxes, the irs uses your ein and business name to identify your business. Generally, businesses need a new ein when their ownership or structure has changed.

IRS Letter 5071C Sample 1

Find the chart of actions. You don’t need a new ein if you just. Generally, businesses need a new ein when their ownership or structure has changed. When you file your business taxes, the irs uses your ein and business name to identify your business. If you decide to change.

38 [pdf] PAYMENT LETTER TO IRS PRINTABLE DOCX ZIP DOWNLOAD

When you file your business taxes, the irs uses your ein and business name to identify your business. You don’t need a new ein if you just. Generally, businesses need a new ein when their ownership or structure has changed. You need a new ein, in general, when you change your entity’s ownership or structure. If you decide to change.

Change address with irs

When you file your business taxes, the irs uses your ein and business name to identify your business. Find the chart of actions. You don’t need a new ein if you just. Although changing the name of your business does not. Learn how to submit a name change for your business to the irs and whether you need a new.

Irs Business Name Change Letter Template

Learn how to submit a name change for your business to the irs and whether you need a new ein or a final return. Although changing the name of your business does not. You need a new ein, in general, when you change your entity’s ownership or structure. You don’t need a new ein if you just. If you decide.

You Need A New Ein, In General, When You Change Your Entity’s Ownership Or Structure.

Although changing the name of your business does not. Find the chart of actions. If you decide to change. You don’t need a new ein if you just.

When You File Your Business Taxes, The Irs Uses Your Ein And Business Name To Identify Your Business.

Generally, businesses need a new ein when their ownership or structure has changed. Learn how to submit a name change for your business to the irs and whether you need a new ein or a final return.