How To Tell If You Have A Tax Lien

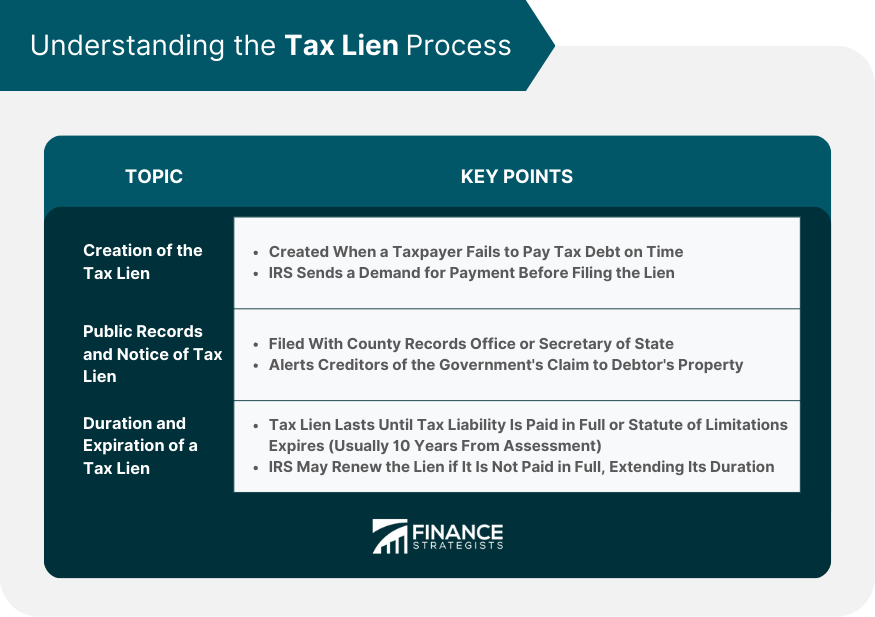

How To Tell If You Have A Tax Lien - Tax liens are legal claims by the irs to your personal or business property and assets due to back owed taxes. If a property owner fails to pay federal taxes, the irs files a notice of federal tax lien with the state recorder's office to secure. Depending on the state, you’ll have to use ucc or tax lien search option and verify your identity when checking if the irs has a lien. Before issuing a tax lien, the irs has to send a letter, but if you didn’t receive a letter, there are other ways to find out if you have a tax lien. For general lien information, taxpayers may refer to the understanding a federal tax lien page on. Notices of federal tax lien.

If a property owner fails to pay federal taxes, the irs files a notice of federal tax lien with the state recorder's office to secure. For general lien information, taxpayers may refer to the understanding a federal tax lien page on. Depending on the state, you’ll have to use ucc or tax lien search option and verify your identity when checking if the irs has a lien. Notices of federal tax lien. Tax liens are legal claims by the irs to your personal or business property and assets due to back owed taxes. Before issuing a tax lien, the irs has to send a letter, but if you didn’t receive a letter, there are other ways to find out if you have a tax lien.

Before issuing a tax lien, the irs has to send a letter, but if you didn’t receive a letter, there are other ways to find out if you have a tax lien. Notices of federal tax lien. If a property owner fails to pay federal taxes, the irs files a notice of federal tax lien with the state recorder's office to secure. Depending on the state, you’ll have to use ucc or tax lien search option and verify your identity when checking if the irs has a lien. Tax liens are legal claims by the irs to your personal or business property and assets due to back owed taxes. For general lien information, taxpayers may refer to the understanding a federal tax lien page on.

Tax Lien Records Search Online Background Check Services a la Carte

Tax liens are legal claims by the irs to your personal or business property and assets due to back owed taxes. Notices of federal tax lien. Before issuing a tax lien, the irs has to send a letter, but if you didn’t receive a letter, there are other ways to find out if you have a tax lien. For general.

Title Basics of the Federal Tax Lien SnapClose

If a property owner fails to pay federal taxes, the irs files a notice of federal tax lien with the state recorder's office to secure. For general lien information, taxpayers may refer to the understanding a federal tax lien page on. Before issuing a tax lien, the irs has to send a letter, but if you didn’t receive a letter,.

Investing in Tax Lien Seminars and Courses

Before issuing a tax lien, the irs has to send a letter, but if you didn’t receive a letter, there are other ways to find out if you have a tax lien. For general lien information, taxpayers may refer to the understanding a federal tax lien page on. Depending on the state, you’ll have to use ucc or tax lien.

Tax Lien Featured Article Segal, Cohen & Landis, P.C.

If a property owner fails to pay federal taxes, the irs files a notice of federal tax lien with the state recorder's office to secure. For general lien information, taxpayers may refer to the understanding a federal tax lien page on. Before issuing a tax lien, the irs has to send a letter, but if you didn’t receive a letter,.

What Is a Tax Lien? Definition & Impact on Credit TheStreet

Depending on the state, you’ll have to use ucc or tax lien search option and verify your identity when checking if the irs has a lien. Notices of federal tax lien. Before issuing a tax lien, the irs has to send a letter, but if you didn’t receive a letter, there are other ways to find out if you have.

Tax Lien Form Free Word Templates

For general lien information, taxpayers may refer to the understanding a federal tax lien page on. Depending on the state, you’ll have to use ucc or tax lien search option and verify your identity when checking if the irs has a lien. Notices of federal tax lien. Before issuing a tax lien, the irs has to send a letter, but.

Tax Lien Definition, Process, Consequences, How to Handle

Before issuing a tax lien, the irs has to send a letter, but if you didn’t receive a letter, there are other ways to find out if you have a tax lien. If a property owner fails to pay federal taxes, the irs files a notice of federal tax lien with the state recorder's office to secure. Depending on the.

Tax Lien How Does Tax Lien Work with Example and Impact?

Depending on the state, you’ll have to use ucc or tax lien search option and verify your identity when checking if the irs has a lien. Notices of federal tax lien. Tax liens are legal claims by the irs to your personal or business property and assets due to back owed taxes. Before issuing a tax lien, the irs has.

What Causes a Tax Lien? Clean Slate Tax

For general lien information, taxpayers may refer to the understanding a federal tax lien page on. Notices of federal tax lien. Before issuing a tax lien, the irs has to send a letter, but if you didn’t receive a letter, there are other ways to find out if you have a tax lien. Depending on the state, you’ll have to.

What Is A Tax Lien? The Leinlord

Notices of federal tax lien. Before issuing a tax lien, the irs has to send a letter, but if you didn’t receive a letter, there are other ways to find out if you have a tax lien. Tax liens are legal claims by the irs to your personal or business property and assets due to back owed taxes. Depending on.

Notices Of Federal Tax Lien.

Before issuing a tax lien, the irs has to send a letter, but if you didn’t receive a letter, there are other ways to find out if you have a tax lien. Tax liens are legal claims by the irs to your personal or business property and assets due to back owed taxes. If a property owner fails to pay federal taxes, the irs files a notice of federal tax lien with the state recorder's office to secure. For general lien information, taxpayers may refer to the understanding a federal tax lien page on.