How To Put A Lien On Property In Illinois

How To Put A Lien On Property In Illinois - The illinois department of revenue can. In illinois, filing a lien is a simple process, but one that comes with specific time limits for legal action. In illinois, a judgment lien can be attached to real estate only, not to personal property. A claim can be filed against your estate. The most common type of. In illinois, the department of revenue or local authorities can place a lien for unpaid taxes. Liens are financial debts attached to real estate. A lien can be filed on any real property you own. The amount of the lien/claim will be equal to the amount of. In illinois, several types of liens can affect real estate transactions, each serving distinct purposes and legal implications.

A claim can be filed against your estate. In illinois, filing a lien is a simple process, but one that comes with specific time limits for legal action. The illinois department of revenue can. Mortgage lenders can place a lien on a property as collateral for a loan. The amount of the lien/claim will be equal to the amount of. Liens are financial debts attached to real estate. Liens force property owners to settle their debts before they are able to sell their. The most common type of. These liens take precedence over most others,. In illinois, several types of liens can affect real estate transactions, each serving distinct purposes and legal implications.

In illinois, several types of liens can affect real estate transactions, each serving distinct purposes and legal implications. In illinois, the department of revenue or local authorities can place a lien for unpaid taxes. Liens force property owners to settle their debts before they are able to sell their. A lien can be filed on any real property you own. Liens are financial debts attached to real estate. Mortgage lenders can place a lien on a property as collateral for a loan. These liens take precedence over most others,. In illinois, filing a lien is a simple process, but one that comes with specific time limits for legal action. How does a creditor go about getting a judgment lien in. A claim can be filed against your estate.

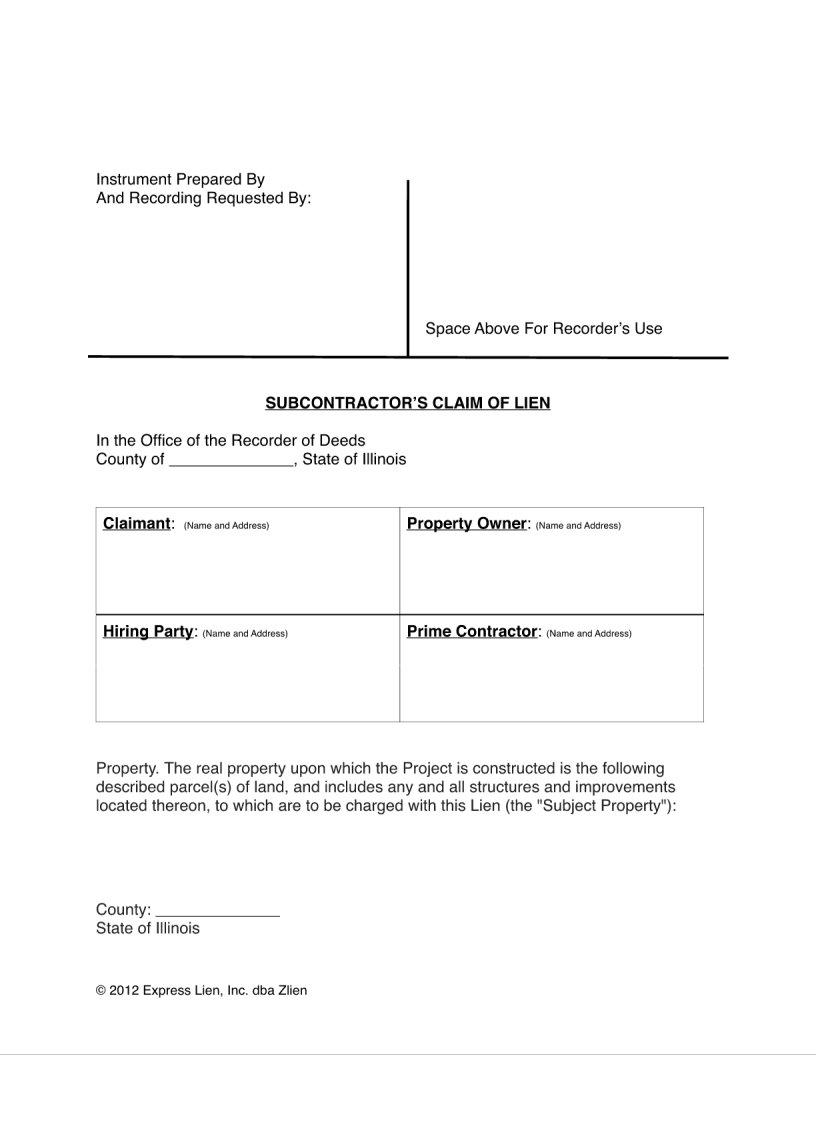

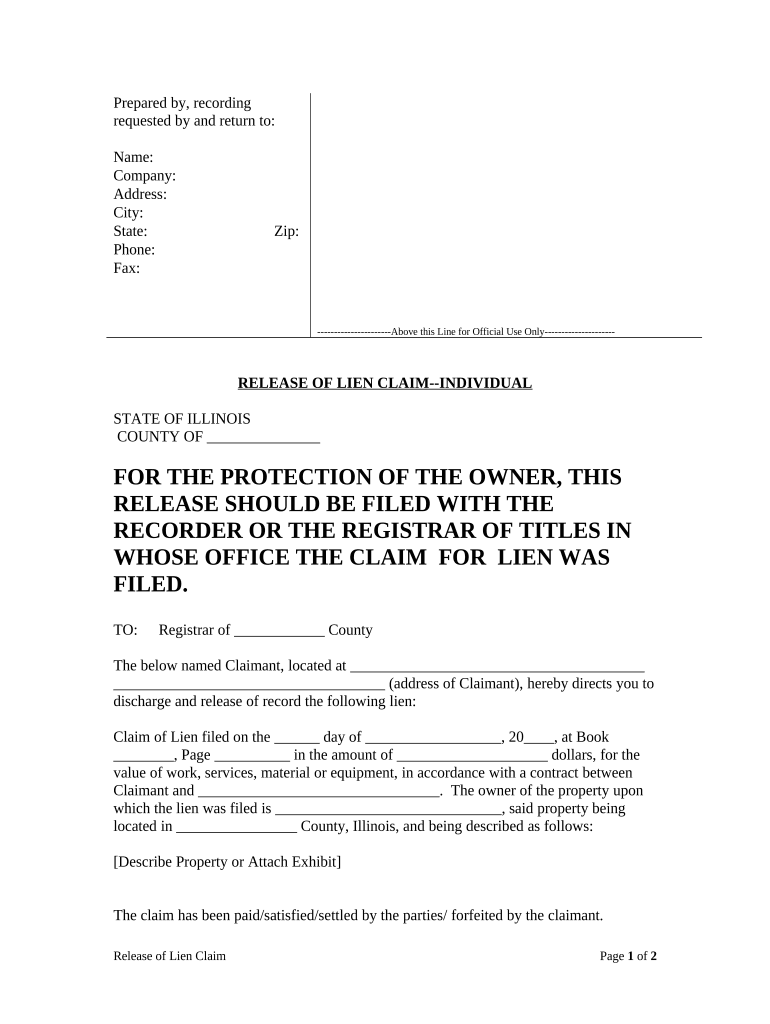

Illinois Notice Lien Form ≡ Fill Out Printable PDF Forms Online

A claim can be filed against your estate. The amount of the lien/claim will be equal to the amount of. In illinois, the department of revenue or local authorities can place a lien for unpaid taxes. Liens are financial debts attached to real estate. These liens take precedence over most others,.

How to Put a Lien on a Property National Lien & Bond

In illinois, the department of revenue or local authorities can place a lien for unpaid taxes. A claim can be filed against your estate. Liens are financial debts attached to real estate. Liens force property owners to settle their debts before they are able to sell their. The illinois department of revenue can.

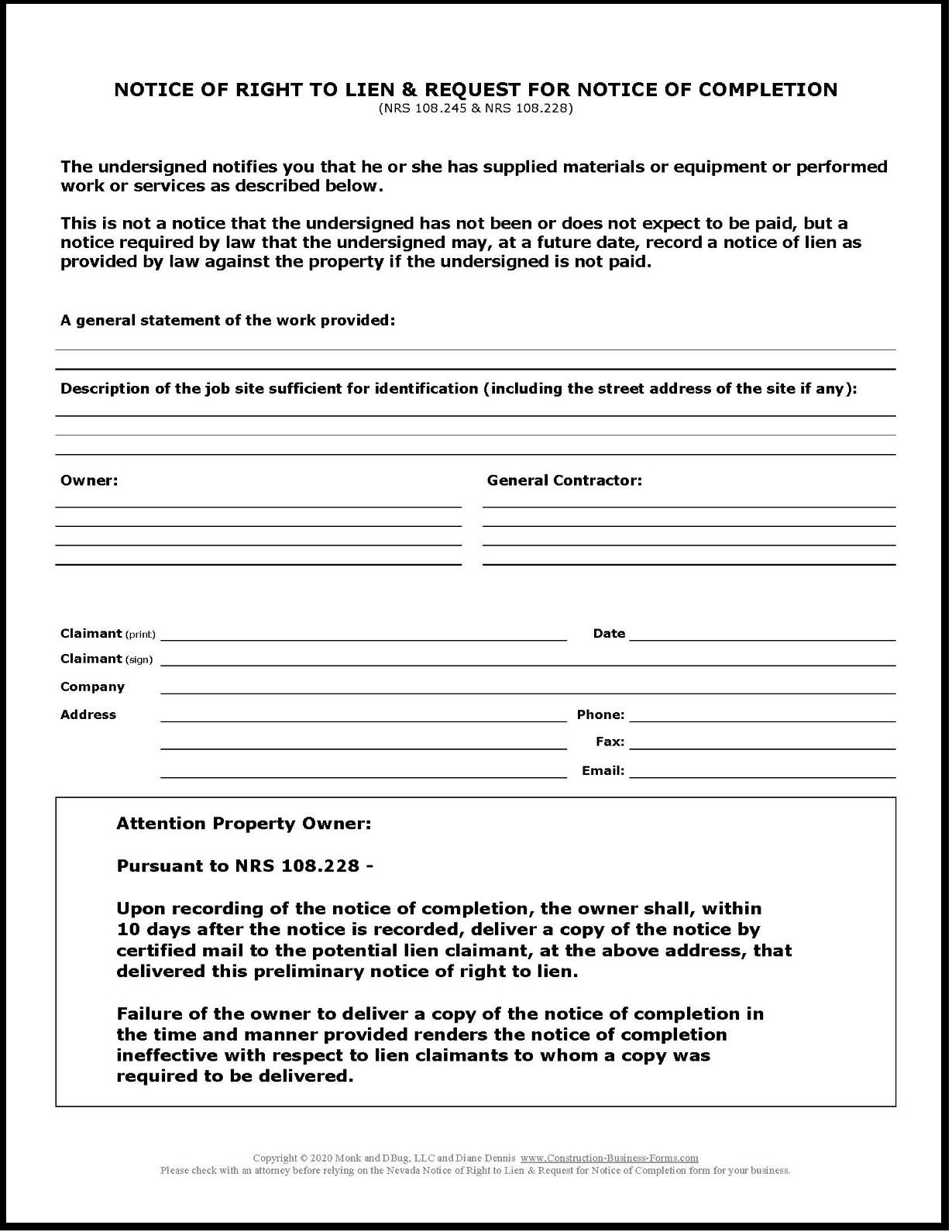

Right to lien the Nevada notice

In illinois, filing a lien is a simple process, but one that comes with specific time limits for legal action. In illinois, a judgment lien can be attached to real estate only, not to personal property. The amount of the lien/claim will be equal to the amount of. Mortgage lenders can place a lien on a property as collateral for.

Federal tax lien on foreclosed property laderdriver

Liens force property owners to settle their debts before they are able to sell their. A claim can be filed against your estate. The illinois department of revenue can. In illinois, the department of revenue or local authorities can place a lien for unpaid taxes. In illinois, filing a lien is a simple process, but one that comes with specific.

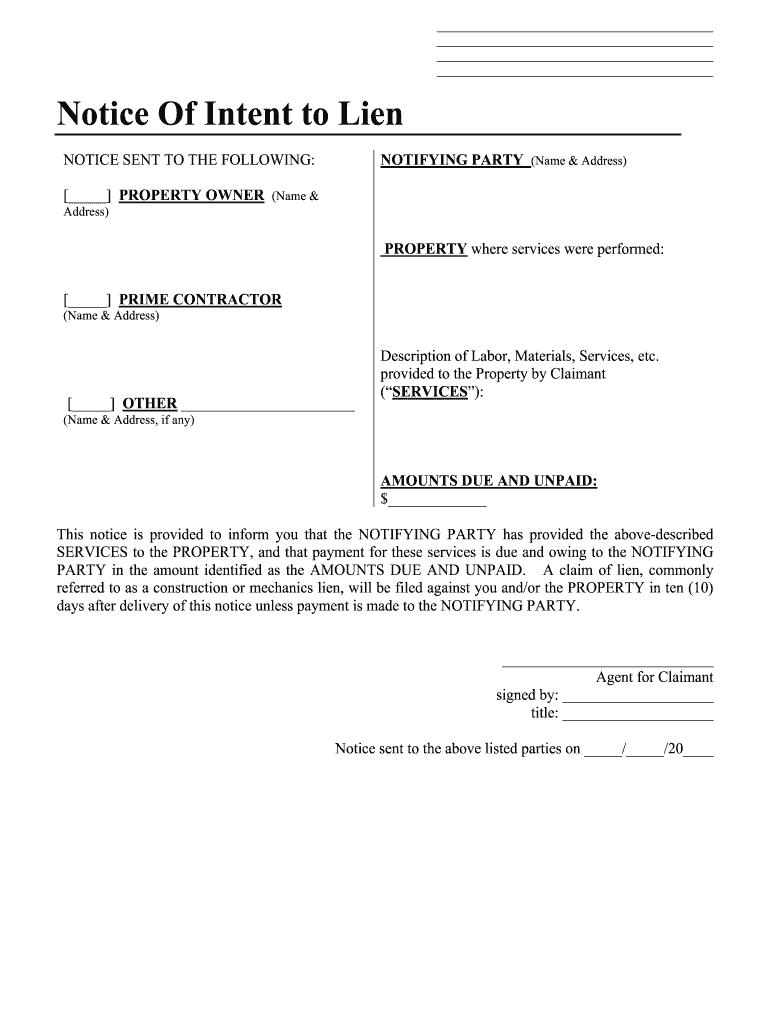

Notice Of Intent To Lien Illinois Pdf Fill Online, Printable

The amount of the lien/claim will be equal to the amount of. How does a creditor go about getting a judgment lien in. A lien can be filed on any real property you own. In illinois, filing a lien is a simple process, but one that comes with specific time limits for legal action. These liens take precedence over most.

Who Can Put a Lien on Your Property? Florida Land Network Leonard

The illinois department of revenue can. In illinois, several types of liens can affect real estate transactions, each serving distinct purposes and legal implications. In illinois, filing a lien is a simple process, but one that comes with specific time limits for legal action. The most common type of. A lien can be filed on any real property you own.

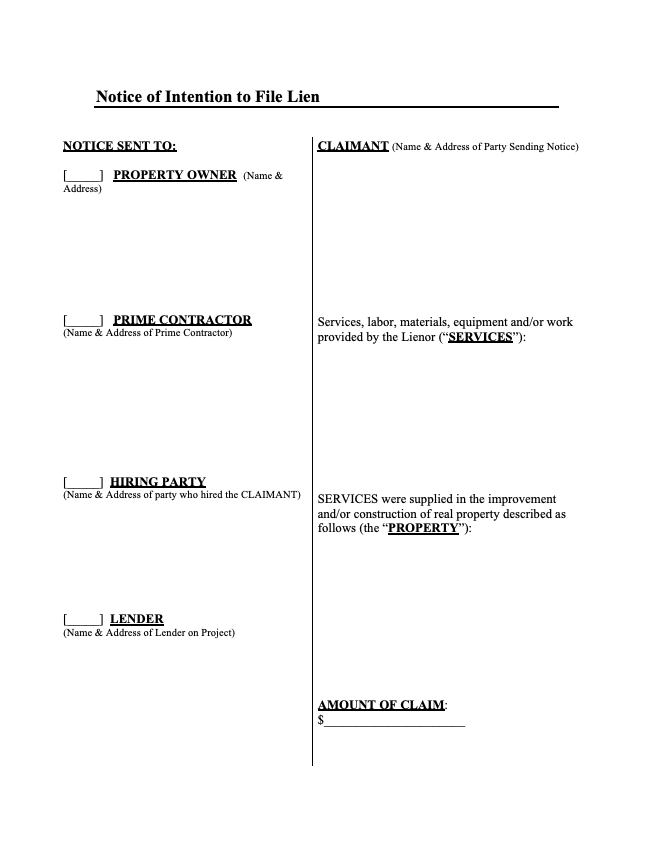

Illinois Notice of Intent to Lien Form Free Downloadable Template

In illinois, several types of liens can affect real estate transactions, each serving distinct purposes and legal implications. These liens take precedence over most others,. A claim can be filed against your estate. In illinois, the department of revenue or local authorities can place a lien for unpaid taxes. The most common type of.

Lien clearance letter illinois Fill out & sign online DocHub

In illinois, the department of revenue or local authorities can place a lien for unpaid taxes. In illinois, several types of liens can affect real estate transactions, each serving distinct purposes and legal implications. The most common type of. These liens take precedence over most others,. In illinois, a judgment lien can be attached to real estate only, not to.

How to Remove a Property Lien from Your Home

In illinois, several types of liens can affect real estate transactions, each serving distinct purposes and legal implications. Liens are financial debts attached to real estate. Liens force property owners to settle their debts before they are able to sell their. The amount of the lien/claim will be equal to the amount of. The illinois department of revenue can.

Notice of lien letter template Artofit

The amount of the lien/claim will be equal to the amount of. Liens force property owners to settle their debts before they are able to sell their. In illinois, the department of revenue or local authorities can place a lien for unpaid taxes. In illinois, a judgment lien can be attached to real estate only, not to personal property. The.

In Illinois, The Department Of Revenue Or Local Authorities Can Place A Lien For Unpaid Taxes.

The illinois department of revenue can. In illinois, several types of liens can affect real estate transactions, each serving distinct purposes and legal implications. Liens are financial debts attached to real estate. In illinois, filing a lien is a simple process, but one that comes with specific time limits for legal action.

How Does A Creditor Go About Getting A Judgment Lien In.

A claim can be filed against your estate. In illinois, a judgment lien can be attached to real estate only, not to personal property. A lien can be filed on any real property you own. Mortgage lenders can place a lien on a property as collateral for a loan.

The Most Common Type Of.

The amount of the lien/claim will be equal to the amount of. Liens force property owners to settle their debts before they are able to sell their. These liens take precedence over most others,.