Form 940 And 941

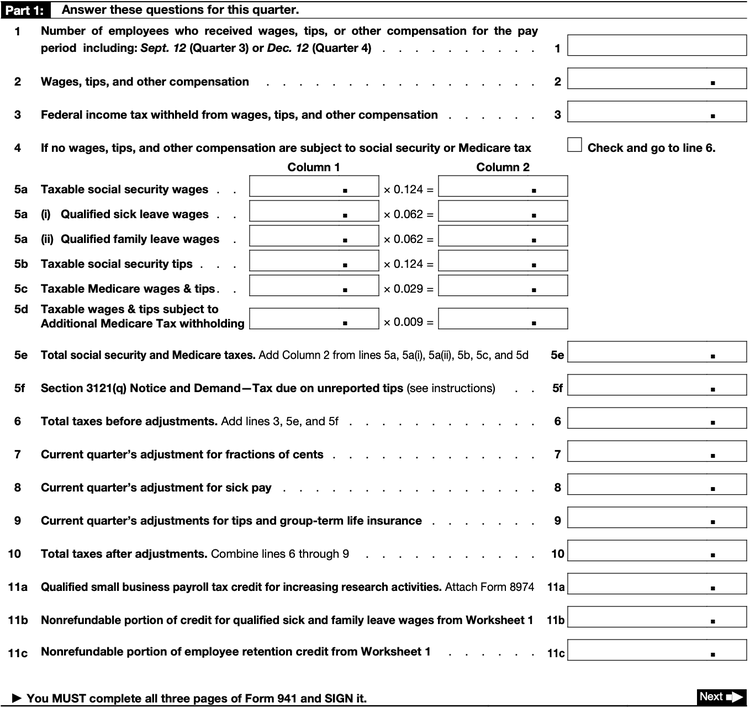

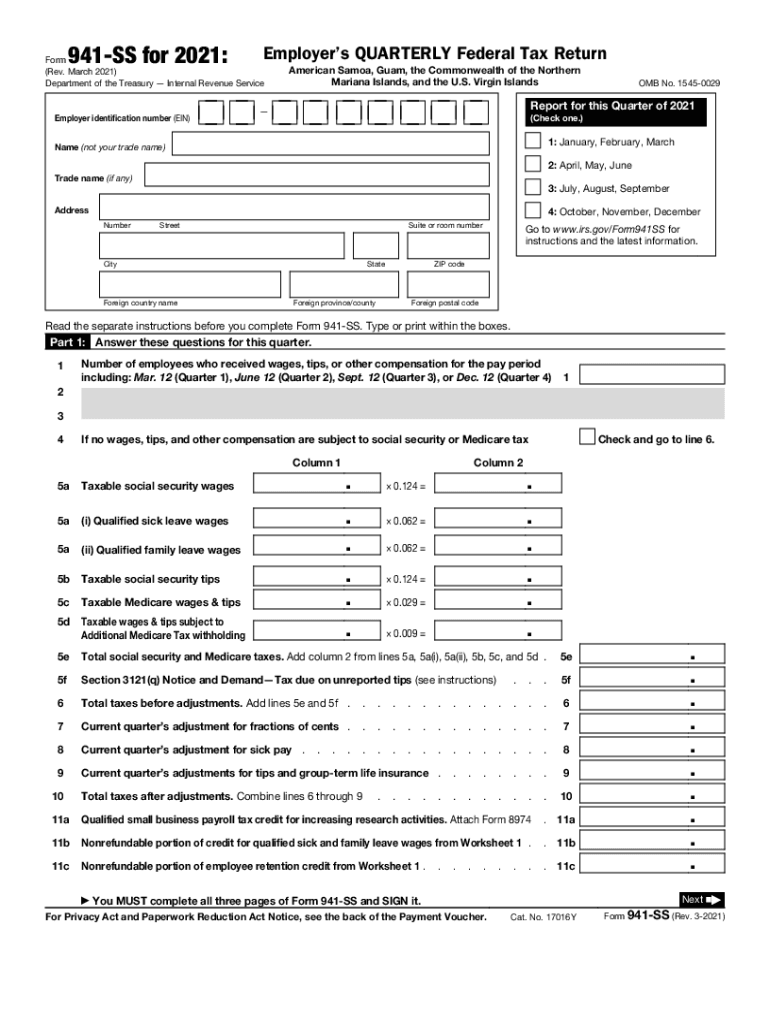

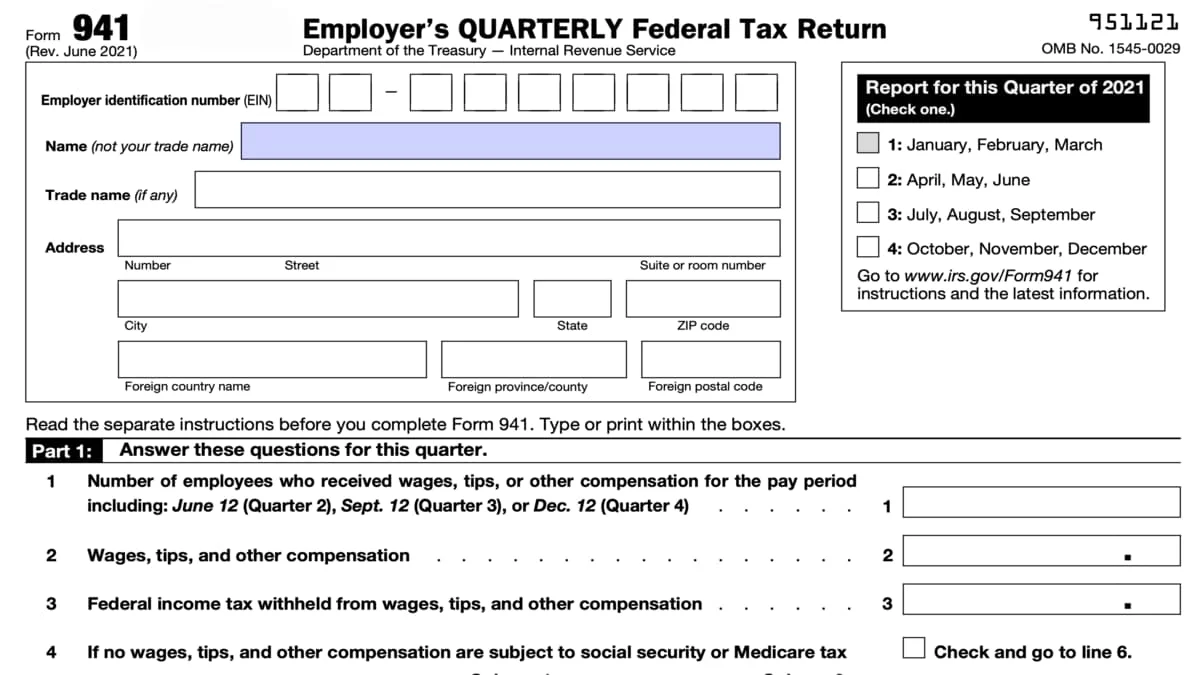

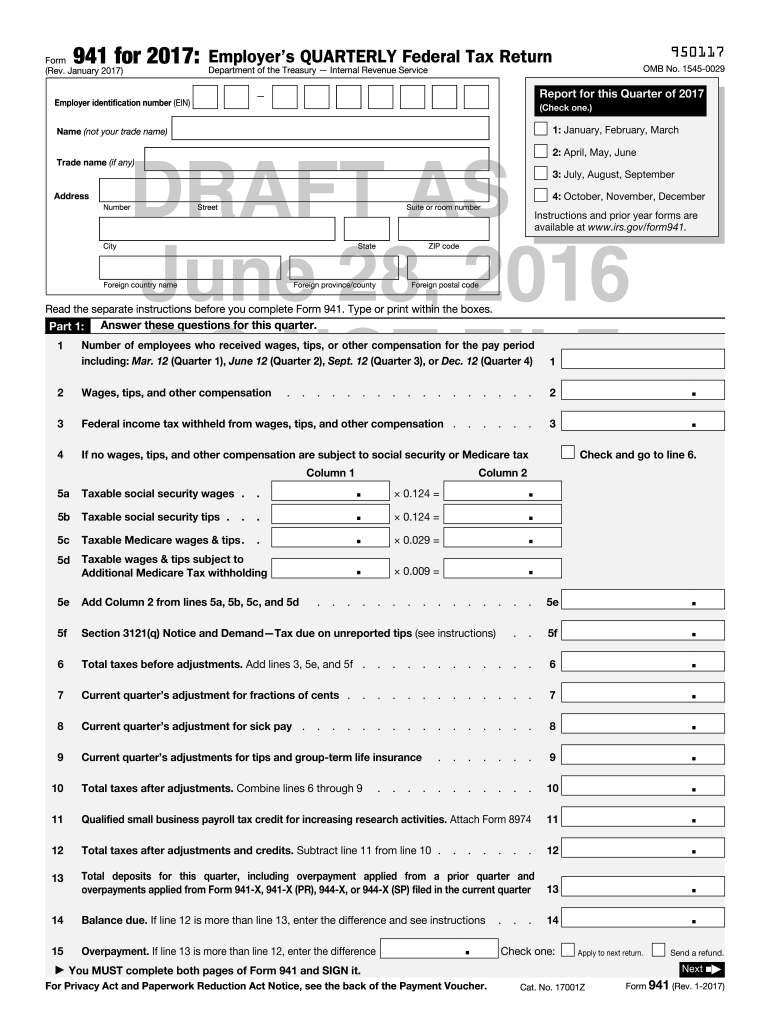

Form 940 And 941 - Find out when and how to file. Form 940 is required for businesses who are subject to federal unemployment (futa). Answer these questions for this quarter. The 940 is an annual federal tax form used to. Information about form 940, employer's annual federal unemployment (futa) tax return, including recent updates, related forms and. Number of employees who received wages, tips, or other compensation for the pay period. Learn how to withhold and deposit federal income tax and other employment taxes for your employees. Form 941 is used by employers who withhold income taxes from wages or who must pay social security or medicare tax.

Find out when and how to file. Number of employees who received wages, tips, or other compensation for the pay period. Information about form 940, employer's annual federal unemployment (futa) tax return, including recent updates, related forms and. Form 940 is required for businesses who are subject to federal unemployment (futa). Learn how to withhold and deposit federal income tax and other employment taxes for your employees. Form 941 is used by employers who withhold income taxes from wages or who must pay social security or medicare tax. The 940 is an annual federal tax form used to. Answer these questions for this quarter.

Form 941 is used by employers who withhold income taxes from wages or who must pay social security or medicare tax. The 940 is an annual federal tax form used to. Find out when and how to file. Answer these questions for this quarter. Form 940 is required for businesses who are subject to federal unemployment (futa). Learn how to withhold and deposit federal income tax and other employment taxes for your employees. Information about form 940, employer's annual federal unemployment (futa) tax return, including recent updates, related forms and. Number of employees who received wages, tips, or other compensation for the pay period.

940 vs 941 What's The Difference Between Them & When to Use FUTA 940

The 940 is an annual federal tax form used to. Find out when and how to file. Answer these questions for this quarter. Form 940 is required for businesses who are subject to federal unemployment (futa). Number of employees who received wages, tips, or other compensation for the pay period.

Form 940 Fill out & sign online DocHub

Form 941 is used by employers who withhold income taxes from wages or who must pay social security or medicare tax. Number of employees who received wages, tips, or other compensation for the pay period. Learn how to withhold and deposit federal income tax and other employment taxes for your employees. The 940 is an annual federal tax form used.

941 Forms 2024 Neysa Adrienne

Information about form 940, employer's annual federal unemployment (futa) tax return, including recent updates, related forms and. Form 940 is required for businesses who are subject to federal unemployment (futa). The 940 is an annual federal tax form used to. Number of employees who received wages, tips, or other compensation for the pay period. Learn how to withhold and deposit.

Form 941 Template

Number of employees who received wages, tips, or other compensation for the pay period. The 940 is an annual federal tax form used to. Learn how to withhold and deposit federal income tax and other employment taxes for your employees. Find out when and how to file. Form 941 is used by employers who withhold income taxes from wages or.

Irs Form 940 TAX

Answer these questions for this quarter. Number of employees who received wages, tips, or other compensation for the pay period. Find out when and how to file. Information about form 940, employer's annual federal unemployment (futa) tax return, including recent updates, related forms and. The 940 is an annual federal tax form used to.

Free Fillable Printable 940 Annual Form Printable Forms Free Online

Form 940 is required for businesses who are subject to federal unemployment (futa). Number of employees who received wages, tips, or other compensation for the pay period. Learn how to withhold and deposit federal income tax and other employment taxes for your employees. The 940 is an annual federal tax form used to. Form 941 is used by employers who.

Form 940 vs Form 941 Difference and Comparison

Number of employees who received wages, tips, or other compensation for the pay period. Information about form 940, employer's annual federal unemployment (futa) tax return, including recent updates, related forms and. Answer these questions for this quarter. Form 941 is used by employers who withhold income taxes from wages or who must pay social security or medicare tax. The 940.

SOLUTION Form 940 And 941 Complete Studypool

The 940 is an annual federal tax form used to. Form 941 is used by employers who withhold income taxes from wages or who must pay social security or medicare tax. Number of employees who received wages, tips, or other compensation for the pay period. Answer these questions for this quarter. Information about form 940, employer's annual federal unemployment (futa).

What is IRS Form 940?

Information about form 940, employer's annual federal unemployment (futa) tax return, including recent updates, related forms and. The 940 is an annual federal tax form used to. Learn how to withhold and deposit federal income tax and other employment taxes for your employees. Form 940 is required for businesses who are subject to federal unemployment (futa). Number of employees who.

941 2016 Complete with ease airSlate SignNow

The 940 is an annual federal tax form used to. Find out when and how to file. Number of employees who received wages, tips, or other compensation for the pay period. Learn how to withhold and deposit federal income tax and other employment taxes for your employees. Form 941 is used by employers who withhold income taxes from wages or.

The 940 Is An Annual Federal Tax Form Used To.

Find out when and how to file. Form 941 is used by employers who withhold income taxes from wages or who must pay social security or medicare tax. Learn how to withhold and deposit federal income tax and other employment taxes for your employees. Number of employees who received wages, tips, or other compensation for the pay period.

Answer These Questions For This Quarter.

Form 940 is required for businesses who are subject to federal unemployment (futa). Information about form 940, employer's annual federal unemployment (futa) tax return, including recent updates, related forms and.