Investing In Tax Lien Certificates

Investing In Tax Lien Certificates - To trigger a tax lien on a. A homeowner or landowner defaults. To do tax lien investing, the following events must take place:

A homeowner or landowner defaults. To trigger a tax lien on a. To do tax lien investing, the following events must take place:

A homeowner or landowner defaults. To trigger a tax lien on a. To do tax lien investing, the following events must take place:

Investing Tax Lien Certificates SWFL Chronicle

To do tax lien investing, the following events must take place: A homeowner or landowner defaults. To trigger a tax lien on a.

Babelcube Owning property with tax lien certificates low risk investing

To trigger a tax lien on a. To do tax lien investing, the following events must take place: A homeowner or landowner defaults.

What are Tax Lien Investing Benefits? Finance.Gov.Capital

A homeowner or landowner defaults. To do tax lien investing, the following events must take place: To trigger a tax lien on a.

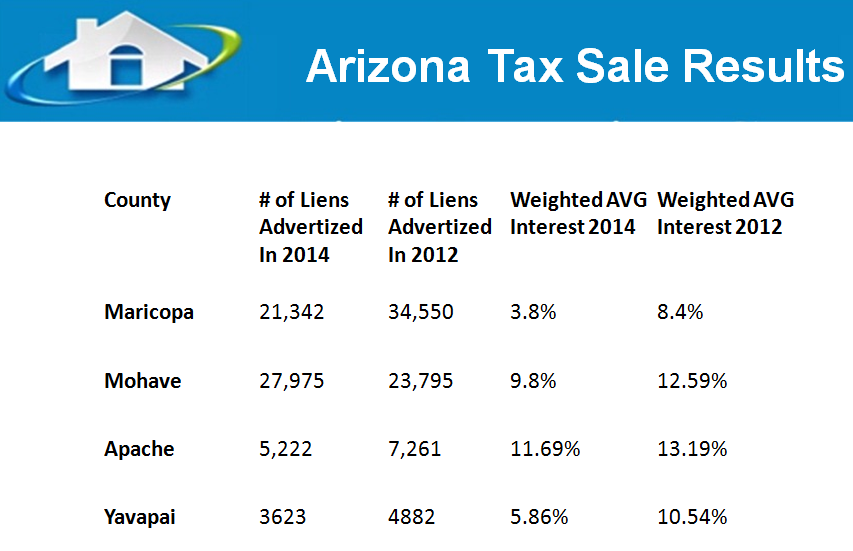

Results From The Arizona Online Tax Lien Sales Tax Lien Investing Tips

A homeowner or landowner defaults. To trigger a tax lien on a. To do tax lien investing, the following events must take place:

Why Tax Lien Investing A Good Business? Tax Lien Certificate School

To trigger a tax lien on a. To do tax lien investing, the following events must take place: A homeowner or landowner defaults.

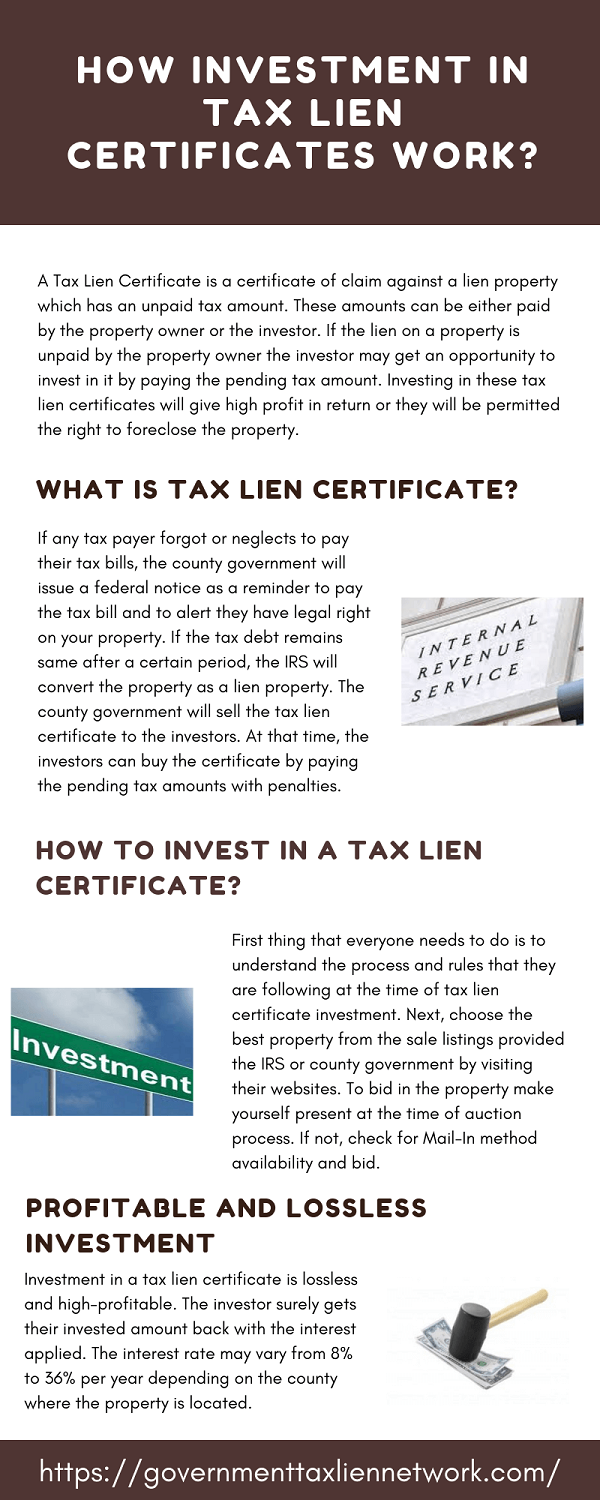

How Investment in Tax Lien Certificates Work? Latest Infographics

To trigger a tax lien on a. To do tax lien investing, the following events must take place: A homeowner or landowner defaults.

How Tax Lien Investing Works — LowCost Exposure to Real Estate

To do tax lien investing, the following events must take place: To trigger a tax lien on a. A homeowner or landowner defaults.

Investing in Tax Lien Certificates A Lucrative Opportunity

A homeowner or landowner defaults. To trigger a tax lien on a. To do tax lien investing, the following events must take place:

Tax Lien Investing What to Know CheckBook IRA LLC

To do tax lien investing, the following events must take place: To trigger a tax lien on a. A homeowner or landowner defaults.

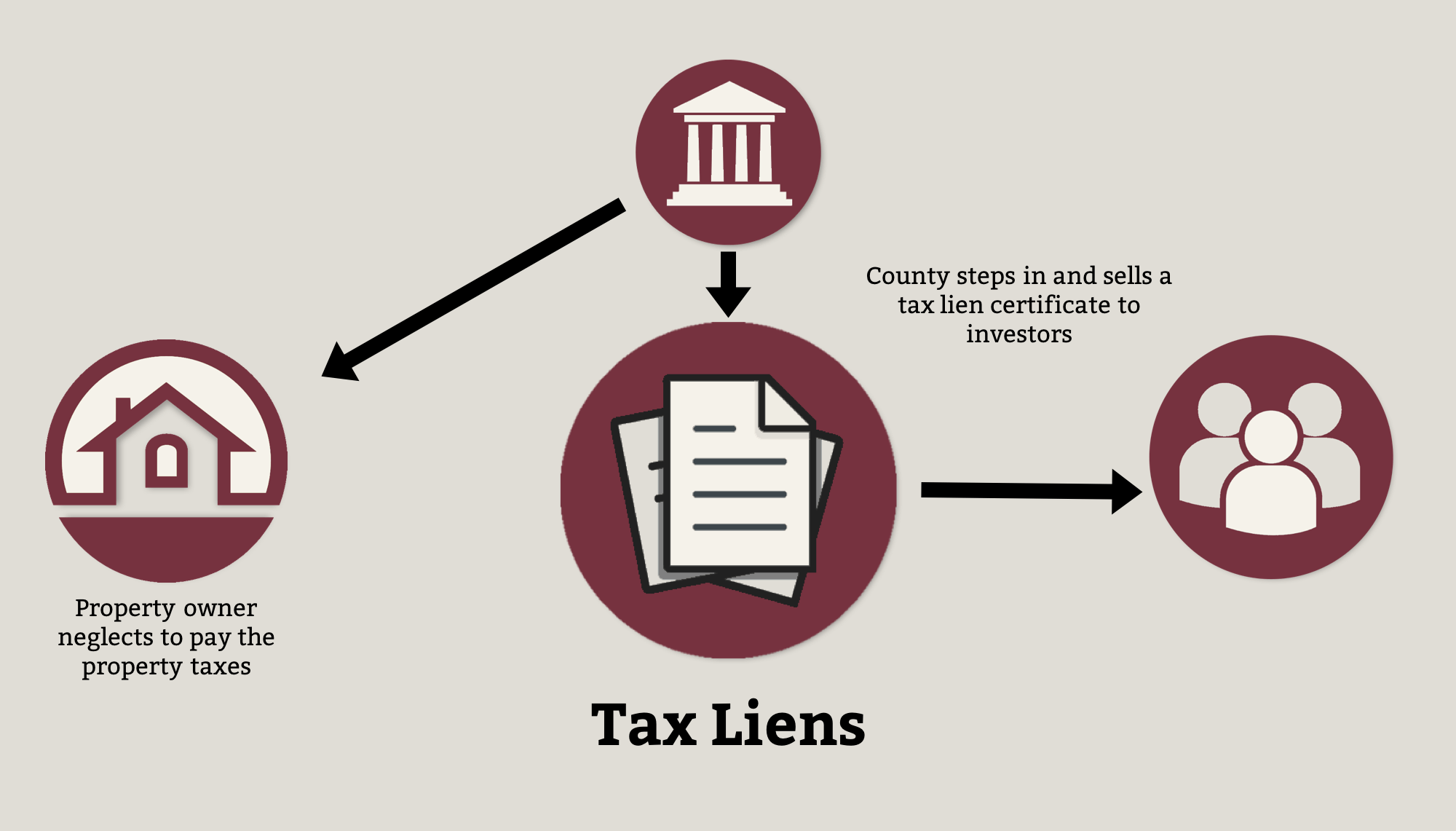

A Homeowner Or Landowner Defaults.

To do tax lien investing, the following events must take place: To trigger a tax lien on a.