How To Pay Form 720 Online

How To Pay Form 720 Online - Forms can be submitted online 24. The part ii in irs excise tax form 720 also comprises of the. File form 720 online in 3 easy steps with efile720. Simplify your excise tax filings today! File form 720 for the quarter in which you incur liability for the tax. Efile 720 is an irs authorized 720 efile provider helping. Register, enter tax details, and pay securely. Seamlessly file your irs form 720 tax with the simple 720 online portal, your trusted excise tax expert. Pay the tax with form 720. Let's break down the key differences between the two:

Let's break down the key differences between the two: File form 720 for the quarter in which you incur liability for the tax. It is to be paid annually using form 720 during the second quarter. When it comes to filing form 720, businesses have two options: Pay the tax with form 720. Seamlessly file your irs form 720 tax with the simple 720 online portal, your trusted excise tax expert. Filing form 720 manually can be challenging, but online excise tax filing is as easy as pie. The part ii in irs excise tax form 720 also comprises of the. See when to file, earlier. Simplify your excise tax filings today!

It is to be paid annually using form 720 during the second quarter. Pay the tax with form 720. File form 720 online in 3 easy steps with efile720. Forms can be submitted online 24. Efile 720 is an irs authorized 720 efile provider helping. Simplify your excise tax filings today! File form 720 for the quarter in which you incur liability for the tax. Let's break down the key differences between the two: The part ii in irs excise tax form 720 also comprises of the. Seamlessly file your irs form 720 tax with the simple 720 online portal, your trusted excise tax expert.

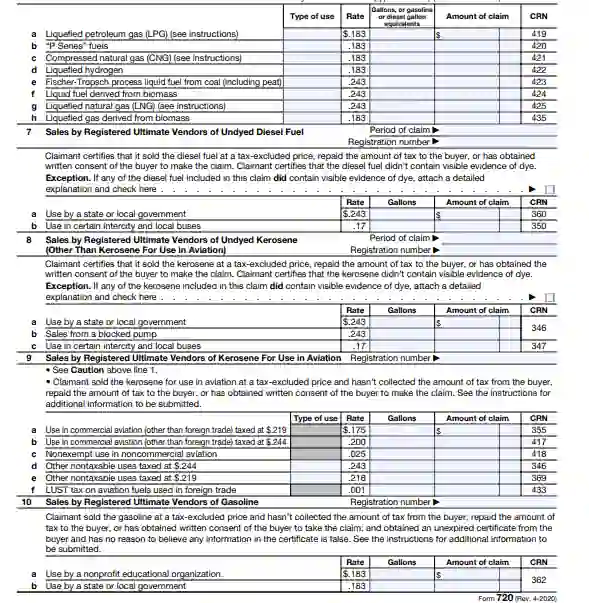

Irs Form 720 2023 Printable Forms Free Online

Seamlessly file your irs form 720 tax with the simple 720 online portal, your trusted excise tax expert. Forms can be submitted online 24. Let's break down the key differences between the two: Efile 720 is an irs authorized 720 efile provider helping. Filing form 720 manually can be challenging, but online excise tax filing is as easy as pie.

Don’t Miss the Deadline It’s Time to Efile Form 720 and PCORI Fees

Efile 720 is an irs authorized 720 efile provider helping. It is to be paid annually using form 720 during the second quarter. File form 720 for the quarter in which you incur liability for the tax. Forms can be submitted online 24. Register, enter tax details, and pay securely.

What’s new in the Federal Excise Tax Form 720? by ThinkTrade Inc

When it comes to filing form 720, businesses have two options: Pay the tax with form 720. File form 720 for the quarter in which you incur liability for the tax. Let's break down the key differences between the two: It is to be paid annually using form 720 during the second quarter.

Fillable Form 720 (2nd Quarter 2019) Irs forms, Form, Fillable forms

See when to file, earlier. Forms can be submitted online 24. File form 720 for the quarter in which you incur liability for the tax. Efile 720 is an irs authorized 720 efile provider helping. Filing form 720 manually can be challenging, but online excise tax filing is as easy as pie.

IRS FORM 720 EFILING ONLINE. IRS Form 720 EFiling by Simple720 Medium

Efile 720 is an irs authorized 720 efile provider helping. Filing form 720 manually can be challenging, but online excise tax filing is as easy as pie. When it comes to filing form 720, businesses have two options: Seamlessly file your irs form 720 tax with the simple 720 online portal, your trusted excise tax expert. The part ii in.

File your IRS Form 720 Online through Simple 720 Portal Flickr

The part ii in irs excise tax form 720 also comprises of the. File form 720 for the quarter in which you incur liability for the tax. See when to file, earlier. Pay the tax with form 720. Filing form 720 manually can be challenging, but online excise tax filing is as easy as pie.

TAX FORM 720 ONLINE FILING. Are you looking for tax form 720 online

It is to be paid annually using form 720 during the second quarter. Forms can be submitted online 24. Let's break down the key differences between the two: Register, enter tax details, and pay securely. Simplify your excise tax filings today!

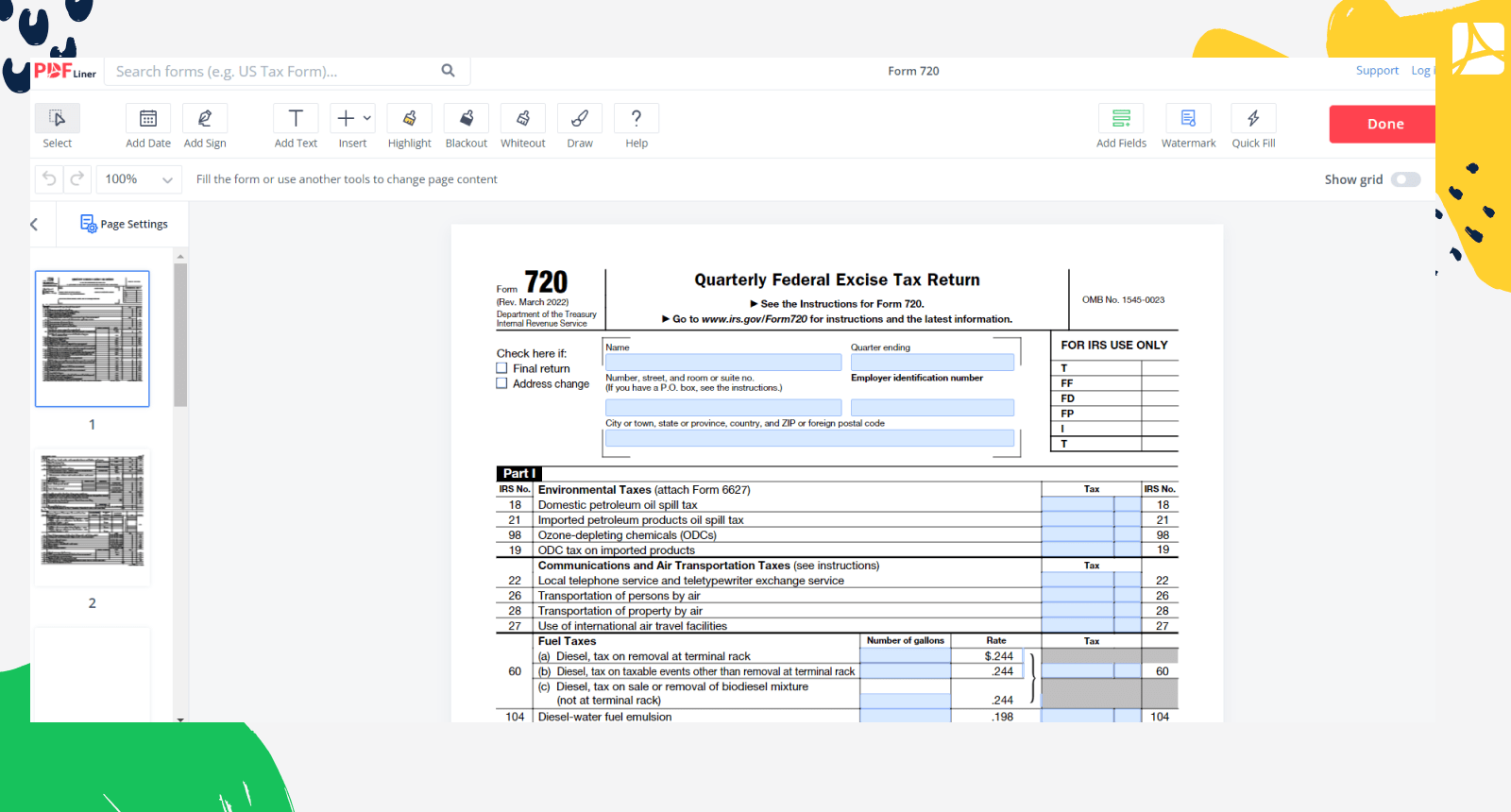

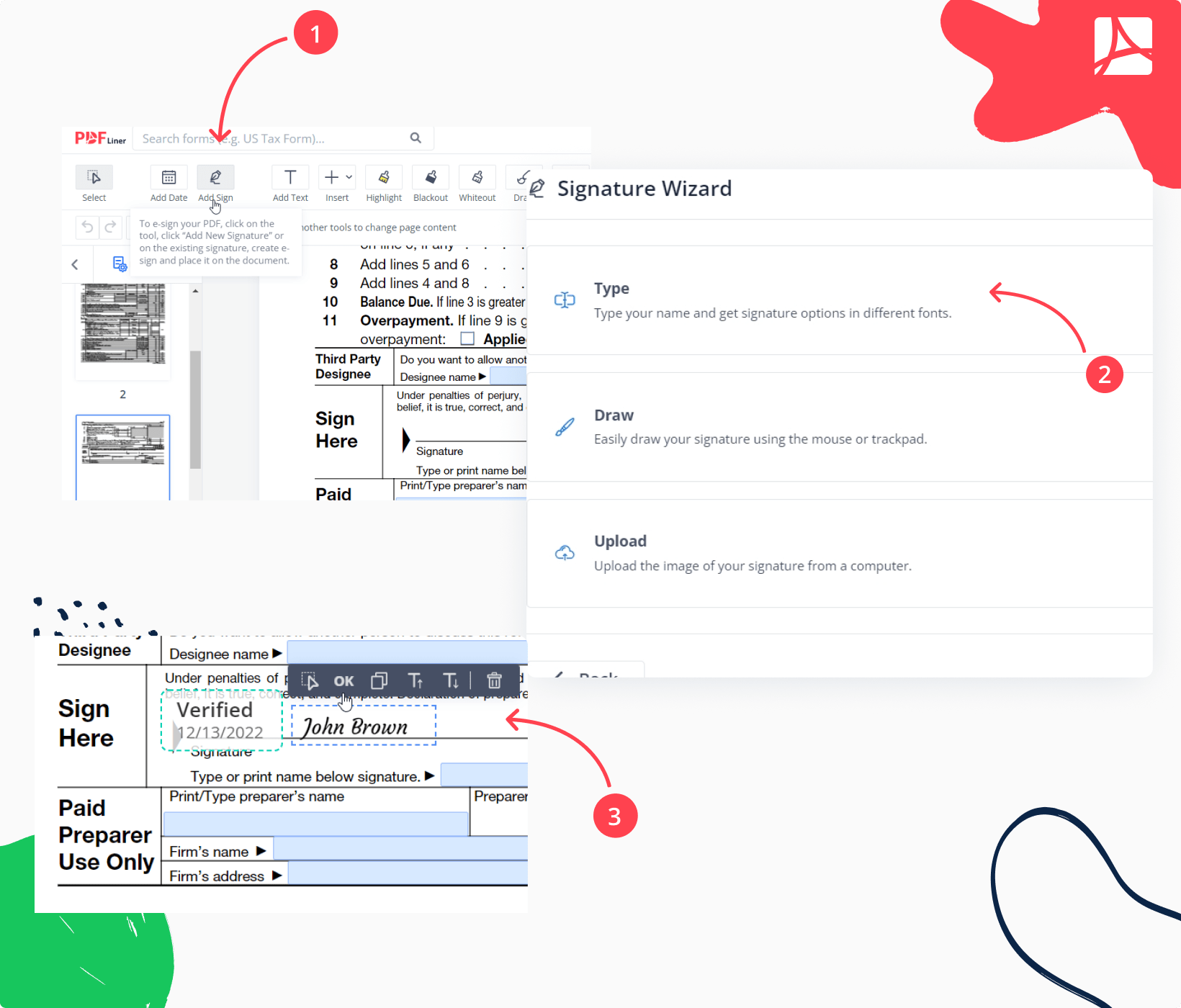

Form 720 Printable Form 720 blank, sign forms online — PDFliner

See when to file, earlier. When it comes to filing form 720, businesses have two options: File form 720 online in 3 easy steps with efile720. Efile 720 is an irs authorized 720 efile provider helping. Let's break down the key differences between the two:

What Is Irs Form 720 Printable Forms Free Online

Register, enter tax details, and pay securely. See when to file, earlier. Simplify your excise tax filings today! Efile 720 is an irs authorized 720 efile provider helping. Filing form 720 manually can be challenging, but online excise tax filing is as easy as pie.

Form 720 Printable Form 720 blank, sign forms online — PDFliner

The part ii in irs excise tax form 720 also comprises of the. File form 720 online in 3 easy steps with efile720. When it comes to filing form 720, businesses have two options: It is to be paid annually using form 720 during the second quarter. See when to file, earlier.

When It Comes To Filing Form 720, Businesses Have Two Options:

Pay the tax with form 720. Forms can be submitted online 24. Simplify your excise tax filings today! Filing form 720 manually can be challenging, but online excise tax filing is as easy as pie.

See When To File, Earlier.

It is to be paid annually using form 720 during the second quarter. The part ii in irs excise tax form 720 also comprises of the. Let's break down the key differences between the two: Efile 720 is an irs authorized 720 efile provider helping.

Seamlessly File Your Irs Form 720 Tax With The Simple 720 Online Portal, Your Trusted Excise Tax Expert.

Register, enter tax details, and pay securely. File form 720 online in 3 easy steps with efile720. File form 720 for the quarter in which you incur liability for the tax.