How Long Is A Federal Tax Lien Valid

How Long Is A Federal Tax Lien Valid - A tax lien typically lasts 10 years and 30 days from the date of assessment (when the irs officially. How long does an irs tax lien last? Prior to november 5, 1990, a federal tax lien was valid for 6 years unless refilled within 6 years and 30 days from the date of assessment.

Prior to november 5, 1990, a federal tax lien was valid for 6 years unless refilled within 6 years and 30 days from the date of assessment. How long does an irs tax lien last? A tax lien typically lasts 10 years and 30 days from the date of assessment (when the irs officially.

Prior to november 5, 1990, a federal tax lien was valid for 6 years unless refilled within 6 years and 30 days from the date of assessment. How long does an irs tax lien last? A tax lien typically lasts 10 years and 30 days from the date of assessment (when the irs officially.

Federal Tax Lien Definition and How to Remove

A tax lien typically lasts 10 years and 30 days from the date of assessment (when the irs officially. How long does an irs tax lien last? Prior to november 5, 1990, a federal tax lien was valid for 6 years unless refilled within 6 years and 30 days from the date of assessment.

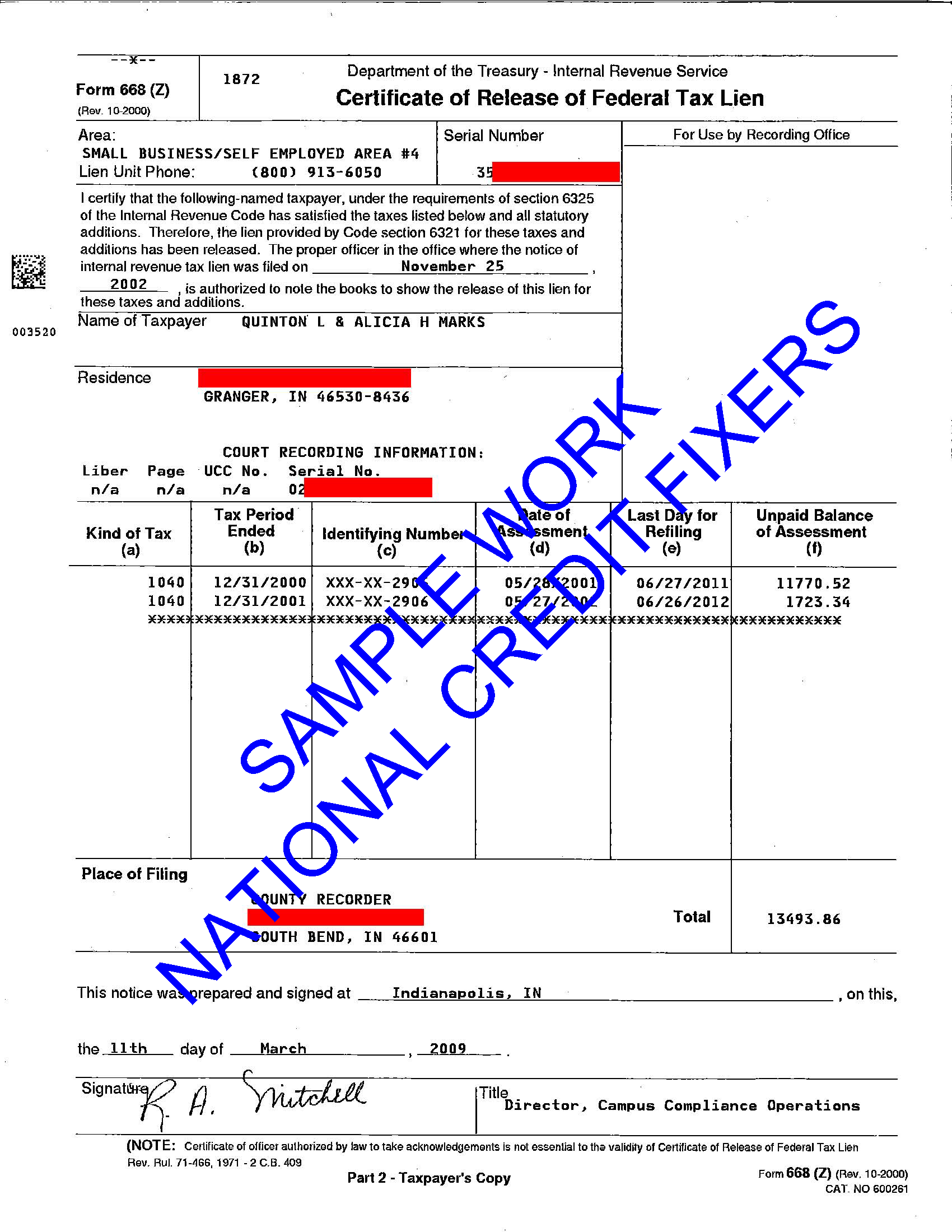

Federal Tax Lien Federal Tax Lien Payment

How long does an irs tax lien last? A tax lien typically lasts 10 years and 30 days from the date of assessment (when the irs officially. Prior to november 5, 1990, a federal tax lien was valid for 6 years unless refilled within 6 years and 30 days from the date of assessment.

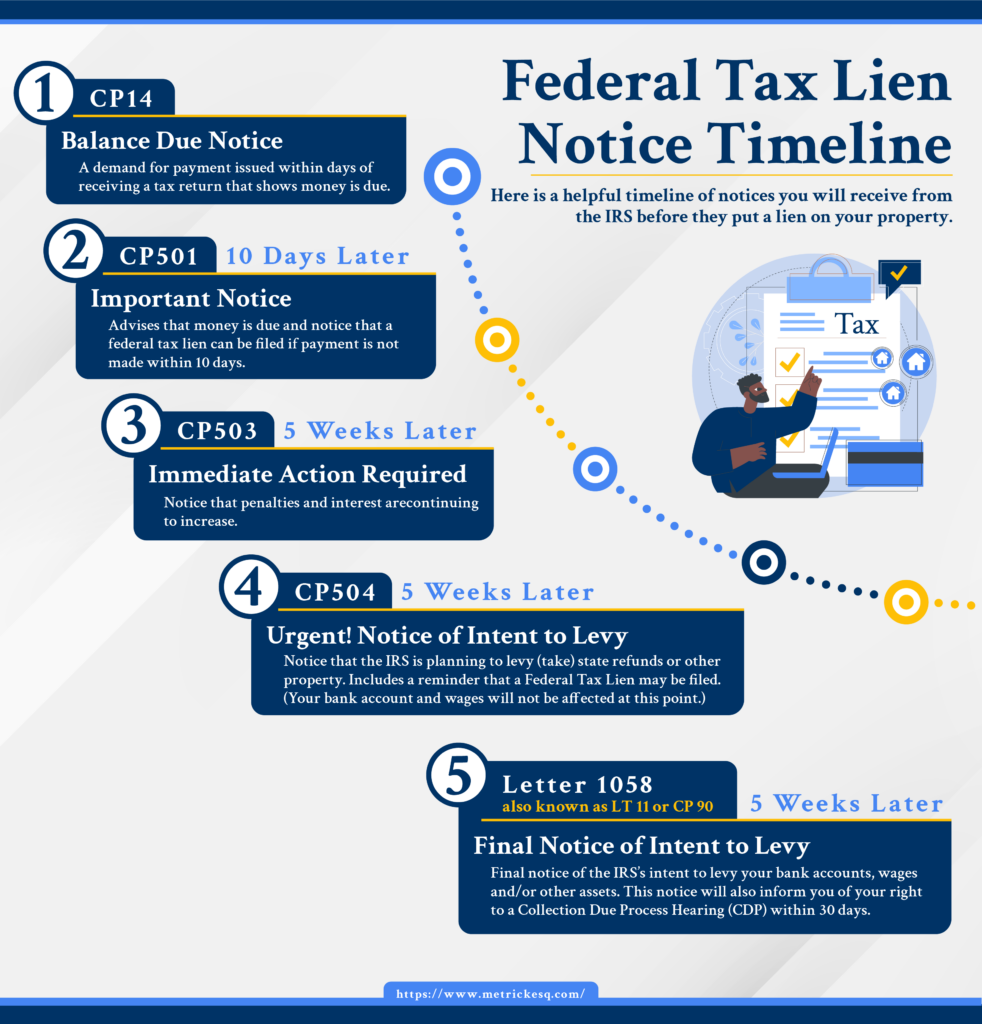

Federal Tax Lien Notice Timeline Ira J. Metrick, Esq.

Prior to november 5, 1990, a federal tax lien was valid for 6 years unless refilled within 6 years and 30 days from the date of assessment. A tax lien typically lasts 10 years and 30 days from the date of assessment (when the irs officially. How long does an irs tax lien last?

Federal Tax Lien Definition

Prior to november 5, 1990, a federal tax lien was valid for 6 years unless refilled within 6 years and 30 days from the date of assessment. A tax lien typically lasts 10 years and 30 days from the date of assessment (when the irs officially. How long does an irs tax lien last?

Federal tax lien on foreclosed property laderdriver

Prior to november 5, 1990, a federal tax lien was valid for 6 years unless refilled within 6 years and 30 days from the date of assessment. How long does an irs tax lien last? A tax lien typically lasts 10 years and 30 days from the date of assessment (when the irs officially.

Title Basics of the Federal Tax Lien SnapClose

How long does an irs tax lien last? Prior to november 5, 1990, a federal tax lien was valid for 6 years unless refilled within 6 years and 30 days from the date of assessment. A tax lien typically lasts 10 years and 30 days from the date of assessment (when the irs officially.

IRS Federal and State Tax Lien Help — Genesis Tax Consultants

Prior to november 5, 1990, a federal tax lien was valid for 6 years unless refilled within 6 years and 30 days from the date of assessment. How long does an irs tax lien last? A tax lien typically lasts 10 years and 30 days from the date of assessment (when the irs officially.

Federal tax lien on foreclosed property laderdriver

A tax lien typically lasts 10 years and 30 days from the date of assessment (when the irs officially. Prior to november 5, 1990, a federal tax lien was valid for 6 years unless refilled within 6 years and 30 days from the date of assessment. How long does an irs tax lien last?

How Long Does a Federal Tax Lien Last? Heartland Tax Solutions

Prior to november 5, 1990, a federal tax lien was valid for 6 years unless refilled within 6 years and 30 days from the date of assessment. A tax lien typically lasts 10 years and 30 days from the date of assessment (when the irs officially. How long does an irs tax lien last?

How Long is a Federal Tax Lien Valid? Murray Moyer PLLC

How long does an irs tax lien last? A tax lien typically lasts 10 years and 30 days from the date of assessment (when the irs officially. Prior to november 5, 1990, a federal tax lien was valid for 6 years unless refilled within 6 years and 30 days from the date of assessment.

Prior To November 5, 1990, A Federal Tax Lien Was Valid For 6 Years Unless Refilled Within 6 Years And 30 Days From The Date Of Assessment.

How long does an irs tax lien last? A tax lien typically lasts 10 years and 30 days from the date of assessment (when the irs officially.

/tax-lien-497446038-d3fe1b94273f4700ad75e4fa45f0fda9.jpg)