Indiana Property Tax Lien

Indiana Property Tax Lien - The floyd county treasurer is responsible for the depository of tax obligations, collection of property taxes, processing of liquor license. For general information about county property tax sale, please visit the sri website. During the redemption period, lien buyers are strongly encouraged to pay all subsequent taxes and special assessments on the properties for. The team of wayne greeson has extensive experience in representing tax lien clients across the state of indiana, and are ready to help you. General property taxes are payable at any time after the first day of january of each year, and are payable in two equal installments. To be removed from a tax sale, payment in full should be. Indiana code provides that real property parcels with delinquent taxes due will be offered for a tax certificate sale by the county treasurer.

Indiana code provides that real property parcels with delinquent taxes due will be offered for a tax certificate sale by the county treasurer. For general information about county property tax sale, please visit the sri website. During the redemption period, lien buyers are strongly encouraged to pay all subsequent taxes and special assessments on the properties for. General property taxes are payable at any time after the first day of january of each year, and are payable in two equal installments. The team of wayne greeson has extensive experience in representing tax lien clients across the state of indiana, and are ready to help you. The floyd county treasurer is responsible for the depository of tax obligations, collection of property taxes, processing of liquor license. To be removed from a tax sale, payment in full should be.

To be removed from a tax sale, payment in full should be. The floyd county treasurer is responsible for the depository of tax obligations, collection of property taxes, processing of liquor license. General property taxes are payable at any time after the first day of january of each year, and are payable in two equal installments. The team of wayne greeson has extensive experience in representing tax lien clients across the state of indiana, and are ready to help you. During the redemption period, lien buyers are strongly encouraged to pay all subsequent taxes and special assessments on the properties for. Indiana code provides that real property parcels with delinquent taxes due will be offered for a tax certificate sale by the county treasurer. For general information about county property tax sale, please visit the sri website.

Tax Lien Indiana State Tax Lien

The floyd county treasurer is responsible for the depository of tax obligations, collection of property taxes, processing of liquor license. Indiana code provides that real property parcels with delinquent taxes due will be offered for a tax certificate sale by the county treasurer. During the redemption period, lien buyers are strongly encouraged to pay all subsequent taxes and special assessments.

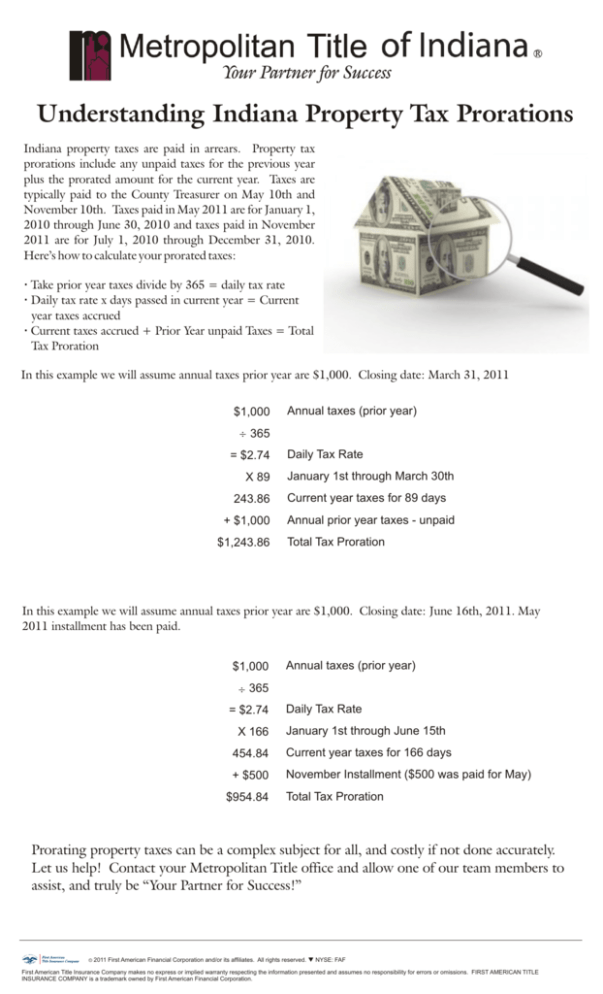

Understanding Indiana Property Tax Prorations

The team of wayne greeson has extensive experience in representing tax lien clients across the state of indiana, and are ready to help you. For general information about county property tax sale, please visit the sri website. During the redemption period, lien buyers are strongly encouraged to pay all subsequent taxes and special assessments on the properties for. General property.

Tax Lien Indiana State Tax Lien

For general information about county property tax sale, please visit the sri website. General property taxes are payable at any time after the first day of january of each year, and are payable in two equal installments. The team of wayne greeson has extensive experience in representing tax lien clients across the state of indiana, and are ready to help.

What is a property Tax Lien? Real Estate Articles by

The team of wayne greeson has extensive experience in representing tax lien clients across the state of indiana, and are ready to help you. Indiana code provides that real property parcels with delinquent taxes due will be offered for a tax certificate sale by the county treasurer. The floyd county treasurer is responsible for the depository of tax obligations, collection.

Tax Lien Sale PDF Tax Lien Taxes

The floyd county treasurer is responsible for the depository of tax obligations, collection of property taxes, processing of liquor license. During the redemption period, lien buyers are strongly encouraged to pay all subsequent taxes and special assessments on the properties for. To be removed from a tax sale, payment in full should be. For general information about county property tax.

Federal tax lien on foreclosed property laderdriver

The team of wayne greeson has extensive experience in representing tax lien clients across the state of indiana, and are ready to help you. During the redemption period, lien buyers are strongly encouraged to pay all subsequent taxes and special assessments on the properties for. General property taxes are payable at any time after the first day of january of.

EasytoUnderstand Tax Lien Code Certificates Posteezy

General property taxes are payable at any time after the first day of january of each year, and are payable in two equal installments. For general information about county property tax sale, please visit the sri website. To be removed from a tax sale, payment in full should be. The team of wayne greeson has extensive experience in representing tax.

Tax Lien Indiana State Tax Lien

The team of wayne greeson has extensive experience in representing tax lien clients across the state of indiana, and are ready to help you. During the redemption period, lien buyers are strongly encouraged to pay all subsequent taxes and special assessments on the properties for. To be removed from a tax sale, payment in full should be. For general information.

Real Property Tax Lien Hymson Goldstein Pantiliat & Lohr, PLLC

General property taxes are payable at any time after the first day of january of each year, and are payable in two equal installments. Indiana code provides that real property parcels with delinquent taxes due will be offered for a tax certificate sale by the county treasurer. The team of wayne greeson has extensive experience in representing tax lien clients.

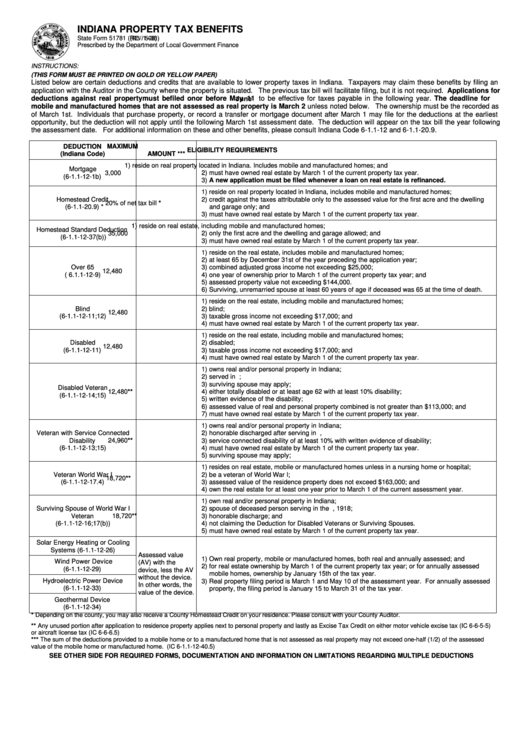

Indiana Property Tax Benefits Form Printable Pdf Download

For general information about county property tax sale, please visit the sri website. General property taxes are payable at any time after the first day of january of each year, and are payable in two equal installments. During the redemption period, lien buyers are strongly encouraged to pay all subsequent taxes and special assessments on the properties for. To be.

The Team Of Wayne Greeson Has Extensive Experience In Representing Tax Lien Clients Across The State Of Indiana, And Are Ready To Help You.

Indiana code provides that real property parcels with delinquent taxes due will be offered for a tax certificate sale by the county treasurer. For general information about county property tax sale, please visit the sri website. To be removed from a tax sale, payment in full should be. The floyd county treasurer is responsible for the depository of tax obligations, collection of property taxes, processing of liquor license.

During The Redemption Period, Lien Buyers Are Strongly Encouraged To Pay All Subsequent Taxes And Special Assessments On The Properties For.

General property taxes are payable at any time after the first day of january of each year, and are payable in two equal installments.